Customer satisfaction is crucial when growing a business. However, there are times when customers need to return a product or request a refund. This is where a credit memo comes into play. A credit memo template is a document issued by a seller to a buyer stating that a certain amount has been credited to the buyer’s account. It serves as a record of the refund or credit due to the customer.

What is a Credit Memo?

A credit memo, also known as a credit note or credit memorandum, is a document issued by a seller to a buyer, indicating that a certain amount has been credited to the buyer’s account. It is typically administered in response to a customer’s request for a refund or as compensation for damaged or defective goods.

When to Send a Credit Memo to Customers

Credit memos are typically issued in various scenarios, including:

- Product returns or exchanges

- Overcharged or incorrect billing amounts

- Quality or performance issues with goods or services

- Discounts or refunds granted to customers

- Compensation for damaged or defective items

How Do You Record a Credit Note?

Recording a credit memo involves several steps:

- Identify the Reason: Determine the reason for issuing the credit memo, whether it’s a return, billing error, or other circumstances.

- Prepare the Document: Create a credit memo detailing the credit amount, the reason for the credit, and relevant customer and transaction information.

- Send to Customer: Provide the credit memo to the customer electronically or physically, ensuring they know the credit issued to their account.

- Record in Accounting System: Enter the credit memo information into your accounting system to update the customer’s account balance and maintain accurate financial records.

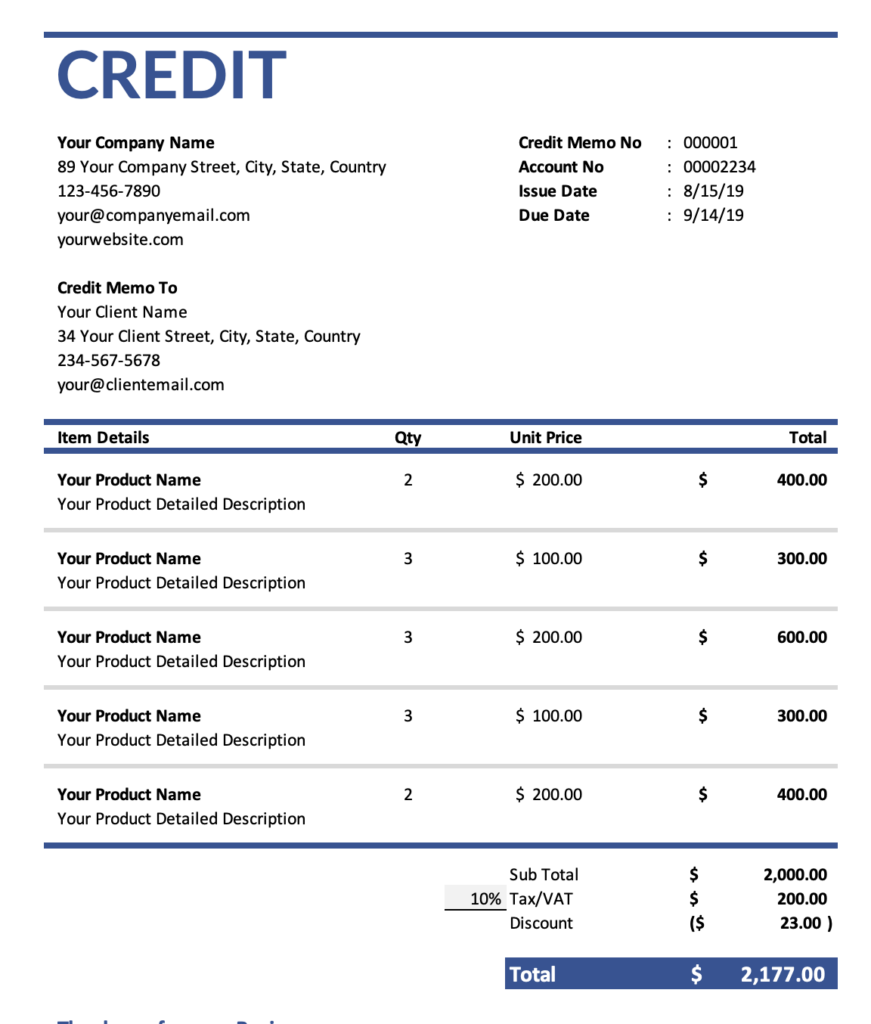

What Should Be Included in a Credit Memo Template?

A credit memo template should include the following:

- Company logo and contact information

- Customer information

- Date of the credit memo

- Reason for the credit memo

- The amount is credited to the customer.

- Terms and conditions (if applicable)

Difference Between a Credit Memo vs Sales Receipt vs Invoice:

- Credit Memo: Issued by the seller to the buyer to provide a credit or refund for previously purchased goods or services.

- Sales Receipt: Acknowledges payment received from the buyer for goods or services at the time of sale.

- Invoice: Requests payment from the buyer for goods or services provided by the seller, detailing the amount owed and payment terms.

Benefits of Using Credit Note Template:

Using a credit memo template offers the following benefits:

- Consistency: Ensures consistent formatting and information inclusion in credit memos.

- Time Savings: Streamlines the credit memo creation process, saving business owners and employees time.

- Accuracy: Helps minimize errors and ensures all relevant details are captured accurately.

- Record-Keeping: Facilitates proper documentation and record-keeping of credit transactions for accounting and auditing purposes.

- Professionalism: Presents a professional and standardized appearance to customers, enhancing credibility and trust.

Download the Free Credit Memo Template in Excel:

Download our free Credit Memo Template in Excel and Google Docs to simplify your refund and return processes. This template is easy to use and can be customized to suit your business needs.

Conclusion

In summary, credit memos are crucial in maintaining customer satisfaction and resolving billing discrepancies in business transactions. Businesses can effectively manage credit transactions and foster positive relationships with their customers by understanding what credit memos are, when to use them, how to record them, and the benefits of using credit memo templates. Download our free credit memo template in Excel and Google Docs to streamline your refunds and returns process.