Running one business is tough because it involves managing finances, inventory, employees, and customers, all at once. Handling multiple businesses is even harder since you must keep track of separate financial records, inventories, and transactions for each entity. This often means juggling multiple platforms or spreadsheets, increasing the risk of errors. That’s why choosing the best accounting software for multiple businesses is so important. The right solution gives you one place to manage all your finances, track inventory across locations, and stay on top of intercompany transactions.

In this blog, we compare the best bookkeeping software for multiple businesses, highlighting their strengths, limitations, and pricing. You’ll discover which tools are best for small business owners, which ones support consolidated reporting, inventory tracking, and intercompany transactions, and why Vencru stands out for managing multiple business entities easily and affordably.

What is Multi-Entity Accounting

Multi-entity accounting refers to managing the financials of multiple business units or legal entities under a single owner. A multi-entity business might be a company with several subsidiaries, franchises, or retail branches. Each entity operates independently but still contributes to overall business performance.

For example, imagine a business owner runs three boutique clothing stores in different cities. Each store tracks its own sales, expenses, and inventory, but the owner wants a single platform to view overall profits and manage finances together. Multi-entity accounting software makes this possible by consolidating data while keeping individual records separate.

Important Features for Multi-Business Accounting

The best accounting software for multiple businesses should offer specific features designed to reduce complexity and save time.

- Easy financial reports: You need clear, real-time insights across all entities. This helps you track profit, expenses, and performance without exporting spreadsheets or using external tools.

- Inventory tracking at multiple places: Managing stock across different business locations or stores requires centralized inventory visibility. This reduces overstocking, avoids stockouts, and simplifies restocking.

- Simple handling of transactions between businesses: Intercompany transactions can get messy fast. A good system should automate reconciliations and eliminate the need for manual adjustments.

- Ability to grow with your business: Whether you’re adding new branches or expanding into new countries, the software should support scalability with multi-currency and multi-location capabilities.

- Easy to use anywhere: Cloud-based access is key for business owners who want to check financials on the go. Remote accessibility ensures you stay informed and in control at all times.

These features are essential for streamlining operations and ensuring your financial data is always accurate and up to date. The best bookkeeping software for multiple businesses also helps reduce the risk of errors and supports smarter decision-making. Thus, allowing business owners to focus more on growth than on administrative tasks.

Top Accounting Software for Managing Multiple Companies

1. Vencru

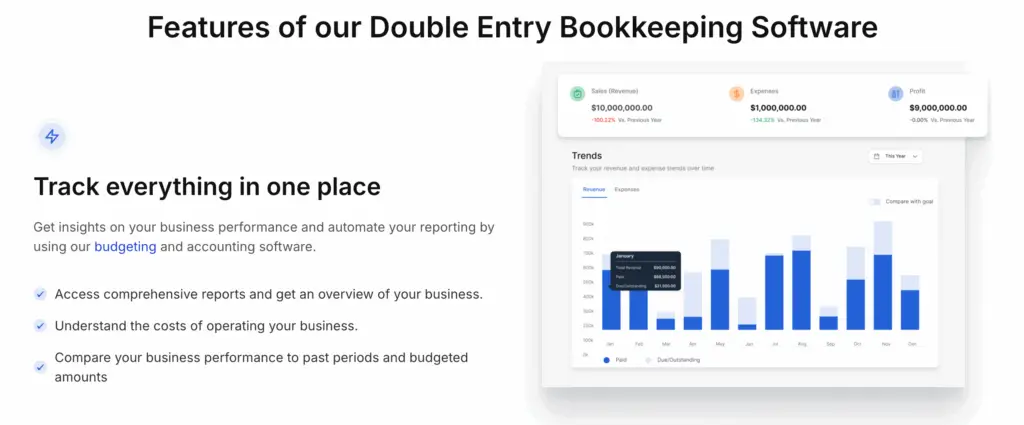

Vencru is an accounting and inventory solution for multiple small businesses or companies with multiple locations. It offers everything in one platform—financial reports, inventory tracking, invoicing, and automated insights. Unlike traditional tools that require switching between systems, Vencru simplifies operations with real-time consolidated reporting, an intuitive interface, and multi-currency support. It’s built specifically for SMEs, setup is quick, and users can manage multiple businesses without extra complexity.

Top Features:

- Easy-to-read combined financial reports

- Simple inventory tracking across locations, with the ability to transfer inventory between multiple locations

- Fast reconciliation of transactions between businesses

- Automatic invoicing and quick payments (Stripe, PayPal, Paystack)

- Forecasting cash flow and sorting expenses

Best for: Small businesses in retail, wholesale, or the service industry.

Pricing: A Free trial and plan are available. Affordable plan ranging from $5 to $50 as your business grows.

2. QuickBooks Online Advanced

QuickBooks Online Advanced is a popular choice for mid-sized to large businesses that require detailed reporting and robust features.

Features:

- Customizable financial dashboards

- Advanced reporting and analytics

- Workflow automation

- Integration with hundreds of third-party apps

Pricing: $235/month

Limitations:

- Complex to set up and use for small businesses

- Steep learning curve

- High cost relative to other tools

Best for: Growing companies with finance teams or accountants

3. Xero

Xero is a cloud-based accounting solution known for its user-friendly interface and strong ecosystem of integrations.

Features:

- Online invoicing and payments

- Bank reconciliation

- Inventory tracking

- Third-party integrations (e.g., Shopify, Gusto)

Pricing: Starts at $13/month, but advanced features require higher tiers

Limitations:

- Weak native support for managing multiple entities

- Inventory features are basic

- May require add-ons for full functionality

Best for: Growing companies with finance teams or accountants

4. Sage Intacct

Sage Intacct is an enterprise-grade financial management platform focused on high compliance and multi-entity control.

Features:

- Multi-entity, multi-currency accounting

- Real-time dashboards

- Advanced audit and compliance tools

- Role-based access control

Pricing: Custom pricing (often above $400/month)

Limitations:

- Complex onboarding and steep learning curve

- Often too advanced for small teams

- Higher ongoing maintenance costs

Best for: Mid-sized to large organizations with complex financial structures.

5. FreshBooks

FreshBooks is a lightweight accounting tool designed for freelancers and solopreneurs.

Features:

- Time tracking and invoicing

- Expense categorization

- Client management

Pricing: Starts at $17/month

Limitations:

- No real support for managing multiple entities

- Lacks robust inventory or consolidated reporting features

Best for: Independent contractors, freelancers, and microbusinesses.

FreshBooks is great for freelancers and small operations.

Top Features:

- Easy invoicing

- Simple expense tracking

Good Points:

- Easy to use

- Affordable

Downside:

- Limited inventory support

- Not suitable for managing multiple business entities

Best for: Freelancers and small businesses.

Why Vencru is the Best Accounting Software for Multiple Businesses

Vencru is easy, affordable, and the best bookkeeping software for managing multiple small businesses. It provides clear financial insights and tools to help you grow without complexity or high costs.

“Vencru makes running my retail stores easy. Managing finances and inventory across locations has never been simpler.” – Sarah L., Retail Owner

Choosing the right bookkeeping software can save you time and money. While QuickBooks, Xero, Sage, and FreshBooks have good features, Vencru is specifically built to make managing multiple small businesses easy and affordable.

Ready to simplify your multi-business bookkeeping and accounting? Start Your Free Vencru Trial Today