Managing every aspect of your business can be challenging as a small business owner, especially for small businesses with a single person or a lean team. As a result, some small businesses overlook bookkeeping or make bookkeeping mistakes. Bookkeeping is crucial for tracking cash flow in and out of business. In addition, bookkeeping provides insights into what drives the growth of your business. Poor or no bookkeeping can lead to blind spots or diminished growth in your business.

To avoid this, here are the top 5 bookkeeping mistakes made by small business owners and the tips on avoiding them.

1. Combining personal and business expenses

It is highly advisable as a business owner to separate your business expenses from your personal expenses. The reason is that you want to track all cash flow required for growing your business. For example, understanding which expenses can be eliminated or reduced. Keeping personal and business records separate allows you to be organized in ensuring that your separate personal and business financial goals are identified so you can accomplish them.

Pro tip: Allocate a set salary for yourself to use separately for personal expenses. This will help ensure that your business and personal expenses are not muddled together.

2. Lacking digital records of your business transactions

Digital transaction records help highlight the key elements that drive your business growth. For example, a business owner will find it hard to determine customer loyalty by using paper records compared to keeping digital records. With digital records, a business owner can determine your most profitable product/services, frequency of customer purchases, most expensive categories, etc.

These details are essential in growing your business. Vencru offers free tools that allow you to record your business transactions and track performance metrics that help your business grow.

3. Waiting until the last minute to perform bookkeeping

Small businesses often leave bookkeeping at the end of the month or year-end. Playing catch-up is stressful and not ideal for two reasons:

- You miss the opportunity to use the information derived from bookkeeping to drive your business growth. For example, identifying which products or services are selling well so you can scale marketing of that item.

- Waiting longer makes the task harder. Trying to collate every sale, expense, and inventory months later is tasking.

Instead, Start a routine. Set aside 20-30 mins every week to reconcile your records. Send clients invoices even if you verbally agree to sell a product or perform a service. If the client has paid, ensure a sales receipt is sent. Invoicing apps like Vencru, Invoice Maker, or Wave allow you to adjust the date when creating an invoice or receipt.

4. Thinking that cash flow is the same as profit

Another major bookkeeping mistake is treating cash flow as profit. Profit is left after expenses have been paid, while cash flow is the inflow and outflow of cash to your business. A company’s profit can be higher than cash flow because some clients may have outstanding payments. Tracking your cash flow is important so you don’t run out of funds to cover expenses. It also helps you identify debtors to follow up with them ahead of upcoming bills.

Tips: Be proactive with debtors. Follow up with debtors weekly. Ask for deposit payments when possible. Track your cash flow and profits separately.

5. Throwing away expense receipts

Another bookkeeping mistake is throwing away receipts and losing tax deductions. Keeping business receipts is essential for tax purposes. Understanding which business expenses are tax-deductible can increase your profits.

Some common tax-deductible expenses include:

- Car and travel expenses

- Salary and wages

- Business office rental

- Home office expenses

- Business meal expenses

- Machine and equipment expenses

- Interest on business debts

- Other work-related deductions

Verify which business expenses are tax-deductible by contacting your country’s tax office.

Pro tip: One way of tracking expenses is to utilize an app to store your expenses digitally. This way, you can retrieve the information during tax season.

