The break-even point in business is a critical financial calculation. It represents the point where total costs and revenue are equal, meaning no net loss or gain exists. The business has sold enough products or services to cover its variable and fixed costs at the break-even point. Performing break-even analysis is crucial for businesses as it helps set sales targets and pricing strategies and understand the impact of changes in costs or sales volume.

For example, if you’re starting a retail clothing store, knowing your break-even point will help you determine how many pieces of clothing you need to sell each month to cover your rent, salaries, and the cost of purchasing the clothes.

The importance of the break-even point

- Determining Financial Feasibility: It helps you assess whether your business model is financially viable. Knowing your break-even point will show you the minimum amount of sales you need to cover all your costs. If this point seems too difficult to achieve with your current pricing and cost structure, it may indicate a need to rethink your business strategy.

- Guiding Pricing Strategies: The break-even analysis helps you understand how pricing affects your ability to cover costs and generate profit. You’ll know how much you need to charge to at least break even and what sales volume is necessary for profitability.

- Cost Management: The break-even point highlights the impact of costs on your business. You can see how changes in fixed costs (like rent or salaries) and variable costs (like the cost of goods sold) affect the number of sales you need to break even. This understanding is crucial for effective cost control and budget management.

- Performance Targets: The break-even point provides a clear sales target to aim for. As a new business, achieving and surpassing your break-even point is an early indicator of potential long-term success. It sets a baseline for evaluating the performance of your business.

- Planning for Growth: You’ll know how much additional sales volume you need to generate profit and can set realistic sales goals and growth objectives accordingly.

How to calculate the break-even point

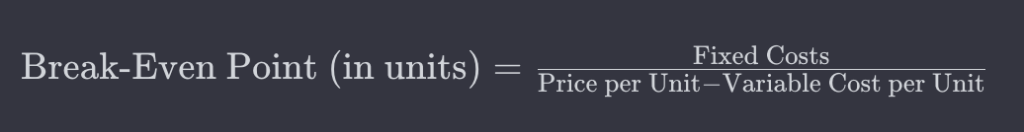

You can use the formula:

Here:

- Fixed Costs are the costs that do not change with the level of production or sales, like rent, salaries, and insurance.

- Price per Unit is the selling price of each unit.

- Variable Cost per Unit is the cost of producing each additional unit, like materials and labor.

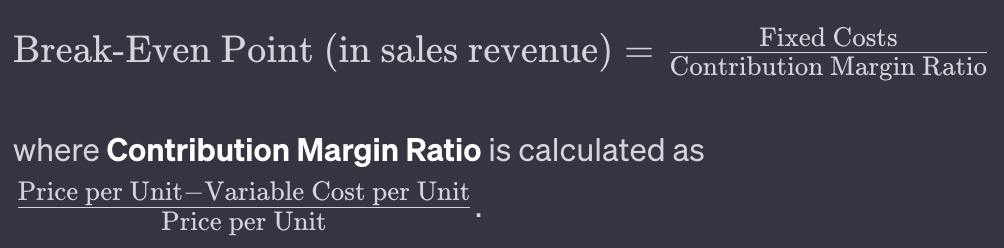

This formula gives you the number of units that need to be sold to break even. There’s also a version of this formula for calculating in terms of sales revenue:

Example: Specialty Coffee Bean Business

Business Details:

- Selling Price per Bag: $15

- Variable Cost per Bag: $10 (this includes the cost of coffee beans, packaging, and any other costs that vary with each bag produced)

- Fixed Costs: $5,000 per month (rent, utilities, equipment, salaries)

Calculating Break-Even Point:

- First, calculate your contribution margin per unit:

- This is the amount each unit contributes towards covering fixed costs and generating profit.

- Contribution Margin per Bag = Selling Price – Variable Cost = $15 – $10 = $5 per bag

- Then, calculate the break-even point in units:

- Break-Even Point (in units) = Fixed Costs / Contribution Margin per Unit

- Break-Even Point = $5,000 / $5 = 1,000 bags

You must sell 1,000 bags of coffee beans monthly to cover all your costs. Any sales beyond 1,000 bags will contribute to profit.