As a freelancer, getting paid on time is crucial for maintaining your cash flow and keeping your business running smoothly. However, invoicing can often be a tedious and frustrating process, especially if you’re not using the right tools or practices. This guide will walk you through everything you need to know to make invoicing hassle-free, from choosing the right tools to handling late payments. We’ll cover:

- What is an Invoice?

- Why Invoicing Matters for Freelancers

- How to Choose the Right Invoicing Tool

- How to Set Up Your Invoicing System

- Key Elements of a Professional Invoice

- How to Handle Late Payments

- Invoicing Best Practices

What is an Invoice?

An invoice is a document issued by a seller to a buyer, detailing goods or services provided and requesting payment. It includes important information such as the items or services rendered, their prices, the total amount due, payment terms, and the due date. Invoices serve as a record of a transaction and are essential for both financial management and legal documentation of your freelance business.

Why Invoicing Matters for Freelancers

Invoicing isn’t just about requesting payment; it’s a vital part of your business operations. Timely invoicing ensures you get paid promptly, which helps you manage your finances better. It also contributes to maintaining professional relationships with your clients, as clear and accurate invoices reflect your professionalism. Additionally, keeping your invoicing organized aids in tracking your income, making tax time less stressful.

Related Read: Invoicing 101: A Complete Guide for Businesses of All Sizes

How to Choose the Right Invoicing Tool

Selecting the right invoicing tool can make a world of difference for your freelance business. Here are some criteria to consider:

- User-Friendliness: Opt for a tool that offers a straightforward interface and intuitive navigation. User-friendly invoicing software saves time and reduces the learning curve, allowing you to focus on your core business activities rather than grappling with complex systems.

- Features: Look for a tool that offers a comprehensive range of features tailored to your needs. Features such as customizable invoice templates, automatic invoice generation, and expense tracking capabilities streamline invoicing processes and enhance productivity. Having all these features in one tool eliminates the need for multiple software subscriptions, saving you both time and money.

- Cost: While cost is a crucial consideration, it’s essential to strike a balance between affordability and functionality. Some tools offer tiered pricing plans based on usage or business size, allowing you to scale up as your business grows. Additionally, consider the long-term value of the tool and how it contributes to your business’s efficiency and growth. Investing in a tool with robust features and excellent customer support can yield significant returns in terms of time savings, reduced errors, and improved client satisfaction.

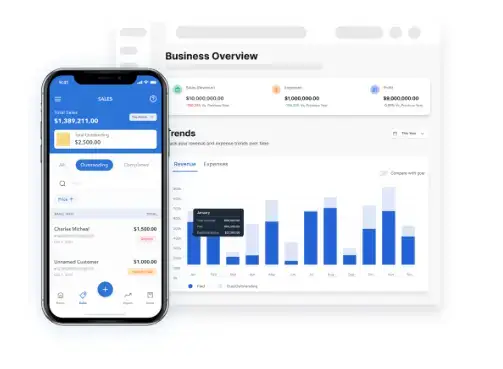

Invoicing tools like Vencru offer a user-friendly interface and comprehensive features tailored for freelancers, making it a great choice for hassle-free invoicing.

Related Read: Invoicing software for small business

How to Set Up Your Invoicing System

Once you’ve chosen your invoicing tool, it’s time to set up your system:

- Collect Necessary Client Information: Gathering comprehensive client information, including contact details and agreed-upon payment terms, lays the foundation for smooth invoicing processes. With accurate client data readily available, you can ensure invoices are sent to the right recipients and payment terms are adhered to, minimizing billing errors and misunderstandings.

