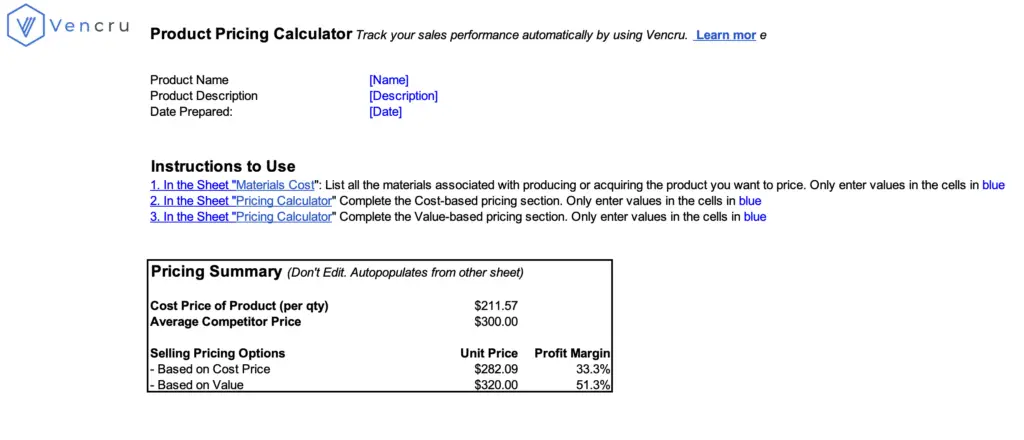

Product Pricing Calculator Template (Free Download)

Setting the right price for your products is critical for business success. However, it can be a complex task that requires careful consideration of various factors. Our Product Pricing Calculator Template simplifies this process, allowing you to make informed decisions and maximize your profitability. In this guide, we’ll explore the

Why is Product Pricing Important?

Product pricing plays a crucial role in determining your business’s profitability, market positioning, and overall success. It directly impacts your revenue, profit margins, and competitiveness in the market. By setting the right price, you can attract customers, drive sales, and achieve your financial goals.

Factors to Consider When Pricing a Product

When pricing a product, there are several factors to consider to ensure that your prices are competitive, attractive to customers, and profitable for your business. These include:

Production Cost:

These are all costs associated with producing the product, including materials, labor, and overhead expenses. For example, if you’re selling handmade jewelry, consider the cost of materials (beads, wire, clasps), labor (time spent on crafting each piece), and overhead expenses (rent, utilities) when determining the price of each item.

Target Market

The level of demand for your product influences how much customers are willing to pay. To effectively price your product, you need to understand your target market’s willingness to pay and price sensitivity. For example, If you sell luxury skincare products, customers who value high-quality ingredients and luxury packaging may be willing to pay a premium price for your products.

Competition

It is important to analyze competitor prices to ensure that your prices are competitive. If you’re operating in a crowded market with many competitors offering similar products, you may need to adjust your prices slightly lower. You may also adjust pricing based on factors such as product quality, brand reputation, and customer service.

Value Proposition

If your product offers unique features, benefits, or solutions to customer pain points, highlight these aspects in your pricing strategy. Customers are often willing to pay a higher price for products that offer greater value or solve specific problems.

Profit Margin

Determine the profit margin you need to achieve to cover your business expenses and generate a satisfactory level of profitability. Calculate your desired profit margin as a percentage of the product’s selling price and ensure that your prices allow for this margin while remaining competitive in the market.

Pricing Psychology

Consider how pricing affects customer perceptions and purchasing behavior. For example, setting prices just below a round number ($9.99 instead of $10.00) may create the perception of a lower price and increase sales.

Seasonality and Demand:

Adjust your prices based on seasonal demand fluctuations. For example, you may offer discounts or promotions during slow seasons to stimulate sales, or increase prices during peak seasons when demand is high to maximize revenue.

Different Ways to Calculate Pricing for a Product

There are three main ways to calculate price of a product

Cost-based pricing

Here, the product selling price is a markup of all the costs associated with producing the product.

- Selling Price = Cost Price + Markup

- Example: If the production cost of a product is $50 and you want a 50% markup, the selling price would be $50 + ($50 * 0.50) = $75.

Competitive pricing

Here, the product selling price is set based on what your competitors are charging for similar products. This method is helpful in highly competitive markets, to attract customers while still allowing a reasonable profit margin.

For example, if your competitors are selling a similar product for $80, you may choose to set your price slightly lower or at the same level depending on your unique value proposition.

Value-based pricing

Here, you may determine prices based on the perceived value of your product to customers. This requires you to take into account factors such as quality, uniqueness, and customer benefits when setting prices. For example, If your product offers unique features or benefits that are highly valued by customers, you can justify charging a higher price compared to competitors offering similar products.

However, determining a product price today should not limit your ability to adjust the pricing later. This is because product pricing can be dynamic, and can be adjusted based on demand, competition, and other market factors. For example, increase prices during periods of high demand and lower prices when demand is low.

Download Our Free Product Pricing Calculator Template

Click here to download our free Product Pricing Calculator Template and take the guesswork out of pricing your products.

Benefits of Using Product Pricing Template

- Time-Saving: Our template automates the pricing calculation process, saving you time and effort.

- Accuracy: Ensure accurate pricing calculations by inputting relevant cost and pricing data.

- Consistency: Maintain consistent pricing across your product portfolio.

- Flexibility: Easily adjust prices based on changes in costs, market conditions, or business objectives.

- Informed Decision-Making: Make data-driven pricing decisions to maximize profitability and competitiveness.

Conclusion

Effective product pricing is essential for business success. Our Product Pricing Calculator Template empowers you to set prices that maximize profitability and competitiveness in the market. By understanding the importance of pricing, exploring different pricing calculation methods, considering key factors, and leveraging our template’s benefits, you can master your pricing strategy and achieve your business goals. Download our free template today and unlock the potential of your pricing strategy.

Related Links

- Bookkeeping Templates

- Inventory management software for wholesalers and retailers

- Profitability Ratios You Need for Business Growth

- What Is Per Diem? Everything You Need To Know About It

- ABC Analysis Report: A Retailer’s Guide to Maximizing Profitability

- Invoice template explained: What is an invoice or receipt?

- Cash Flow For A Small Business