Running a restaurant involves juggling numerous financial transactions, from managing inventory to tracking expenses and revenue. Restaurateurs need an organized financial framework to maintain control and make informed decisions. That’s where a Restaurant Chart of Accounts comes in.

In this guide, we explain the Restaurant Chart of Accounts, delve into its crucial components, and show you why Vencru is the accounting solution for Restaurant businesses.

- Why Chart of Accounts Matters for Restaurant

- What is Included in a Restaurant Chart of Accounts?

- Restaurant Chart of Account Template

- Optimizing Your Restaurant Chart of Accounts

- How Vencru can help you automate your chart of accounts

Why Chart of Accounts Matters for Restaurants

A well-designed Chart of Accounts is indispensable for restaurant owners for several reasons:

- Financial Clarity: A structured CoA offers a clear overview of the restaurant’s financial landscape, enabling owners to track revenue sources, monitor expenses, and assess profitability with ease.

- Strategic Planning: By categorizing expenses and revenues, a CoA facilitates strategic planning and budgeting, empowering restaurant owners to set realistic financial goals and make informed decisions for business growth.

- Tax Compliance: With a tailored CoA, restaurant owners can accurately track tax obligations, ensuring compliance with local tax regulations and minimizing the risk of penalties or fines.

- Streamlined Reporting: A well-organized CoA simplifies the process of generating financial reports, including profit and loss statements, balance sheets, and cash flow statements, providing valuable insights for informed decision-making.

What is Included in a Restaurant Chart of Accounts?

A Chart of Accounts is a comprehensive listing of all financial accounts a business uses to record its transactions. It should cover every aspect of restaurant financial management, ensuring nothing is overlooked.

Here are the key types or groups of accounts found in a Restaurant Chart of Accounts:

1. Asset Accounts: These encompass everything a restaurant owns. For example:

- Bank Accounts: To track cash flow.

- Inventory Assets: To monitor the value of goods on hand.

- Property and Equipment: To record your restaurant’s physical assets.

2. Liability Accounts: These represent obligations, like loans and outstanding bills.

3. Equity Accounts: Show the owner’s interest in the restaurant’s assets, including owner’s equity and retained earnings.

4. Revenue Accounts: Document all the income streams, like sales, catering, and gift certificates.

5. Expense Accounts: Cover your day-to-day costs, including wages, rent, utilities, and food costs.

Related Read: Chart of Accounts: Definition, examples, and industry-specific versions

Restaurant Chart of Account Template

Here’s a more detailed breakdown of a typical Restaurant Chart of Accounts:

Asset Accounts

| Account Number | Account Name | Description |

|---|---|---|

| 1000 | Cash on Hand | Cash that is available in the register or deposit drawer. |

| 1010 | Checking Account | Funds in the primary business checking account. |

| 1020 | Savings Account | Funds saved in a business savings account (e.g., emergency fund). |

| 1100 | Accounts Receivable | Money owed to the restaurant by customers for outstanding bills. |

| 1200 | Inventory – Food | The cost of food items currently in stock for preparation. |

| 1210 | Inventory – Beverage | The cost of beverages (alcoholic & non-alcoholic) currently in stock. |

| 1220 | Inventory – Bar Supplies | The cost of bar supplies (e.g., garnishes, mixers) currently in stock. |

| 1300 | Prepaid Expenses | Costs paid in advance for future benefits (e.g., prepaid rent, insurance). |

| 1400 | Equipment | The cost of restaurant equipment (e.g., ovens, refrigerators). |

| 1500 | Furniture & Fixtures | The cost of furniture and fixtures used in the restaurant (e.g., tables, chairs). |

| 1600 | Leasehold Improvements | Any improvements made to the leased space that increase its value. |

Liability Accounts

| Account Number | Account Name | Description |

|---|---|---|

| 2000 | Accounts Payable | Money owed to suppliers and vendors for goods and services received on credit. |

| 2100 | Accrued Expenses | Expenses incurred but not yet paid (e.g., unpaid wages). |

| 2200 | Notes Payable | Short-term loans taken out by the restaurant that need to be repaid within a year. |

| 2300 | Long-Term Debt | Loans with a repayment period exceeding one year (e.g., mortgage). |

Equity Accounts

| Account Number | Account Name | Description |

|---|---|---|

| 3000 | Owner’s Equity | The owner’s investment in the restaurant, including initial investment and retained earnings. |

| 3010 | Retained Earnings | Accumulated profits or losses. |

Revenue Accounts

| Account Number | Account Name | Description |

|---|---|---|

| 4000 | Food Sales | Revenue generated from the sale of food items. |

| 4010 | Beverage Sales | Revenue generated from the sale of alcoholic and non-alcoholic beverages. |

| 4020 | Catering Revenue | Revenue generated from providing catering services for events. |

| 4030 | Other Revenue | Revenue from any other sources not categorized above. |

| 4040 | Merchandise Sales | Revenue from selling merchandise (e.g., branded merchandise). |

Expense Accounts

| Account Number | Account Name | Description |

|---|---|---|

| 5000 | Food Cost | The cost of ingredients used in preparing food items sold. |

| 5100 | Beverage Cost | The cost of beverages (alcoholic & non-alcoholic) sold. |

| 5200 | Prime Cost | The total cost of food and beverage sold (Food Cost + Beverage Cost). |

| 5300 | Labor Cost | Wages and salaries paid to employees. |

| 5400 | Payroll Taxes | Taxes withheld from employee paychecks (e.g., Social Security, Medicare). |

| 5500 | Rent & Utilities | Cost of rent, electricity, water, gas, etc. |

| 5600 | Marketing & Advertising | Expenses related to promoting the restaurant. |

| 5700 | Other Operating Expenses | Any other costs incurred to run the restaurant (e.g., repairs, uniforms, insurance). |

This template provides a solid foundation for your restaurant’s financial tracking, ensuring nothing falls through the cracks.

