Invoicing is crucial for running a business efficiently. It ensures you get paid for the services you provide or the products you sell. Creating professional invoices can significantly impact how your business is perceived and how effectively you manage your finances. This guide walks you through everything you need to know about creating professional invoices, from understanding an invoice to using an invoice generator and creating one from scratch. We’ll be discussing:

- What is an Invoice?

- Difference between Bill and Invoice

- Legal Requirements for an Invoice

- Tips to Keep Your Invoice Looking Professional

- How to Create Invoice with a Generator

- How to Create Invoice from Scratch

- Tips for Effective Invoice Management

- Leveraging Vencru for Your Invoicing Needs

What is an Invoice?

An invoice is a document sent by a seller to a buyer, detailing the products or services provided and requesting payment. It typically includes information such as the seller’s and buyer’s contact details, a description of the goods or services, the payment terms, and the total amount due. Invoices serve as records of sales transactions and are essential for bookkeeping and tax purposes.

Difference Between Bill and Invoice

While “bill” and “invoice” are often used interchangeably, they have distinct meanings in a business context:

- Invoice: Issued by a seller to a buyer, an invoice requests payment for goods or services rendered. It outlines the transaction details and specifies the payment terms.

- Bill: Issued by a seller to a buyer, a bill demands immediate payment. It is typically used in retail or restaurant settings where payment is expected at the point of sale.

In essence, an invoice is a payment request, often with terms allowing for deferred payment, while a bill is a demand for immediate payment.

Legal Requirements for an Invoice

Creating a legally compliant invoice is crucial for avoiding disputes and ensuring smooth business operations. Essential elements that should be included in a professional invoice are:

- Invoice Number: A unique identifier for each invoice, helping in tracking and record-keeping.

- Date of Issue: The date when the invoice is created and sent.

- Seller’s Information: Business name, address, contact number, and email.

- Buyer’s Information: Client’s name, address, contact number, and email.

- Description of Goods or Services: Detailed description, including quantities, unit prices, and total amounts for each item or service.

- Subtotal and Total Amount Due: Clearly state the subtotal, taxes (if applicable), and the total amount due.

- Payment Terms: Specify the due date, accepted payment methods, and any late payment penalties.

- Tax Information: Include relevant tax identification numbers and rates if applicable.

- Additional Notes: Any other relevant information, such as terms and conditions or special instructions.

Tips to Keep Your Invoice Looking Professional

A professional-looking invoice not only enhances your brand image but also ensures clarity and reduces the likelihood of payment delays. Here are some tips to keep your invoice looking polished:

- Consistent Branding: Use your company’s logo, colors, and fonts to create a consistent and professional appearance.

- Clear and Readable Format: Use a clean, easy-to-read layout with clear headings and sections. Avoid clutter and unnecessary information.

- Detailed Descriptions: Provide clear and detailed descriptions of the goods or services provided to avoid any confusion.

- Accurate Calculations: Double-check all calculations to ensure the amounts are correct.

- Professional Language: Use formal and polite language throughout the invoice.

- Digital Invoices: Consider using digital invoices, which are easier to manage, send, and track.

How to Create an Invoice with a Generator

Using an invoice generator can simplify the process of creating professional invoices. Here’s a step-by-step guide to creating an invoice with an invoice generator:

- Choose an Invoice Generator: Select a reliable invoice generator, such as Vencru, which offers customizable templates and automated features.

- Enter Your Business Information: Input your business name, logo, address, and contact details.

- Add Client Information: Enter the client’s name, address, and contact details.

- List Goods or Services: Provide detailed descriptions of the products or services, including quantities and unit prices.

- Set Payment Terms: Specify the payment terms, due date, and accepted payment methods.

- Review and Customize: Review the invoice for accuracy and make any necessary adjustments. Customize the template to match your branding.

- Send the Invoice: Once you’re satisfied, send the invoice directly to your client via email or download it for printing.

How to Create an Invoice from Scratch

Creating an invoice from scratch allows for complete customization and ensures that all necessary details are included. Here’s how to do it:

- Open a New Document: Use software such as Microsoft Word, Excel, or Google Docs to open a new blank document.

- Add a Header: Include your business name, logo, address, and contact details at the top of the document.

- Include Client Information: Below the header, add the client’s name, address, and contact details.

