Running a successful retail business requires careful financial management, and one of the most crucial financial documents you’ll need is a Profit and Loss Statement (P&L Statement). This document provides valuable insights into your business’s financial health, helping you make informed decisions and plan for the future. This comprehensive guide will explore what a Profit and Loss Statement is, why it’s essential, how to create one, and how Vencru can simplify the process for you.

What Is a Profit and Loss Statement?

A Profit and Loss Statement, also known as an income statement or P&L statement, is a financial report that summarizes your business’s revenues, costs, and expenses during a specific period. It is one of the critical financial documents companies use to assess their financial performance and profitability. An income statement clearly shows whether your business profits or incurs losses.

Benefits of Preparing a Profit and Loss Statement

A Profit and Loss Statement (P&L) offers several benefits for businesses, including wholesale businesses. Here are some key advantages, explained in simple terms:

- Assesses Profitability: The P&L helps determine if your wholesale business is making money or losing it. It subtracts all your costs from your revenue, showing you the net profit. For instance, if your wholesale company made $50,000 in sales but spent $40,000 on goods, labor, and expenses, your P&L will reveal a profit of $10,000.

- Identifies Trends: By regularly analyzing your P&L, you can spot trends in your business’s financial performance. For example, your profits tend to increase during certain seasons or months due to higher sales volumes. This information can help you make informed decisions about inventory levels or marketing strategies.

- Cost Control: The P&L breaks down expenses into categories like rent, utilities, and labor. This breakdown lets you identify areas where you’re overspending and make cost-cutting adjustments. For instance, you might investigate energy-efficient solutions if your utility bills are consistently high.

- Pricing Strategy: It helps you assess your pricing strategy. If your P&L consistently shows low profits, you might need to reevaluate your pricing to ensure you cover your costs and generate a healthy profit margin.

- Financial Planning: Your P&L is a valuable tool when planning for the future. Let’s say you want to expand your wholesale business by opening a new warehouse. Your P&L can help you project whether you have the financial capacity based on your historical profit trends.

- Investor and Lender Confidence: If you seek investment or loans to grow your wholesale business, potential investors and lenders will want to see your P&L. It gives them an understanding of your financial health and whether you’re a wise investment.

- Tax Reporting: Your P&L simplifies the process when tax season arrives. It summarizes your income and expenses, making reporting accurate figures to tax authorities easier. Plus, it helps you take advantage of tax deductions, reducing your tax liability.

- Goal Setting: A P&L can be a benchmark for setting financial goals. Let’s say you aim to increase your net profit by 10% this year. You can use your previous P&Ls to assess if your strategies are helping you achieve this target.

Difference Between Profit and Loss Report and Cashflow Report

While both reports are essential for financial analysis, they serve different purposes. An Income Statement focuses on whether your business is profitable based on revenue earned and expenses incurred, regardless of when cash changes hands.

On the other hand, a Cash Flow Report concentrates on how cash moves in and out of your business, which is crucial for day-to-day financial operations and ensuring you have the funds to meet your obligations. Both reports are essential for managing your business effectively.

| Aspect | Income Statement | Cash Flow Report |

| Purpose | Shows profitability over a specific period (e.g., a month, quarter, or year). | Tracks cash inflows and outflows over the same period. |

| Basis | Accrual accounting: Records revenue when it’s earned and expenses when they’re incurred. | Cash accounting: Records revenue when it’s received and expenses when they’re paid. |

| Content | Includes sales, costs of goods sold, operating expenses, and taxes. | Includes cash receipts (income) and cash payments (expenses). |

| Focus | Focuses on whether the business is making a profit (revenue > expenses) or a loss (revenue < expenses). | Focuses on whether the business has enough cash on hand to meet its financial obligations. |

| Timing | Can show a profit even if there’s no cash in the bank (e.g., sales made on credit). | Can show a cash shortfall even if the business is profitable (e.g., when bills are due but customers haven’t paid yet). |

| Key Use | Helps assess the business’s overall financial health and profitability. | Helps manage daily cash needs, ensuring the business can pay its bills and debts on time. |

| Example Scenario | You sold $10,000 worth of products in December. If customers still need to pay, it’s counted as revenue. | In December, you paid $8,000 for inventory and $1,000 for rent. These expenses are considered cash outflows. |

| Common Metrics | Net profit, gross profit margin, and operating profit margin. | Cash flow from operations, cash flow from financing, and cash flow from investing. |

What Is Included in a Profit and Loss Statement

A typical P&L statement includes the following sections:

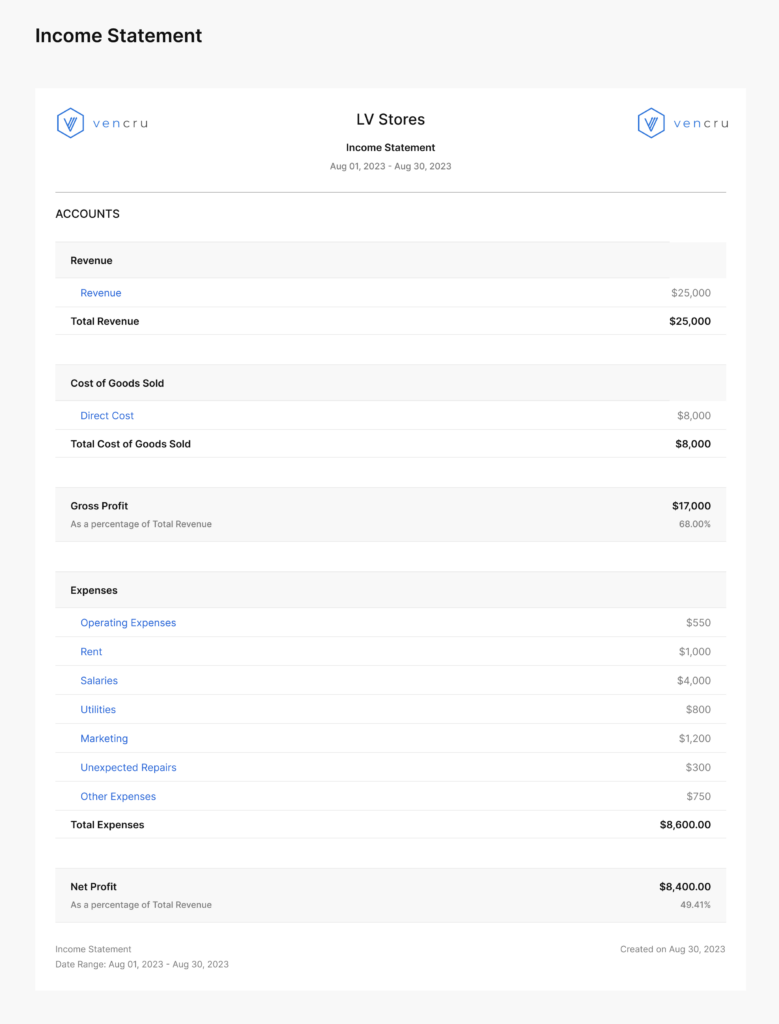

- Revenue: This section includes the total income generated from the sale of goods or services. It represents the top line of the statement.

- Cost of Goods Sold (COGS): Also known as “direct costs,” COGS includes all expenses directly associated with producing the goods or services sold. This can include manufacturing costs, raw materials, labor, and more.

- Gross Profit: This is calculated by subtracting the COGS from the total revenue. It reflects the profit a business makes before considering operating expenses.

- Operating Expenses: This encompasses all costs of running the business’s day-to-day operations. Examples include rent, utilities, employee salaries, marketing, and office supplies.

- Operating Income: This figure is derived by subtracting the total operating expenses from the gross profit. It represents the profit or loss generated from the business’s core operations.

- Other Income and Expenses: This section includes any additional sources of income or unexpected expenses that are not part of the regular operations. For example, interest income, rental income, or one-time repair costs may be included here.

- Net Income (Net Profit): Net income is the final figure on the Profit and Loss Statement and represents the overall profit or loss after accounting for all revenues, expenses, and additional income or expenses. A positive net income indicates a profit, while a negative net income indicates a loss.

How to Write a Profit and Loss Statement

Follow these steps to create your P&L statement:

- Choose a Reporting Period: Decide whether you want to create a monthly, quarterly, or annual statement.

- Gather Financial Data: Collect all relevant financial data, including sales records, expense receipts, and other income sources.

- Organize Your Data: Categorize income and expenses into the appropriate sections.

- Calculate Gross Profit: Subtract COGS from revenue.

- Deduct Operating Expenses: Subtract operating expenses from gross profit to calculate operating income.

- Include Other Income and Expenses: Add any additional income and deduct unexpected expenses.

- Calculate Net Income: Subtract other income and expenses from operating income.

- Review and Analyze: Carefully review your P&L statement to ensure accuracy and analyze the results.

How Vencru Can Help You Create Your Income Statement

Vencru offers a user-friendly accounting and business management platform that simplifies financial reporting. With Vencru, you can effortlessly create your P&L statement, track expenses, and monitor your business’s financial health.

Example: Sample Profit and Loss Statement for a Retail Business (Month of July)

Conclusion

A Profit and Loss Statement is a powerful tool that enables retail business owners to assess financial performance, make informed decisions, and plan for the future. With the right tools and guidance, such as Vencru’s accounting and business management platform, you can create accurate P&L statements and gain valuable insights into your business’s financial health. Start using Vencru today and take control of your retail business’s finances with ease.

Sign up for Vencru and access free income statement templates to streamline your financial reporting.