Free Petty Cash Log Template

Manage your petty cash transactions with our printable petty cash log template. Download it in Excel, PDF, or Google Docs format for free.

Fill the information below to instantly get access to your free copy

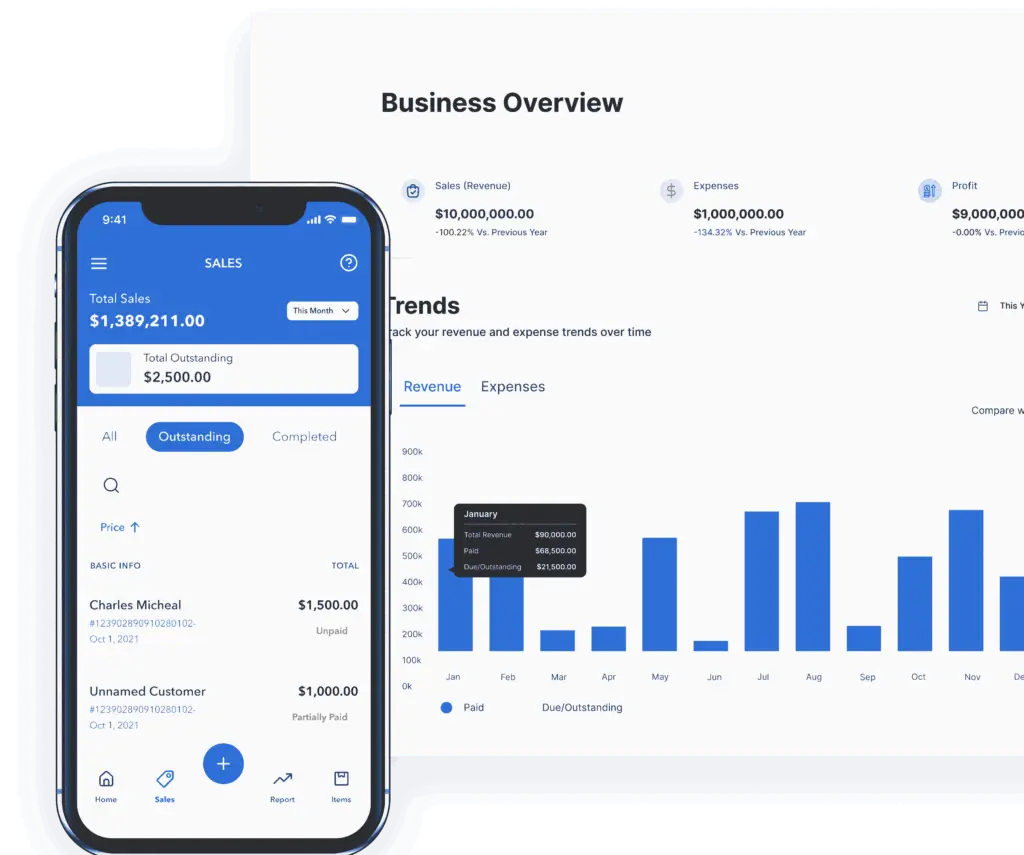

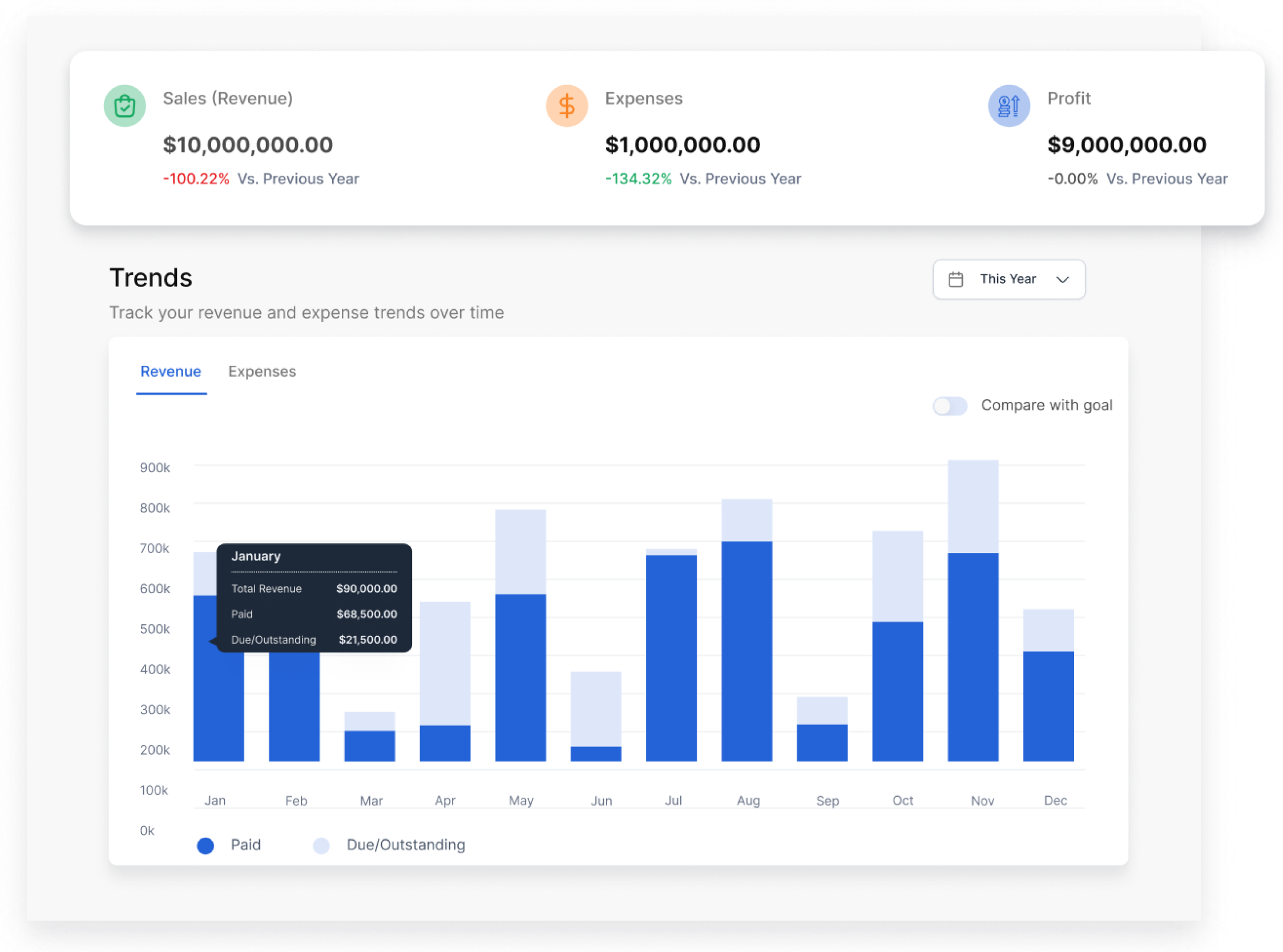

Get more value than Sales templates

Automatically track cash transactions, and generate cashflow sales reports and other financial statements using Vencru’s bookkeeping software.

