In accounting, debits and credits are the fundamental building blocks for recording financial transactions. They may appear challenging, but understanding debits and credits is critical for keeping correct financial records. This guide will break down what is debit and credit, explain how they apply to different account types, and provide examples to help you comprehend them.

- Understanding Debits and Credits

- Debits and Credits in Different Account Types

- Relation to General Ledger, Trial Balance, and Financial Statements

- Sample Entries with Debits and Credits for Common Scenarios

- Automate Your Debit and Credit Accounting with Vencru

Understanding Debits and Credits

Imagine your accounting system as a giant T-shaped chart. Each account in your system (like cash, inventory, or expenses) has its T-account. The left side of the T represents the debit side, and the right side represents the credit side.

Transactions are recorded by making entries in these T-accounts. Debits and credits affect accounts differently depending on their type:

- Debit (DR): A debit typically increases asset and expense accounts and decreases liability, equity, and revenue accounts. You can think of “debit” as “Debit to Get” for assets and expenses.

- Credit (CR): A credit typically increases liability, equity, and revenue accounts and decreases asset and expense accounts. Think of “credit” as “Credit to Give” for liabilities, equity, and revenue.

Remember: These are general rules, and there may be exceptions depending on specific accounts.

Debits and Credits in Different Account Types

Let’s delve into debits and credits for various account types with illustrative examples:

Assets

Assets are resources owned by the business, that hold the promise of future economic benefits. From a crisp $20 bill in the cash register to the delivery truck used for making sales, assets are fundamental to financial health and operational success. Let’s delve deeper into some key asset categories:

- Cash: represents the tangible currency and coins held by the business

- Accounts Receivable: tracks the money customers owe for goods or services purchased on credit.

- Inventory: represents the stock of goods a business holds for sale – from raw materials to finished products.

- Equipment: Machinery, vehicles, furniture – these tangible assets used in daily operations.

- Prepaid Expenses: Think of prepaid rent or insurance – these represent expenses paid for in advance.

Debits generally increase the value of assets (e.g., purchasing equipment, receiving cash), while Credits decrease the value of assets (e.g., selling equipment, using supplies)

For example, if a business purchases inventory for $1,000 cash:

- A debit of $1,000 is recorded in the Inventory account, increasing the asset.

- Simultaneously, a credit of $1,000 is logged in the Cash account, reflecting the decrease in assets.

Liabilities

Liabilities are financial obligations or debts owed to external entities like suppliers, banks, or employees. Here’s a breakdown of some key sub-accounts within liabilities:

- Accounts Payable: tracks the amounts owed to suppliers for goods or services purchased on credit.

- Loans Payable: reflects the principal amounts borrowed through loans.

- Accrued Expenses: Not all expenses are settled immediately. Accrued expenses capture those incurred but not yet paid, such as salaries owed to employees or utilities used.

- Notes Payable: When a business issues formal promissory notes to creditors, the amounts owed are tracked in this sub-account.

Debits generally represent actions that decrease liabilities, such as paying off a loan. On the other hand, credits signify activities that increase liabilities, like borrowing money. For example, borrowing $5,000 from the bank would involve debiting cash (the asset increases) and crediting accounts payable (the liability increases).

Equity

Equity represents the ownership claim on the business’s assets, essentially what’s left after subtracting all liabilities (debts) from the total assets. It includes the following sub-accounts:`

- Common Stock: reflects the initial investment made by shareholders in exchange for ownership rights in the company.

- Retained Earnings: accumulates the net profits or losses earned by the business after distributing dividends to shareholders.

- Owner’s Equity: tracks the financial stake of the owner(s) in the business, representing their direct investment.

Debits generally decrease equity, such as when an owner withdraws cash for personal use, while credits represent activities that increase equity, like retaining profits or receiving a new investment. For instance, if you invest $10,000 cash into your business:

- Debit Cash: $10,000 (Asset decreases)

- Credit Common Stock: $10,000 (Equity increases)

Revenue

Revenue represents the income generated from its core activities. It encompasses various streams, with notable sub-accounts being:

- Sales Revenue: captures the income earned from selling goods or services to customers.

- Service Revenue: reflects the income earned from providing and delivering services to clients or customers.

- Interest Income: tracks the interest earned on investments or loans made by the business.

