Law Firm Invoice Template

As a lawyer, you know precision and accuracy are critical to the profession and gaining client trust. This extends beyond courtroom arguments to every facet of a law firm’s operations, including billing and invoicing. That is why we have created our user-friendly and fully customizable law firm invoice templates available in Word, Excel, PDF, Google Docs, and Google Sheets. These free invoice templates are invaluable for attorneys and legal professionals.

Instead of drowning in paperwork, invest your time and expertise where it matters most – in the courtroom.

Importance of Law Firm Invoice Templates

Billing clients as a legal professional can be intricate. Attorneys often work on various cases, each with its unique billing requirements. This complexity makes it challenging to keep track of billable hours, expenses, and fees accurately. Law firm invoice templates come to the rescue by providing a structured framework for invoicing that ensures:

- Accuracy: Legal invoices must be precise and transparent to maintain the client’s trust. Law firm invoice templates help prevent errors and omissions in billing, enhancing your professionalism.

- Consistency: A uniform format for all invoices streamlines the billing process, making it more efficient. Clients appreciate receiving invoices that are easy to understand and consistent in presentation.

- Transparency: Clients have the right to understand how their money is being spent. Law firm invoice templates offer a clear breakdown of services, hours worked, and expenses incurred, promoting transparency in billing.

What Should an Attorney Invoice Template Include?

A well-structured law firm invoice template should include the following essential elements:

- Client Information: This includes the client’s name, contact information, and any reference or matter numbers for easy identification.

- Law Firm Details: Clearly state your law firm’s name, address, and contact information.

- Invoice Date: The date the invoice is issued is crucial for tracking payment deadlines.

- Due Date: Specify the deadline for payment to avoid any confusion or delays.

- Description of Services: List the legal services provided, including case descriptions, court appearances, research, and consultations.

- Hourly Fees: For services billed by the hour, include a breakdown of hours worked and the corresponding hourly rates.

- Flat Fees: If your law firm charges flat fees for specific services, clearly outline them in the invoice.

- Billable Expenses: Include any reimbursable expenses incurred on behalf of the client, such as filing fees, travel expenses, or court costs.

- Total Amount Due: Summarize the total amount the client owes, including all fees, expenses, and taxes.

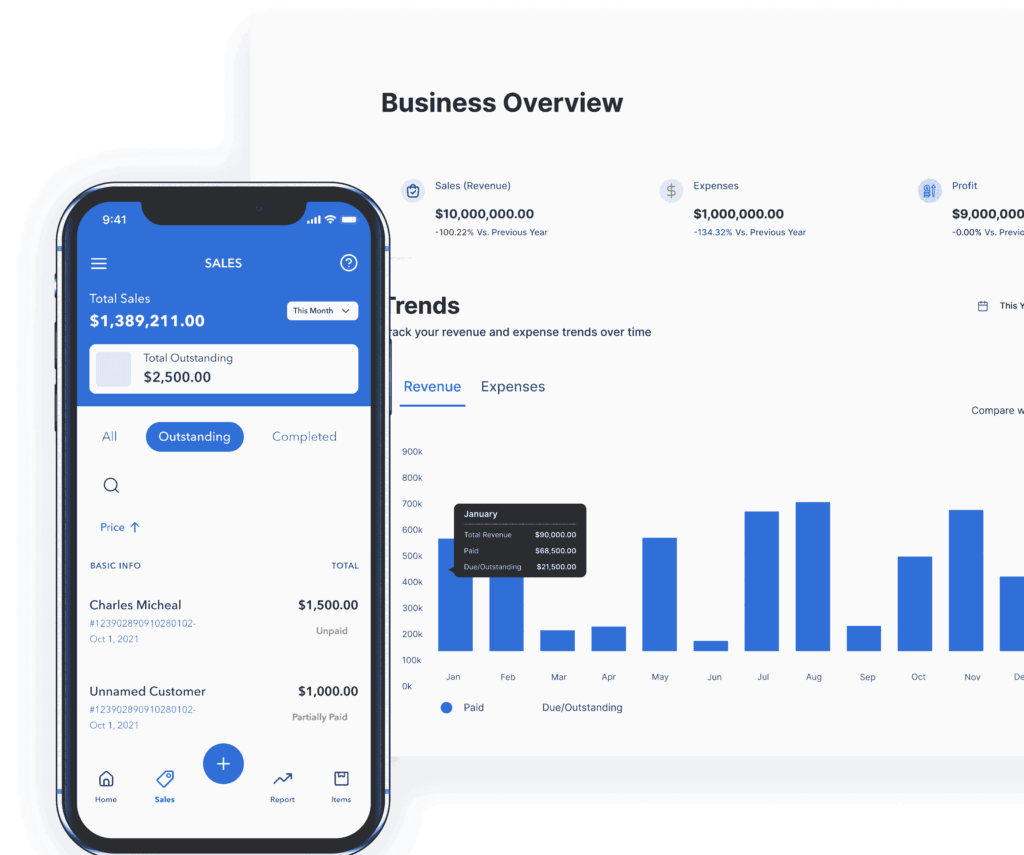

Take Your Invoicing to the Next Level with Vencru

But why stop at just templates when you can streamline your entire invoicing process effortlessly? Vencru’s invoicing app is the perfect companion for legal professionals. Here’s how it can benefit you:

| Features | Downloadable invoice templates | Vencru invoicing |

|---|---|---|

| Cost | $0 Download Template | $0 Get Started Free |

| Editable | ||

| Printable | ||

| Downloadable | ||

| Email to Clients | ||

| Unlimited Invoicing, Estimates, and Inventory | ||

| Accept Online Payment | ||

| Track Invoice Status | ||

| Track Sales & Debtors | ||

| Create and Send Invoices from Your Mobile Device - Anywhere Anytime | ||

| Get Business Insights and Accounting Reports |

Difference Between Invoice and Trust Request Receipt

In the legal profession, it’s crucial to distinguish between invoices and trust request receipts. While both are financial documents, they serve distinct purposes:

- Invoice: An invoice is a request for payment from a client for legal services rendered. It outlines the fees, expenses, and services provided. Invoices are sent to clients to facilitate billing and payment.

- Trust Request Receipt: This document serves as a record of funds held in trust on behalf of a client. It outlines deposits, withdrawals, and interest earned on the trust account. Trust request receipts ensure compliance with ethical and legal obligations regarding client funds.

Get your free invoicing software

Download our mobile app and manage your bookkeeping on the go. You can send invoices, see sales reports, monitor inventory levels, track expenses, and more through your mobile app – anytime and anywhere.