Understanding cost per unit is essential for effective pricing, budgeting, and financial management. This metric helps businesses determine the expense of producing a single product or service. Accurate calculation enables companies to set competitive prices, manage expenses efficiently, and enhance overall profitability. It also provides valuable insights into cost control and efficiency. This blog will explore the formula for calculating unit cost, its importance, components, and strategies to reduce it. We’ll be discussing:

- What is Cost Per Unit?

- The Components of Cost Per Unit

- Breaking Down the Formula

- The Difference Between Cost Per Unit and Price Per Unit

- How to Use Unit Cost for Better Business Decisions

- Strategies to Reduce Cost Per Unit

What is Cost Per Unit?

Cost per unit is a financial metric that represents the total expense associated with producing a single product unit. This includes both fixed and variable costs. Understanding this metric is crucial for pricing strategies, budgeting, and evaluating business performance.

The average cost provides insights into the efficiency of production processes and helps set appropriate selling prices to ensure profitability. It also aids in identifying areas where savings can be achieved.

The Importance of Cost Per Unit

Cost per unit is a critical metric for any business, as it directly impacts pricing, budgeting, and profitability. Understanding the average cost allows businesses to set prices that cover costs and generate profit while remaining competitive. It aids in budgeting by providing a clear picture of production costs, enabling better financial planning and resource allocation.

Additionally, monitoring average cost helps identify areas where price reductions can be made, improving overall efficiency and profitability. Knowing the cost is essential for making informed decisions that drive financial success.

The Components of Cost Per Unit

To accurately calculate the cost per unit, it is important to understand its components: fixed and variable costs.

Fixed Costs

Fixed costs are expenses that do not change with the level of production. These costs remain constant regardless of the number of units produced. Examples include:

- Rent: The cost of leasing production facilities, which includes expenses related to maintaining and operating the premises, can be a significant fixed cost.

- Salaries: Salaries of permanent employees, which encompass wages, benefits, and other compensation, contribute to the ongoing expenses of a business.

- Depreciation: The equipment price over time, which reflects the gradual reduction in the value of assets due to wear and tear, is an important factor in calculating the total production cost.

Variable Costs

Variable costs fluctuate with the production volume. They increase as production rises and decrease as production falls. Examples include:

- Raw Materials: The materials expense incurred in production, including all the components and substances required to create the final product, significantly impacts overall production expenses.

- Direct Labor: Wages paid to workers directly involved in manufacturing, which includes compensation for employees who physically work on the production line, directly influence the average cost.

- Utilities: Costs for electricity and water used in production, which encompass all essential services required to run machinery and maintain operations, add to the overall production cost.

Breaking Down the Cost Per Unit Formula

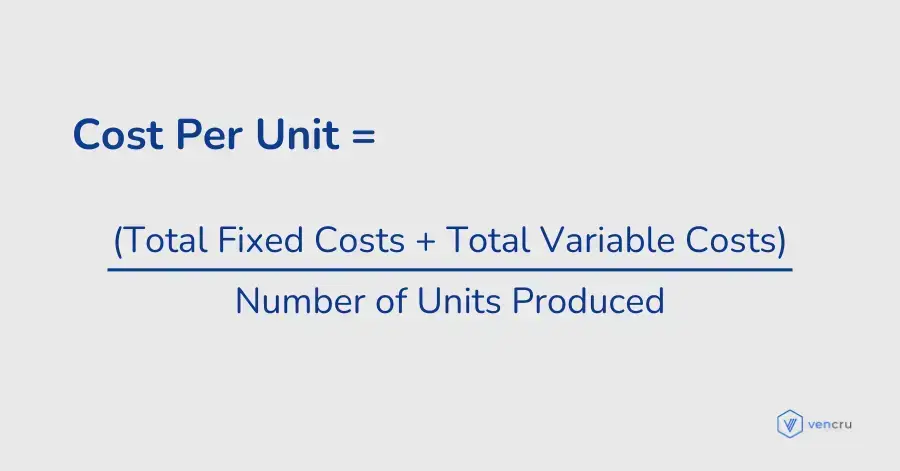

The formula for calculating cost per unit is:

This formula combines fixed and variable costs and divides them by the total number of units to determine the expense incurred for each unit. Accurate calculation is essential for setting prices and managing expenses.

Consider, for example, a company that manufactures 1,000 widgets with the following costs:

- Fixed Costs: $10,000 (includes rent, salaries, and depreciation)

- Variable Costs: $5,000 (includes raw materials and direct labor)

Using the formula: Cost Per Unit = ($10,000 + $5,000) / 1,000

The average unit cost is $15. This means each widget costs $15 to produce.

Related Read: Inventory Valuation Methods: Which One Should You Choose?

The Difference Between Cost Per Unit and Price Per Unit

Understanding the difference between cost per unit and price per unit is crucial for business strategy.

Price Per Unit

Price per unit is the amount a customer pays for a single product unit. It is determined based on the unit cost, desired profit margin, and market conditions.

The Relationship Between Cost Per Unit and Price Per Unit

The unit cost is a critical factor in setting the unit price. The price must cover the production expense and include a profit margin to ensure profitability. The relationship can be expressed as:

Price Per Unit = Cost Per Unit + Desired Profit Margin

How to Use Cost Per Unit for Better Business Decisions

Understanding and utilizing unit cost can enhance business decisions in several ways:

- Setting the Right Selling Price: By knowing the cost, businesses can set a selling price that covers expenses and generates profit. This ensures financial sustainability and competitiveness in the market.

- Evaluating Business Efficiency: Analyzing costs helps identify inefficiencies in production processes and opportunities for cost reduction. This evaluation supports better resource allocation and operations.

Related Read: Inventory Management Best Practices: Guide

Strategies to Reduce Cost Per Unit

Reducing costs can enhance profitability and competitiveness. Here are some strategies:

- Optimizing Logistic Strategy: Improving logistics can lower transportation and handling costs. Efficient routing, bulk shipping, and effective inventory management can contribute to cost reductions.

- Lowering Material Costs: Negotiate with suppliers for better rates or find alternative materials that reduce costs without compromising quality. Bulk purchasing can also lead to discounts.

- Reducing Overhead Costs: Minimize overhead costs by optimizing resource usage, reducing waste, and improving efficiency. Regularly review expenses to identify areas for cost-saving.

- Minimizing Returns, Reshipments, and Dead Stock: Implement quality control measures to reduce returns and reshipments. Efficient inventory management helps minimize dead stock and associated costs.

Conclusion

Calculating and understanding unit cost is essential for effective pricing and financial management. By knowing how to compute average costs, businesses can make informed decisions about pricing, budgeting, and expense reduction. Implementing strategies to lower expenses can enhance profitability and efficiency.

For businesses seeking to streamline expense management and improve financial performance, Vencru offers advanced tools for tracking and analyzing expenditures. Vencru’s features can help businesses optimize their expenses and make data-driven decisions for better financial outcomes.

Related Content