Per Diem is a Latin term meaning “Per day” – compensation on expenses incurred during a business trip. Examples of such costs include accommodation, feeding, transportation, and incidental expenses.

From the term Per day, you will see that compensation covers daily expenses for an on-site and client project sponsored by the employee’s company.

These trips offer experiences to the employee, overseen by HR.

What is Per Diem?

Per diem is an allowance paid to an employee by his organization or company to cover the daily living expenses on a business trip.

It provides information on the right amount of money given to an employee to cover his daily expenses while on a business trip.

Within the United States, the GSA is responsible for fixing the per diem rates, whereas, in other geographical areas, the State Department or Department of Defense and foreign rates do.

How Does Per Diem Work?

As a business owner, when you hire a per diem employee, you need to abide by all applicable labor laws, as well as those surrounding minimum wage and overtime.

While hiring a per diem employee, you should understand that they must get their full per diem rate, regardless of total hours worked.

An example is a scenario where you employ the services of a per diem videographer to capture scenes during an interview with one of your angel investors. If the agreed per diem rate for the videographer is $400 and the job gets completed a few hours earlier than discussed, the per diem employee is allowed his pay of $400.

Another situation is when the videographer works some extra hours. The videographer is entitled to overtime pay depending on the number of hours worked.

How Does Per Diem Relate to Small Businesses?

There are two different explanations where per diem can be related to small businesses, and they are:

Per Diem Employees:

In this situation, employees of an organization work full-time and others part-time.

It is expected of full-time staff to work 7-8 hours every working day (Monday – Friday) and a total of 35-40 hours a week. Whereas part-time staff work in shifts, morning hours between 7 am – 12 pm and afternoon shifts begin immediately between 1 pm – 5 pm.

Per Diem, employees are different from full-time/part-time employees, as they are employed on a daily or as-needed. Companies and organizations hire per diem employees to get some extra job done such as sitting in for sick staff, and other related/urgent reasons.

Some sectors where you can find per diem employees are in:

- Healthcare sectors

- Education sectors

- Other areas could be organizations in need of extra support like management, warehouse, event, etc.

Per Diem For Travel Expenses:

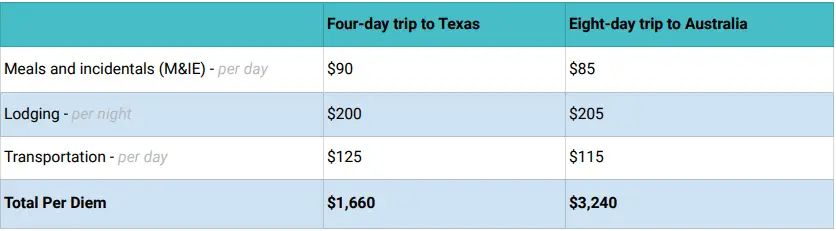

The per diem travel expenses covers,

- Meals and incidentals (M&IE)

- Lodging

- Transportation

For employees on business trips, per diem reimbursement on travel expenses are like a daily allowance.

You can understand better from the figures in the Google spreadsheet below

(Sample 1) –

What Are The Per Diem Rates For 2022?

Federal per diem rates for each location can be confirmed on the GSA website – https://www.gsa.gov/travel/plan-book/per-diem-rates.

The keyword here is accountability.

Keeping track of receipts or tracking the employee’s supervisor for approval on travel-related costs might not be needed.

How Is The Per Diem Breakdown?

Let us use the U.S. as a case study.

- Federal per diem rate is paid to employees of the United States of America for meals, lodging, and incidental expenses when they travel out for business reasons.

- Incidental Expenses are tips given to luggage carriers, hotel staff, and other staff for their services.

- Travel Expenses include lodging, meals, and incidental expenses.

- Transportation is expenses incurred on travel trips.

Where Can You Get The Per Diem Calculator?

Information on per diem rates as fixed by the government on

Taxes on Per Diem

If compensation from per diem meets government conditions, they are regarded as non-taxable funds.

This compensation/reimbursement becomes taxable when the:

- Per diem rate is more than the agreed federal rate

- Employee failed to file an expense report with his organization

- Worker’s expense report does not carry information like,

- Date

- Time

- Place

- Amount of expense accumulated

- And the purpose for the business trip

- Staff is granted a per diem for the travel, but his employer did not require the expense report

Benefits on Per Diem Payments Methods

- One of the benefits of the per diem payment method is the use of company credit cards or upfront payment methods to fund trips for their employees. It is easier and simpler.

So far as, travel expenses don’t exceed the per diem amount, there is no need for an official business receipt. This cuts down on the paperwork.

- If at the end of a business trip, an employee is left with some balance – options are it could be kept or returned.

- The payment method selected by a company builds up some sense of responsibility on the part of the employee, giving them a first-hand field-like experience of the company activity.

How Can Vencru Help You?

Vencru is the easiest invoicing and accounting software to get your sales and business reports, perform inventory management, manage clients and employee sales – all in one place.

Vencru can help you manage your business and risks. With our unique features, we would reduce the amount of work left for your employees. We’d keep track of both their activities and input.

Sign up now to gain more control over your business and employees.

Final Takeaway

Per diem is an allowance paid to an employee by his organization or company to cover the daily living expenses on a business trip.

It covers compensation for accommodation, feeding, transportation, and incidental expenses.

Make sure you stay tuned to our blog to get more amazing resources to help you navigate the market. Good luck!