As a retailer or wholesaler, understanding your net profit is crucial for making informed financial decisions and assessing the overall profitability of your business.

In this comprehensive guide, we will walk you through the concept of net profit, its significance for retailers and wholesalers, the formula used to calculate it, and how Vencru can simplify the process for you. Let’s dive in and explore the world of net profit with real-life examples tailored to your industry.

What is Net Profit?

Net profit, also known as the “bottom line,” represents the profit left over after all business expenses, including operating expenses and cost of sales, have been deducted from total revenue. It reflects the amount of money your retail or wholesale business has earned or lost during a specific period.

For example: Let’s say you run a retail store, and during a month, your total revenue from sales is $50,000. During the same period, you incurred various expenses, such as operating expenses like rent ($5,000), utilities ($1,000), employee salaries ($10,000), and cost of sales ($20,000) for the products you sold. After deducting these expenses from your total revenue, your net profit for the month would be $14,000 ($50,000 – $20,000 – $5,000 – $1,000 – $10,000).

Why is Calculating Net Profit Important for Retailers and Wholesalers?

Calculating net profit is vital for retailers and wholesalers as it provides valuable insights into the financial health and profitability of their businesses. Let’s delve deeper into why net profit is crucial for your retail or wholesale venture:

- Business Growth: Understanding your net profit helps you identify areas for improvement and growth opportunities, enabling you to make strategic decisions for the future. For instance, by analyzing your net profit over time, you may discover that certain product lines or services are more profitable than others, allowing you to focus on those areas and optimize your business strategies.

- Financial Stability: Net profit serves as a key indicator of your business’s financial stability. A positive net profit indicates that your business is generating more revenue than it incurs in expenses, ensuring that you have sufficient funds to cover operational costs and potential expansion plans. On the other hand, a negative net profit signals financial challenges, prompting you to take corrective actions to improve profitability.

- Investment Decisions: Investors and stakeholders often use net profit as a critical factor when making investment decisions. A strong net profit demonstrates that your retail or wholesale business is operating efficiently and generating profits, making it an attractive investment opportunity. As a result, understanding your net profit can help you attract potential investors and secure additional funding for your business growth.

- Tax Planning: Net profit plays a significant role in tax planning for your retail or wholesale business. Tax authorities use your net profit as the basis for calculating profit taxes owed. By accurately calculating your net profit, you can ensure that you are compliant with tax regulations and avoid any potential penalties or tax overpayments.

Example: Imagine you own a retail store that sells electronic gadgets. During a quarter, your total revenue from sales is $200,000. However, you incurred various operating expenses, such as employee salaries ($30,000), rent ($10,000), utilities ($5,000), and advertising costs ($15,000), as well as the cost of sales ($100,000). After subtracting these expenses from your total revenue, your net profit for the quarter would be $40,000 ($200,000 – $100,000 – $30,000 – $10,000 – $5,000 – $15,000). This positive net profit indicates that your retail business is profitable, and that you have room for expansion or investment opportunities.

Net Profit Formula in Accounting

The net profit formula is straightforward and easy to calculate:

Net Profit = Total Revenue – (Cost of Sales + Operating Expenses)

Cost of Sales

This represents the direct costs associated with producing or purchasing the goods that a company sells during a specific period. For retail and wholesale businesses, cost of sales includes expenses directly related to the products they sell. Here are some examples of the cost of sales for a retail or wholesale business:

- Cost of Raw Materials: For a manufacturing business, this includes the cost of purchasing raw materials to produce the goods.

- Wholesale Purchase Cost: For a wholesale business, cost of sales includes the cost of purchasing products from manufacturers or suppliers.

- Freight and Shipping Costs: The expenses incurred to transport raw materials or finished goods to the business premises.

- Direct Labor Costs: The wages paid to employees directly involved in the production or handling of goods, such as assembly line workers or warehouse personnel.

- Packaging Materials: The cost of materials used to package the products for sale.

- Manufacturing Overhead: Indirect costs associated with production, such as utilities, factory rent, and equipment depreciation.

- Inventory Adjustments: Any adjustments made to inventory value due to spoilage, obsolescence, or shrinkage.

- Customs Duties and Taxes: For businesses involved in international trade, this includes the customs duties and taxes paid on imported goods.

- Direct Equipment Costs: The depreciation or rental expenses of machinery or equipment used directly in production.

- Quality Control Expenses: The costs associated with testing and ensuring the quality of finished goods.

For retail businesses, cost of sales is particularly crucial as it directly impacts the gross profit margin. By carefully monitoring and managing the cost of sales, retail and wholesale businesses can improve profitability and make informed pricing decisions.

It’s important to note that the specific elements included in cost of sales can vary based on the nature of the business and its industry. Accurate tracking of these costs is essential for calculating net profit and evaluating the overall financial health of the company.

Operating Expenses

These are the day-to-day costs that a retail or wholesale business incurs to keep its operations running smoothly. Here are some examples of operating expenses that a retail or wholesale business might encounter:

- Rent and Utilities: The cost of renting the retail or warehouse space and utility bills such as electricity, water, and gas.

- Payroll: The salaries and wages paid to employees, including sales staff, store managers, warehouse workers, and administrative personnel.

- Inventory Costs: The expenses associated with purchasing and maintaining inventory, including the cost of sales for products sold in retail stores.

- Marketing and Advertising: The expenses for marketing campaigns, advertising materials, social media promotions, and other promotional activities to attract customers.

- Insurance: The cost of business insurance, which may include liability insurance, property insurance, and worker’s compensation insurance.

- Office Supplies: The expenses for office essentials like stationery, printing materials, and other supplies required for day-to-day operations.

- Repairs and Maintenance: The costs associated with maintaining and repairing equipment, fixtures, and facilities.

