What is Accounts Payables Turnover?

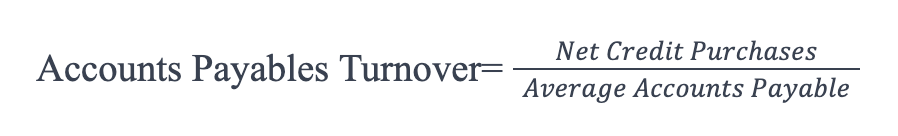

Accounts Payables Turnover is a financial metric that assesses how effectively a business manages its accounts payable, indicating the number of times a company pays off its average accounts payable balance during a specific period. The formula for calculating this ratio is:

Why is it Important or Used in Accounting?

Accounts Payables Turnover is crucial for several reasons:

- Cash Flow Management: It provides insights into how efficiently a company manages its cash flow. A higher turnover ratio suggests that the business pays its suppliers more promptly, which can positively impact cash flow.

- Vendor Relations: Monitoring this metric helps assess the relationship between a company and its suppliers. Maintaining a reasonable turnover ratio is essential for building and sustaining positive supplier relationships.

- Operational Efficiency: A high turnover ratio can indicate effective inventory management and streamlined payment processes, showcasing operational efficiency.

Advantages of Accounts Payables Turnover:

- Liquidity Assessment: It assists in evaluating the liquidity of a business by indicating how quickly it settles its short-term liabilities.

- Operational Effectiveness: A higher turnover ratio often correlates with efficient operations and strong financial management, which can be attractive to investors and creditors.

- Strategic Decision-Making: Businesses can use this metric to make informed decisions about payment terms with suppliers, optimizing cash flow while maintaining positive supplier relationships.

Disadvantages of Accounts Payables Turnover:

- Overemphasis on Ratios: Relying solely on this ratio without considering other financial metrics may provide a limited view of a company’s financial health.

- Industry Variations: Ideal turnover ratios can vary by industry, and comparing ratios across industries may not be meaningful. What is considered high in one sector might be low in another.

Example of Accounts Payables Turnover for a Wholesaler or Retailer Business:

Suppose a wholesale electronics distributor reports net credit purchases of $1,000,000 during the year. At the beginning of the year, the accounts payable balance was $200,000; at the end of the year, it was $300,000. The average accounts payable for the year is (200,000+300,000)/2=250,000. Using the formula:

Accounts Payables Turnover= 1,000,000250,00=4

This indicates that, on average, the wholesaler pays off its accounts payable four times during the year. Interpretation of this ratio would depend on industry benchmarks, company policies, and specific financial goals.

In conclusion, while Accounts Payables Turnover is a valuable metric for assessing financial efficiency and liquidity, it should be used with other financial indicators for a comprehensive analysis of a company’s financial health.