Understanding the profitability of your Shopify business is crucial to your success as a business owner. The income statement for a Shopify Business gives you insight into how well your business is performing over a specific period and what you can change to be more profitable.

An income statement, also known as a profit and loss statement (P&L), is a financial statement that summarizes the revenues, costs, and expenses incurred during a specific period, usually a fiscal quarter or year. It provides a snapshot of a company’s profitability over time.

Why is Generating an Income Statement Important for a Shopify Business?

- Performance Evaluation: The income statement helps you assess the profitability and financial performance of your Shopify business over a specific period.

- Decision-Making: Income statements enable you to make informed decisions about resource allocation, pricing strategies, and overall business strategy for your Shopify store

- Investor and Lender Relations: Investors and lenders often rely on income statements to evaluate the financial health and stability of a business before making investment or lending decisions.

How to Generate an Income Statement for a Shopify Store:

Your Shopify Store income statement includes these important components:

- Revenue: Total sales or income generated from selling goods or services.

- Cost of Goods Sold (COGS): The direct costs associated with producing or purchasing the goods sold.

- Gross Profit: Revenue minus COGS.

- Operating Expenses: Indirect costs related to the operation of the business (e.g., rent, salaries, marketing).

- Operating Profit: Gross profit minus operating expenses.

- Other Income and Expenses: Non-operating items such as interest and taxes.

- Net Profit: Operating income plus other income minus other expenses.

Generating Your Income Statement Manually:

To manually generate your Shopify business income statement, use this formula:

| Net Profit = (Revenue−COGS) − Operating Expenses + Other Income − Other Expenses |

Here’s a simplified example of an income statement for a Shopify business:

XYZ Shopify Store

Income Statement

For the Year Ended December 31, 2023

| Amount | % of Sales | |

| Revenue | $800,000 | 100% |

| Cost of Goods Sold | -($300,000) | -(37.5%) |

| Gross Profit | $500,000 | 62.5% |

| Operating Expenses | ||

| Marketing Expenses | $50,000 | 6.25% |

| Employee Salaries | $180,000 | 22.5% |

| Rent and Utilities | $30,000 | 3.75% |

| Shipping and Handling | $20,000 | 2.5% |

| Other Operating Expenses | $20,000 | 2.5% |

| Total Operating Expenses | -($300,000) | -(37.5%) |

| Other Income | $10,000 | 1.25% |

| Other Expenses | -($15,000) | -(1.875%) |

| Net Profit | $195,000 | 24.375% |

Generating Income Statement Automatically Using Vencru

Vencru is an accounting platform for e-commerce businesses offering invoicing, inventory management, order processing, client and vendor management, expense tracking and robust accounting reports. Enjoy comprehensive accounting with simplicity and user-friendliness at affordable prices starting at $6 billed monthly.

Integrating your Shopify store with Vencru is simple. Skip manual calculations with Vencru and spend your time doing what you love! Here’s how to integrate Vencru to generate your income statement for Shopify business:

From Your Shopify Store:

- Log in to your Shopify Store

- Click Settings on the menu bar

- Click “Apps and Sales Channels”

- Search for Vencru and Click Install

- On the Plans page, select the plan that suits your business needs and Approve payment

- On the Connect Shopify Pages, select your preferences and click “Save and Continue”

- Then, Click “Finish Integration” after reviewing your settings.

From Your Vencru Account:

- Sign up or Log in on Vencru

- Select “Settings” on the Menubar from the Dashboard

- Then, click “Commerce Settings” from the sidebar

- Click the “Connect Now” button under Shopify

- Fill in your Shopify Store URL and click “Connect To Shopify”

- Click Install on the authorization page

- On the Connect Shopify Pages, select your preferences and click “Save and Continue”

- Then Click “Finish Integration” after reviewing your settings.

Your Vencru account is synced to your Shopify store, now you can generate your Income statement automatically on Vencru!