How Vencru can help you avoid these bookkeeping mistakes

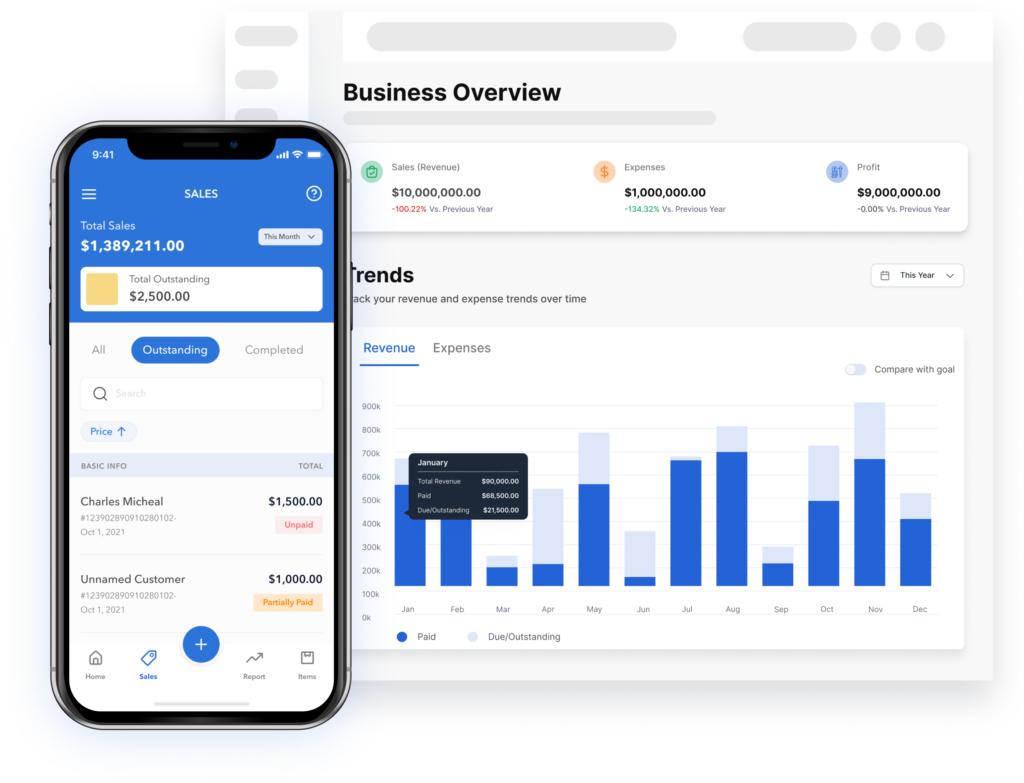

Bookkeeping mistakes could be costly to the growth of your business. Vencru is a simple sales management and bookkeeping software designed to help businesses, whether they are retailers, wholesalers, or service providers, avoid common bookkeeping mistakes and maintain accurate financial records. Here’s how Vencru achieves this:

- Real-Time Business Tracking: With Vencru, you can track your sales, expenses, and inventory levels in real-time. This ensures that your financial records are always up to date, reducing the chances of discrepancies.

- Inventory Management: Vencru offers powerful inventory management features, allowing you to track stock levels, receive alerts for low stock or expiring products, and even automate inventory valuation and cost of goods sold (COGS) calculations. This prevents inventory-related errors in financial statements.

- Expense Tracking: Easily record and categorize your business expenses within Vencru. The system ensures that all expenses are properly documented, minimizing the risk of missing deductions or misclassification.

- Sales and Accounting Reporting: Vencru generates various sales reports, such as sales by product, customers, and employees. It also automates financial reports, including income statements, balance sheets, and cash flow statements. These reports are essential for understanding your business’s financial health and making informed decisions.

- Tax Compliance: Vencru helps you stay compliant with tax regulations by automatically calculating and tracking sales taxes. This prevents underreporting or overreporting of taxes, reducing the risk of audits or fines.

- Multi-Currency Support: If your business deals with multiple currencies, Vencru’s multi-currency support ensures that foreign transactions are accurately recorded and converted at the current exchange rates.

Conclusion

In summary, Vencru streamlines bookkeeping processes, automates data entry, and provides the necessary tools and support to help businesses avoid common bookkeeping mistakes. With Vencru, you can maintain accurate financial records, stay compliant with tax regulations, and make informed financial decisions with confidence.

We hope these tips have helped you understand bookkeeping mistakes to avoid and how to avoid them. For more helpful tips and tricks on managing your bookkeeping and tracking your invoices and expenses, visit Vencru Business Corner to read more articles like this one.