Shopify Bookkeeping 101: Detailed Guide

Are you running your business on Shopify and feeling unsure about how to perform bookkeeping? Explore our comprehensive, step-by-step guide covering all the essential information on Shopify bookkeeping. In this guide, we will cover

- Importance of bookkeeping

- Difference between bookkeeping and accounting

- Steps involved in performing Shopify bookkeeping

- Reports every Shopify business owner should review

- How to perform inventory management

- How to track sales taxes

- Common mistakes in e-commerce bookkeeping to avoid

- Vencru: Bookkeeping software for Shopify merchants

What is Shopify Bookkeeping?

Shopify bookkeeping is keeping accurate financial records for your e-commerce business on the Shopify platform. It involves tracking and recording all financial transactions related to your business’s sales, expenses, and other financial activities.

Why is bookkeeping important for Shopify merchants?

The goal of performing Shopify bookkeeping is to maintain accurate and organized financial records for your e-commerce business that operates on the Shopify platform. This process serves several important purposes:

- Financial Control and Insight: Bookkeeping allows Shopify merchants to maintain control over their finances. It provides a clear picture of income, expenses, and profits. With accurate records, you can make informed financial decisions to optimize your business.

- Inventory Management: For Shopify stores that sell physical products, bookkeeping helps manage inventory. You can track stock levels, assess the cost of goods sold (COGS), and identify slow-moving or obsolete items.

- Tax Compliance: Proper bookkeeping ensures that you comply with tax regulations. You can accurately calculate and report your sales, income, and other taxes required for your e-commerce business. This reduces the risk of costly tax penalties and audits.

- Profitability Analysis: Bookkeeping helps you assess the profitability of your Shopify store. By tracking expenses and comparing them to your revenue, you can identify areas where you can cut costs or invest more to increase profits.

- Performance Evaluation: By comparing financial data over different periods, you can assess your business’s performance and identify trends. This helps you make strategic decisions to improve performance.

- Budgeting and Planning: Effective bookkeeping allows you to create budgets and financial forecasts. These tools help Shopify merchants plan for future expenses, expansion, or marketing campaigns. A well-thought-out budget can prevent overspending and financial stress.

- Vendor and Supplier Management: Accurate records allow you to track payments to vendors and suppliers easily. This ensures timely payments, strengthens relationships, and can lead to favorable terms or discounts.

What is the difference between bookkeeping and accounting for Shopify businesses?

Accounting and Bookkeeping are closely related functions, but they serve distinct purposes in managing the financial aspects of Shopify businesses.

- Bookkeeping: Primarily focuses on recording and categorizing financial transactions. It’s the foundation for accounting and provides the raw data needed for financial statements and reports.

- Accounting: Involves a more comprehensive analysis of financial data. Accountants use bookkeeping records to create Shopify financial statements, perform financial analysis, and provide strategic advice.

What are the steps involved in performing Shopify bookkeeping?

Performing bookkeeping for a Shopify business involves several key steps to ensure accurate financial recordkeeping and reporting. Here are the steps involved in performing Shopify bookkeeping:

- Create a customized chart of accounts for your Shopify business to track common categories like sales, expenses, assets, liabilities, and equity.

- Integrate your Shopify store with accounting software to streamline data entry.

- Record sales transactions with details such as order date, customer information, product details, and payment method, and manage outstanding invoices and bills for cash flow.

- Implement an inventory tracking system to monitor stock levels, COGS, and inventory value changes.

- Regularly reconcile bank and payment processor statements with recorded transactions to ensure accuracy.

- Log all business expenses correctly within your chart of accounts, including operating, marketing, rent, and utilities.

- Reconcile financial transactions regularly to match records with bank statements and financial reports.

- Keep accurate income and expense records for simplified tax preparation and compliance.

- Prepare financial statements like income statements, balance sheets, and cash flow statements to assess your Shopify business’s financial health and make informed decisions.

- Create budgets and financial forecasts based on historical data and projections to set financial goals and track progress.

What reports should you review for your Shopify business?

As a Shopify business owner, reviewing various financial reports is crucial for understanding the health and performance of your business. Here are some key reports you should regularly review:

Sales Trends Reports

Customer Reports

Inventory Reports

Accounting Reports

Cashflow reports

How do you perform inventory management for Shopify businesses?

Managing inventory is essential for Shopify businesses to ensure products are available when customers want to purchase them while minimizing carrying costs. Here’s how to perform inventory management for Shopify businesses:

- Organize your physical and digital inventory, categorizing products and maintaining a structured database in your Shopify store.

- Determine reorder points and consider safety stock levels to prevent stockouts and manage unexpected demand fluctuations.

- Assign unique SKUs and barcodes to products for accurate tracking and quick identification.

- Regularly update inventory counts and conduct physical audits to reconcile physical and digital records, detecting discrepancies and potential theft.

- Monitor sales trends and customer demand, considering seasonality and promotions.

- Use inventory management software to synchronize stock levels across multiple sales channels to avoid overselling or stockouts.

- Maintain good supplier relationships, communicate inventory needs, and negotiate favorable terms to ensure a steady supply of products and reduce carrying costs.

- Consider dedicated inventory management software integrated with Shopify for automation, real-time tracking, and reporting.

- Leverage Shopify’s reporting tools and third-party analytics solutions to gain insights into inventory performance, analyze slow-moving items, and make data-driven adjustments.

- Choose and consistently apply an inventory valuation method (e.g., FIFO, LIFO, weighted average) to affect profitability and calculate COGS.

How do you track sales taxes for Shopify businesses?

