Accept Online Payment in your Small Business

The easiest and fastest solution to the how to accept online payments dilemma: Vencru. Accept online payments with credit cards, debit cards, eChecks, and more, and have every penny accounted for with our bookkeeping features.

The best part? You can start for free today.

Benefits of Vencru's Invoicing and Payment Software

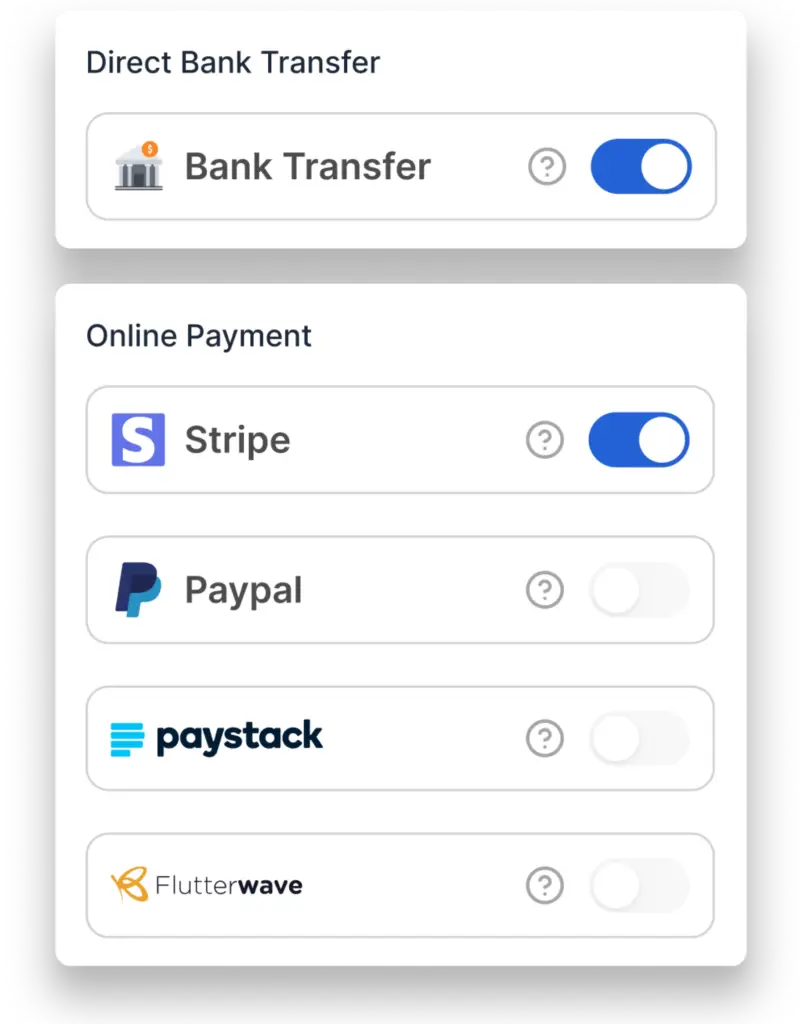

Accept payments directly from invoices

Connect your Vencru account to payment gateways like PayPal, Stripe, Paystack, and Flutterwave to accept online payments via Credit and Debit Cards.

Send invoices to customers on the go, showcase your business branding, and organize your sales with our invoicing software.