Optimizing Your Restaurant Chart of Accounts

To maximize the effectiveness of your Chart of Accounts, consider the following strategies:

- Tailor to Your Restaurant Type: Customize your CoA to reflect your restaurant’s unique operations and revenue streams, ensuring it aligns with your business model and objectives.

- Utilize Sub-Accounts: Create sub-accounts within each category to provide detailed tracking and analysis of expenses and revenues, allowing for better financial insights and decision-making.

- Regular Review and Update: Periodically review and update your CoA to accommodate changes in your restaurant’s operations, menu offerings, or financial goals, ensuring it remains relevant and accurate.

- Leverage Technology: Take advantage of restaurant accounting software like Vencru to automate financial processes, streamline data entry, and generate real-time financial reports, saving time and improving accuracy.

Related Read: Accounting Software for Restaurants

Use Restaurant-Specific Accounting Software Like Vencru

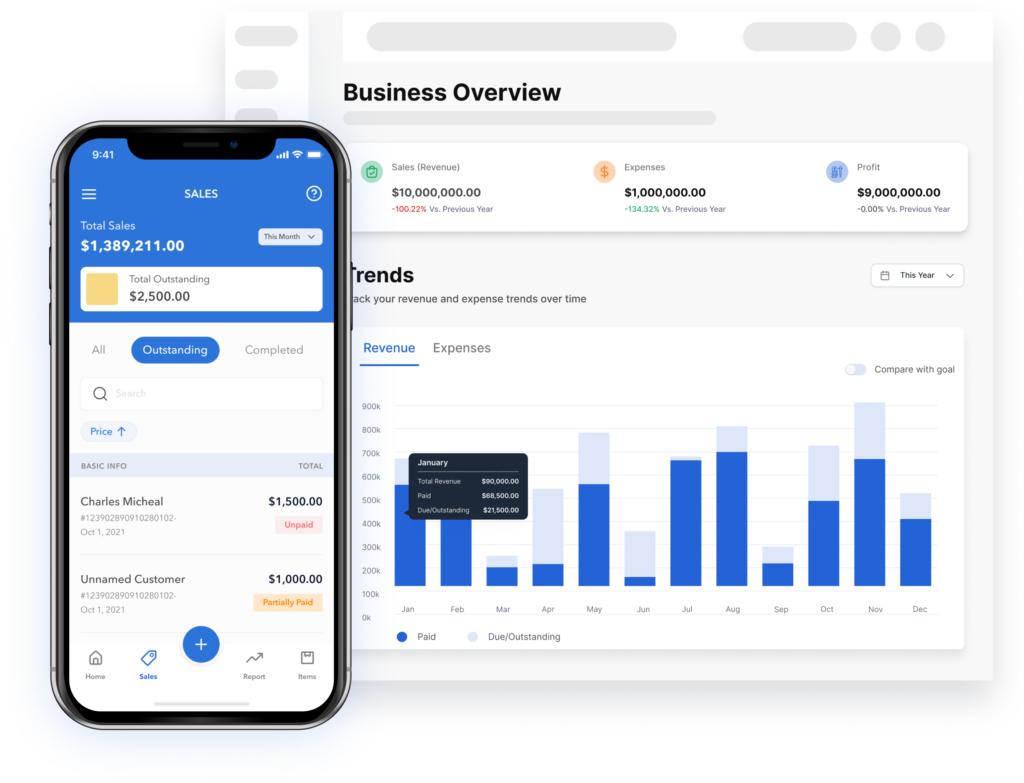

Managing a Restaurant’s financials, including inventory, can be complex. That’s where dedicated Restaurant accounting software like Vencru comes into play. Vencru offers features tailored to the unique needs of Restaurant businesses:

- Inventory Management: Easily track and manage inventory across all your channels. Ensure you never run out of crucial ingredients, reducing wastage and improving customer satisfaction.

- Expense Tracking: Streamline expense recording for items like employee wages, rent, and supplies. Reduce the risk of errors in your financial statements.

- Sales Reporting: Gain valuable insights into your restaurant’s performance with detailed sales reports. Understand which dishes or beverages are the most popular and profitable.

- Cost of Goods Sold (COGS) Calculation: Vencru accurately calculates your restaurant’s COGS, helping you determine your gross profit and make informed pricing decisions.

- Security: Rest easy knowing your financial data is secure with Vencru’s robust encryption and data protection measures.

- Customer Service: Vencru offers dedicated customer support, ensuring you get the assistance you need when navigating your accounting and inventory management.

A structured chart of accounts is your secret recipe for financial success. Vencru simplifies the process by offering specialized features that cater to the unique needs of restaurant businesses. Say goodbye to manual data entry

Benefits of Using Vencru

- Single Platform: Vencru eliminates the need for multiple software tools by combining inventory management and accounting in one platform.

- Avoid Duplicate Entries: Say goodbye to redundant data entry. Vencru ensures that your financial data is consistent across all aspects of your business.

- Data Security: Trust in Vencru’s robust security measures to safeguard your sensitive financial information.

- Customer Service: Access top-notch customer support to resolve any issues promptly.

In conclusion, a well-structured retail chart of accounts is indispensable for effectively managing your retail business’s finances. With the right tools like Vencru, you can streamline your accounting processes, gain valuable insights, and ensure the financial health of your retail venture. Get started today and experience the difference Vencru can make in your retail accounting journey.

Ready to explore Vencru? Get started here or book a demo

Disclaimer: This article is for informational purposes only and does not constitute financial or legal advice. Please consult with a qualified professional for personalized guidance.