What is a 401(k) plan? The 401(k) is a retirement plan. It has made life after retirement better for the aged. Workers who invest in these plans depend on the money they invest in them to provide for themselves in their retirement years.

What is The 401(k) Plan?

The 401(k) plan is an employer-sponsored retirement plan, named after a section of the U.S. Internal Revenue Code. This plan is offered by American employers that have tax advantages.

To be eligible for such a plan, an employee must acknowledge having a percentage of each paycheck paid directly into an investment account provided by the employer. The employee is responsible for choosing the specific investments from offers provided by the employer, at times, mutual funds.

Types of The 401(k) Plan

There are two types of the 401(k) plan, and they are:

- Traditional

- Roth

The Traditional 401(k) plan

The traditional 401(k) plan is an employer-sponsored plan that provides employees with a choice of investment plans to select.

There are two essential features of the traditional 401(k) plan:

- Employees/Investors pay taxes on contributions and paychecks when they make a withdrawal.

- Income tax on deposited funds is deferred until withdrawal.

The Roth 401(k) plan

The definition of the Roth 401(k) plan is the same as that of the traditional 401(k) plan, but their tax advantages are different – key features are;

- Contributions and paychecks made by employees are taxed and not deferred.

- Withdrawals made after retirement are tax-free.

- Each year, the IRS adjusts contribution limits for inflation reasons.

- To guarantee successful withdrawal, an employee must be at least 59½ years to avoid penalties.

Benefits of The Roth 401(k) Plan

As an employee, you look forward to getting the best deal at the end of your work phase.

The Roth 401(k) puts you on a one-time tax-pay-role where you pay income tax on your earnings and contributions just once; afterward, your earnings grow tax-free, and upon retirement, you would never pay taxes at the point of withdrawal.

It takes the stress/edge off employees who feel they will be in a higher tax bracket later in life and gets them away from it while saving for retirement.

Special Conditions to Benefit From The Roth 401(k) Plan

The conditions needed to benefit from the Roth 401(k) plan are as follows:

- Although participation is voluntary, all employees participating must agree to have a percentage of each paycheck deducted and paid into an investment account of their choice.

- The minimum number of years in which the account holder must have held the account is 5.

- Withdrawal is issued on a few conditions;

- When the account holder is over 59½ years of age

- If the account holder experiences a disability of any kind

- In the death of an account owner.

Contributions (Max/Min)

As employees of the various salary ranges get involved, contribution varies. Statistics show that all 401(k) plan contribution limits is $19,500 for 2021 and $20,500 for 2022.

Investment Options

Companies involved in the 401(k) plan offer a series of investment plans for employees to invest in. Several mutual funds such as index funds, growth funds, value funds, and blend funds are open to employees based on recommendations from their employers.

Rules For Withdrawals

There are principal occurrences that can lead to an early or due withdrawal. A 10% tax penalty is on those younger than 59½.

Here are the principal occurrences leading to withdrawals:

If an employee/investor;

- Encounters a distinct hardship as defined under the 401(k) plan

- Is disabled before retirement or dies

- Reaches age 59½ and above

- Retires or quits the job

- Terminates the plan

Post-retirement rules

The Internal Revenue Service maps out guidelines for account owners to begin required minimum distributions (RMDs) at age 72.

Post-retirement rules are overruled if an employer retains the services of an employee.

Rollovers rules

The rollover rule is of two sections; that’s the direct and indirect rollover rules.

On the direct rollover, the money moves from the old account to a new account, and there are no tax charges.

In an indirect rollover, the money is sent to the employee, who in turn will owe the complete income taxes on balance in that tax year.

To have your tax charges reduced or avoided is to complete the rollover process within 60 days of withdrawing funds from the original account.

About Employer’s Matching Guide

An employer matches your contribution by adding a certain amount to your 401(k) account plan based on your annual contribution.

Employers match amounts to free money added to employees’ retirement savings, so it is best not to overlook these funds.

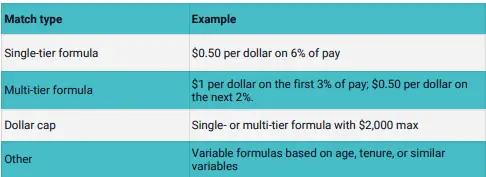

Formulas For Employer Matching Contribution

Employers use various formulas for matching contributions. Some of which are as follows:

According to the American Society of Pension Professionals & Actuaries, the above are formulas for employee matching.

How Does Matching Work?

Matching works in this manner, assuming your employer offers a 100% match on your contributions each year, a maximum of 3% of your annual income.

If you earn $50,000, the maximum amount your employer would contribute each year is $1,500. To maximize this benefit, you must also contribute $1,500.

If you contribute less than 3% of your salary, your contributions are unmatched.

Using this formula, you must contribute the exact amount/percentage to maximize and reap the full benefit of your employer’s matching. Regardless of what percentage of your annual income it may represent.

Contributing more or less of your employer’s matched percentage will lead to an unmatched.

How can Vencru Assist You?

Vencru is the easiest invoicing and accounting software to get your sales and business reports, perform inventory management, manage clients’ and employees’ sales – all in one place.

Vencru manages the activities of your teammates and their sales performance. With our software, you’d always be able to track your employees and be sure of steps to take when conditions are required for pre/post-tax deduction and contribution to their benefit.

Sign up now to gain more control over your business.

Final takeaway

The 401(k) retirement plan is a medium to pile up saved-up funds for retirement age.

For employees who feel they’ll be in a higher tax bracket later in life, the 401(k) retirement plan gets them relaxed while saving for retirement.

Note, withdrawals are initiated if employees,

- Encounters a distinct hardship as defined under the 401(k) plan

- Is disabled before retirement or dies

- Reaches age 59½ and above

- Retires or quits the job

- Terminates the plan

Make sure you stay tuned to our blog to get more amazing resources to help you navigate the market. Good luck!