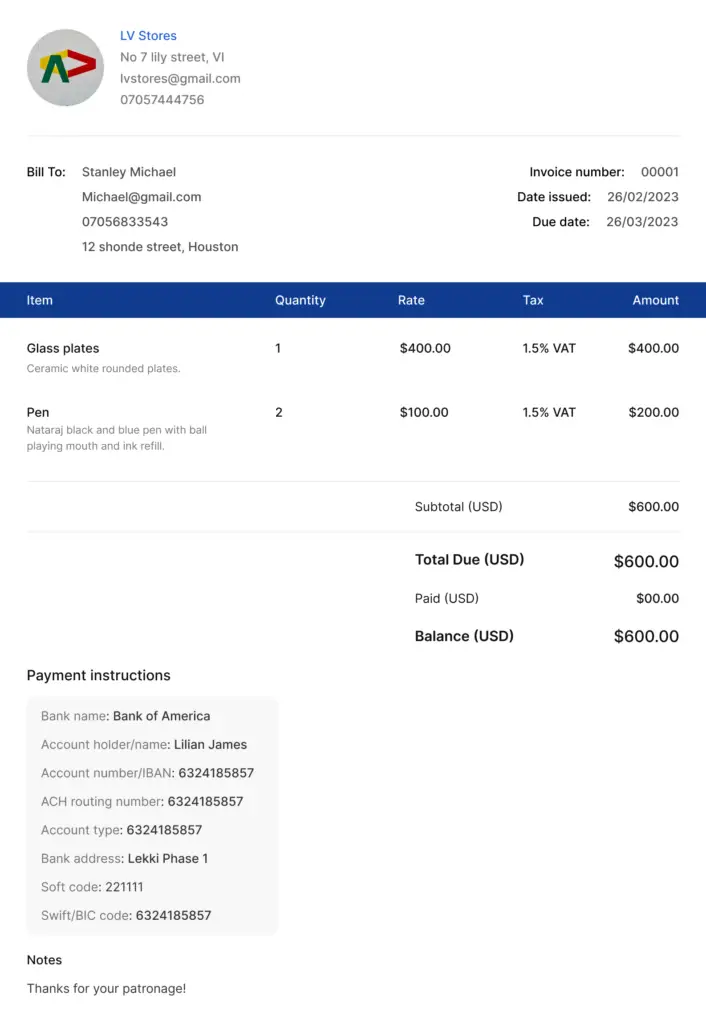

- Create a Standard Invoice Template: A standardized invoice template not only saves time but also ensures consistency and professionalism across all your transactions. By including essential elements such as your business logo, contact information, an itemized list of services rendered, and payment terms, you provide clarity to your clients and reinforce your brand identity. Moreover, using a template reduces the risk of overlooking crucial information, such as invoice numbers or due dates, leading to fewer billing discrepancies and disputes.

- Establish Consistent Invoicing Practices: Consistency is key to effective invoicing management. Establishing standardized practices, such as implementing a numbering system for invoices and setting standard due dates, streamlines your invoicing workflow and facilitates easier tracking and reconciliation. A structured approach to invoicing reduces the likelihood of missed payments, late submissions, and administrative errors, ultimately enhancing your freelance business professional reputation and client relationships.

Key Elements of a Professional Invoice

A professional invoice for your freelance business should include:

- Your Business Information: Incorporate your logo and contact details prominently on the invoice. This not only reinforces your brand identity but also makes it easy for clients to identify the source of the invoice. Consistent branding builds credibility and trust with clients.

- Client Details: Provide the client’s name and address accurately to ensure the invoice reaches the right recipient. Including client details on the invoice also demonstrates attention to detail and personalization, fostering a positive client experience.

- Invoice Number and Date: Assign a unique invoice number and include the invoice date to facilitate tracking and record-keeping. Sequentially numbering your invoices ensures each transaction is easily identifiable and helps prevent duplicates or discrepancies in your accounting records.

- Detailed Description of Services Provided: Clearly outline the services or products rendered in the invoice. Be specific about the nature of the work performed or the items sold to avoid any confusion or disputes regarding billing. Providing a detailed description instills transparency and accountability in your invoicing process.

- Payment Terms and Methods: Specify the terms of payment, including the due date and accepted payment methods. Clearly communicate when you expect to be paid and how clients can remit payment. Offering multiple payment options, such as credit card, PayPal, or bank transfer, accommodates diverse client preferences and expedites the payment process.

- Due Date and Late Fee Policy: Clearly indicate the due date for payment to prompt timely settlement. Additionally, include any applicable late fee policies to incentivize prompt payment and deter delays. Communicating consequences for late payment upfront encourages clients to adhere to payment deadlines and minimizes the risk of overdue invoices.

Related Resource: See our downloadable free invoice templates.

