Running a successful retail business requires more than just an eye for great products and a knack for customer service. Understanding your finances is equally important. This guide delves into the world of retail accounting, exploring various retail accounting methods, the backbone of recording your financial activities. This guide will also unpack the differences between retail accounting vs cost accounting, equipping you with the knowledge to master retail bookkeeping and make informed financial decisions, whether you’re a seasoned store owner or just starting out.

Here, we’ll explore:

- The Basics of Retail Accounting

- Retail Accounting vs Cost Accounting

- Different Types of Retail Accounting Methods (with Examples)

- Choosing the Right Retail Accounting Method for Your Business

- Retail Accounting Best Practices

- Optimize Your Retail Accounting with Vencru

Understanding the Basics of Retail Accounting

Retail accounting is the specialized system used by retailers to track their financial activities. It focuses on recording income from sales, managing inventory levels, and calculating the cost of goods sold (COGS), which is a crucial metric for profitability analysis.

Retail bookkeeping, on the other hand, is the day-to-day process of recording these financial transactions. This can involve tasks like processing sales receipts, managing accounts payable and receivable, and generating financial reports.

Retail Accounting vs Cost Accounting

It’s important to distinguish between retail accounting and cost accounting. While both deal with financial tracking, they serve different purposes:

- Retail accounting focuses on the selling price of goods, making it ideal for retail businesses that typically don’t manufacture their products.

- Cost accounting, on the other hand, tracks the actual cost of producing goods, which is more relevant for manufacturing companies.

Retail Accounting Methods

Several retail accounting methods exist, each with its advantages and limitations. The best method for your business depends on factors like your inventory volume, profit margins, and the type of products you sell. Here’s a breakdown of the most common retail accounting methods with illustrative scenarios:

Retail Inventory Method (Average Cost)

This popular method estimates the cost of ending inventory based on the average cost of goods sold throughout a specific period. It’s relatively simple to implement and works well for businesses with steady sales and constant inventory turnover.

Scenario:

Let’s say you own a clothing boutique. At the beginning of the month, you have $5,000 worth of inventory. During the month, you purchase $2,000 of new clothes and sell $4,000 worth of merchandise. To estimate the cost of your ending inventory using the retail inventory method (average cost), you’d follow these steps:

- Calculate the cost of goods available for sale: Beginning Inventory + Purchases = $5,000 + $2,000 = $7,000

- Subtract sales from the cost of goods available for sale: $7,000 – $4,000 = $3,000 (estimated ending inventory)

Specific Identification Method

This method tracks the individual cost of each item in your inventory, making it ideal for high-value goods like jewelry or electronics. However, it requires detailed record-keeping and can be time-consuming for businesses with a large volume of inventory.

Scenario:

Imagine you own a jewelry store. You purchase a diamond ring for $5,000. Using the specific identification method, the cost of that specific ring would be tracked individually in your inventory records until it’s sold.

FIFO (First-In, First-Out) Method

This method assumes that the first items purchased are the first ones sold. It’s a simple approach that often reflects the actual flow of inventory in retail stores. FIFO can be beneficial for businesses that sell perishable goods or products with a short shelf life.

Scenario:

Your bakery receives a shipment of 100 cupcakes on Monday and another shipment of 100 on Wednesday. By Friday, you’ve sold 150 cupcakes. Using FIFO, we assume the first 100 cupcakes sold were from the Monday shipment.

LIFO (Last-In, First-Out) Method

This method assumes the last items purchased are the first ones sold. LIFO can be advantageous during periods of inflation as it allows you to value your ending inventory at a lower cost, potentially reducing your tax burden. However, it may not accurately reflect the actual flow of goods in some retail businesses.

Scenario:

Let’s revisit your clothing boutique scenario. You buy 10 new shirts at the beginning of the month for $10 each (total cost: $100). Later in the month, due to rising cotton prices, the same shirts cost $12 each (total cost: $120). By the end of the month, you’ve sold 8 shirts. Under LIFO, we assume the 8 shirts sold were from the more recent purchase (costing $12 each), resulting in a higher ending inventory value ($24 for the remaining 2 shirts) compared to FIFO.

Related Read: Inventory accounting: Key terms and valuation methods for retail

Choosing the Right Retail Accounting Method

As you can see, each method has its pros and cons. Here are some additional factors to consider when choosing a retail accounting method:

- Inventory Turnover Rate: Businesses with high inventory turnover (meaning they sell inventory quickly) may find the average cost method efficient.

- Inventory Fluctuations: If your inventory levels fluctuate significantly, FIFO or LIFO might be a better choice than the average cost method.

- Compliance Requirements: Some industries may have specific accounting method requirements. Consult with your accountant to ensure you’re following the appropriate regulations.

Retail Accounting Best Practices

1. Keep An Eye On The Retail Accounting Issues And Trends

The retail landscape is constantly evolving. Staying informed about emerging issues and trends in retail accounting is crucial for proactive business management. For instance, the COVID-19 pandemic significantly impacted inventory management for many retailers due to lockdowns and store closures. Understanding and preparing for such eventualities can minimize disruptions and financial losses.

