What is the Accounts Receivable Aging Method?

Accounts Receivable Aging Method is an accounting technique used to organize a company’s outstanding invoices based on how long they’ve been unpaid. This method groups receivables into different time categories, often in 30-day increments like 0-30 days, 31-60 days, 61-90 days, and over 90 days. These categories help businesses assess their receivables and spot potential issues with late payments. On average, most invoices are paid within 30 to 45 days, though this can vary based on industry standards and customer relationships. Unfortunately, 60% of invoices are paid late in the United States. Thus, managing invoice payments is extremely important.

Why is Accounts Receivable Aging Important?

The Accounts Receivable Aging Method plays a key role in accounting for several reasons:

- Risk Assessment: It highlights overdue invoices, helping businesses assess which customers pose a risk of non-payment. For example, if a business has multiple invoices overdue for over 90 days, some customers might not pay on time. This allows the business to target these high-risk customers with specific follow-up actions, such as contacting them directly or offering different payment options to improve collections.

- Cash Flow Management: It helps estimate future cash inflows, making cash flow management and planning more predictable. For example, a small bakery might use aging reports to see that $5,000 worth of invoices are due within 30 days. This allows the owner to plan inventory purchases and set aside money for expenses, knowing when payments will arrive.

- Credit Policy Evaluation: Aging analysis reveals if many customers fall into older categories, suggesting the need to tighten credit policies or improve collection strategies. For example, a small landscaping business might notice several customers are consistently late on payments, with invoices falling into the 60-90 day category. This signals a need to reconsider their credit terms or send reminders earlier to encourage prompt payments.

Related post: 5 Common Invoicing Mistakes to Avoid

How to Calculate Accounts Receivable: Accounts Receivable Aging Method

Calculating accounts receivable aging involves the following steps:

- List All Outstanding Invoices: Gather a list of all unpaid invoices, including their issue dates, due dates, and amounts due.

- Categorize by Age: Classify each invoice into aging categories (e.g., 0-30 days, 31-60 days, 61-90 days, and over 90 days). This helps visualize which invoices are overdue and by how much.

- Calculate Total Amounts: Add up the total amount owed for each category. This will show you how much is outstanding for each aging bracket.

- Identify High-Risk Invoices: Highlight invoices that fall into the older aging brackets (e.g., over 90 days). These invoices are at a higher risk of non-payment and may need special attention.

Example: Let’s say a small business has the following unpaid invoices:

- Invoice A: $1,000 (issued 10 days ago)

- Invoice B: $2,000 (issued 40 days ago)

- Invoice C: $3,000 (issued 80 days ago)

You would categorize these invoices as follows:

- 0-30 days: $1,000

- 31-60 days: $2,000

- 61-90 days: $3,000

This process clearly identifies the business’s outstanding receivables and which customers need follow-up actions. Invoicing software can also automatically track the aging of account receivables.

Advantages of Accounts Receivable Aging Method

- Timely Action: Aging categories make it easy to prioritize overdue accounts, allowing businesses to take early action and reduce bad debts.

- Performance Monitoring: It serves as a performance gauge for credit management, showing how well current collection efforts are working.

- Decision Support: The method informs decisions around extending credit and prioritizing debt collection, helping maintain healthy cash flow.

Disadvantages of Accounts Receivable Aging Method

- Over-Simplification: Categorizing invoices into set time periods can miss unique customer behaviors, leading to possible inaccuracies.

- Assumption of Uniformity: It assumes similar payment behavior within each category, though in reality, customers can vary significantly.

- Limited Historical Insight: The method mainly focuses on current invoices, providing limited perspective on long-term payment patterns.

Example: Accounts Receivable Aging for a Wholesaler

Let’s say a wholesale distributor sells clothing on credit to retail stores. After a month, they categorize their receivables as follows:

- 0-30 days: $100,000

- 31-60 days: $50,000

- 61-90 days: $30,000

- Over 90 days: $20,000

From this breakdown, the wholesaler notices a large amount of $50,000 in the 31-60-day range. This suggests potential payment issues with those customers. The distributor can then focus on these accounts with targeted collection strategies to boost cash flow and avoid future bad debts.

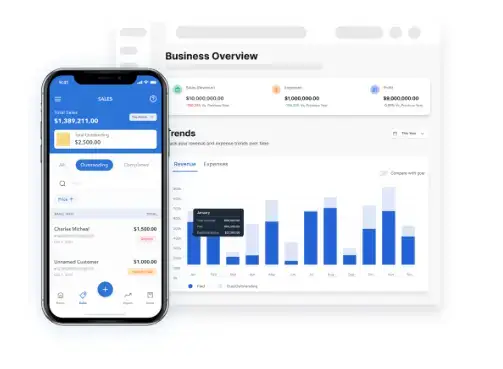

How Vencru Can Help with Managing Accounts Receivable

Vencru provides tools that streamline the management of accounts receivable for small businesses. Here’s how Vencru can make a difference:

- Automated Invoicing and Follow-Ups: With Vencru, you can create and send invoices automatically and provide reminders for overdue payments. This ensures timely follow-up without manual tracking, saving time and reducing the risk of missed payments.

- Real-Time Aging Reports: With Vencru, businesses can quickly generate accounts receivable aging reports that categorize unpaid invoices by age. This feature allows users to see at a glance which accounts require immediate attention, making cash flow management easier.

- Customer Payment Tracking: Vencru offers features to track customer payments, giving a clear view of payment history. This helps business owners identify consistent late payers and adjust credit terms accordingly.

- Integrated Payment Options: Vencru integrates with popular payment platforms like Stripe and PayPal, making it easier for customers to pay promptly. This helps reduce the overall aging of receivables.

These features simplify accounts receivable management, reduce overdue payments, and improve a business’s cash flow health.

Conclusion

Accounts Receivable Aging is a simple yet powerful tool for monitoring payments and improving credit management. By understanding which accounts are overdue, businesses can focus collection efforts effectively, maintain cash flow, and reduce financial risks.