Every business has a better chance of being profitable and competitive if it reduces cost. This ensures that every money spent has a short-term or long-term benefit to the business. Here are five tips for evaluating and reducing cost in your business.

1. Separate your business from personal transactions

You have probably heard this before, but it is extremely important that you keep business and personal accounts separate (even if means you have two Current Accounts!). It is difficult to know if your business is making profits or just being busy if you mix inflows and outflows of cash from both business and personal accounts.

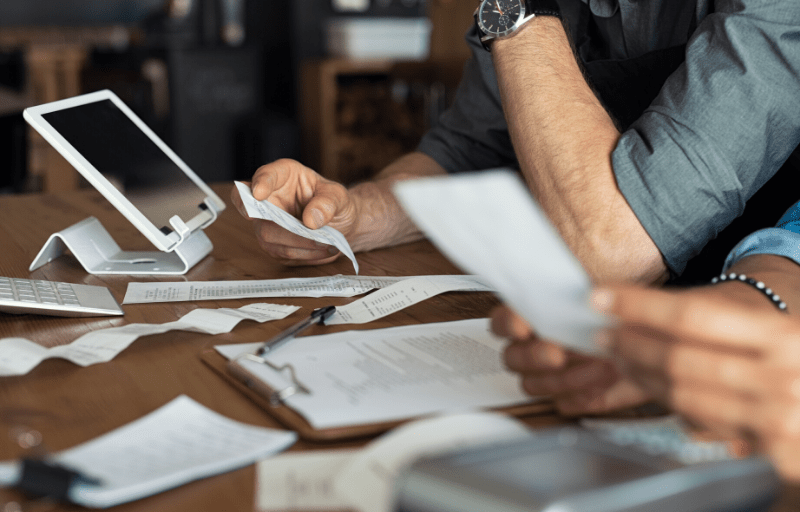

2. Track every expense

We advise our clients to track every Naira spent on activities associated with running their businesses. Paid for Uber to visit a client? Track it. Bought food for your staff? Track it. Paid yourself a salary? Track it. Even if you didn’t “actually spend cash” Track it. For example, you sent clothes to a social media influencer to market for your business? Track clothes cost as a marketing expense. Tracking everything will help you understand your true business expense and give you a baseline to know where to reduce cost.

You can use the Vencru app to track your expenses.

3. Group your expenses to know what’s your biggest expenditure

Want to reduce your business cost but don’t know where to start? Consider grouping expenses by similar categories and starting with the largest group. For example, does your cost include payments to Uber, Taxify/Bolt, logistics for delivering clothes to customers? Group those costs as Transportation/Logistics. That way you can understand what is the largest expense group that is driving your business cost down.

4. Track how many sales you need to make to recover your investment cost or expense

Sometimes we make major expenses such as marketing or expansion but don’t always check to see if these expenses would result in future profits. For example, you spent $200 on marketing for your Bakery but you only make a profit of $10 for each sold cake, you need 20 orders to make that new marketing expense worth it. Making investments without making reasonable profits can drive your profits further down — remember busyness vs profits.

5. Review your vendors’ cost to ensure your business is competitive

To ensure you are getting the best rate, periodically review your vendors’ cost by sourcing for new quotes. Keeping your vendors’ cost low (but of similar quality) can help you maximize profits.

Originally published on Nerve Africa

Learn how Vencru can help you manage your business easier. Invoicing, Inventory and business reporting made easy and FREE with Vencru.