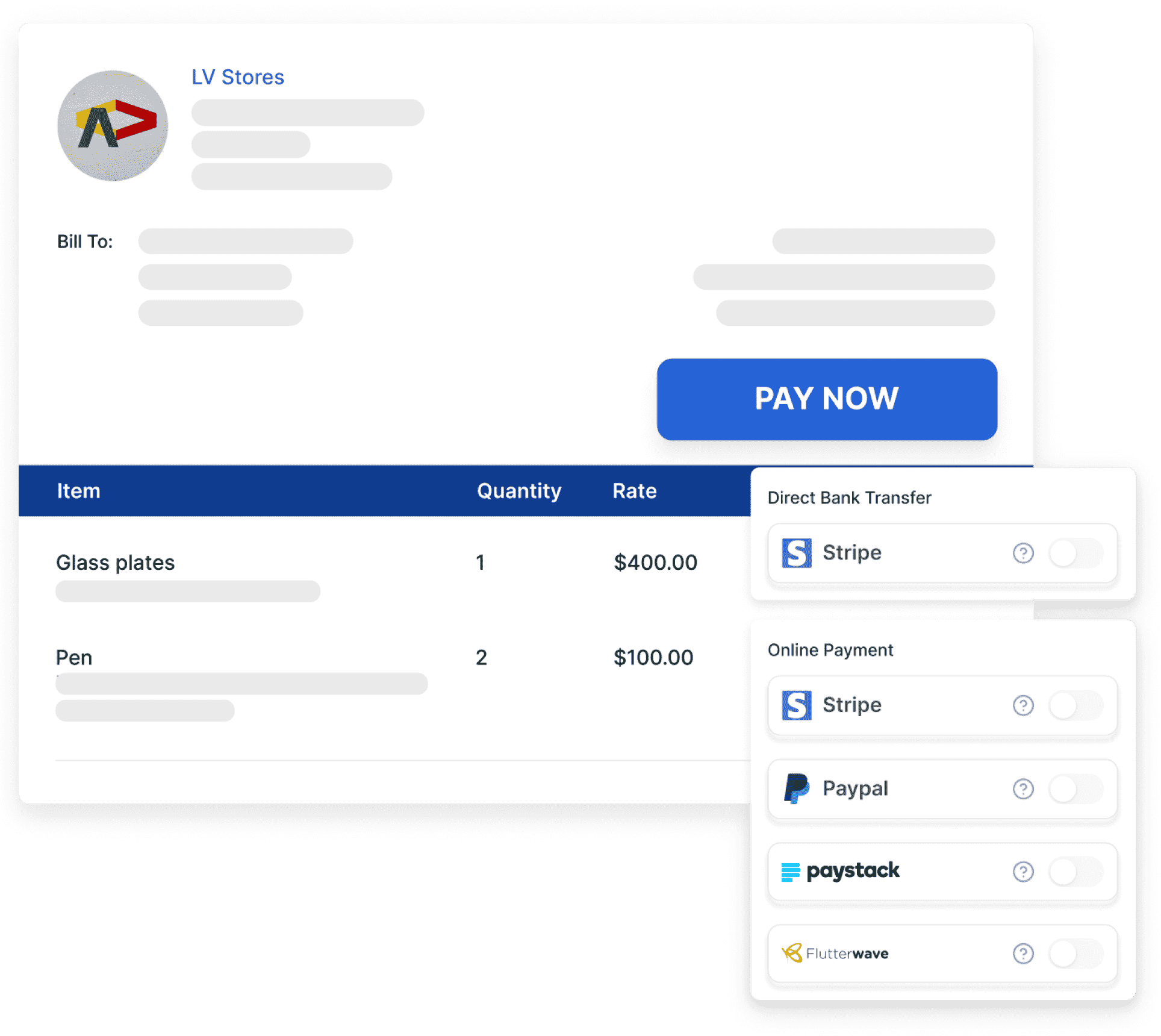

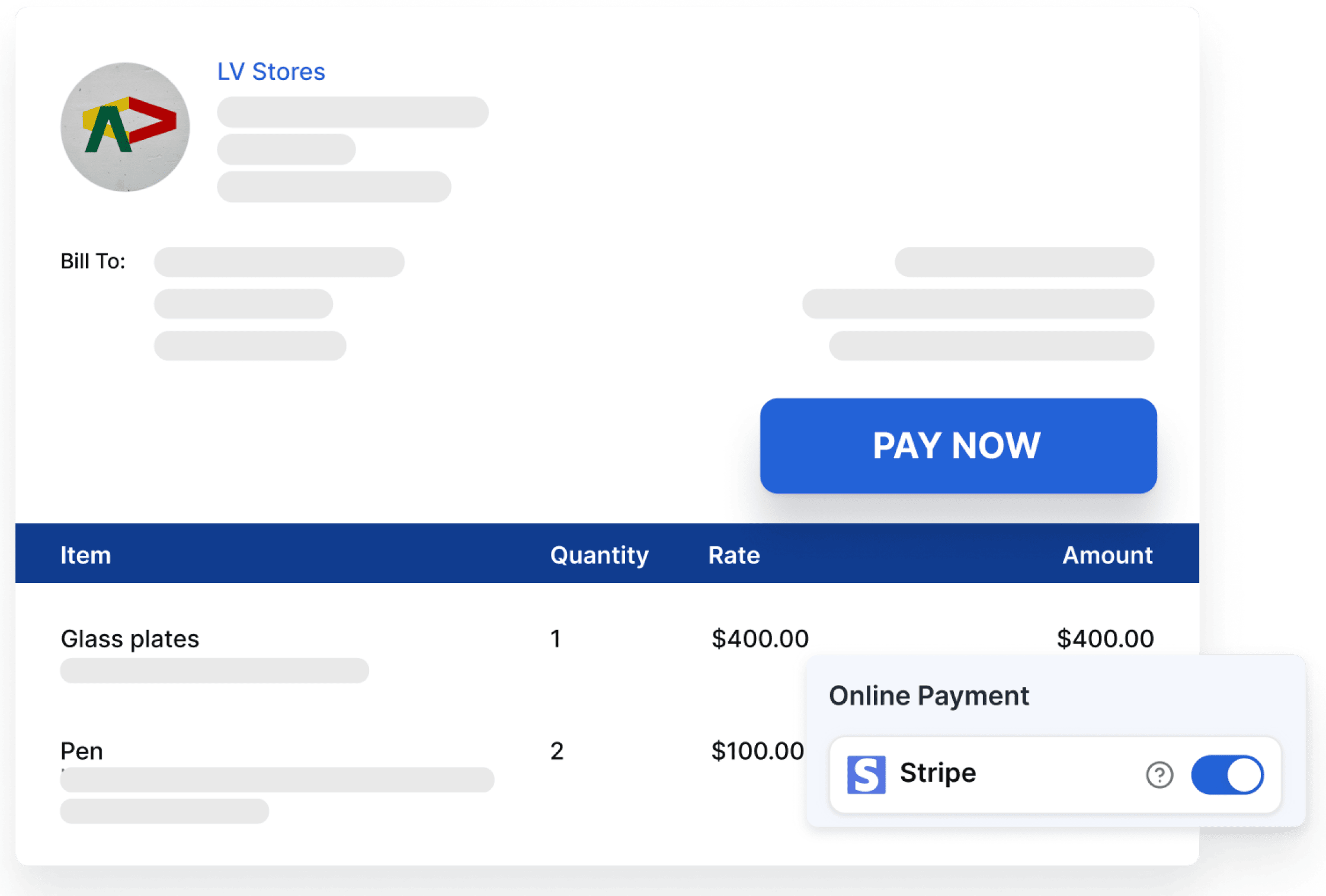

Send invoices and manage debtors

Make business transactions easier and simpler with professional invoices generated through Vencru. Accept online payments. Say goodbye to calculators and get automated updates on paid invoices, pending and overdue.

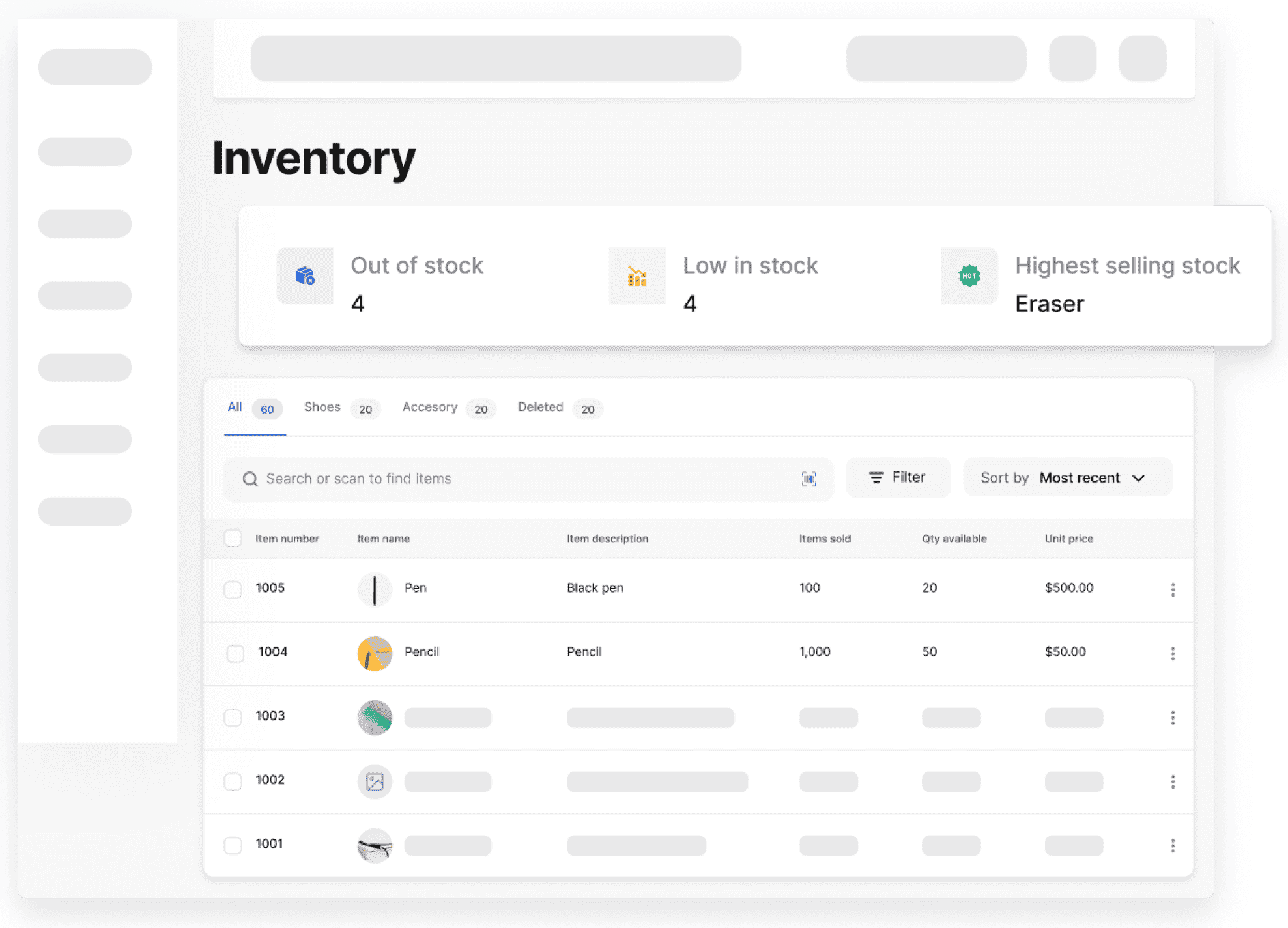

Automatically track stock levels

Managing an online retail business or a shop with inventory? Vencru has you covered with our inventory management features. You can track your inventory levels, link invoicing to inventory, & perform stock taking. You can also import your product details seamlessly.

