In the world of business transactions, both quotes and invoices play critical roles in ensuring clear communication and financial accuracy. Although they are both essential documents, they serve different purposes at various stages of the sales process. This blog will delve into the differences between quotes and invoices, explain when to use each, and outline their benefits. By understanding these documents, you can streamline your business processes and maintain better financial control. We’ll be discussing:

What Is a Quote?

A quote, also known as a quotation, is a formal document provided by a seller to a potential buyer. It outlines the price and terms of the products or services offered before any sale is made. Quotes are usually issued during the initial stages of a transaction, helping potential clients understand the cost of a project or purchase before they commit.

Key Aspects of a Quote:

- Pricing: A detailed breakdown of costs for products or services.

- Terms and Conditions: Any payment, delivery, and other terms.

- Validity Period: The time frame during which the quote is valid.

When To Use a Quote?

You should use a quote in several situations:

- Initial Client Inquiry: When a potential client requests pricing information before making a purchase decision.

- Project Proposals: When bidding for a project and needing to provide detailed cost estimates.

- Custom Orders: When dealing with custom products or services that require a tailored pricing approach.

Providing a quote helps set clear expectations and avoids misunderstandings regarding costs and terms. It allows the client to evaluate their options and make an informed decision before committing to a purchase.

Benefits of Providing a Quote

Providing a quote offers several advantages:

- Clarity: A quote clearly outlines the costs and terms, reducing the likelihood of disputes later.

- Professionalism: Issuing a formal quote demonstrates a professional approach and can build trust with potential clients.

- Budgeting: It allows clients to budget for the expense and make decisions based on their financial situation.

Quotes help establish a solid foundation for the transaction by ensuring both parties agree on the costs and terms before proceeding.

What Is an Invoice?

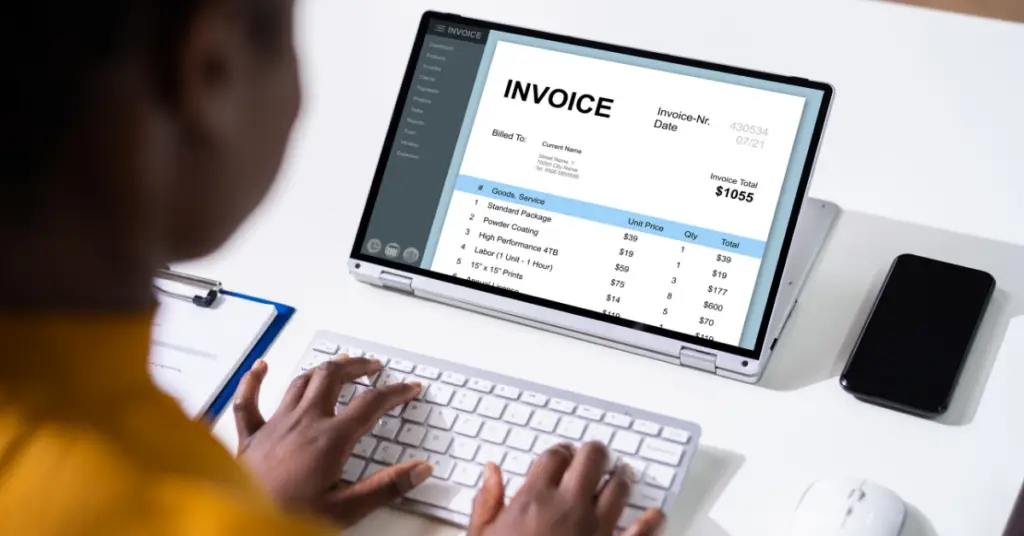

An invoice is a document issued after a sale has been completed or a service has been rendered. It serves as a request for payment from the buyer to the seller. Invoices include detailed information about the transaction and are crucial for maintaining accurate financial records.

Key Aspects of an Invoice:

- Invoice Number: A unique identifier for the invoice.

- Date of Issue: The date when the invoice is created.

- Itemized List: A detailed list of products or services provided, including quantities and prices.

- Total Amount Due: The total amount the buyer owes.

- Payment Terms: Information about payment due dates, methods, and any applicable late fees.

When To Use an Invoice?

You should use an invoice in the following situations:

- Completion of Sale: When a product or service has been delivered, and payment is due.

- Periodic Billing: For regular services or subscriptions, where invoices are issued on a recurring basis.

- Finalizing Transactions: When closing out a project or completing a sale and requiring formal payment documentation.

An invoice is essential for recording revenue, managing cash flow, and ensuring that payments are collected in a timely manner.

What’s Included in an Invoice?

A well-prepared invoice typically includes:

- Business Information: The seller’s and buyer’s contact details.

- Description of Goods/Services: Detailed information about what was provided.

- Pricing Details: Unit prices, quantities, and any applicable discounts.

- Total Amount Due: The sum total of all charges, including taxes.

- Payment Instructions: Details on how and where to make the payment.

These components ensure that the invoice is clear, complete, and professional, facilitating prompt payment and effective financial management.

Quote vs Invoice

While both quotes and invoices are important, they serve distinct functions in the sales process:

- Purpose: A quote provides a preliminary estimate of costs and terms before a sale is made, while an invoice requests payment for completed transactions.

- Timing: Quotes are issued before a sale to inform the client of potential costs, whereas invoices are issued after a sale or service to request payment.

- Content: Quotes include estimated pricing and terms, while invoices detail the actual transaction, including itemized costs and payment instructions.

Understanding the differences between quotes and invoices can help businesses manage client expectations and ensure smooth financial operations.

Conclusion

Quotes and invoices are both essential documents in the business world, each serving a unique role in the transaction process. By using quotes, businesses can provide potential clients with clear pricing and terms, helping them make informed decisions. Invoices, on the other hand, ensure that payments are requested and tracked accurately once a sale is complete. Understanding when and how to use each document can streamline your operations, improve client relations, and enhance your financial management. Implementing effective practices for both quoting and invoicing will contribute to your business’s success and financial stability.

Related Content