- Bank Fees and Credit Card Processing: The fees charged by banks and payment processors for processing transactions and managing financial accounts.

- Professional Services: The fees paid to external consultants, accountants, lawyers, and other professionals for specialized services.

- Software and Technology: The expenses for software subscriptions, point-of-sale systems, inventory management systems, and other technology-related costs.

- Transportation and Shipping: The expenses related to delivering goods to customers or receiving inventory from suppliers.

- Training and Development: The cost of training employees to improve their skills and knowledge in areas such as customer service, sales techniques, and product knowledge.

It’s important for retail and wholesale businesses to carefully track and manage their operating expenses to maintain profitability and financial stability. Efficiently managing these expenses can contribute to higher net profit and overall business success.

Example: Let’s take a wholesaler as an example. Suppose the wholesaler’s total revenue for the year is $500,000. During the same period, the business incurred operating expenses like warehouse rent ($30,000), shipping costs ($20,000), employee salaries ($100,000), and the cost of sales ($250,000). Using the net profit formula, the wholesaler’s net profit for the year would be $100,000 ($500,000 – ($30,000 + $20,000 + $100,000 + $250,000)).

Where is Net Profit on Financial Statements?

Net profit is a critical component of the income statement, which provides a summary of your business’s revenues, expenses, and net profit or loss over a specific period. As a retailer or wholesaler, you can find your net profit at the bottom of the income statement, hence the term “bottom line.”

Here’s an example: Let’s consider a retailer. On its income statement, the retailer’s total revenue is $200,000 for the year, and the total of operating expenses and cost of sales is $150,000. The net profit for the year would be $50,000, listed at the bottom of the income statement.

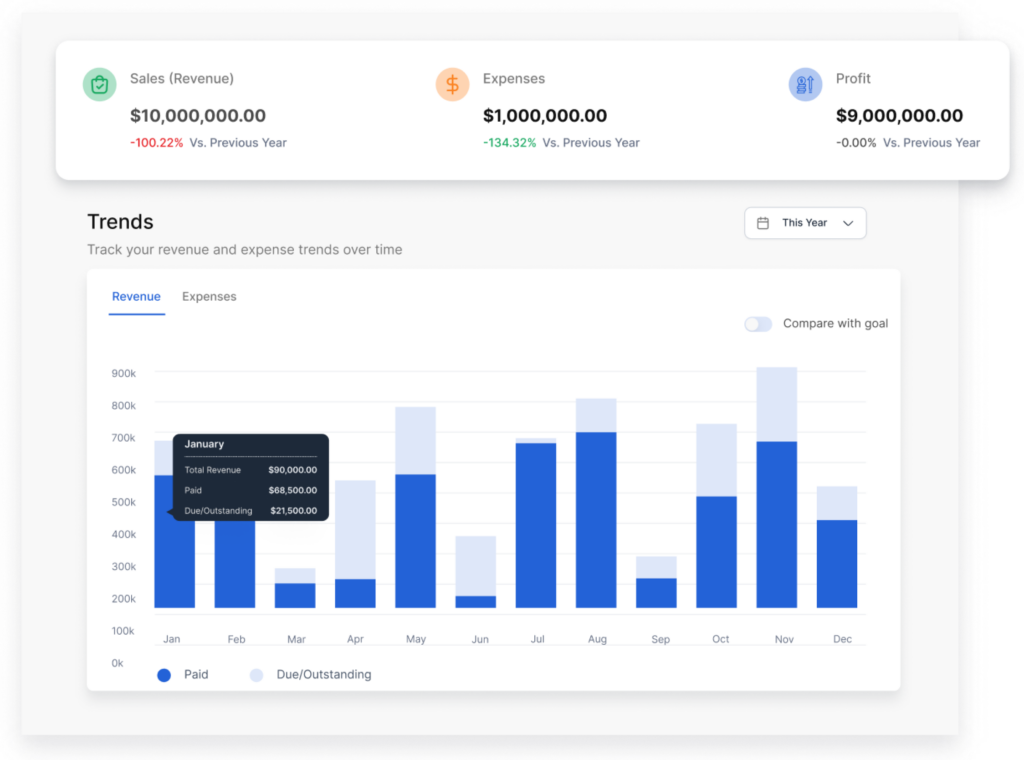

How Vencru Helps You Compute Net Profit for Your Retail or Wholesale Business

Vencru, the leading accounting software for retailers and wholesalers, streamlines calculating net profit by automatically tracking sales and expenses. Vencru offers a wide range of benefits, including:

- Auto-generate Financial Statements: Vencru can create financial statements automatically. These statements include the income statement. They provide instant information about your net profit and how your business is doing.

- Comprehensive Features: Vencru has many features like invoicing, inventory management, sales tracking, expense management, and more. These help calculate net profit accurately.

- User-friendly Interface: Vencru’s easy-to-use platform allows business owners and finance professionals alike to navigate the software effortlessly and gain valuable financial insights.

- Accessible Anywhere: Vencru is on the web and mobile. Thus you can access your business’s financial data, run your business, and monitor net profit wherever you are.

- Strong Security and Customer Support: Vencru prioritizes the security of your financial data and provides dedicated customer support to assist you whenever needed.

Conclusion

Calculating net profit is not only a fundamental aspect of financial management but also a strategic tool for your retail or wholesale business. It provides a comprehensive view of your business’s financial performance, guides your investment decisions, and helps you plan for future growth and success.

By understanding the significance of net profit and leveraging Vencru’s powerful accounting software, you can drive your retail or wholesale venture toward greater financial prosperity and sustainable growth. Book a demo with Vencru now to see how we can help manage your business’s finances and make it more successful.