Have you just set up your retail store and are looking for tips regarding your business’s retail bookkeeping and accounting? Well, then you have come to the right place!

Having a retail store is complicated enough on its own. You have to manage various things and ensure all tasks are carried out as smoothly as possible. Between managing the inventory, keeping a record of the finances, and invoicing, there are way too many tasks that have to be completed for your retail store to run successfully.

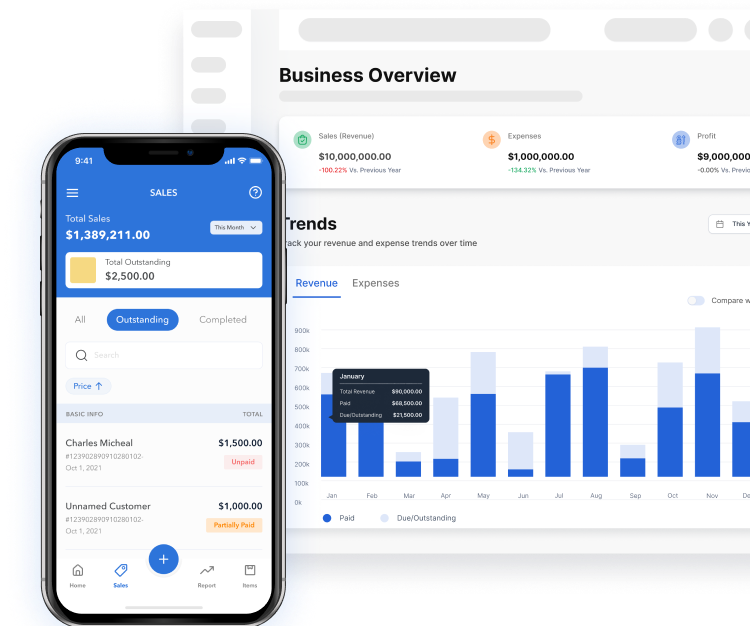

Getting retail bookkeeping software can help you manage numerous tasks and carry out all the operations for your retail store. Vencru is accounting software and invoicing software for small businesses. It enables you to record all the finances and accounts and automates your invoicing. You can also use it to manage your inventory and ensure you can create the most accurate financial reports for your retail store.

When running a retail store, hiring people who provide retail bookkeeping services can cost extra and take a toll on your budget. Knowing how to manage the bookkeeping yourself is a much cheaper option. However, before we get into what you should do for the bookkeeping of your retail store, you need to know what retail bookkeeping really is.

What Is Retail Bookkeeping?

Although people often refer to it as retail bookkeeping or retail accounting, it is actually a method of inventory valuation and management more than bookkeeping or accounting.

You value and estimate the price of the products in your inventory based on any changes in the selling price and all the latest pricing trends.

When you carry out retail bookkeeping, you also have to keep records of all the finances of your retail store and track the sales that are made.

You can keep track of all the expenses and the money you have made. Retail bookkeeping can be an overwhelming process if you are not familiar with the different aspects.

Retail bookkeeping is incredibly crucial for retail stores as it enables you to keep accurate records of all your finances. You must track how much money you have invested in the business and how much you are making from it. Carrying out retail bookkeeping for your store yourself can be more cost-effective than getting help from retail bookkeeping services.

The Aspects Of Retail Bookkeeping

- Income Tracking

When bookkeeping for a retail store, you have to track your income and stay updated at all times. You must know where the income is coming from and how much you have made in a day.

For retail bookkeeping, most of the income comes through sales, but that is not the only source of income you need to be tracking. You may get money through after-sales service fees or commission on consignments.

You can use retail bookkeeping software like Vencru to track all your incomes and keep a digital record of all your finances. It is always a good idea to go through all the data and records once in a while to ensure no inaccuracies and errors have been made. You should always record invoices and purchase orders related to your business.

- Inventory Bookkeeping Or Accounting

You should have a robust system to keep track of your retail store’s inventory. There must be a record of all inventory coming into your retail store or going out.

Without a record, there are chances of errors occurring, and you can be understocked when you should not be. Having a strong inventory management system can help you prevent any shortcomings or failures related to deliveries.

As a retail store, your inventory is the one aspect you invest the most money in. You should always know what is available and what is running low.

When you stay updated with your inventory every day, you don’t face the risk of overstocking, and you always have the needed items. You also need to check all the products that get spoiled or can’t be used and make a record of them.

- Retained Earnings And Owner’s Equity

As a retail business and store, you need to have a separate account for the retained earnings. You can think of the retained earnings as a savings account for your business, and you can use the amount you have included over time and invest it in your business again to get even better outcomes.

For the retail bookkeeping of the retained earnings, you need to record what is in the account and what you spend from it to make everything more streamlined.

There should also be a separate account set up to track all the resources that have been put into the business by the owners. Even if you are the only owner, you need to keep a separate account to make your finances easier to manage.

Maintaining these records helps in the short-term retail bookkeeping, and you know where the money is coming from. It is also beneficial if multiple business owners decide to leave the company.

- Expense Tracking

Just like your income, you also have to record all your business expenses. All the records you keep must be checked against bank statements and other financial statements to ensure there are no inaccuracies or you don’t lose track of where the money from your business is. You can take help from accounting software like Vencru to automate regular expenses like rent or lease.

You need to keep a thorough record of all your business expenses. These expenses may include fees, labor expenses, purchases, the cost of the goods you have sold, taxes, and more.

If you make any significant one-time investments, you need to keep a record of those in a separate account so that it is easy for you to differentiate between them and your regular expenses.

- Record Of Payables And Receivables

For retail bookkeeping, you have to record any money owed to you or any money you owe to anyone. You must have a robust accounting system that tells you which clients have their payment due and which clients are delaying their payment so you can send them reminders and get your amount as soon as possible.

Both payables and receivables are crucial for you to run your store. If you pay all your debts in time, you can maintain a positive credit score, and getting your receivables ensures a positive cash flow for your business.

You also need to have a bookkeeping system that reminds you of the due dates for your bills, taxes, etc., so you never miss out on them.

Final Takeaway

When running a retail store, your business’s bookkeeping is a crucial aspect and should be done accurately. You have to manage and track various elements to ensure all your finances are in order. Keeping a record is beneficial for your business in the long run.

Using Vencru for retail bookkeeping can help you automate all your accounting processes and keep an accurate record of all the expenses and income. It is also an excellent tool for inventory management.