In today’s fast-paced business environment, efficient invoicing practices are no longer a luxury – they are a necessity. Whether you’re a solopreneur or a large corporation, clear, timely, and professional invoices are essential for ensuring you get paid promptly and keep your cash flow healthy.

This comprehensive guide explores invoicing best practices for businesses of all sizes, differences between invoices and receipts, the various types of invoices, and essential elements every professional invoice should include.

- What is an Invoice?

- Invoice vs. Receipt: Understanding the Difference

- Understanding Invoice Types

- Essential Elements of a Professional Invoice

- Invoicing Best Practices for Businesses

- Free Invoice Templates

What is an Invoice?

An invoice is a formal document issued by a seller to a buyer that details the products or services, associated costs, and payment terms. It acts as a transaction record and a legal payment request.

Invoice vs. Receipt: Understanding the Difference

Invoices and receipts might seem interchangeable, but they serve distinct purposes in the financial dance between you and your clients.

Invoice: A payment request, detailing what’s owed (products, quantities, prices) and when (due date). It’s like a bill asking your client to settle up.

Receipt: Proof of payment received. It shows the total amount paid and the transaction date, acting as your “thank you” with financial details.

A Simple Analogy:

Think of ordering a delicious pizza. The restaurant provides an invoice before or upon delivery, clearly outlining the pizza’s cost, any extra toppings, and the final amount due. Once you settle the bill, the restaurant issues a receipt acknowledging your payment for the delicious pizza.

Related Read: Invoice vs. Receipt: What’s the Difference?

Understanding Invoice Types

While the core elements remain consistent, invoices can be categorized into different types based on their function:

- Standard Invoice: The most common type, used for one-time transactions of products or services.

- Recurring Invoice: Ideal for ongoing services or subscriptions, automatically generated at predetermined intervals (e.g., monthly, quarterly) for a set fee, eliminating the need for manual creation each time.

- Progress Invoice: Used for long-term projects, requesting payment for completed project stages.

- Debit Note: Issued to a client to adjust a previously issued invoice, typically for a price reduction or returned goods.

- Credit Note: Issued to a client to acknowledge a refund or cancellation of a service.

Choosing the Right Invoice for the Job

Now that you’re familiar with the different types of invoices, selecting the most appropriate one becomes a breeze. Here’s a quick guide:

- One-time sale? Standard invoice is your go-to.

- Ongoing service? Automate things with a recurring invoice.

- Long-term project? Track progress with progress invoices.

- Price adjustment or returned goods? Issue a debit note.

- Refund or cancellation? A credit note is the answer.

By strategically utilizing these various invoice types, you can streamline your invoicing process, improve cash flow management, and strengthen your financial relationships with clients.

Essential Elements of a Professional Invoice

A well-designed invoice should include the following elements:

- Company Information: Prominently display your business name, logo, and contact details (address, phone number, email) for easy reference.

- Client Information: List your client’s name, billing address, and any relevant contact details to ensure accurate delivery and communication.

- Unique Invoice Number: Assign a unique identifier to each invoice for effortless tracking and record-keeping.

- Invoice Date: Indicate the date the invoice was issued to establish a clear timeline for payment.

- Due Date: Set a specific due date by which you expect payment to be received. This helps manage cash flow and encourages timely settlements.

- Detailed Description of Services/Products: Provide a clear and concise breakdown of the products or services rendered. Include quantities and unit prices for each item, ensuring transparency and clarity.

- Accurate Totals: Calculate and display the subtotal before taxes, any applicable taxes (e.g., sales tax), and the final amount due. This ensures your client understands the complete cost.

- Payment Terms: Outline your preferred payment methods (e.g., bank transfer, or online payment) for client convenience. Additionally, communicate any late payment penalties to encourage prompt settlements.

Invoicing Best Practices for Businesses

Craft Clear and Concise Invoices

- Essential Information: Every invoice should include key details like your business name and contact information, the client’s name and address, a unique invoice number, invoice date, and due date.

- Detailed Line Items: List the products or services provided, along with the quantities, descriptions, and unit prices.

- Payment Terms: Specify your payment terms. This includes the acceptable payment methods (e.g., check, bank transfer, credit card) and any late payment penalties.

Embrace Automation

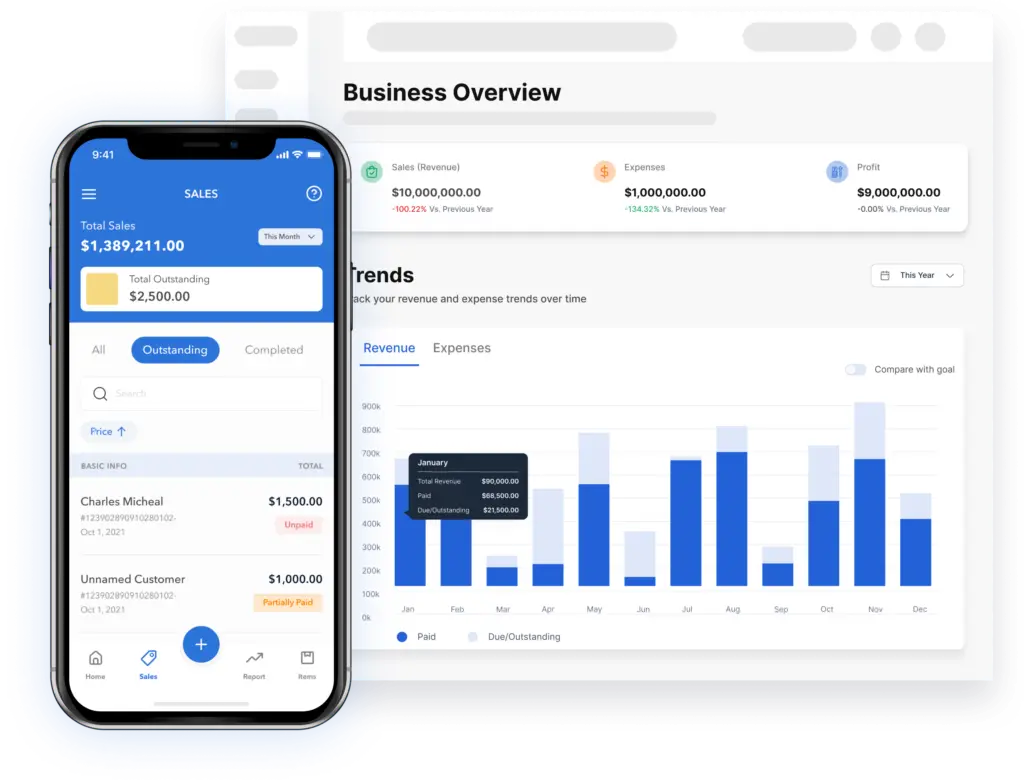

Manual invoicing is time-consuming and prone to errors. Consider leveraging invoicing software like Vencru to automate repetitive tasks. Vencru allows you to create professional invoices with ease, send them electronically with a single click, and track payments efficiently.

Related Read: Guide: Choosing An Invoicing Accounting Software

Standardize Your Invoicing Process

Develop a consistent invoicing process and stick to it. This includes creating templates for your invoices, establishing a regular invoicing schedule (e.g., weekly, bi-weekly, monthly), and implementing a clear system for tracking outstanding payments.

Prioritize Timely Invoicing

Don’t delay sending your invoices! The sooner you send your invoices, the sooner you get paid. Set reminders for yourself to send invoices promptly after completing a project or delivering a product.

Set Clear Due Dates and Late Payment Fees

Establish clear due dates on your invoices and communicate any late payment fees or penalties. This encourages timely payments and helps manage your cash flow.

Offer Multiple Payment Options

Make it easy for your clients to pay you. Offer a variety of payment methods such as online payments, bank transfers, or credit cards. Vencru integrates seamlessly with various payment gateways, allowing your clients to pay you securely and conveniently.

Communicate Effectively

Clear communication is key. Include a brief note on your invoice thanking your client for their business. Additionally, if a payment is overdue, send polite and professional reminder emails or follow-up calls.

Follow Up on Overdue Invoices

Don’t be afraid to send friendly reminders for overdue payments. A gentle nudge can often prompt your client to settle the outstanding balance.

Maintain Accurate Records

Keep a well-organized system for tracking invoices, payments, and outstanding balances. This ensures efficient financial management.

Free Invoice Templates

Vencru offers a range of invoice templates designed to meet the needs of various industries. Whether you are a freelancer, a retailer, or a service provider, we have the right template for you. Our library of customizable invoice templates lets you add company details and tailor the format to your specific invoicing needs.

See the downloadable free invoice templates to help you get started.

Related Read: Invoice template explained: What is an invoice or receipt?

Streamline Your Workflow with Invoicing Software

By implementing the valuable invoicing best practices outlined in this guide, you can transform your payment collection process from a time-consuming burden into a smooth and efficient system. But why stop there? Take your invoicing to the next level and unlock the true potential of automation with user-friendly invoicing software like Vencru.

Vencru goes beyond basic invoicing. It’s a comprehensive solution that streamlines your entire financial workflow. From creating professional invoices in seconds to automating repetitive tasks and tracking outstanding payments, Vencru empowers you to:

- Save valuable time: Focus on what matters most – growing your business – by eliminating manual invoicing and data entry.

- Reduce errors: Eliminate the risk of human error with automated calculations and ensure accurate financial records.

- Improve cash flow: Get paid faster with automated reminders and online payment options.

- Gain valuable insights: Track key financial metrics and make data-driven decisions to optimize your business.

Ready to explore Vencru? Get started here or book a demo.