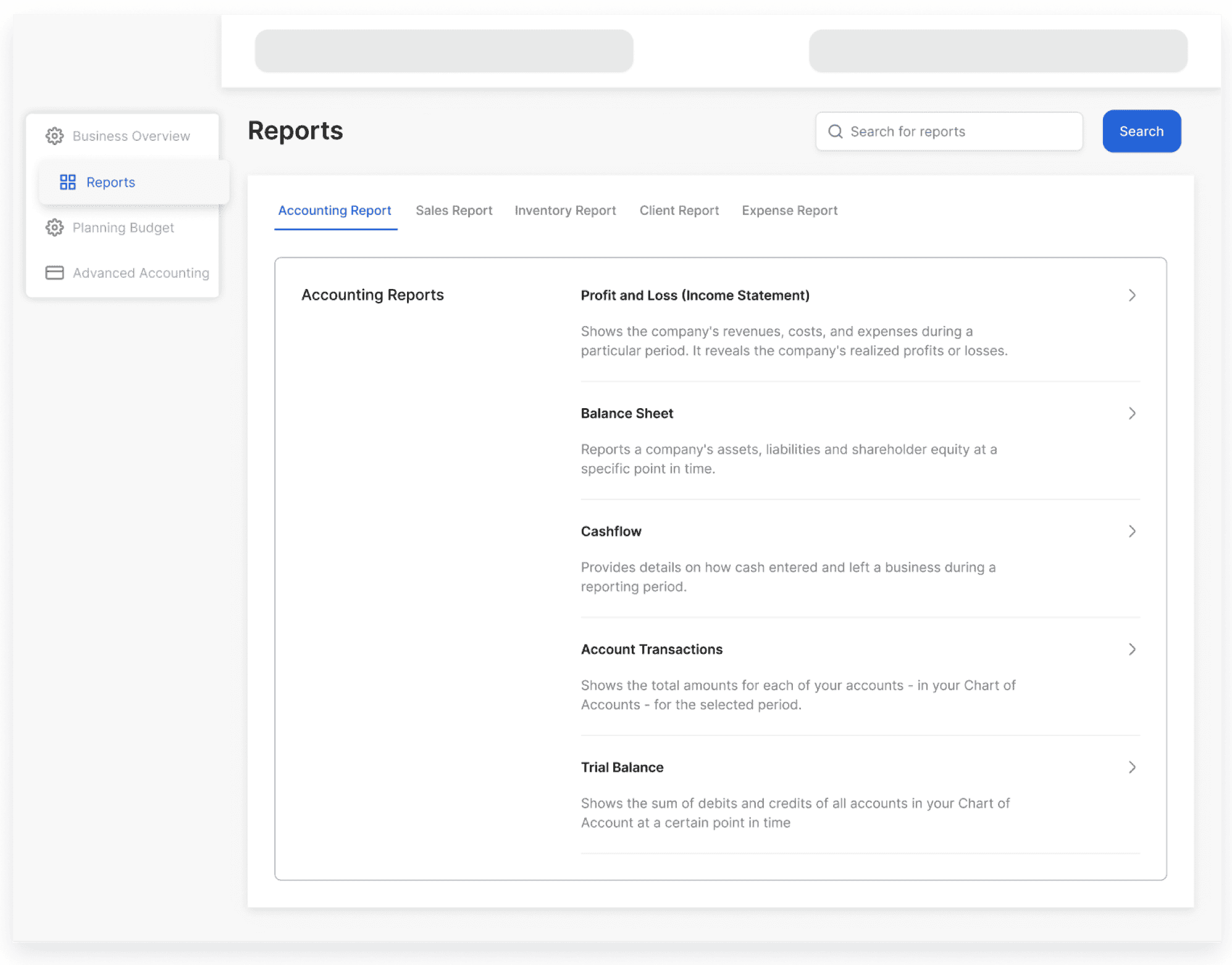

Up to date accounting reports

Reviewing accounting reports does not have to be complex. Track your finances and get accurate double entry accounting reports. You can also collaborate with your accountant at any time.

Easy to understand reports

Generating a daily sales report or income statement should be simple. With Vencru, you can access your accounting reports with just one click. Simple or complex, we simplify into easy reports that you can understand your finances.

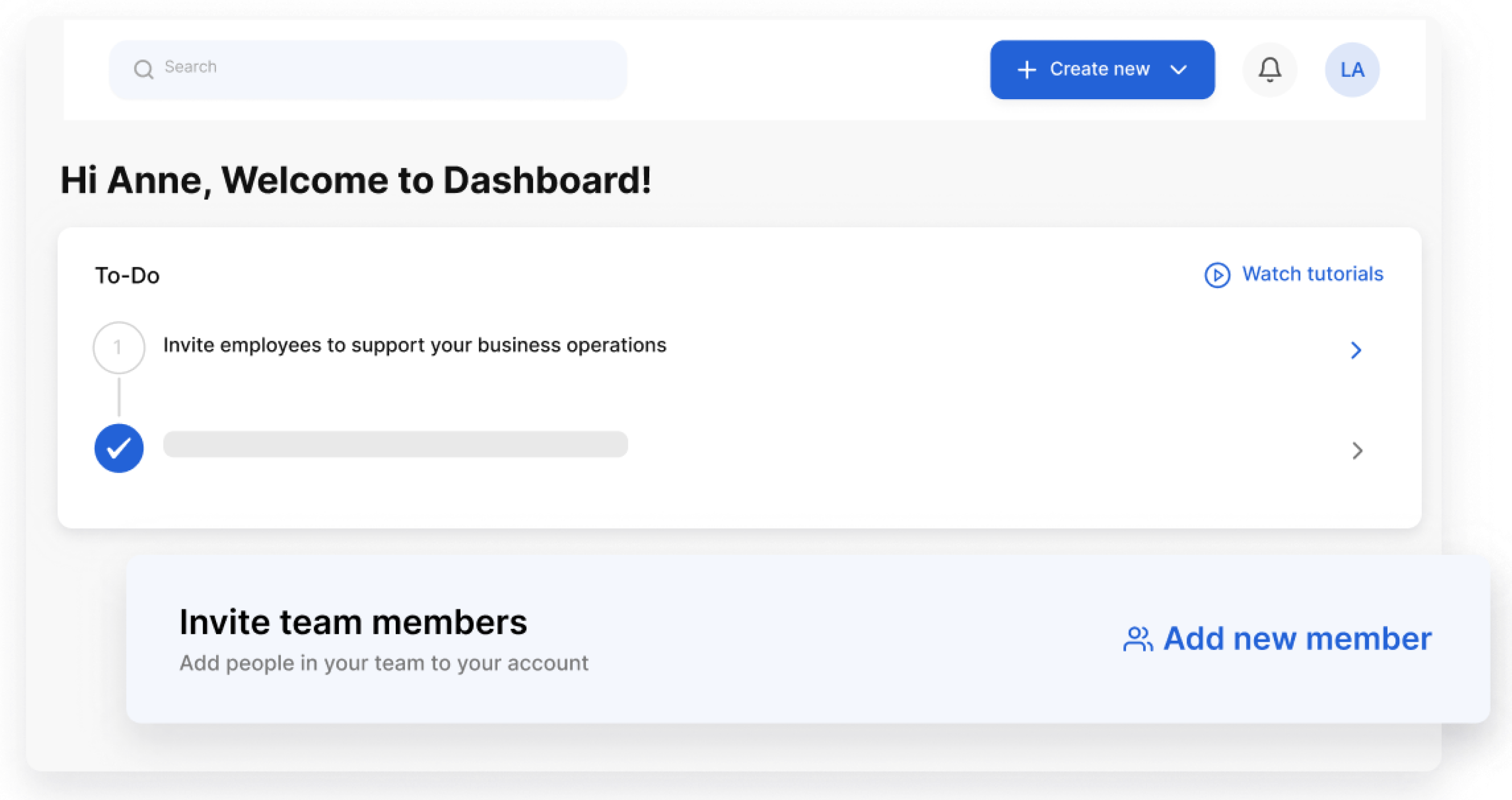

Manage employees better

Easily manage your employees, improve team productivity and make better business decisions.

Secure online Payments

Receiving payments from customers does not have to be a hassle anymore. Accept swift and secure online payments or direct bank transfer from customers.

What is a Petty Cash Log Used For?

A petty cash log is a record-keeping tool used to track small, miscellaneous expenses paid out of a designated petty cash fund. It helps businesses monitor cash disbursements, maintain accurate financial records, and ensure proper allocation of funds.

Example of Using a Petty Cash Book

Suppose a small retail business keeps a petty cash fund for miscellaneous office expenses. At the beginning of the month, the fund is replenished to a set amount, say $100. Here are a few transactions that might be recorded in the petty cash book over the course of a month:

Office Supplies: The manager purchases pens and paper for the office costing $15 on the 5th of the month. This transaction is recorded in the petty cash book, noting the date, amount, and nature of the expense.

Courier Charges: On the 12th, a parcel needs to be sent to a customer, incurring a courier charge of $10. This expense is also logged in the petty cash book.

Refreshments: The business buys coffee and snacks for a staff meeting on the 18th, totaling $20. This is recorded in the petty cash book with all relevant details.

