Running a successful e-commerce business involves more than just selling products online. Efficiently managing your finances is crucial for growth and profitability. That’s where the right accounting software comes into play. In this guide, we’ll delve into the best accounting software solutions for e-commerce businesses in 2024, comparing Vencru, Quickbooks, Xero, and Bench to help you make an informed choice.

Features of Best Accounting Software for E-commerce

Effective accounting software for e-commerce should offer a range of features tailored to the unique needs of online businesses. Here are some key features to look for:

- Transaction Tracking: Efficiently track and categorize sales, expenses, and refunds specific to your e-commerce operations.

- Inventory Management: Seamlessly integrate with your inventory management system to monitor stock levels, sales, and reordering.

- Multi-Channel Integration: Integrate with multiple e-commerce platforms, marketplaces, and payment gateways to consolidate financial data.

- Automated Data Entry: Reduce manual data entry by automatically importing transactions, invoices, and receipts.

- Tax Compliance: Stay compliant with e-commerce tax regulations, including sales tax, VAT, and GST, and generate tax reports.

- Financial Reporting: Access comprehensive financial reports, including profit and loss statements, balance sheets, and cash flow reports.

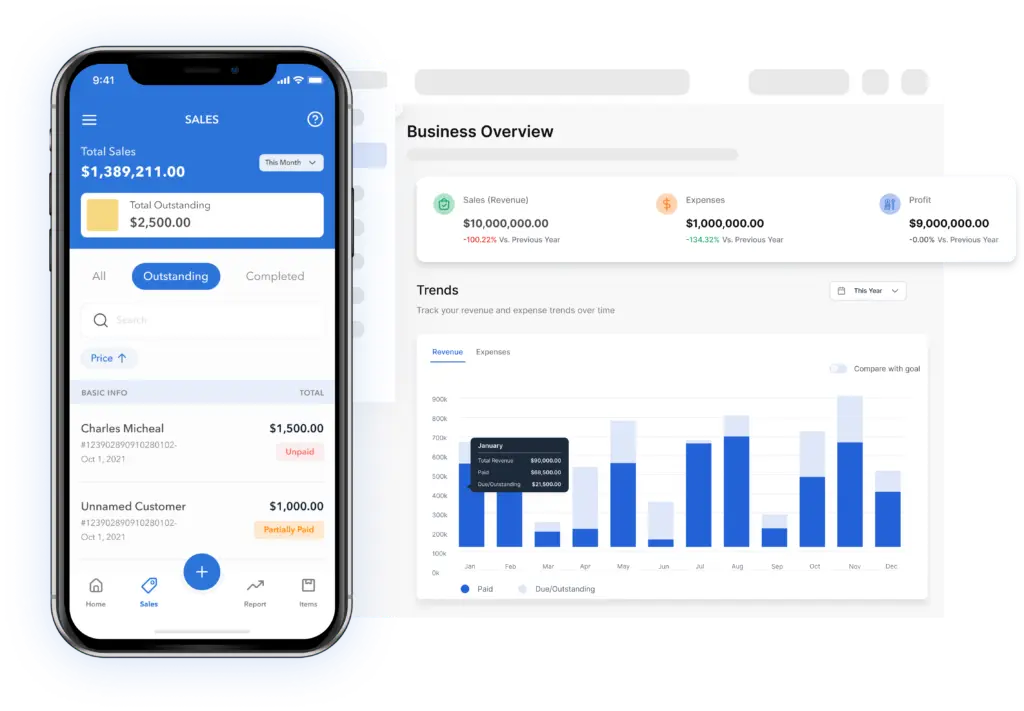

- Mobile Accessibility: Manage your e-commerce finances on the go with mobile apps for real-time insights.

Best Accounting Software for e-commerce businesses

Here’s a brief overview of four top accounting software options for e-commerce businesses:

Vencru

- Description: Vencru is a comprehensive business management and accounting software designed for small and medium-sized businesses (SMBs) and freelancers. It offers features like invoicing, expense tracking, inventory management, sales reports, and financial insights, all in one platform. Vencru is great for businesses in various industries, including retail, wholesale, e-commerce, consulting, and more.

- Key Features: Mobile point-of-sale (POS), inventory tracking, expense management, invoice customization, financial reports, multi-currency support, tax management, and more.

- Advantages: Vencru is user-friendly, offers mobile accessibility, and is designed to simplify accounting and business management for entrepreneurs and small business owners.

Xero

- Description: Xero is an accounting software primarily for small and medium-sized businesses. It provides a range of accounting and financial tools to help businesses manage their finances, invoicing, bank reconciliations, and more.

- Key Features: Bank reconciliation, expense tracking, invoicing, payroll (with an additional subscription), financial reporting, multi-currency support, and integration with numerous third-party apps.

- Advantages: Xero is known for its ease of use and a wide array of integrations, allowing businesses to tailor the software to their specific needs.

QuickBooks

- Description: QuickBooks, developed by Intuit, is one of the most popular accounting software options globally. It’s for small businesses and offers a variety of accounting tools and features for financial management, including invoicing, expense tracking, payroll, and tax management.

- Key Features: Invoicing, expense tracking, financial reports, payroll processing, tax calculations, project tracking, and integrations with numerous apps.

- Advantages: QuickBooks is widely recognized for its robust feature set, scalability, and strong support, making it suitable for businesses of varying sizes.

Bench

- Description: Bench is unique among these options as it combines accounting software with a dedicated team of bookkeepers. It takes the burden of bookkeeping and financial reporting off business owners’ shoulders, providing an all-in-one solution.

- Key Features: Expert bookkeeping services, financial reports, tax filing assistance, expense tracking, and financial insights.

- Advantages: Bench offers a hands-off approach to accounting, making it an attractive choice for business owners who want to outsource their bookkeeping entirely.

Each of these accounting software options caters to different business needs and preferences. Choosing the right one depends on factors like the size of your business, industry, accounting expertise, budget, and specific requirements.

Related Content