Inventory accuracy is crucial for the smooth operation and financial health of any business dealing with physical goods. One essential practice for ensuring this accuracy is conducting regular inventory audits. In this blog, we will delve into why inventory audits are important, the numerous benefits they offer, and the best practices for conducting them effectively. By maintaining accurate inventory records through regular audits, businesses can enhance their operational efficiency and prevent costly errors. We’ll be discussing:

- What Is an Inventory Audit?

- Why Inventory Audits Matter

- Best Practices for Inventory Audits

- How to Conduct Effective Inventory Audits

- Challenges of Performing an Inventory Audit

What Is an Inventory Audit?

An inventory audit is a systematic process of verifying and reconciling the physical stock of goods with the inventory records maintained by a business. It involves counting physical items, comparing the counted quantities with recorded data, and identifying any discrepancies. The primary goal of an inventory audit is to ensure that the inventory records accurately reflect the actual stock levels, which is crucial for effective inventory management, financial reporting, and decision-making.

Why Inventory Audits Matter

Ensuring Inventory Accuracy

Inventory audits help verify that the physical inventory matches the recorded inventory in your system. Accurate inventory records are essential for making informed business decisions, maintaining customer satisfaction, and optimizing supply chain management.

Preventing Theft and Loss

Regular audits can identify discrepancies caused by theft, loss, or damage. By pinpointing these issues, businesses can take corrective measures to prevent future occurrences and maintain tighter control over their inventory.

Financial Reporting and Compliance

Accurate inventory data is critical for financial reporting and compliance with accounting standards. Auditing Inventory ensures that financial statements reflect the true value of a company’s assets, which is essential for stakeholders, investors, and regulatory bodies.

Optimizing Inventory Management

By conducting regular audits, businesses can identify slow-moving or obsolete inventory, enabling them to make better decisions about inventory purchases and management. This helps in reducing carrying costs and improving cash flow.

Best Practices for Inventory Audits

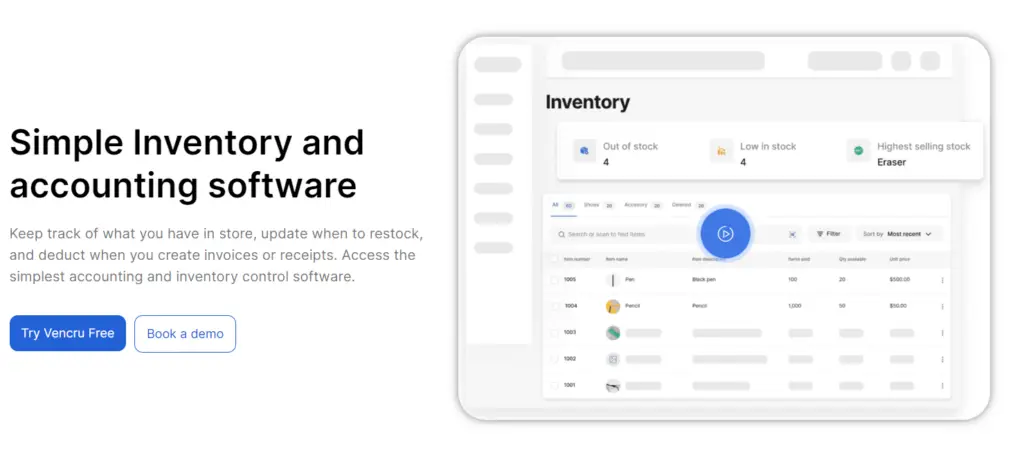

Use Inventory Management Software

Leverage inventory management software to streamline the process, reduce human errors, increase inventory benefits, and maintain accurate inventory records. The software can automate counting, reconciliation, and reporting, making the process more efficient.

Train Employees

Ensure that all employees involved in the inventory process are well-trained in proper inventory handling, recording, and auditing procedures. Regular training helps reduce errors and improve inventory accuracy.

Implement Cycle Counting

Instead of conducting a full audit once a year, implement cycle counting. This involves counting a portion of the inventory regularly, ensuring that the entire inventory is audited over a specific period. Cycle counting helps maintain continuous inventory accuracy with less disruption to operations.