2. Maintain Accurate Records:

Retail businesses juggle numerous transactions daily, making record-keeping a potential challenge. Managing a vast amount of data on expenses, income, and inventory can be overwhelming. Traditional methods, such as manual record-keeping or hiring an accountant, can be susceptible to human error.

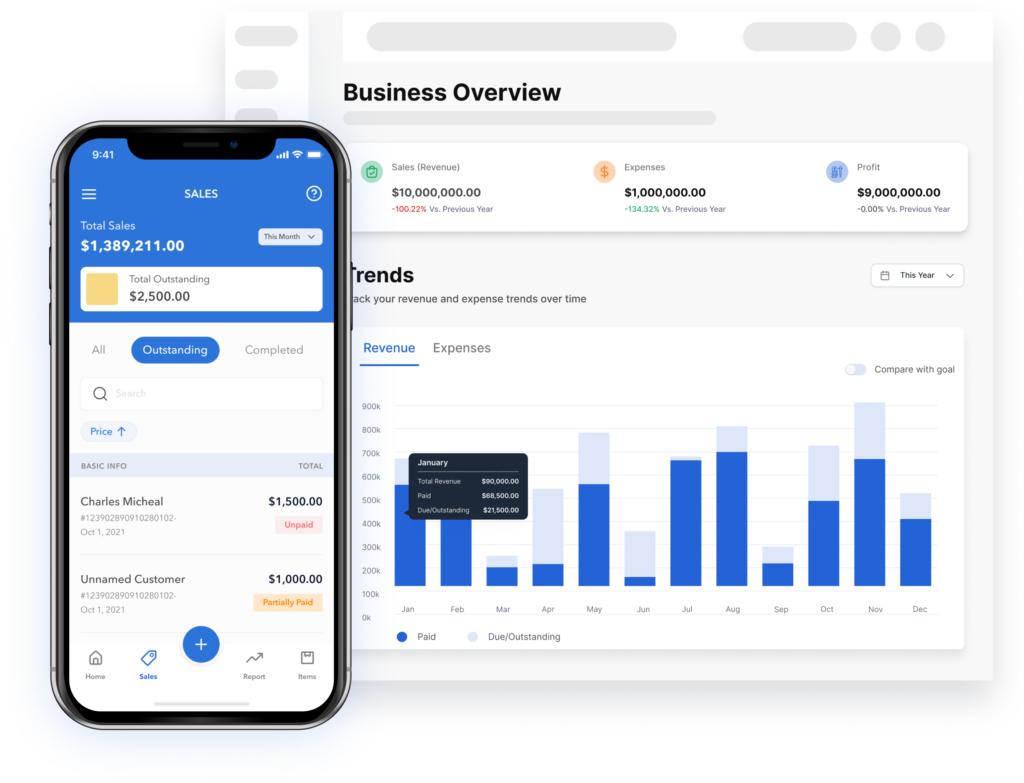

Through exceptional accounting software for retail businesses like Vencru, you can manage all the payments, labor charges, inventory stock, and keep an eye on your workers. It provides you with all the retail accounting solutions and helps you create a more efficient workflow.

3. Follow Established Accounting Policies

Following established accounting policies is essential for any retail business. These policies dictate the processes and rules governing your financial activities, ultimately impacting your bottom line. For example, inventory valuation is one of the most crucial accounting policies in the retail industry. A retail business can decide whether they want to value their stock using an average cost method or they can choose to assume that they will sell their oldest stock first, also known as the “first-in, first-out” (FIFO) method. Choosing the policy that represents your business most fairly is the best option.

4. Make Data-Driven Decisions

The power of retail accounting lies in its ability to transform raw data into actionable insights. Whether you leverage retail accounting software or maintain manual records, analyzing trends and studying your data empowers you to make informed business decisions. Financial data can reveal what strategies work best, identify areas for improvement, and help you anticipate upcoming trends like rising inventory costs. By understanding your data, you can be better prepared to navigate any changes in the retail landscape.

5. Invest in an Accounting Software

Numerous user-friendly accounting software solutions are specifically designed for retail businesses. These tools streamline your bookkeeping process, automate calculations, and generate valuable financial reports. Investing in such software can significantly enhance your retail accounting efficiency and empower you to focus on core business activities.

Related Read: 8 Best Practices for Managing Retail Sales Effectively

Optimize Your Retail Accounting with Vencru

Vencru is the key to unlocking a new level of control and efficiency in your retail accounting. Our powerful, user-friendly software is specifically designed to meet the unique needs of retail businesses, empowering you to:

- Streamline Your Workflow: Eliminate manual data entry and automate repetitive tasks, freeing up your team to focus on what matters most – your customers.

- Gain Real-Time Inventory Insights: Never be caught off guard by stockouts or overstocking again. Vencru provides real-time inventory tracking, purchase order automation, and low-stock alerts.

- Simplify Accounting Tasks: Manage all your retail bookkeeping and financial activities – from invoices and receipts to payroll and expense tracking – in one centralized platform.

- Make Data-Driven Decisions: Gain valuable insights from comprehensive financial reports and data analysis tools. Identify trends, optimize pricing strategies, and track profitability with ease.

- Reduce Human Error: Minimize the risk of errors with automated calculations and a user-friendly interface.

Ready to explore Vencru? Get started here or book a demo

Related Content: