Inventory management is a crucial aspect of running any business that involves selling goods. To make informed decisions about inventory, businesses need to understand inventory costing methods, one of which is the retail inventory method. In this blog post, we will discuss the method, its advantages and disadvantages, and alternatives to it. We will also discuss how Vencru can help retailers perform inventory accounting using weighted average costs.

What is Inventory Costing?

Inventory costing is the process of determining the value of goods that a business has in its possession. It involves assigning a value to each unit of inventory and keeping track of the total value of inventory.

What is Retail Inventory Method?

This method of inventory costing that is commonly used in the retail industry. It involves calculating the value of inventory by using the ratio of cost to retail price. In other words, the retail inventory method determines the cost of goods sold and the value of inventory by using the retail price of goods.

This is important because it provides businesses with a real-time valuation of their inventory. This can help businesses make informed decisions about pricing, ordering, and inventory management.

How does retail inventory method work?

This works by calculating the cost of goods sold as a percentage of retail sales. This percentage is known as the cost-to-retail percentage. The cost-to-retail percentage is calculated by dividing the cost of goods by the retail price of goods.

- First, the cost-to-retail percentage is calculated.

- Then, this percentage is applied to the total retail value of inventory.

- Finally, the cost value of inventory is determined.

Calculation of average cost to retail percentage

The average cost to retail percentage is calculated by dividing the cost of goods sold by the retail price of goods sold. For example, if the cost of goods sold is $50,000 and the retail price of goods sold is $100,000, the average cost to retail percentage is 50%.

Advantages of Retail Inventory Method

- Provides real-time inventory valuation: This provides businesses with a real-time valuation of their inventory. This can help businesses make informed decisions about pricing, ordering, and inventory management.

- Enables businesses to identify and address inventory issues quickly: Since the retail inventory method provides a real-time inventory valuation, it enables businesses to identify and address inventory issues quickly. For example, if a business notices that the cost-to-retail percentage is increasing, it may indicate inventory shrinkage or overpricing.

- Facilitates effective decision-making: The real-time inventory valuation provided by the retail inventory method can help businesses make informed decisions about pricing, ordering, and inventory management. This can lead to increased profitability and better business outcomes.

Disadvantages of Retail Inventory Method

- Requires a lot of record-keeping and calculations: This requires a lot of record-keeping and calculations. Businesses must keep track of retail prices, cost of goods sold, and other inventory-related data to use this method effectively.

- Can be time-consuming and labor-intensive: Due to the record-keeping and calculations required, the retail inventory method can be time-consuming and labor-intensive. Businesses need to allocate sufficient resources to perform these tasks.

- May not be suitable for all businesses: This may not be suitable for all businesses. For example, businesses with a low sales volume may find it difficult to use this method effectively.

Alternatives to Retail Inventory Method

There are several alternative inventory costing methods to the inventory valuation method, and it’s important to understand their advantages and disadvantages to determine which method works best for your business.

First-In, First-Out (FIFO)

The FIFO method assumes that the oldest inventory is sold first, and the newest inventory remains in stock. This method is ideal for businesses selling perishable goods. The older inventory is likely to spoil or become outdated.

This method guarantees that the oldest inventory is sold first. FIFO also provides a better representation of the current inventory value when prices are rising.

Last-In, First-Out (LIFO)

The LIFO method assumes that the newest inventory is sold first, and the oldest inventory remains in stock. This method is ideal for businesses that sell non-perishable goods. Such goods do not decrease in value over time. Therefore, older inventory does not have a major effect on the overall value of the inventory.

LIFO is advantageous for businesses during times of inflation. This is because it reduces taxable income. It achieves this by pairing the most recent, and thus higher-priced, inventory with the income from sales.

Weighted Average Cost

The weighted average cost method calculates the average cost of all inventory items.

This is done by dividing the total cost of goods for sale by the total units available. This method can benefit businesses with many inventory items or frequent price changes, as it smooths out price fluctuations over time and provides a stable average cost per unit.

How to Implement Retail Inventory Method

Implementing this involves several steps, including:

- Choosing a software program or system to perform the necessary calculations and record-keeping.

- Establishing a regular schedule for inventory counts and adjustments.

- Determining the cost and retail value of inventory items.

- Calculating the average cost to retail percentage.

- Recording and tracking inventory purchases, sales, and adjustments.

It’s also important to consider factors such as shrinkage, seasonality, and customer demand when implementing the retail inventory method.

By following best practices and ensuring accuracy in inventory tracking and valuation, businesses can effectively utilize the retail inventory method to manage inventory and make informed decisions.

Conclusion

Inventory costing methods are important for inventory management. It is important to understand the advantages and disadvantages of each method. This will help businesses to decide which method is the best for their needs. While the retail inventory method has advantages and disadvantages, it can provide real-time inventory valuation and facilitate effective decision-making.

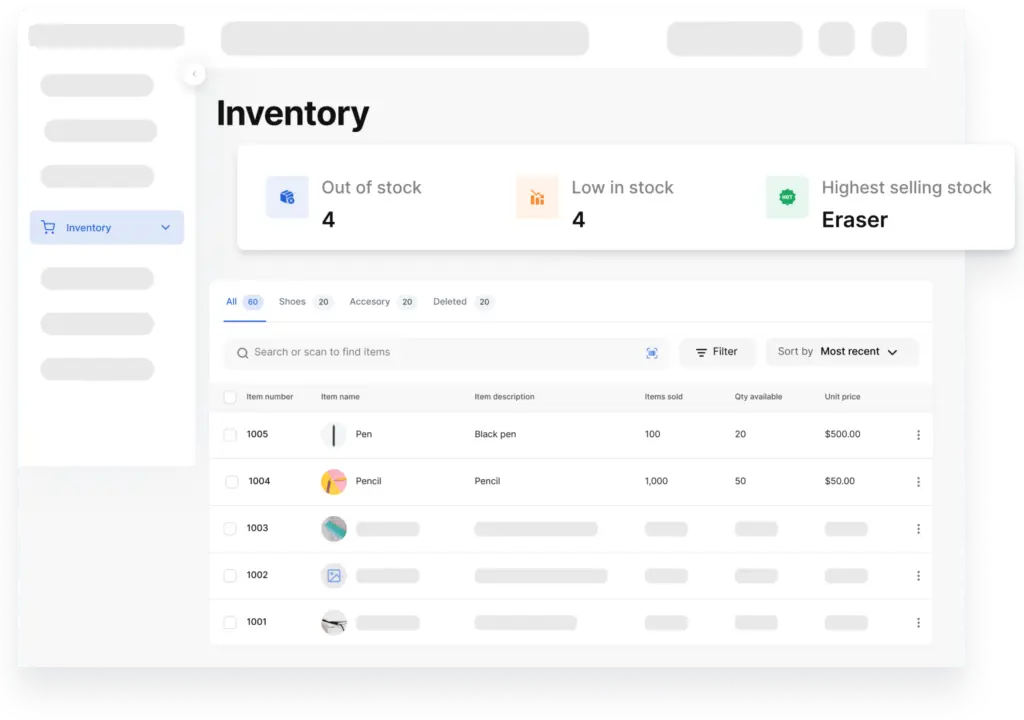

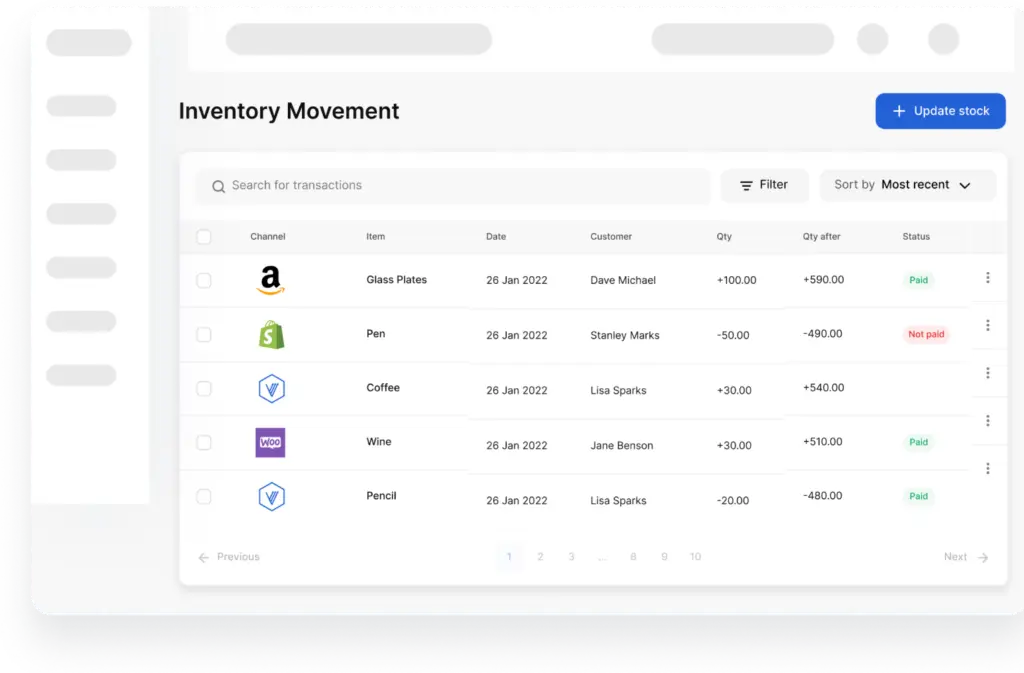

Businesses can use a software program like Vencru to manage their inventory with the weighted average cost method. This method offers a steady average cost per unit. It is beneficial for businesses that have frequent price changes or a large number of inventory items.

Related: Retail Chart of Accounts, Inventory accounting: Key terms and valuation methods for retail, All about the retail inventory method