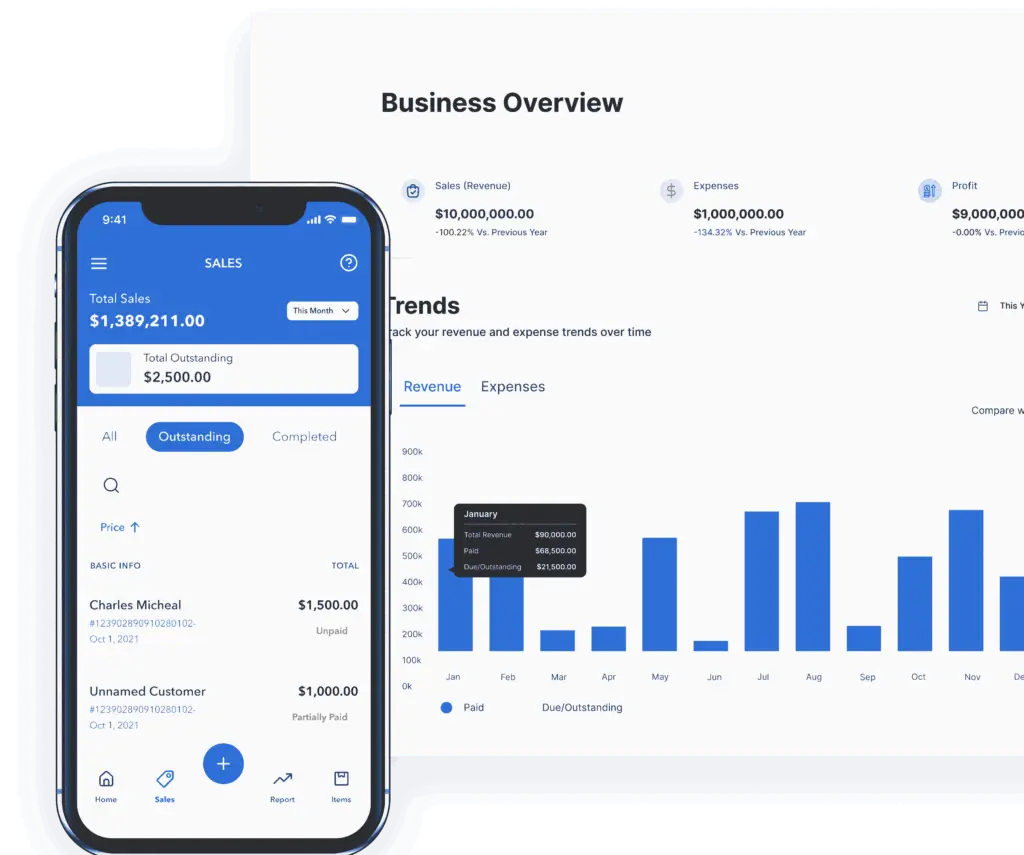

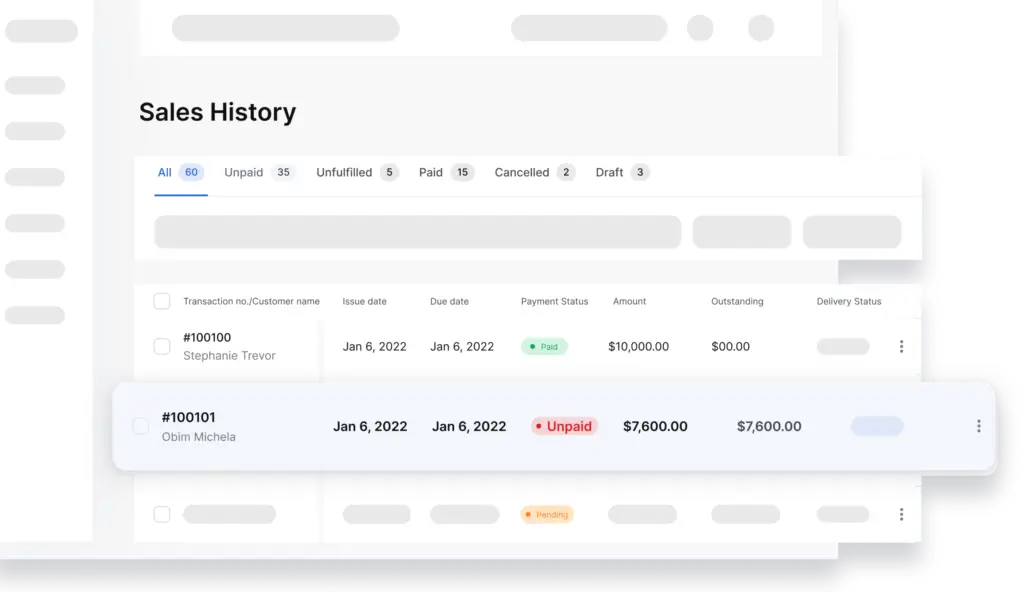

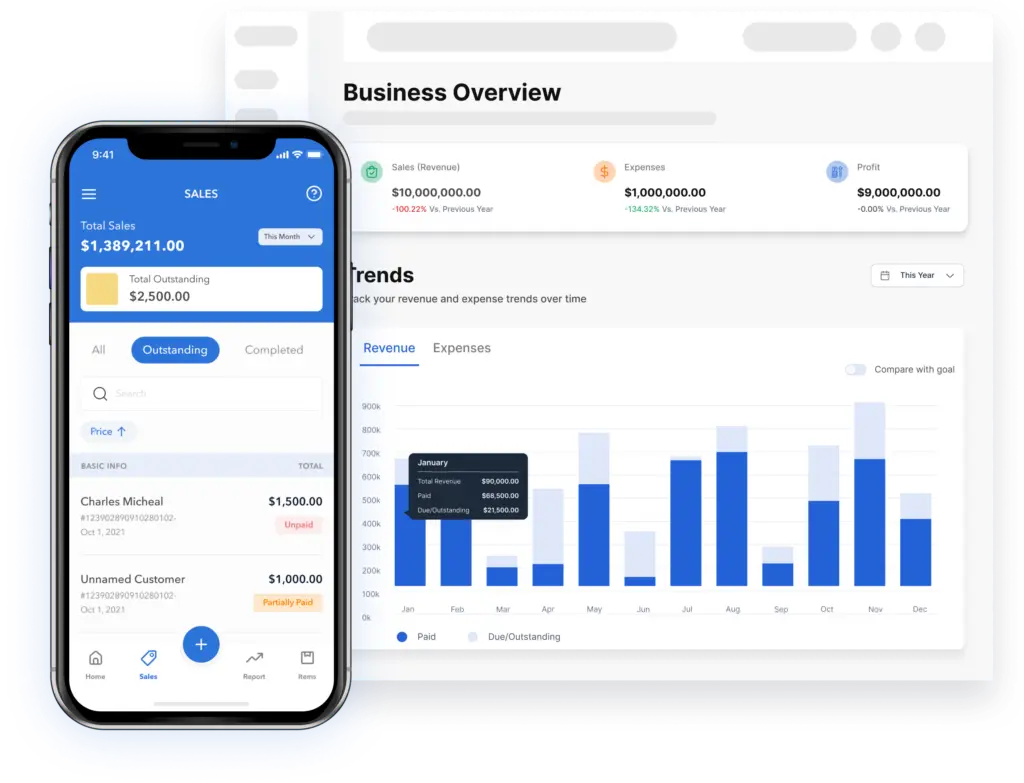

Track payments and debtors

Get real-time updates on processed payments, and unpaid invoices. Easily generate client statements on sales transactions and payment history.

Automate accounting on payments received

With Vencru, you can automatically generate reports based on the payments you receive. These business reports include Sales Reports, Income Statements, Cash Flow Reports, Balance Sheets, and more. There are 15+ business and accounting reports on Vencru.

FAQs on our Online Payment Integration

Everything you need to know about accepting payments via Vencru Invoicing Software

How do you accept payment online without website?

You can use an invoicing software to accept payments online without creating a website. An invoicing software allows you to showcase your business brand without a website. You can include your logo, business address, and terms. You can also integrate with payment processors such as Stripe, Paypal, Paystack, and Flutterwave. This will allow you to accept payments from the invoice and track sales. Compare invoicing solutions here.

Who accepts ACH payments online?

Stripe can be used to accept ACH payments. Stripe can be integrated with an invoicing software like Vencru. Transaction fees may apply. Learn more here.

What is small business accounting?

Small business accounting is not a lot different than accounting for bigger businesses. It involves accurate bookkeeping, recording all financial transactions, and a comprehensive overview of liabilities, assets, expenses, sales, and other similar metrics.

The main types of accounting reports that businesses need to make the most out of their experience are balance sheets, cash flow reports, and income statements. And guess what? Vencru provides you with all 3 of these within just one software!

How much do I have to pay to access my accounting reports?

For the most part, you don’t have to pay anything. Yes, you heard that right! If you opt for our free plan, you don’t have to pay a penny. For $0, you can access and review simple business reports that will help you understand your business better.

However, if you want more comprehensive reports, you can choose between the Starter Plan and the Growth Plan. For more information, please visit this page.

Can Vencru generate financial reports?

Yes, Vencru auto-creates in-depth financial reports that will help you gain a better understanding of your transaction, and then use that analysis to develop and expand your business in the right direction.

Get your free business bookkeeping software

Download our mobile app and manage your bookkeeping on the go. You can send invoices, see sales reports, monitor inventory levels, track expenses, and more through your mobile app – anytime and anywhere.