Debits are typically used to decrease revenue accounts, although this is rare and often related to returns or customer allowances. Conversely, a revenue account is increased by credits indicating activities that boost revenue, such as sales of products or services.

For example, if $2,000 worth of goods are sold to a client

- To record a sale on account the company should debit the Accounts Receivable account of $2000, increasing the asset.

- Simultaneously, a credit of $2,000 is logged in the Sales Revenue account, reflecting the rise in revenue.

Expenses

Expenses are the costs incurred by the business while generating revenue. They include a variety of categories necessary for business operations:

- Rent Expense: captures the costs of renting or leasing property, such as office space or equipment, used for business activities.

- Utility Expense: records the expenditures related to essential services like electricity, water, and gas necessary for business operations.

- Salaries Expense: accounts for the remuneration disbursed to employees for their contributions to the business.

Debits are primarily used to increase expense accounts, reflecting the cost being used or paid. For example, if you pay $500 cash for your monthly rent, you’d debit rent expense (the expense increases) by $500 and credit cash (the asset decreases) by $500.

Credits are rarely used for expenses, but they might come into play for exceptional circumstances, such as reversing an expense that was recorded incorrectly.

Journal Entry

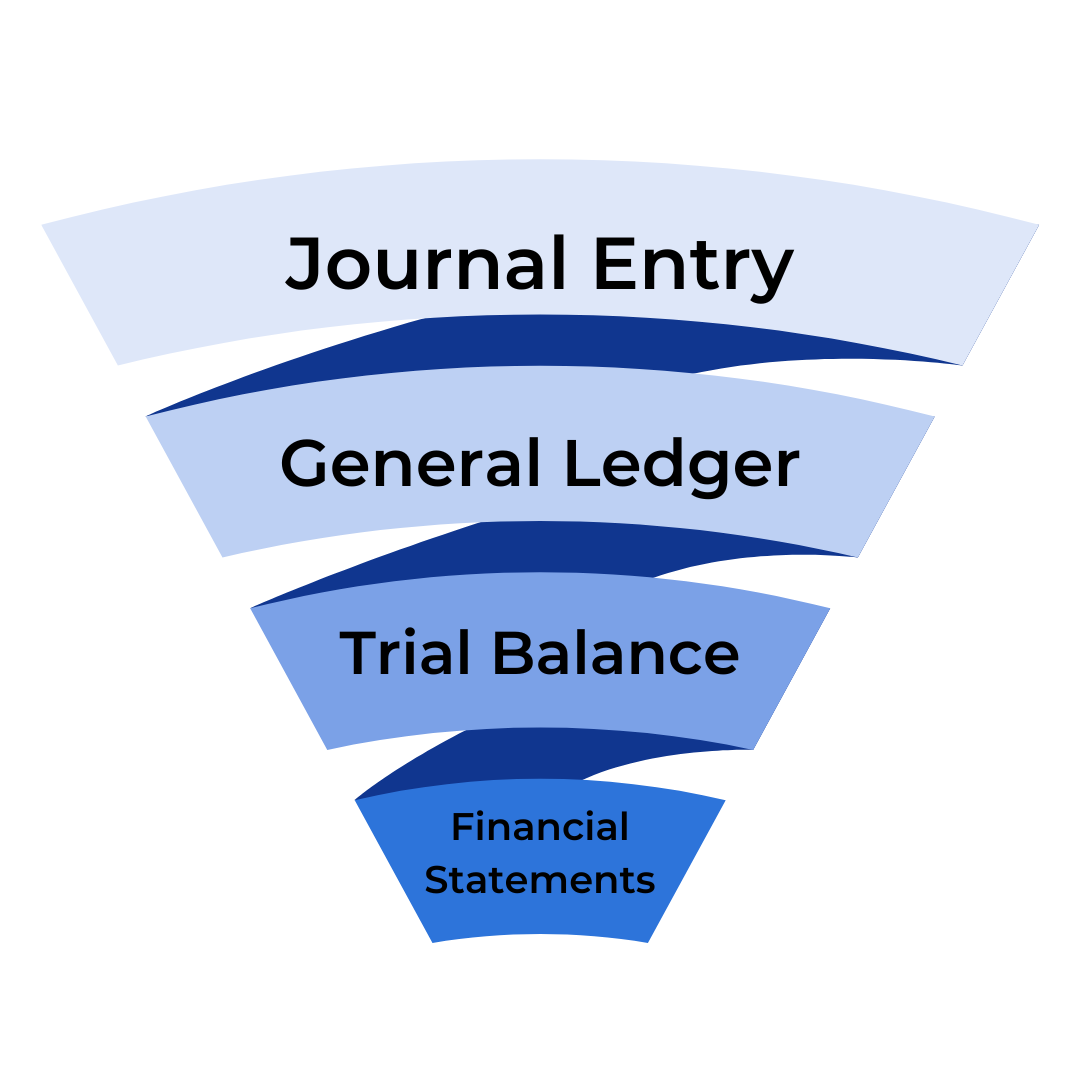

Journal entry is the formal recording of financial transactions in the accounting system. Each journal entry consists of at least one debit and one credit, with the total debits equaling the total credits. Journal entries are used to update the general ledger accounts and form the foundation for financial statements.

Relation to General Ledger, Trial Balance, and Financial Statements:

- General Ledger: contains all the individual accounts businesses use, showing the transactions and balances for each account. Journal entries are posted to the appropriate accounts in the general ledger.

- Trial Balance: is a list of all general ledger account balances at a specific time. It ensures that the total debits equal the total credits.

- Financial Statements: summarize a business’s financial performance and position. They are created using information from the general ledger and trial balance. Common financial statements include:

- Income Statement (Summarizes revenues and expenses for a period)

- Balance Sheet (Shows assets, liabilities, and equity at a specific point in time)

- Cash Flow Statement (Details cash inflows and outflows from operating, investing, and financing activities)

How They Relate:

- Journal entries capture individual transactions.

- The general ledger accumulates these entries in each account.

- The trial balance verifies the accuracy of these entries by ensuring the debits and credits balance.

- Financial statements use summarized data from the general ledger to present the business’s overall financial health.

Here’s an example to illustrate how debits and credits, journal entries, and reports connect:

- Scenario: A company sells products for $1,000 cash and incurs $200 in rent expenses (paid in cash).

- Journal Entry:

- Debit Cash: $1,000 (Asset increase – cash received)

- Credit Sales Revenue: $1,000 (Revenue increase – product sale)

- Debit Rent Expense: $200 (Expense increase – rent paid)

- Credit Cash: $200 (Asset decrease – cash paid for rent)

- Impact on Reports:

- The sales transaction increases cash (asset) and sales revenue.

- The rent expense increases expenses and decreases cash.

- These transactions are posted to the general ledger and eventually reflected in the income statement (sales revenue and rent expense) and balance sheet (cash, sales revenue, and rent expense).

Sample Entries with Debits and Credits for Common Scenarios:

Accounts Payable

Example: Purchased $1,000 worth of inventory on credit.

- Journal Entry:

- Debit: Inventory (Asset) – $1,000

- Credit: Accounts Payable – $1,000

Accounts Receivable

Example: Sold goods totaling $2,000 to a client on credit.

- Journal Entry:

- Debit: Accounts Receivable – $2,000

- Credit: Sales Revenue – $2,000

Advertising Expense

This includes costs incurred for promoting products or services to potential customers. For example, paid $300 for an online advertising campaign.

- Journal Entry:

- Debit: Advertising Expense – $300

- Credit: Cash – $300

Asset Source Transaction

This can involve various scenarios, but generally:

- Debit: Asset Account (e.g., Inventory, Equipment) – This increases the asset acquired.

- Credit: Cash (if purchased with cash) or Accounts Payable (if purchased on credit) – This decreases the asset (cash) or increases the liability (accounts payable).

Common Stock

Is Common Stock a debit or credit? Common stock is recorded as a credit in the accounting records. When shareholders invest in the company by purchasing common stock, it increases the business equity, which is recorded as a credit to the common stock account. For example, if a company issues common stock for $5,000 cash, the journal entry would be:

- Debit: Cash – $5,000

- Credit: Common Stock – $5,000

Cash Received on Account

This refers to cash received from customers for previous sales made on credit. For example, received $500 cash from a customer who purchased goods on credit.

- Journal Entry:

- Debit: Cash – $500

- Credit: Accounts Receivable – $500

Cost of Goods Sold

Example: Sold inventory for $3,000 with a cost of goods sold of $1,500.

- Journal Entry:

- Debit: Cost of Goods Sold – $1,500

- Credit: Inventory – $1,500

Depreciation Expense

This accounts for the gradual decrease in the value of a non-current asset over time. For example, a business recorded monthly equipment depreciation amounting to $400.

- Journal Entry:

- Debit: Depreciation Expense – $400

- Credit: Accumulated Depreciation – $400

Related Read: What is depreciation in accounting and how is it calculated?

Gain

Gain accounts record profits earned from transactions other than normal business operations. For example, a business sold an investment property for $20,000 more than its book value.

- Journal Entry:

- Debit: Cash – $20,000

- Credit: Gain – $20,00

Insurance Expense

Example: Paid $700 for monthly insurance premiums

- Journal Entry:

- Debit: Insurance Expense – $700

- Credit: Cash – $700

Interest Income

Example: Received $300 in interest from a bank deposit.

- Journal Entry:

- Debit: Cash – $300

- Credit: Interest Income – $300

Land

Example: Purchased land for $50,000 cash.

- Journal Entry:

- Debit: Land – $50,000

- Credit: Cash – $50,000

Net Income

This represents the total profit earned by the business after deducting all expenses from total revenue. For example, you generated $10,000 in revenue and incurred $7,000 in expenses.

- Journal Entry:

- Debit: Revenue Accounts – $10,000

- Credit: Expense Accounts – $7,000

- Credit: Net Income – $3,000

Related Read: How To Calculate Net Income: A Complete Guide

Owner’s Drawings

Drawings represent withdrawals made by the owner from the business for personal use. For example, the business owner withdrew $1,000 cash for personal expenses.

- Journal Entry:

- Debit: Owner’s Drawings – $1,000

- Credit: Cash – $1,000

Owner’s Equity

Example: Invested $10,000 cash into the business.

- Journal Entry:

- Debit: Cash – $10,000

- Credit: Owner’s Equity – $10,000

Prepaid Insurance

This represents insurance premiums paid in advance, which will be expensed over time. Is prepaid insurance an asset? Yes, prepaid insurance is indeed classified as an asset. This is because the insurance coverage provides future economic benefits to the business, similar to other assets. For example, paid $1,200 for annual insurance coverage.

- Journal Entry:

- Debit: Prepaid Insurance – $1,200

- Credit: Cash – $1,200

Retained Earnings

This represents the cumulative profits earned by the business that has not been distributed to shareholders as dividends. For example, the net income for the year is $20,000.

- Journal Entry:

- Debit: Net Income – $20,000

- Credit: Retained Earnings – $20,000

Salaries Expense

Example: Paid employees $4,000 in salaries.

- Journal Entry:

- Debit: Salaries Expense – $4,000

- Credit: Cash – $4,000

Supplies

This represents consumable items used in the business’s day-to-day operations, such as office or cleaning supplies. For example, purchased office supplies for $300 cash.

- Journal Entry:

- Debit: Supplies (Asset) – $300

- Credit: Cash – $300

Wages Payable

This represents the wages or salaries owed to employees that have been earned but not yet paid. For example, a business accrued $1,000 in wages for the current pay period.

- Journal Entry:

- Debit: Wages Expense – $1,000

- Credit: Wages Payable – $1,000

Automate Your Debit and Credit Accounting with Vencru

In conclusion, understanding debits and credits is fundamental to maintaining accurate financial records and ensuring a business’s financial health. By mastering the concepts outlined in this guide, businesses can effectively record transactions, analyze financial performance, and make informed decisions.

However, managing debits and credits manually can be time-consuming and prone to errors. That’s where Vencru comes in. With Vencru’s intuitive accounting software, businesses can streamline their debit and credit accounting processes, automate journal entries, and easily generate comprehensive financial reports.

Whether you’re recording expenses, tracking revenue, or managing assets and liabilities, Vencru simplifies the accounting process, allowing businesses to focus on what they do best—growing and succeeding. So why struggle with manual accounting when you can use Vencru to automate your debit and credit accounting and take your business to the next level? Try Vencru today and experience the difference!