An invoice represents a document that signifies a legal demand for payment from your customer. It’s the way you get paid. More importantly, it tells your customer in detail what they owe you.

Together we will go through everything you need to know:

Meaning Of Invoice

It can be a document with information on a business transaction between a seller and a buyer. With this, an invoice contains all the necessary information about the product or service for sale, its price, a brief description or details, and lists all other related provisions such as warranties, discounts, and tax information.

It typically contains the following details:

- Invoice Number [Invoice no.]

- Sellers/ Business Logo.

- Sellers/ Business contact information.

- Clients/ Customers contact information.

- Date of issue.

- Due date.

- Description of items.

- Price of product/ services.

- Quantity to be purchased.

- Discount information [if any].

- Warranties.

- Tax information.

- Expected Amount.

- Other payment methods like Bank Transfer e.t.c

What Is An Invoice Used For?

Invoices are used for instantaneous transactions and also used to request payment for a previously approved date. Thus, invoices are useful for various purposes like;

- Maintaining records of the seller/ business owner, the client/buyer, and the exact time the goods/ services were sold.

- Providing both the seller/ business owner an optimized track record of payment and Amount owed.

- Aiding a business owner to develop an effective marketing strategy to meet the client’s needs with proper analysis on their invoice trail.

Advantages Of Invoicing

- Firstly, it prevents overpayments and payment duplication.

- Secondly, it keeps clients abreast of the Amount they owe and the due date for payment.

- Thirdly, it helps keep track of your payment, sales, and inventory is made easy.

- Fourthly, it is an effective way of record keeping.

- Lastly, adding a business logo sends a message to the clients.

Common Misconceptions

Invoice is often confused with some other business documents. Here are some common examples

Invoice vs Bill

Frequently, questions like – what is the difference between a bill and an invoice? Or What is an invoice bill? – are often asked.

Products and services approved immediately are Bills. A bill is a one-time use document that lists how much money a client owes a business with less information. For example, when you visit KFC [Kentucky Fried Chicken] or any restaurant, at the end of your meal, the waitress presents you with a bill, not an invoice.

Invoice vs Contract

A contract outlines what you need to pay – where both parties agree upon the details of a project before it commences. On the other hand, a contract has to be signed before an invoice is issued as a notification/ reminder with details of payment previously agreed by both parties.

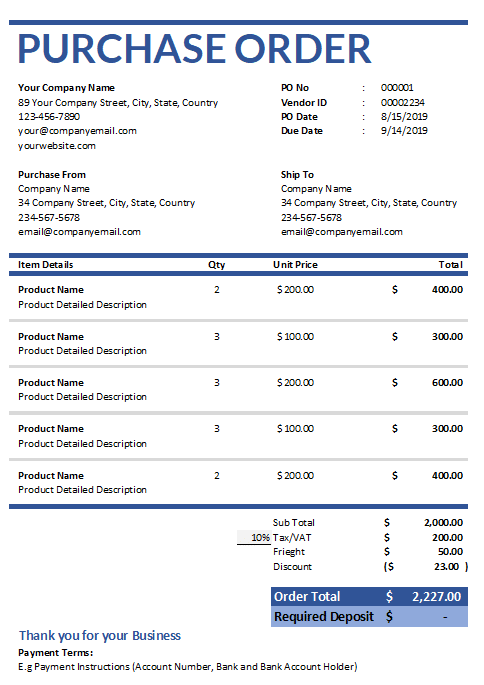

Invoice vs Purchase Order

A purchase order is a document sent by clients to business owners to monitor their purchases and processes. Purchase orders are generated when clients place an order. Thus, as a business owner, once you’ve received the purchase order ‘PO’ of your client, you will carry out the order and in turn, send an invoice requesting payment.

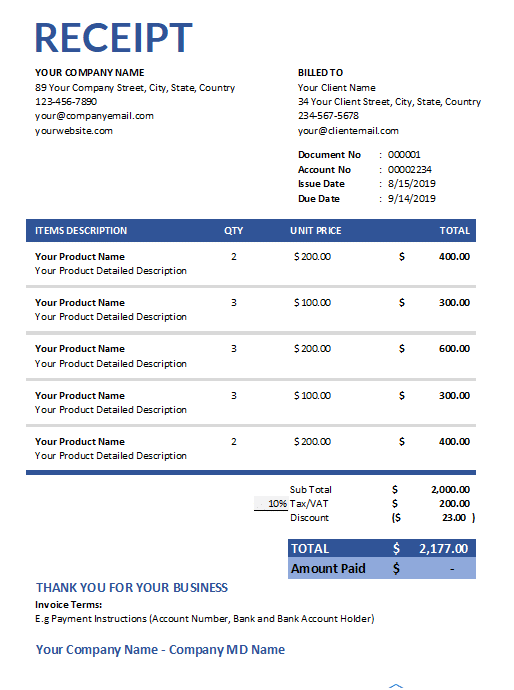

Invoice vs Receipt

Subsequently, to a sale of goods and services, a receipt is a document that an individual receives in confirmation of money or property received for payment. As such, a critical component of a receipt is that it must carry a date of payment received. And this is issued after an invoice has been sent and payment made.

What Does An Invoice Look Like?

It should be clean, readable, professional, and detailed with relevant information. Therefore, All of such information is stated below but not limited to the following:

Top Section

- Document Number: This is a number found at the very top. It could be in a mix of letters and numbers so don’t get confused. Its primary purpose is to keep accurate track of your sales and all information issued within the invoice.

- Sellers/ Business Logo: Every business has a logo and this tells a lot about your brand and presents you as a professional and easy to be identified. The logo is at the top left corner of an invoice.

- Sellers/ Business contact information: A detailed information of the business name, address, corporate/ personal phone number, email address, and fax number. This keeps the client informed of where and whom the invoice is coming from.

- Clients/ Customers contact information: The full name of the client, is important. This makes it easier to identify with them and what they ordered.

- Date of issue and Due date: Every invoice needs to carry the date of issuance and the due date to make payment. This makes it less stressful for the client in keeping track of their payment pattern.

Middle Section

- Description of items: Imagine requesting a client to pay for a product they never consumed or order? Not a good idea right? Information on the right items requested by a client and their quantities are important to be noted on an invoice to avoid payment delays.

- Price of product/ services: Failure to put the exact amount of money discussed with a client upon purchase of a product or services, will lead to further discrepancies and delays in payment. So, therefore, the exact price discussed between the business owner and a client on a product/ service should be documented on an invoice.

- Quantity to be purchased: Documenting the exact number of a product/service ordered on an invoice makes it clear to the client the quantity they ordered or are expecting.

- Discount information [if any]: If as a business owner, you can reduce the purchase price of your products for loyal customers.

- Tax information: Value Added Tax is never to be omitted on a professional invoice to avoid being reviewed by the IRS. It’s located under the subtotal amount to be paid.

- Expected amount to be paid: Having added the VAT and deducted the discount, the amount left to be paid is your expected amount/ amount due.

- Other payment methods: These include payment by bank transfers, online payment, and lots more. This makes it convenient for your clients to pay you from any part of the world without having to revisit your office in person.