Understanding the financial metrics that predict business profitability is important to succeed as a Shopify business owner. Cost of Goods sold (COGS) is one of these key metrics. In this blog post, we’ll be discussing the Cost of Goods Sold for Shopify Store.

Cost of Goods Sold (COGS) represents the direct costs associated with producing or purchasing the goods that a company sells during a specific period. These costs typically include the cost of materials, labor, and overhead directly tied to the production of goods.

Why is Calculating COGS Important for a Shopify Business?

Calculating Cost of Good Sold for your Shopify store is crucial for several reasons:

- Profitability Analysis: COGS is a key factor in determining the gross profit of a business. Subtracting COGS from revenue provides the gross profit, which is an important indicator of a Shopify Store’s profitability.

- Financial Reporting: COGS is an essential component in financial statements, helping businesses accurately report their financial performance.

- Taxation: COGS is deductible for tax purposes. Accurate calculation ensures proper tax reporting and can contribute to tax savings for your Shopify store.

How to Calculate COGS for a Shopify Store:

These metrics are important in calculating the COGS for a Shopify Store:

- Opening Inventory: The value of inventory at the beginning of the accounting period.

- Purchases: The total cost of acquiring or producing the goods that a company sells within a given period. This covers direct costs related with producing or purchasing the products sold to customers.

- For a manufacturing company, purchases comprise raw materials, direct labor, and overhead costs associated with producing goods.

- For a non-manufacturing company, purchases include the cost of purchasing finished goods for resale.

- Closing Inventory: The value of inventory at the end of the accounting period.

Related: Shopify Bookkeeping 101: Detailed Guide

Calculating Your COGS Manually:

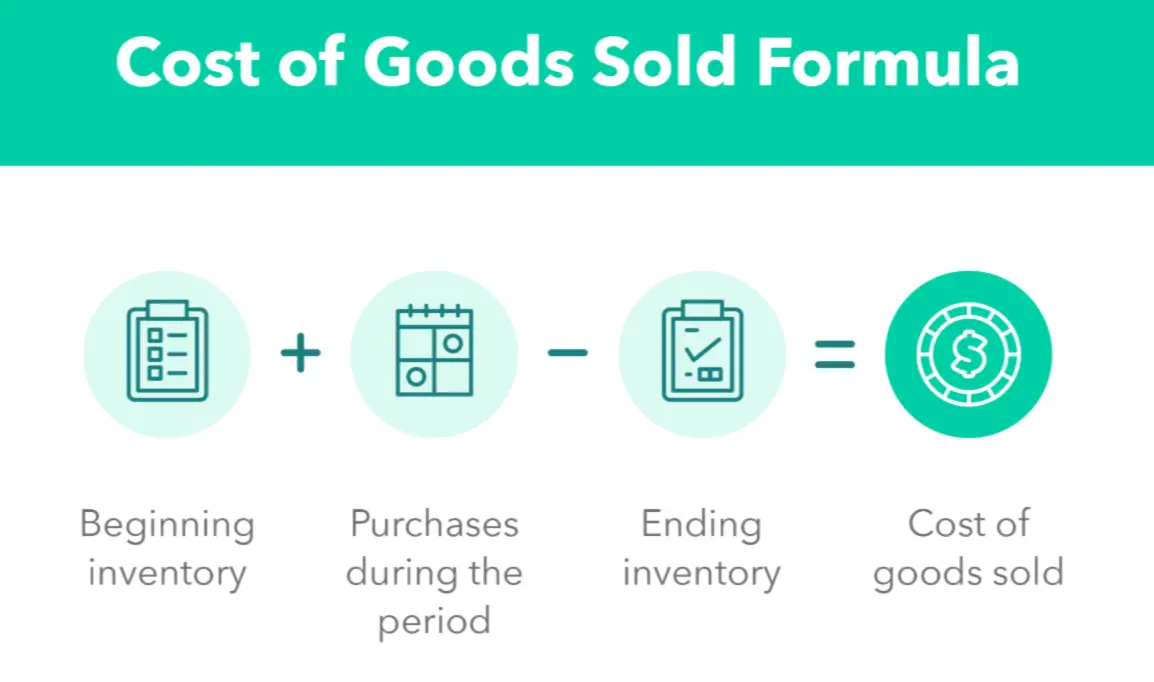

To manually calculate your Shopify business Cost of Goods Sold, use this formula:

Here’s an example for calculating COGS for Shopify business:

- Beginning Inventory: At the beginning of the year, the business had $10,000 worth of inventory on hand.

- Purchases: Throughout the year, the business made new inventory purchases. Let’s say the total purchases during the year cost $30,000.

- Ending Inventory: At the end of the year, after selling some products, there is still some inventory left. The value of the remaining inventory is $15,000.

Now, plug these values into the formula:

COGS=($10,000+$30,000)−$15,000

COGS=$40,000−$15,000

COGS=$25,000

So, in this example, the Cost of Goods Sold (COGS) for the Shopify business is $25,000. This represents the cost of the inventory that was sold during the year.

Generating COGS Automatically using Vencru

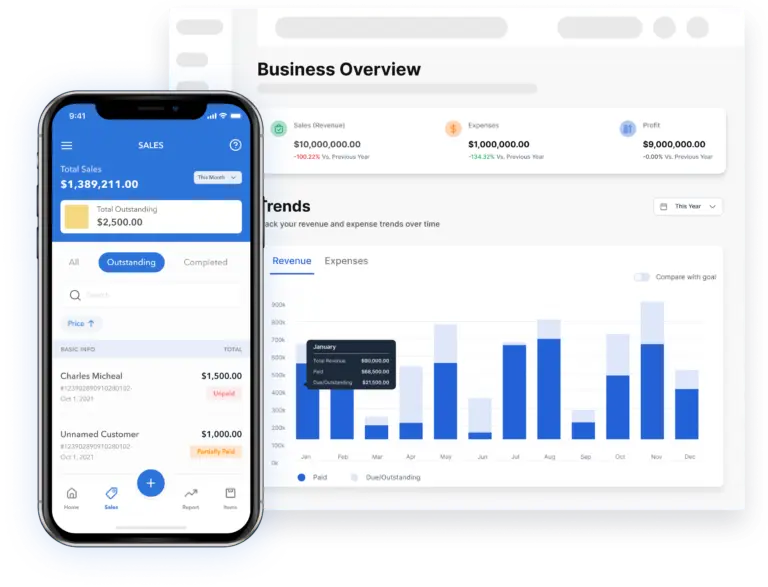

Vencru is an accounting platform for e-commerce businesses. Enjoy simple invoicing, inventory management, order processing, client and vendor management, expense tracking and robust accounting reports all in one place with affordable pricing starting at $6 billed monthly.

Manual calculations can be a lot, skip the hassle with Vencru! Integrating your Shopify store would take just a minute. Here’s how to get started:

From Your Shopify Store:

- Log in to your Shopify Store

- Click Settings on the menu bar

- Click “Apps and Sales Channels”

- Search for Vencru and Click Install

- On the Plans page, select the plan that suits your business needs and Approve payment

- On the Connect Shopify Pages, select your preferences and click “Save and Continue”

- Then, Click “Finish Integration” after reviewing your settings.

From Your Vencru Account:

- Sign up or Log in on Vencru

- Select “Settings” on the Menubar from the Dashboard

- Then, click “Commerce Settings” from the sidebar

- Click the “Connect Now” button under Shopify

- Fill in your Shopify Store URL and click “Connect To Shopify”

- Click Install on the authorization page

- On the Connect Shopify Pages, select your preferences and click “Save and Continue”

- Then Click “Finish Integration” after reviewing your settings.

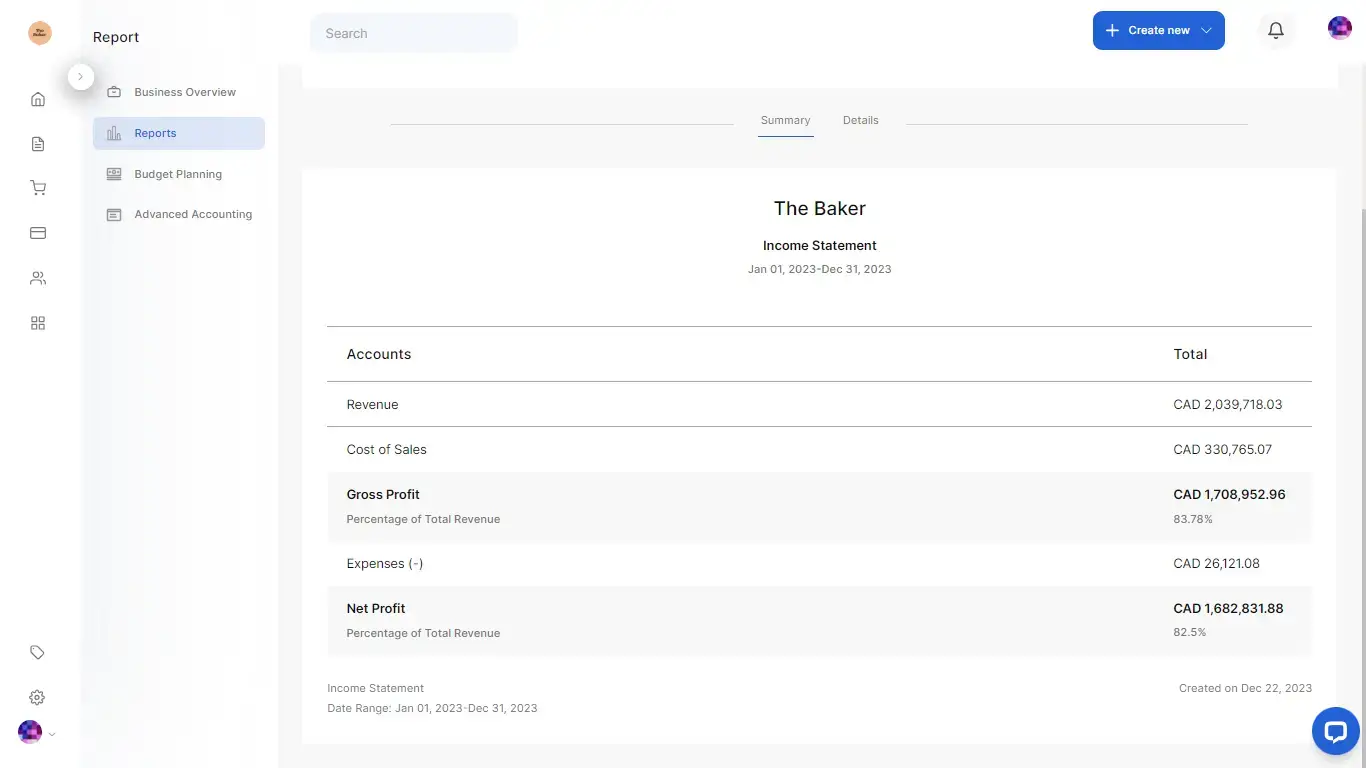

Your Vencru account is synced to your Shopify store, now your COGS is automatically calculated on Vencru! View your COGS on your Income Statement on Vencru! To generate your Income Statement:

- Login to your Vencru Account

- Click Reports from the menu bar and select “Reports” from the sidebar

- Select Income Statement

Your income Statement is displayed with your COGS as Cost of Sales! You can toggle to Details on the page to get more insight into your COGS data.

- The date period on which you want your statement can be edited by clicking on the arrow in the Date period box. Click on Run Report to get your statement for the selected period.

- Export your statement as a PDF or CSV file by clicking the Export button and selecting which of the two formats you want. Click Export to have your file downloaded.

Best Practices for Managing COGS:

- Accurate Record-Keeping: Maintain accurate and up-to-date records of inventory and related costs.

- Consistency: Use consistent methods for valuing inventory and calculating COGS to ensure comparability over time.

- Regular Audits: Conduct regular inventory audits to verify the accuracy of recorded inventory levels.

- Use Accounting Software: Implement accounting software like Vencru for efficient and accurate calculations.

- Understand Your Costs: Understand the components of COGS, including direct material costs, direct labor costs, and overhead.

- Monitor Trends: Keep an eye on trends in your COGS over time and investigate any significant fluctuations.

- Seek Professional Advice: Consult with accounting professionals or financial advisors for guidance on optimizing COGS management.

By effectively managing and calculating COGS, Shopify businesses can make informed decisions, improve financial performance, and maintain compliance with tax regulations.