Tracking sales taxes for Shopify businesses is essential for ensuring compliance with tax regulations and accurate financial reporting. Here’s how to track sales taxes effectively:

- Before tracking sales taxes, research and comprehend the relevant tax laws and regulations, varying by location (tax nexus).

- Utilize Shopify’s built-in tax settings to establish tax rates based on your business’s location and obligations.

- Gather accurate customer details, including billing address, shipping address, and tax exemption status.

- Employ Shopify’s automated tax calculation feature for precise tax rate calculations.

- Transparently display taxes on customer invoices and receipts.

- Accurately track both taxable and non-taxable sales.

- Adhere to tax filing schedules, which may be monthly, quarterly, or annually, depending on your location and obligations.

- Maintain comprehensive records of sales transactions, including tax calculations and collections.

- Regularly review tax reports with sales records to ensure accuracy, aided by Shopify’s tax reports.

- Seek guidance from a tax professional or e-commerce tax specialist for complex tax situations or compliance concerns.

What are the common mistakes in e-commerce bookkeeping to avoid?

E-commerce bookkeeping can be complex, and mistakes can lead to financial discrepancies, tax issues, and compliance problems. To ensure accurate bookkeeping, it’s essential to avoid these common mistakes:

- Maintain separate financial accounts for your e-commerce business to avoid mixing personal and business finances.

- Record all sources of income, including online sales, refunds, shipping fees, and gift card sales, for accurate financial statements.

- Ensure sales tax compliance to avoid penalties and fines.

- Keep detailed records of all business expenses to prevent overestimating profits and tax liability.

- Regularly reconcile bank statements with accounting records to catch discrepancies early.

- Account for returns and chargebacks to accurately reflect your revenue.

- Properly manage and value your inventory to avoid incorrect cost of goods sold (COGS) calculations.

- Update financial records regularly to prevent errors and identify issues promptly. Consider using modern accounting software for automation and accuracy.

Bookkeeping software for Shopify merchants

Vencru offers a range of features and advantages that make it an excellent choice for Shopify merchants needing bookkeeping software. It stands out as the best bookkeeping software for Shopify merchants:

- Seamless Shopify Integration: Vencru seamlessly integrates with your Shopify store, allowing you to import sales data, products, and customer information directly into the accounting system. This integration streamlines bookkeeping processes, reducing manual data entry and the risk of errors.

- Automated Bookkeeping: Automate many bookkeeping tasks, such as tracking sales, expenses, and inventory changes. This automation ensures accuracy and saves you valuable time that can be better spent on growing your business.

- Inventory Management: Track stock levels, manage multiple products, and calculate the cost of goods sold (COGS) in real time.

- Sales Tax Calculation: Automate sales tax calculations and categorizations. This ensures that you accurately collect and remit sales tax, reducing the risk of compliance issues.

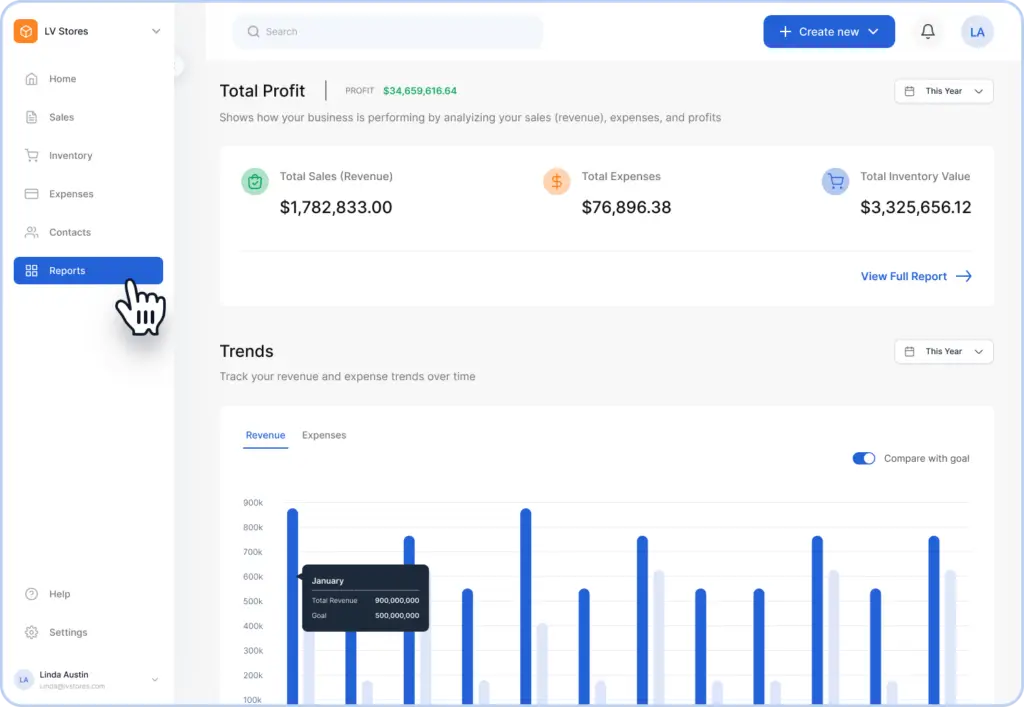

- Financial Reporting: Generate various financial reports, including income statements, balance sheets, and cash flow statements, directly from Vencru. These reports provide insights into your business’s financial health and help with decision-making.

- Multi-Currency Support: If your Shopify store deals with international customers, Vencru can handle multi-currency transactions, automatically converting and recording them in your accounting system.