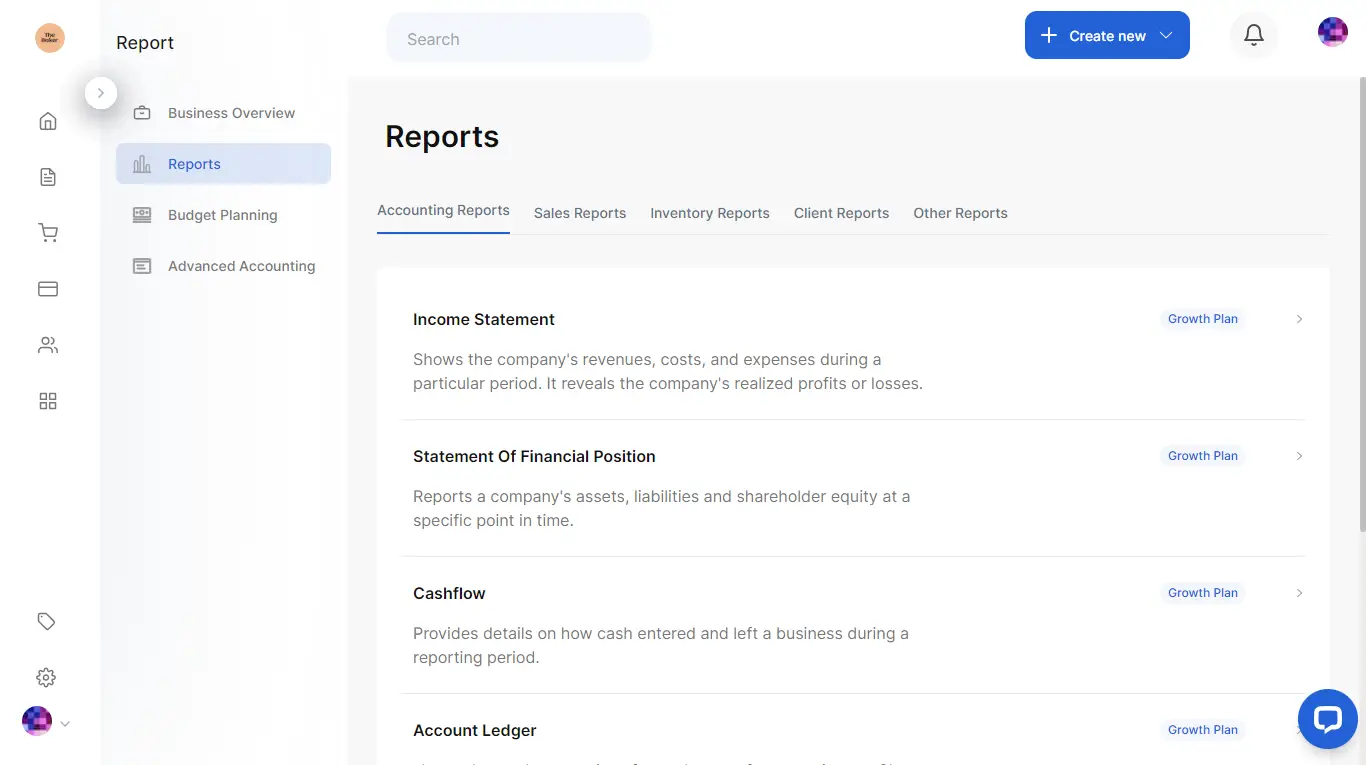

To generate your Income Statement,

- Login to your Vencru Account

- Click Reports from the menu bar and select “Reports” from the sidebar

- Select Income Statement

Your income Statement is displayed!

- The date period on which you want your statement can be edited by clicking on the arrow in the Date period box. Click on Run Report to get your statement for the selected period.

- Export your statement as a PDF or CSV file by clicking the Export button and selecting which of the two formats you want. Click Export to have your file downloaded.

Related: The importance of Accounting Software for businesses

Best Practices for Managing an Income Statement:

- Accurate Record-Keeping: Maintain accurate and up-to-date financial records to ensure the reliability of the income statement.

- Consistency: Use consistent accounting methods and practices to allow for meaningful comparisons over time.

- Regular Monitoring: Review and analyze the income statement regularly to identify trends, opportunities, and areas for improvement.

- Budgeting and Forecasting: Use historical income statement data for budgeting and forecasting future financial performance.

- Understand Key Metrics: Understand key financial metrics such as gross margin, operating margin, and net profit margin.

- Segmentation: If applicable, consider segmenting the income statement to analyze the performance of specific product lines, geographic regions, or customer segments.

- Compliance: Ensure compliance with accounting standards and regulations when preparing the income statement.

- Professional Assistance: Seek professional advice from accountants or financial consultants to optimize financial reporting and analysis.

By effectively managing and calculating the income statement, Shopify businesses can gain insights into their financial performance, make informed decisions, and communicate their financial health to stakeholders.