At the end of the month, the remaining cash is counted, and the petty cash book is used to verify that the sum of the remaining cash and the recorded expenditures equals the original amount of $100. The business then replenishes the fund for the next month, based on the expenses logged in the petty cash book, ensuring the fund is back to its original amount.

How to Post Petty Cash in General Ledger

To post petty cash transactions in your general ledger:

- Review the petty cash log to ensure all transactions are accurately recorded.

- Prepare a journal entry to reflect the total petty cash expenditures for the period.

- Debit the appropriate expense accounts for the total amount of petty cash disbursements.

- Credit the petty cash account to reduce its balance back to the original amount.

In the example above, at the end of the month, you will

- Debit [Expense Account] $45

- Credit Petty Cash Account $45

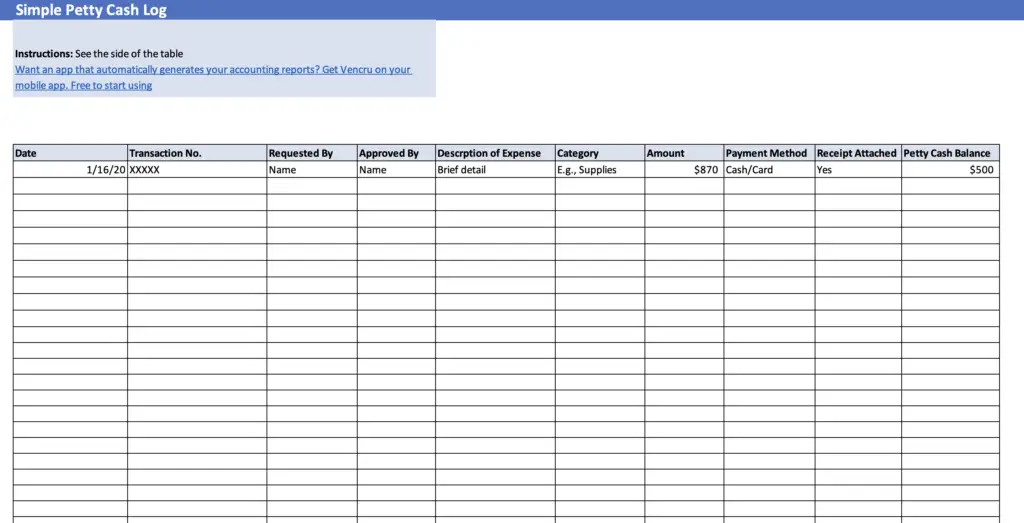

What is Included in a Petty Cash Template?

Our petty cash log template includes fields to record essential details of each transaction, such as:

- Date: The date the transaction occurred.

- Description: A brief description of the expense.

- Amount: The amount of cash disbursed for the expense.

- Receipt: Whether a receipt or documentation is attached.

- Category: The category or purpose of the expense (e.g., office supplies, postage).

- Initials: Initials of the person responsible for approving the expense.

How to Use a Petty Cash Template

Using our printable petty cash log template is straightforward:

- Download the template in your preferred format (Excel, PDF, or Google Docs).

- Customize the template by adding your business name and logo, if desired.

- Print multiple copies of the template to keep in your petty cash drawer or store it electronically for digital access.

- Whenever a petty cash expense occurs, fill out the appropriate fields in the template, including the date, description, amount, receipt status, category, and initials.

- Periodically reconcile the petty cash log with the remaining cash balance to ensure accuracy and accountability.

Access more free tools for your business

Accounting Templates

Easily manage your financial records with pre-designed templates for tracking income, expenses, and profits.

Bookkeeping Templates

Access 30+ templates to manage your business. From sales and inventory to cashflow and contracts.

Accounting Software

Ready to save time managing your business? Get the simplest bookkeeping and accounting software available

Invoice Generator

Streamline your billing process with our generator that helps you create invoices smoothly.

Invoice Templates

Create professional invoices quickly and accurately using customizable invoice and receipt templates for easy billing.

Estimate Generator

Provide accurate project cost estimates with ease using our convenient and simple estimate maker.

Get your simple bookkeeping software

You can send invoices, see sales reports, monitor inventory levels, track expenses, and more. Signup on the web or download our mobile app to get started.