Accounting for an online business can be challenging, especially for a global business. Thus, it is important to have a structured framework for organizing all financial transactions. This makes it easier to categorize and record various income and expenses associated with e-commerce accounting. That’s where the Chart of Accounts for e-commerce businesses comes in.

In this guide, we explain the E-commerce Chart of Accounts, delve into its crucial components, and show why Vencru is the accounting solution for e-commerce businesses.

- What is a chart of accounts for e-commerce businesses?

- Why is accounting important for e-commerce businesses

- What is included in a chart of accounts for e-commerce businesses (template included)

- Why use E-commerce Accounting Software

What is a chart of accounts for e-commerce businesses?

A Chart of Accounts (CoA) for e-commerce businesses is a comprehensive and structured list of financial accounts that categorizes and tracks all an online retail operation’s financial transactions and activities. It is the backbone of an e-commerce business’s accounting and financial reporting system. Each account in the chart represents a specific type of financial activity, and they are organized into categories to make financial management more organized and manageable.

Why is accounting important for e-commerce businesses

A Chart of Accounts is crucial for an e-commerce business for several reasons:

- Financial Organization: It provides a structured and organized framework for classifying all financial transactions of an e-commerce business, making it easier to locate specific transactions and generate financial reports.

- Accurate Reporting: You can produce accurate financial statements such as income and balance sheets with well-defined accounts. This is essential for understanding the health of your e-commerce business. You can identify high and low profitability areas by categorizing expenses and revenues.

- Tax Compliance: It helps ensure compliance with tax regulations by categorizing income and expenses appropriately. This makes tax filing more straightforward and minimizes the risk of errors.

- Budgeting and Forecasting: It facilitates budgeting and forecasting by allowing you to allocate expenses and revenues to specific accounts. This is essential for setting financial goals and tracking progress.

- Audit Trail: It creates an audit trail, enabling you to trace financial transactions. This is crucial for identifying errors or fraudulent activities.

What is included in a chart of accounts for e-commerce businesses?

The CoA for e-commerce businesses typically includes five primary categories:

Asset Accounts

These accounts represent the e-commerce business’s assets, such as cash, accounts receivable, inventory, and equipment. Asset accounts are essential for e-commerce businesses as they provide insights into the company’s financial health, liquidity, and ability to invest in growth opportunities.

| Account Number | Account Name | Description |

|---|---|---|

| 1010 | Cash on Hand | Operating cash on hand for an online retailer |

| 1011 | Undeposited funds | Earned revenue but not deposited into your account |

| 1020 | Accounts Receivable | Amounts owed to the business |

| 1030 | Inventory | Value of unsold products in stock |

| 1040 | Prepaid Expenses | Advance payments for future expenses |

| 1050 | Equipment | Office equipment and machinery |

Liability Accounts

Liability accounts in the online retailer chart of accounts represent obligations or debts the business owes to external parties. These accounts track the sources of funds that the business has received or will need to repay in the future.

| Account Number | Account Name | Description |

|---|---|---|

| 201 | Accounts Payable | Amounts owed by the business |

| 202 | Loans Payable | Outstanding loans and debts |

| 203 | Accrued Liabilities | Unpaid expenses not yet recorded |

| 204 | Credit Card Payable | Outstanding credit card balances |

Equity Accounts

Equity accounts reflect the owner’s investment in the e-commerce business and accumulated profits or losses over time.

| Account Number | Account Name | Description |

|---|---|---|

| 301 | Owner’s Equity | Owner’s investment in the e-commerce business |

| 302 | Retained Earnings | Accumulated profits or losses |

| 303 | Common Stock | Shares of common stock issue |

Revenue Accounts

These accounts record all sources of income generated by the online store, such as product sales, service fees, and subscription income.

| Account Number | Account Name | Description |

|---|---|---|

| 401 | Product Sales | Revenue from product sales |

| 402 | Service Fees | Income from service fees |

| 403 | Subscription Income | Income from subscription services |

| 404 | Shipping Revenue | Income from shipping charges |

Expense Accounts

Expense accounts in an online retailer chart of accounts cover all the costs incurred by the business, including marketing expenses, shipping costs, and office supplies.

| Account Number | Account Name | Description |

|---|---|---|

| 501 | Advertising Expenses | Costs related to advertising |

| 502 | Cost of Goods Sold (COGS) | Costs directly tied to product sales |

| 503 | Marketing Expenses | Marketing and promotional expenses |

| 504 | Shipping Costs | Costs associated with shipping |

| 505 | Office Supplies | Expenses for office supplies |

A well-structured CoA ensures that all financial transactions are properly categorized and can be easily tracked and reported. It helps e-commerce businesses maintain accurate financial records, make informed financial decisions, and ensure compliance with tax regulations. Additionally, it simplifies the process of generating financial statements, such as income statements and balance sheets, which are essential for assessing the health of the e-commerce business.

Related Read: Chart of Accounts: Definition, examples, and industry-specific versions

Use E-commerce Accounting Software Like Vencru

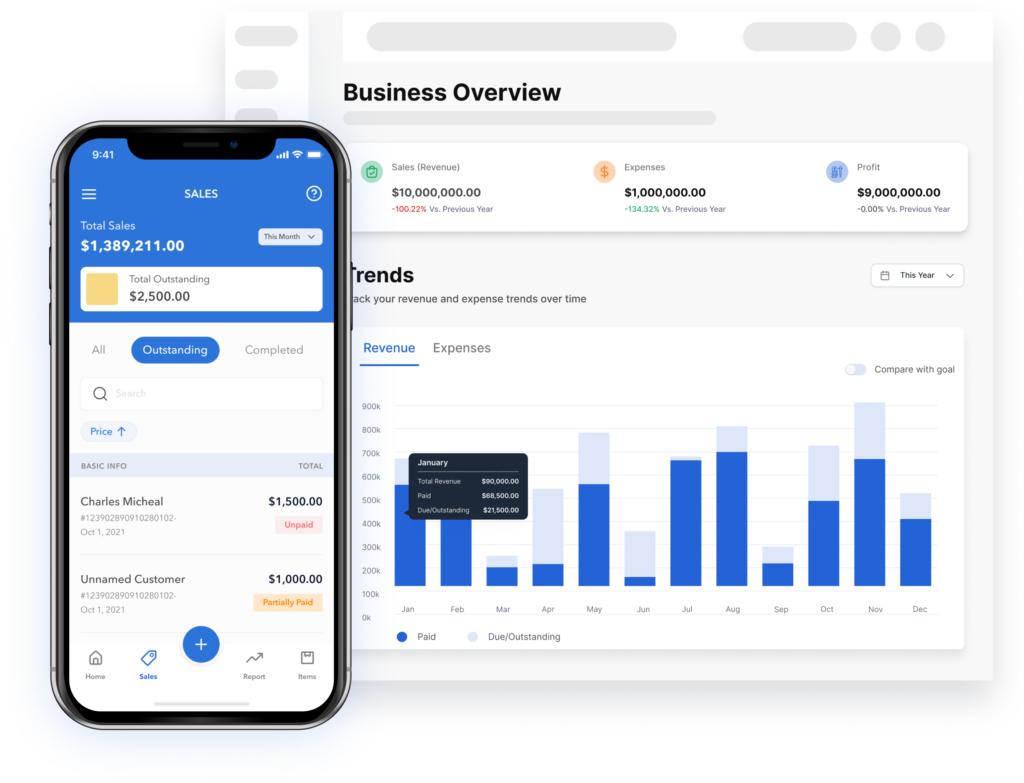

Managing an online business’s financials, including inventory, can be complex. That’s where dedicated e-commerce accounting software like Vencru comes into play. Vencru offers features tailored to the unique needs of online businesses:

- Automated Accounting: Vencru integrates seamlessly with e-commerce platforms like Shopify, automating the accounting process. It automatically imports sales data, expenses, and transaction details, reducing manual data entry and minimizing errors.

- Customized Chart of Accounts: Vencru allows e-commerce businesses to create a chart of accounts specific to their industry and needs. This customization ensures that the financial reports accurately reflect the business’s performance.

- Inventory Management: Vencru offers robust inventory management features that help e-commerce businesses track stock levels, manage product variations, and receive low-stock alerts. This ensures they never run out of popular products and can plan for restocking in advance.

- Cost of Goods Sold (COGS) Tracking: E-commerce businesses can easily calculate their COGS, a crucial metric for profitability. Vencru enables them to track the costs of purchasing and selling products, helping in pricing decisions and financial analysis.

- Expense Tracking: Managing expenses is vital for e-commerce profitability. Vencru simplifies expense tracking, allowing businesses to categorize expenses, upload receipts, and generate expense reports.

- Tax Compliance: E-commerce businesses often deal with complex tax scenarios, especially when selling across borders. Vencru helps calculate and manage sales tax, ensuring compliance with tax regulations.

- Financial Reporting: Vencru generates detailed financial reports, including income statements, balance sheets, and cash flow statements. These reports offer insights into the business’s financial health and aid in strategic decision-making.

A structured online retailer chart of accounts is your secret recipe for financial success. Vencru simplifies the process by offering specialized features that cater to the unique needs of online retailers. Say goodbye to manual data entry

Benefits of Using Vencru

- Single Platform: Vencru eliminates the need for multiple software tools by combining inventory management and accounting in one platform.

- Avoid Duplicate Entries: Say goodbye to redundant data entry. Vencru ensures that your financial data is consistent across all aspects of your business.

- Data Security: Trust in Vencru’s robust security measures to safeguard your sensitive financial information.

- Customer Service: Access top-notch customer support to resolve any issues promptly.

In conclusion, a well-structured online retailer chart of accounts is indispensable for effectively managing a business’s finances as an online retailer. With the right tools like Vencru, you can streamline your accounting processes, gain valuable insights, and ensure the financial health of your retail venture. Get started today and experience the difference Vencru can make in your retail accounting journey.

Ready to explore Vencru? Get started here or book a demo

Related Links

- Guide to Retail Chart of Accounts (with sample PDF)

- Accounting software for E-commerce

- 20 Accounting Terms Every Retailer and Wholesaler Should Know

- Chart Of Accounts For A Construction Company: Detailed Guide

- Guide to Restaurant Chart of Accounts (with sample PDF)

- Chart of Accounts for Rental Property: A Comprehensive Guide

Disclaimer: This article is for informational purposes only and does not constitute financial or legal advice. Please consult with a qualified professional for personalized guidance.