Accounting is the language of business, and understanding its terminology is essential for retailers and wholesalers alike. Whether you are managing your finances in-house or working with an accountant, these 50 accounting terms will empower you to make informed financial decisions and maintain a healthy bottom line.

This comprehensive guide will define each term and provide real-world examples to illustrate their application. Discover how Vencru, your trusted business partner, can streamline your accounting processes.

20 Essential Accounting Terms

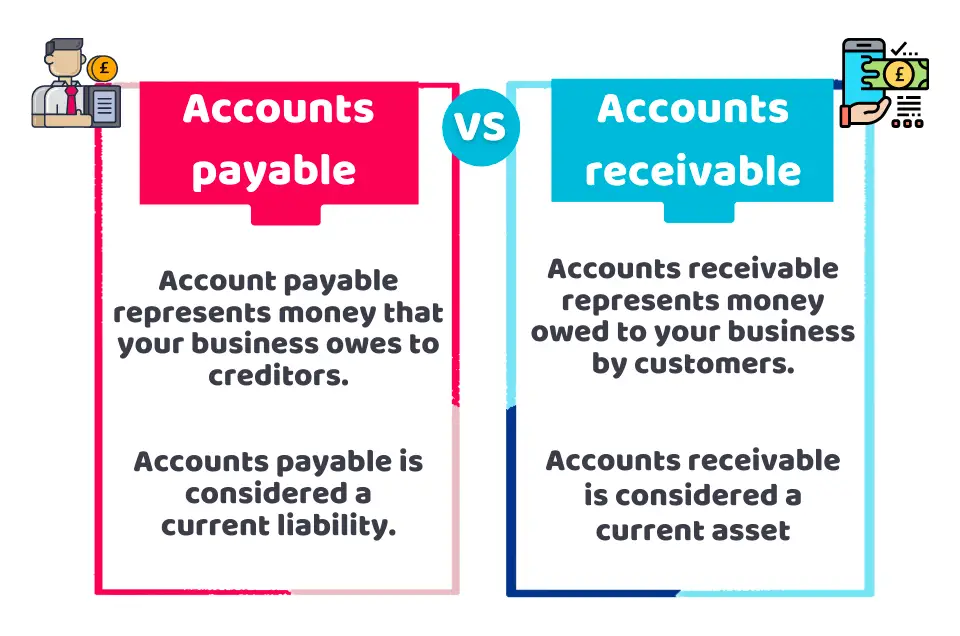

Accounts Payable (AP)

AP is the money the retail business owes to suppliers for goods or services purchased on credit. For example, if a retailer buys clothing from a manufacturer but has yet to pay, the amount due is recorded under Accounts Payable.

Accounts Receivable (AR)

AR is the money owed to the business by customers who have purchased goods or services on credit. For example, if a client owes your wholesale company $5,000 for a bulk purchase, that’s an Accounts Receivable.

Accrual Accounting

Accrual accounting is an accounting method where revenue and expenses are recorded when they are earned or incurred, regardless of when the cash is exchanged. This means Booking a sale when goods are ordered, not when payment is received. For example, a retailer records revenue when it ships products to customers, even if payment is due later. Understand the difference between cash and accrual accounting.

Cash Accounting

Cash accounting is an accounting method where revenue and expenses are recorded when cash is exchanged. In this approach, income is recognized only when cash is received, and expenses are recorded when payments are made. Small businesses and sole proprietors often favor this method due to its simplicity and immediate visibility of available cash.

Assets

These are items of value owned by a business. These can include cash, inventory, buildings, or even accounts receivable. For example, a retail store’s assets may include $10,000 in cash, $50,000 worth of inventory, and a building valued at $500,000.

Liabilities

These represent debts or obligations a business owes to external parties. Common liabilities include loans, accounts payable, and salaries payable. For example, a wholesaler owes $20,000 in accounts payable to suppliers and has a loan liability of $50,000.

Equity

Equity is the residual interest in the assets of a business after deducting liabilities. It represents the owner’s stake in the business. Example: If the total assets of a retail business are $100,000, and liabilities are $30,000, the equity is $70,000.

Revenue

Revenue is the income generated from selling goods or services. It is also known as sales or turnover. Example: A retailer earns $50,000 in revenue from selling electronics monthly.

Expenses

Expenses are the costs incurred to generate revenue. Common expenses include rent, utilities, and salaries. Example: A wholesaler spends $5,000 on rent, $2,000 on utilities, and $10,000 on employee salaries.

Gross Profit

Gross profit is the difference between revenue and the cost of goods sold (COGS). It reflects the profitability of the core business activities. Example: A retailer’s revenue is $60,000, and the COGS is $30,000, resulting in a gross profit of $30,000.

Net Income

Net income, or net profit, is the amount left after deducting all expenses from revenue. It represents the true profitability of the business. Example: After deducting $20,000 in expenses from $40,000 in revenue, a retailer has a net income of $20,000. See how to calculate net income.

Cost of Goods Sold (COGS)

COGS represents the direct costs of producing or purchasing the goods a business sells during a specific period. It includes expenses such as materials, labor, and manufacturing overhead. Example: A clothing retailer’s COGS includes the cost of fabric, labor for production, and manufacturing overhead. See more inventory accounting terms.

Profit Margin

Profit margin is a ratio that measures a business’s profitability. It’s calculated by dividing net income by revenue and is often expressed as a percentage. Example: If a wholesaler’s net income is $10,000, and revenue is $50,000, the profit margin is 20%.

Cash Flow

Cash flow is the movement of money in and out of a business. Positive cash flow indicates that a business receives more money than it’s spending. Example: A retailer has positive cash flow when it receives customer payments, pays suppliers, and covers expenses.

Balance Sheet

A balance sheet is a financial statement that provides a snapshot of a business’s financial position at a specific time. It lists assets, liabilities, and equity. Example: A wholesaler’s balance sheet shows its assets, like inventory and equipment, liabilities, loans, and equity or owner’s investment.

Income Statement

An income statement, also known as a profit and loss statement, summarizes a business’s revenue, expenses, and net income or loss over a specific period. Example: A retailer’s income statement reveals that it generated $100,000 in revenue and had $60,000 in expenses, resulting in a net income of $40,000 for the year. You can access free income statement templates here.

Trial Balance

A trial balance is a list of all the general ledger accounts and their balances at a specific point in time. It helps identify any discrepancies in the accounting records. Example: An accountant prepares a trial balance to ensure that debits and credits match.

Equity Ratio

The equity ratio measures the proportion of a business’s assets financed by equity (owner’s investment) rather than debt. It indicates the financial leverage of a company. Example: If a wholesaler’s assets are $200,000, and equity is $100,000, the equity ratio is 50%.

Amortization

Amortization spreads the cost of an intangible asset, like a patent or trademark, over its useful life. Example: A retailer with a 10-year patent costing $50,000 would amortize $5,000 yearly.

Earnings Before Interest and Taxes (EBIT)

EBIT measures a company’s operating performance and profitability before deducting interest and income tax expenses. Example: A restaurant’s EBIT is $80,000 before accounting for interest on loans and income taxes.

Understanding these accounting terms is essential for effectively managing your retail or wholesale business. With Vencru’s intuitive features, you can apply these concepts seamlessly, ensuring accurate financial management and growth for your enterprise.

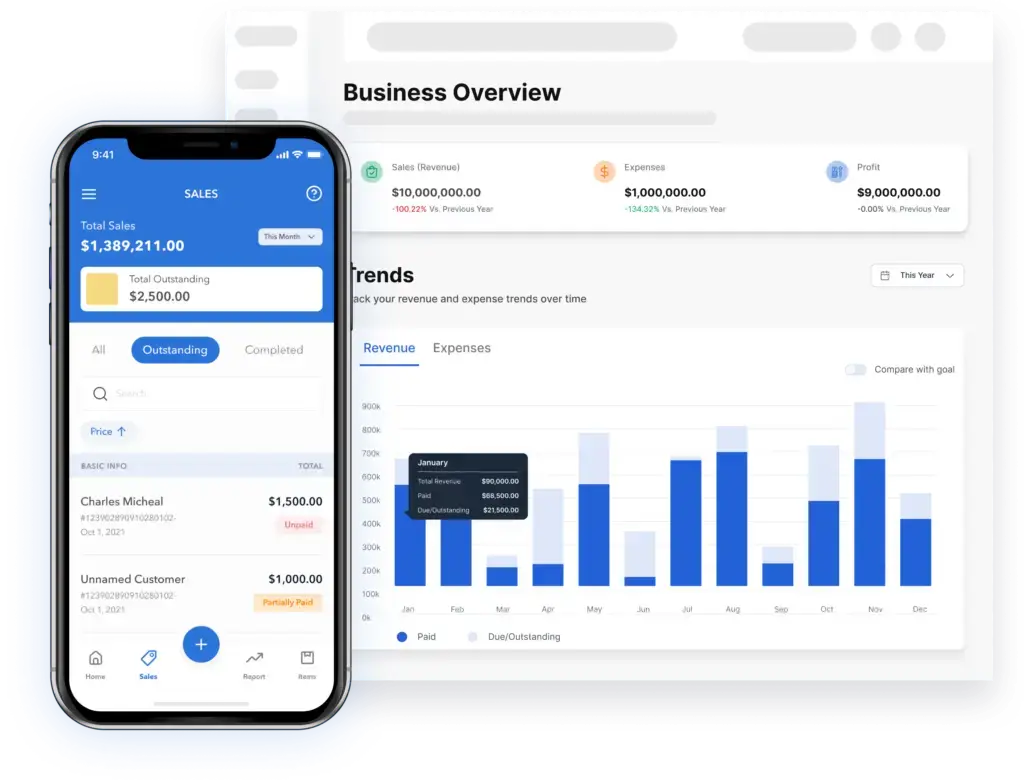

How Vencru Can Elevate Your Accounting Journey

Accounting can be daunting, especially when juggling inventory, sales, and financial management. Here’s how Vencru steps in:

- Simplified Bookkeeping: Automatically categorize transactions, reducing manual data entry and errors.

- Real-time Insights: Get a live pulse on your business’s financial health, from revenue to expenses.

- Automated Journal Entries: Vencru automates the recording of financial transactions, reducing the risk of errors and ensuring accurate books.

- Inventory Accounting: Easily track the cost of goods sold (COGS), manage inventory levels, and simplify inventory valuation.

- Financial Reports: Generate detailed financial statements, including cash flow reports, income statements, balance sheets, and more with just a few clicks.

- Multi-Currency Support: For businesses dealing with international clients or suppliers, Vencru handles multi-currency transactions seamlessly.

By integrating Vencru into your retail or wholesale business, you’re mastering the accounting terms and practically applying them for enhanced business performance.

With the foundation of these accounting terms, retailers and wholesalers can make informed decisions, optimize profitability, and drive growth. It’s not just about numbers; it’s about understanding them and leveraging insights for sustainable success.