Maintain Clear Documentation

Keep clear and detailed documentation of all inventory transactions, including purchases, sales, returns, and adjustments. This documentation is essential for accurate inventory records and efficient audits.

Related Read: Inventory Management Best Practices

How to Conduct Effective Inventory Audits

Inventory audits are essential for verifying the accuracy of records and ensuring proper inventory management. Here’s a guide on the procedures involved:

- Planning the Audit: Start by defining the objectives, such as verifying quantities or identifying discrepancies, and set a schedule that minimizes operational disruptions. Assemble a team of auditors, ideally with members from different departments to ensure objectivity.

- Preparing for the Audit: Review inventory records, including purchase orders, sales data, and management reports, to identify potential areas of concern. Organize the inventory to ensure it is well-labeled and easily accessible for counting. Communicate the audit schedule and procedures to staff to coordinate efforts and minimize disruptions.

- Conducting the Physical Count: Perform a physical count of all inventory items using methods like cycle counting or a full inventory count. Record the quantities on inventory counting sheets or electronic devices, ensuring accuracy by segregating counting and recording duties.

- Reconciling Inventory Records: Compare the physical count data with inventory records to identify and resolve discrepancies. Update records to reflect accurate quantities, and make necessary adjustments for discrepancies, including write-offs for damaged or obsolete inventory.

- Evaluating Inventory Valuation: Review the methods used for inventory valuation, such as FIFO or LIFO, to ensure consistency with accounting policies. Verify the accuracy of unit costs and adjust valuations for any impaired or obsolete inventory.

- Reporting and Follow-Up: Document the audit procedures, findings, discrepancies, and corrective actions in a detailed report. Implement corrective actions to address any issues identified during the audit, and schedule follow-up audits to ensure the effectiveness of these actions and maintain inventory accuracy over time.

Challenges of Performing an Inventory Audit

Conducting an inventory audit can be a complex process, and businesses often face several challenges that can impact the accuracy and efficiency of the audit. Here are some common challenges:

- Discrepancies Between Records and Actual Stock: Historical data may contain errors, leading to discrepancies between recorded inventory and physical counts. Identifying and resolving these discrepancies can be time-consuming.

- Resource Allocation: Auditing Inventory requires significant time and manpower, particularly for businesses with large or complex inventories. Allocating sufficient resources while maintaining daily operations can be a challenge.

- Complexity of Inventory Systems: Businesses often deal with diverse inventory types, such as raw materials, finished goods, and consignment items. Managing these varying categories during an audit can complicate the process.

- Seasonal Fluctuations: Seasonal changes in demand can lead to rapid fluctuations in inventory levels, making it challenging to conduct accurate audits. Companies must time their audits strategically to account for these changes.

- Technology Integration: Integrating inventory management systems with auditing processes can be difficult, especially if there are compatibility issues or if the technology is outdated.

- Compliance and Regulation: Adhering to industry regulations and compliance standards during an audit can add complexity, requiring additional documentation and verification processes.

Simplifying Inventory Management with Vencru

Vencru makes audits straightforward and efficient. Here’s how:

- Automated Processes: Vencru automates counting and reconciliation, streamlining the process and minimizing human errors.

- Real-Time Tracking: Receive instant updates on inventory levels, ensuring that your audits reflect the most current data available.

- Easy Reporting: Generate comprehensive reports that enable quick identification of discrepancies and facilitate informed decision-making.

- User-Friendly Interface: Navigate and manage audits with ease, even for users with limited technical expertise, thanks to Vencru’s intuitive design.

Conclusion

Auditing Inventory is a critical practice for ensuring inventory accuracy, preventing theft and loss, complying with financial reporting standards, and optimizing inventory management. By planning and conducting effective audits, businesses can improve their operations, increase inventory benefits, reduce costs, and enhance customer satisfaction. Leveraging technology, training employees, and implementing best practices can further enhance efficiency and accuracy, contributing to the overall success of the business.

Related Content