The Chart of Accounts (COA) is a foundational tool in accounting, serving as the backbone of a company’s financial recordkeeping system. This guide offers an in-depth exploration of the chart of accounts, providing definitions, an example, and a downloadable template to enhance your financial organization and reporting.

What Is a Chart of Accounts?

A Chart of Accounts is an organized list of all the accounts in a company’s general ledger, systematically used for recording transactions. Each account in the COA is typically set as a unique identifier, often a number, and is organized to reflect the business’s structure and reporting needs.

Why is a Chart of Accounts Important?

The COA is used for:

- Organizing Financial Transactions: The COA provides a systematic way to organize every financial transaction a business undertakes. Each transaction is recorded in its respective account, making locating and understanding financial data easier.

- Ensuring Consistency: With a structured list of accounts in your COA, you ensure consistent recording of all financial activities. This consistency is the bedrock of accurate bookkeeping and reliable financial reporting.

- Facilitating Financial Reporting: The COA acts as a translator between your business activity and financial statements. Accounts in your COA directly correspond to line items in your balance sheet, income statement, and other reports, simplifying the entire financial reporting process.

- Budgeting and Forecasting: The COA gives you a clear and comprehensive view of all your financial aspects. This crystal ball allows you to make more accurate predictions about future financial performance, empowering you to create effective budgets and forecasts.

- Regulatory Compliance: The COA helps you align your accounting practices with established accounting standards and regulatory requirements. This ensures you’re always playing by the rules and avoids potential fines or legal issues down the road.

Key Elements of a Chart of Accounts

- Assets: These represent the resources your business owns that have economic value. Examples include cash on hand, inventory, equipment, and accounts receivable.

- Liabilities: These represent your business’s financial obligations that need to be settled in the future. Examples include accounts payable loans payable, and accrued expenses.

- Equity: This represents the ownership interest in the business. For a sole proprietorship, this would be the owner’s equity account, reflecting the initial investment and any accumulated profits or losses.

- Revenue: These accounts record all the income generated by your business’s activities. Examples include sales of products or services and interest earned on investments

- Expenses: These accounts record all the costs incurred by your business to operate. Examples include salaries and wages, rent and utilities, marketing costs, office supplies, and depreciation.

Standard Chart of Accounts numbering system

The Standard Chart of Accounts (COA) numbering system is a structured approach used to categorize and organize financial transactions in accounting. The COA categorizes all financial transactions into different types of accounts. This system assigns a unique number to each account, facilitating easy identification, recording, and reporting. Here’s a breakdown of how this numbering system typically works:

Basic Structure

- Sequential Numbering: Each type of account is assigned a range of numbers. This sequence usually starts from the lowest numbers for asset accounts and progresses toward higher numbers for liabilities, equity, revenue, and expense accounts.

- Number of Digits: The system can vary in complexity, with larger organizations using more digits to allow for more sub-categories. A common structure is to use a 4-digit numbering system, but it can range from 3 to 7 digits depending on the size and complexity of the business.

Common Number Ranges

- Assets (1000-1999): These accounts are typically numbered in the 1000s. They include current assets like cash (1010), accounts receivable (1100), and inventory (1200). They also include fixed assets like buildings (1700) and equipment (1800).

- Liabilities (2000-2999): Liabilities are often numbered in the 2000s. This includes accounts like accounts payable (2100), short-term loans (2200), and long-term debt (2600).

- Equity (3000-3999): Equity accounts generally fall in the 3000s. They include common stock (3100), retained earnings (3200), and dividends (3300).

- Revenue (4000-4999): Revenue or income accounts are usually in the 4000 range. This includes accounts such as sales revenue (4100) and service income (4200).

- Expenses (5000-5999 and beyond): Expense accounts often start from 5000 onwards. This broad category can extend to higher numbers due to the diversity of expenses, like rent expenses (5100), salaries (5200), and utilities (5300).

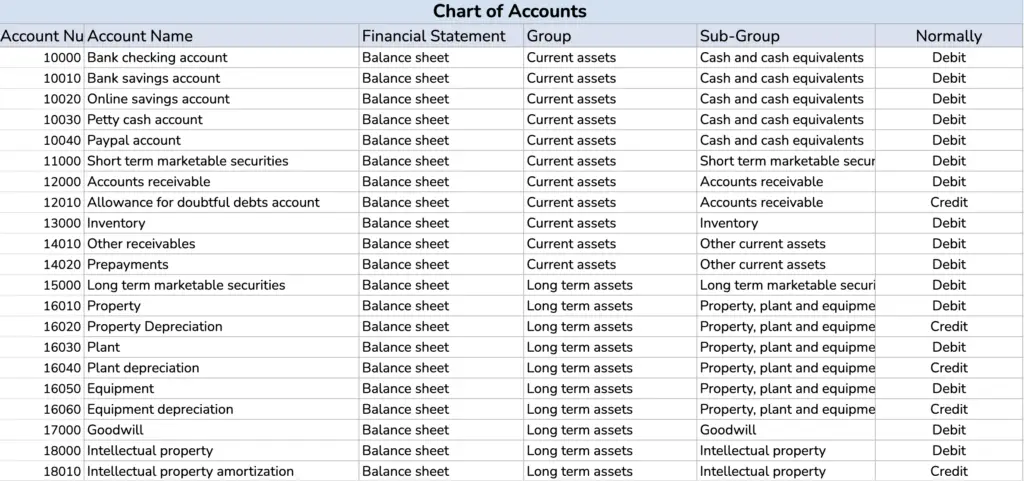

Chart Of Accounts Example

This chart of accounts example includes a variety of common account types and their typical numbering. Actual accounts and numbers can vary depending on each business’s specific needs and structure. Larger businesses may have more detailed accounts, including more specific sub-categories. The COA should be tailored to fit the unique accounting needs of each business, capturing all relevant financial activities.

| Account Number | Account Type | Description |

|---|---|---|

| 1000-1999: Assets | ||

| 1010 | Current Assets | Cash |

| 1020 | Current Assets | Accounts Receivable |

| 1100 | Current Assets | Inventory |

| 1200 | Fixed Assets | Equipment |

| 1300 | Fixed Assets | Buildings |

| 2000-2999: Liabilities | ||

| 2010 | Current Liabilities | Accounts Payable |

| 2020 | Current Liabilities | Accrued Expenses |

| 2100 | Long-Term Liabilities | Long-Term Debt |

| 3000-3999: Equity | ||

| 3010 | Equity | Common Stock |

| 3020 | Equity | Retained Earnings |

| 4000-4999: Revenue | ||

| 4010 | Revenue | Sales Revenue |

| 4050 | Revenue | Service Income |

| 5000-5999: Expenses | ||

| 5010 | Operating Expenses | Salaries and Wages |

| 5020 | Operating Expenses | Rent Expense |

| 5030 | Operating Expenses | Utilities Expense |

| 5100 | Operating Expenses | Marketing and Advertising Expense |

Download Chart of Accounts Example Template (Excel included)

See a free Excel template with a standard chart of accounts with payroll expenses, etc.

Chart of Accounts Best Practices

Adopting best practices for the Chart of Accounts (COA) is crucial for efficient financial management and reporting. Here are key best practices to consider:

- Simplicity and Clarity: Keep the COA simple while ensuring it meets your business needs. Overly complex accounts can complicate financial recording and analysis. Each account should have a clear, descriptive name so its purpose is easily understood.

- Consistency: Develop consistent naming conventions, structures, and usage patterns for your accounts. This allows for effortless comparison of financial data over time and guarantees reliable reporting

- Scalability: Design your COA with an eye towards the future. Build flexibility to accommodate new accounts as your business expands or evolves, avoiding the need for a complete overhaul down the line.

- Alignment with Reporting Requirements: Ensure your COA adheres to the reporting standards and requirements that govern your business, whether it’s Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

- Regular Reviews and Updates: Schedule periodic reviews and updates to reflect changes in your business environment, operations, or regulatory landscape. This might involve adding new accounts, removing obsolete ones, or reclassifying existing accounts to maintain accuracy.

- Grouping and Segmentation: Organize similar accounts into groups and leverage segmentation where it enhances analysis. Consider segmenting by department, location, or project to gain deeper financial insights.

- Standardized Numbering System: Implement a logical and standardized numbering system for your accounts. This simplifies sorting, identification, and helps prevent errors in your financial data.

- Integration with Accounting Software: Ensure your COA seamlessly integrates with your accounting software. This streamlines transaction recording and generates accurate financial reports with ease.

Chart of Accounts by Industry

Different industries have unique COA needs. For instance, a manufacturing business will have different account requirements than a service-based business. Here’s a list of our example COA by industry:

- Retail

- E-commerce business

- Non-profit

- Restaurant

- Construction

- E-commerce

- Healthcare

- Small Business

- Rental property

- Distribution Company

- Transportation and Logistics

- Manufacturing

- Cafe

- Law firm

- Advertising agency

- Merchandising business

- Software as a service (SaaS)

- Amazon FBA or Amazon seller

- Automotive chart of accounts

- Bakery

- Brewery

- Service business

- Consulting services

- Gym

- Auto repair shop

- Grocery store

Conclusion

The Chart of Accounts is an indispensable tool in the realm of accounting, vital for accurate and efficient financial management. Understanding its structure, types, and best practices is key to maintaining an organized financial record-keeping system.