- Insert Invoice Details: Add the invoice number, date of issue, and due date.

- Create a Table: Insert a table to list the goods or services provided. Include columns for description, quantity, unit price, and total amount.

- Calculate Totals: Calculate the subtotal, apply any taxes, and provide the total.

- Specify Payment Terms: Clearly state the payment terms, including accepted payment methods and any late fees.

- Add Additional Notes: Include any additional notes or instructions relevant to the invoice.

- Review and Finalize: Review the invoice for accuracy, ensure all information is clear and professional, and then save the document.

Tips for Effective Invoice Management

Beyond creating invoices, managing them efficiently is crucial for maintaining a healthy cash flow and good client relationships. Here are some best practices for effective invoice management:

- Timely Invoicing: Send invoices promptly after delivering goods or services to ensure timely payments.

- Follow-Up: Establish a system for following up on overdue invoices. Gentle reminders can effectively ensure clients pay on time.

- Organized Records: Keep detailed records of all invoices sent and received. This helps in tracking payments and managing finances.

- Clear Policies: Communicate your payment terms and policies to clients from the outset to avoid misunderstandings.

- Automate Processes: Use accounting software to automate invoicing, reminders, and payment tracking to save time and reduce errors.

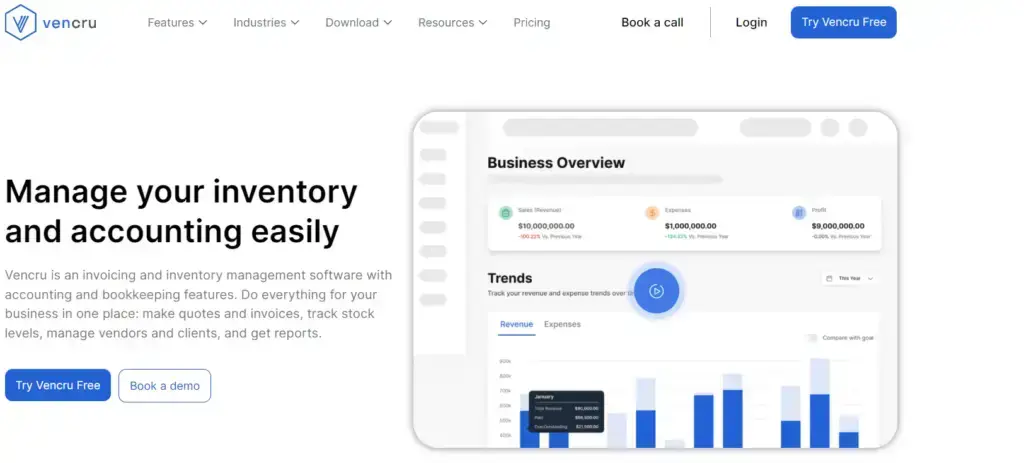

Leveraging Vencru for Your Invoicing Needs

Vencru is designed to simplify and streamline the invoicing process, making it an excellent choice for businesses looking to improve their financial management. Here’s how Vencru can help:

- Customizable Templates: Vencru offers a variety of customizable templates to match your brand’s look and feel, ensuring your invoices are professional and consistent.

- Automated Features: Vencru’s automation features reduce manual work, helping you create, send, and track invoices effortlessly. Automated reminders ensure that your clients never miss a payment deadline.

- Real-Time Tracking: Keep track of all your invoices in real-time, knowing exactly when they are viewed and paid. This transparency helps you stay on top of your finances.

- Detailed Reporting: Generate comprehensive reports to gain insights into your invoicing patterns, payment timelines, and overall financial health.

By leveraging Vencru, you can take control of your invoicing process, ensure accuracy, and present a professional image to your clients. The time saved and efficiency gained can be redirected to other critical areas of your business, driving growth and success.

Conclusion

In conclusion, creating professional invoices is essential for maintaining a smooth and efficient business operation. By understanding the components of an invoice, knowing the difference between bills and invoices, adhering to legal requirements, and following best practices for a professional appearance, you can ensure your invoicing process is both effective and polished. Whether using an invoice generator or creating invoices from scratch, attention to detail and consistency are key. Leveraging tools like Vencru can further simplify the process, providing you with professional, accurate, and efficient invoicing solutions.

Ready to elevate your invoicing process? Start using Vencru today

Related Content