Tips for Ensuring Prompt Payments

To ensure you get paid on time, it is important to:

- Clearly Communicate Payment Terms Upfront:

Transparent communication of payment terms before commencing work sets expectations and avoids disputes down the line. Clearly outline payment milestones, due dates, and accepted payment methods in your contract or agreement. This ensures both parties are on the same page regarding financial obligations, fostering a positive working relationship built on trust and clarity. - Send Invoices Promptly:

Time is of the essence when it comes to invoicing. As soon as you complete a project or deliverable, generate and send the invoice promptly. Delaying invoicing can lead to delayed payments, impacting your cash flow and potentially causing financial strain. By sending invoices promptly, you demonstrate professionalism and prompt clients to prioritize payment, reducing the risk of overdue invoices. - Set Up Reminders:

Leverage the automation features of your invoicing tool to set up reminders for overdue payments. Schedule reminders to be sent before the due date and at regular intervals thereafter for outstanding invoices. This proactive approach gently nudges clients to settle their invoices promptly, minimizing the need for manual follow-up and reducing the likelihood of payment delays. - Offer Multiple Payment Options:

Providing clients with multiple payment options enhances convenience and expedites the payment process. While traditional methods like bank transfers and checks are still prevalent, offering online payment options such as credit cards, PayPal, or digital wallets caters to diverse client preferences and speeds up payment processing. Integrating a variety of payment gateways into your invoicing system simplifies the payment process for clients, allowing them to choose the method that best suits their needs and preferences. This flexibility reduces barriers to payment and encourages timely settlements, ultimately improving cash flow and business liquidity.

How to Handle Late Payments

Despite your best efforts, late payments can still happen which affects the cashflowof your freelance business. Here’s how to handle them:

Steps to Take When a Payment is Overdue:

Initiate contact with the client through a polite reminder, reminding them of the outstanding invoice and requesting prompt payment. If the payment remains outstanding after the initial reminder, escalate to a firmer follow-up, clearly stating the consequences of further delay.

How to Send Polite but Firm Payment Reminders:

Begin with a friendly tone in your reminders, emphasizing the importance of timely payment and expressing understanding of any potential challenges the client may be facing. However, if the payment deadline passes without payment, adopt a firmer tone in subsequent communications, clearly outlining the repercussions of continued non-payment, such as late fees or suspension of services.

When and How to Charge Late Fees:

Clearly communicate your late fee policy in your initial agreement or invoice. Specify the amount of the late fee and the conditions under which it will be applied, such as a certain number of days past the due date. Enforce your late fee policy consistently to encourage clients to prioritize timely payments and deter future late payments.

Options for Escalating Non-Payment Issues:

If despite your efforts, the client fails to make payment, you may need to escalate the matter further. Consider engaging a collections agency to recover the outstanding debt. Alternatively, if the amount owed justifies it, you may pursue legal action through small claims court or hire a lawyer to assist with debt recovery. While these measures should be a last resort, they provide a means of recourse when all other attempts to secure payment have been exhausted.

Invoicing Best Practices

Optimize your freelance invoicing process with these five best practices:

- Keep Detailed Records: Maintain comprehensive records of invoices and payments to track income accurately. Detailed records simplify accounting, aid in identifying outstanding payments, and facilitate financial reporting.

- Regularly Update Processes: Continuously evaluate and improve your invoicing workflow to enhance efficiency. Update invoice templates to reflect changes in services or pricing, streamline repetitive tasks, and incorporate client feedback for improved customer satisfaction.

- Utilize Reporting Features: Take advantage of reporting features offered by your invoicing tool to track your financial health. Monitor key metrics such as total revenue, outstanding invoices, and payment trends over time to identify potential issues early and make informed business decisions.

- Stay Tax Compliant: Understand the tax regulations relevant to your business and ensure compliance. Register for taxes, collect and remit sales tax where applicable, and file accurate tax returns on time. Compliance with tax laws minimizes the risk of penalties and maintains the financial integrity of your business.

- Seek Professional Advice: When in doubt, consult with a tax professional for expert guidance on tax matters. A tax professional can provide personalized advice tailored to your business needs, ensuring that you meet all legal requirements and take advantage of available deductions or credits. Investing in professional advice helps mitigate risks and ensures peace of mind regarding tax compliance.

Related Read: Invoicing For Small Businesses: Best Invoicing Procedures

Manage Your Freelance Invoicing with Vencru

Streamlining your invoicing process is crucial for maintaining a steady cash flow and reducing stress. By choosing the right tools, setting up a solid system, and following best practices, you can make invoicing a hassle-free part of your freelancing business.

Vencru is a comprehensive invoicing solution integrating inventory managemnt, client management, expense management, robust accounting and business reports, purchase management and so much more in a simple platform for businesses of all sizes. Ready to simplify your freelance invoicing process? Book a Demo or Sign up for a free trial of Vencru today!

Related Read: