Proper invoicing is crucial for the success of any construction project. However, in the hustle of deadlines and the complexities of the construction site, invoicing can often be overlooked or mismanaged, leading to delays, disputes, and ultimately, financial strain. This blog post will cover the best practices for invoicing in construction projects, helping construction business owners streamline their processes and ensure timely payments. We will discuss:

- What is a Construction Invoice?

- Understanding Invoicing in Construction Projects

- Invoicing Methods in Construction

- 7 Best Practices for Construction Invoicing

What is a Construction Invoice?

A construction invoice is a document used by contractors or construction companies to request payment from clients for services and materials provided. It includes details like the project’s name, description of work completed, itemized materials, labor costs, payment terms, and contact information. This invoice ensures both parties have a clear understanding of the work done and the costs involved, facilitating smooth financial transactions.

Related Read: Invoicing 101: A Complete Guide for Businesses of All Sizes

Understanding Invoicing in Construction Projects

Invoicing in construction is not just about sending a bill. It’s about providing a detailed record of work completed, materials used, and labor costs. The complexity of construction projects, with multiple stakeholders and varying phases, makes accurate invoicing essential. Here are the key benefits:

- Comprehensive Documentation: Invoicing provides a detailed record of work completed, materials used, and labor costs, offering transparency and accountability in construction projects. This documentation serves as a crucial reference for tracking project progress and ensuring accurate financial reporting.

- Facilitating Decision-Making: Detailed invoicing aids decision-making processes by providing insights into project performance and resource utilization. Project managers can use invoicing data to assess project profitability, identify areas for cost optimization, and allocate resources effectively.

- Navigating Complex Projects: Invoicing is particularly vital in the context of complex construction projects, which involve multiple stakeholders and varying phases. Accurate invoicing ensures that all project-related expenses are properly accounted for, reducing the risk of oversights and financial discrepancies.

- Mitigating Risks: Accurate invoicing helps mitigate risks associated with payment delays, disputes, and financial instability. By providing clear documentation of project expenses and payments, invoicing reduces the likelihood of misunderstandings between parties and helps maintain positive relationships with clients and suppliers.

- Ensuring Financial Stability: Timely and precise invoicing is essential for maintaining financial stability throughout the project lifecycle. It ensures that contractors and subcontractors receive payments promptly, enabling them to meet financial obligations and sustain operations without disruptions. Additionally, accurate invoicing contributes to better cash flow management and risk mitigation strategies.

Related Resource: Free construction invoice template

Invoicing Methods in Construction

Selecting the right invoicing method in construction is crucial for maintaining cash flow and ensuring project success. Here are some common invoicing methods used in the industry:

1. Progress Billing:

Progress billing involves invoicing clients at regular intervals or upon the completion of specific project milestones. Consequently, this method aligns payments with the project’s progress, making it easier for clients to manage expenses and for contractors to maintain cash flow. Additionally, it provides a clear record of work completed and costs incurred at each stage.

2. Time and Material Invoicing:

Time and material invoicing charges clients based on the actual time spent on the project and the materials used. This method, therefore, requires detailed tracking of labor hours and material costs. It is ideal for projects with variable scopes or where the exact amount of work cannot be determined upfront. By ensuring that all incurred costs are covered, it reduces the risk of underbilling.

3. Fixed-Price Invoicing:

Fixed-price invoicing involves charging a set amount for the entire project. This method necessitates a detailed initial agreement outlining the project’s scope and deliverables. Thus, it is beneficial for clients who prefer cost certainty. However, any changes or additional work must be documented and agreed upon to avoid disputes.

4. Cost-Plus Invoicing:

Cost-plus invoicing charges clients for the actual costs incurred on the project plus a fixed fee or percentage for overhead and profit. Consequently, this method provides transparency as clients see the exact costs involved. It is suitable for projects where the scope may change or expand over time. Clear documentation of all expenses is essential to maintain trust and avoid disputes.

5. Unit Price Invoicing:

Unit price invoicing involves billing clients based on the number of units of work completed, such as square footage or number of items installed. This method is easy to understand, making it suitable for projects with repetitive tasks. Consequently, it ensures that payments are directly tied to the amount of work done.

6. Retainage Billing:

Retainage billing involves withholding a percentage of each invoice until the project is substantially complete. Therefore, this method provides a financial incentive for contractors to finish the project on time and to the client’s satisfaction. The retained amount is usually released upon final inspection and approval of the work.

Choosing the right invoicing method can enhance financial stability, improve client relationships, and contribute to the overall success of your construction projects.

7 Best Practices for Construction Invoicing

- Issue Clear and Detailed Invoices

- Use Accurate Time Tracking

- Send Timely Invoices

- Use of Invoicing Software

- Maintain Clear Communication

- Verify Work Completion before Invoicing

- Stay Informed on Tax Regulations

1. Issue Clear and Detailed Invoices

Ensure your invoices are clear and detailed. Include itemized lists that break down all costs—materials, labor, and other expenses. Segment your invoices by project milestones or phases. This approach makes it easier for clients to understand the charges and simplifies tracking payments for completed work. Detailed invoices help prevent misunderstandings and ensure clients see exactly what they are paying for.

Related Read: 5 Common Invoicing Mistakes to Avoid

2. Use Accurate Time Tracking

Accurate time tracking is essential. Use time-tracking tools designed for construction projects to log daily labor and equipment usage accurately. Keeping daily logs ensures that all billable hours and resources are accounted for, reducing the risk of underbilling or overbilling. Precise time tracking helps maintain financial accuracy and project accountability.

3. Send Timely Invoices

Timely invoicing is crucial for maintaining cash flow. Set a regular invoicing schedule—whether weekly, bi-weekly, or monthly—and send invoices promptly after completing project milestones. This practice accelerates payments and keeps your projects financially healthy. Regular and timely invoicing ensures a steady cash flow, which is vital for the ongoing operations of your construction business.

4. Use of Invoicing Software

Utilize invoicing software to enhance your invoicing process. Such software automates many aspects of invoicing, ensuring accuracy and efficiency. Invoicing tools streamline the process, making it easier to manage and track payments. Automation reduces manual errors and saves time, allowing you to focus on other critical aspects of your projects.

Related Read: Invoicing Software vs. Spreadsheets

5. Maintain Clear Communication

Clear communication with clients is vital. Inform your clients about your invoicing schedules and amounts upfront. Document all communications related to project changes or additional costs. Transparency helps build trust and reduces the likelihood of disputes. Keeping clients informed ensures they understand the billing process and any adjustments, fostering a positive working relationship.

6. Verify Work Completion before Invoicing

Before invoicing, verify that the work outlined in the invoice has been completed satisfactorily according to the project scope. Conduct thorough inspections and quality checks to ensure all deliverables meet the agreed-upon standards. Invoicing for completed work reduces the likelihood of disputes and ensures accurate billing.

7. Stay Informed on Tax Regulations

Stay abreast of local, state, and federal tax regulations relevant to construction invoicing, including sales tax, use tax, and value-added tax (VAT). Understand tax obligations related to construction services and materials to ensure accurate invoicing and tax compliance. Compliance with tax regulations prevents penalties and legal consequences associated with tax non-compliance.

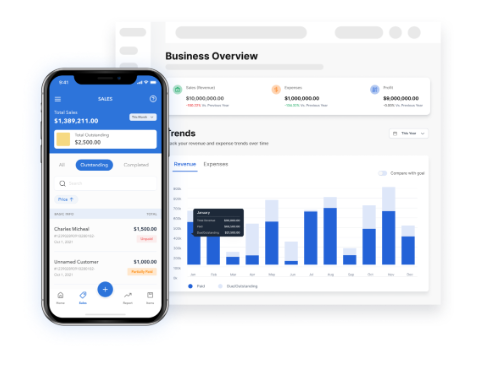

Manage Your Construction Invoicing with Vencru

Effective invoicing practices are vital for the success of construction projects. By following these invoicing best practices, you can ensure timely payments, reduce disputes, and maintain financial stability. Vencru construction invoicing software can help you streamline your invoicing process and remain on top of client billing.

Vencru is a simple all-in-one solution with best practices for construction invoicing, inventory management, and accounting. With Vencru, you can issue professional invoices, manage purchases, track project expenses, manage project inventory, track taxes, generate business reports, manage employees, manage clients and suppliers, and so on one affordable platform. Enjoy the ease of integrated invoicing and accounting on Vencru- Sign up here or book a demo to get started.

Related Read: