Inventory revaluation adjusts the recorded value of a company’s inventory to match current market conditions. This process is vital for businesses dealing with fluctuating carrying costs of inventory due to market uncertainty, changes in demand, or economic factors like exchange rates. By revaluing inventory using the appropriate inventory valuation method, companies can ensure their financial statements accurately reflect their assets and overall net income while maintaining effective inventory management.

Accurate inventory valuation is crucial for maintaining compliance with accounting standards and supporting better decision-making and financial planning. This practice helps businesses manage carrying costs, handle supply chain disruptions, and optimize the use of inventory management software. Additionally, it contributes to a transparent and reliable financial overview for stakeholders by reflecting the expected selling price, shelf life, and other market factors (NRV market).

In this blog, we’ll discuss:

- Understanding Inventory Revaluation

- How Inventory Revaluation Affects Your Business

- Implementing Inventory Revaluation

- Scenarios Where Revaluing Inventory is Critical

- Leveraging Vencru’s Inventory Management Solution

- Tips for Successful Inventory Revaluation

Understanding Inventory Revaluation

Inventory revaluation involves reassessing the value of a company’s inventory based on current market prices, rather than the historical cost the inventory was originally purchased. This adjustment can lead to an increase or decrease in the inventory value on hand.

There are several inventory valuation methods, including:

- Market Value Method: This method updates inventory values based on market prices. It’s helpful for businesses dealing with commodities or goods with fluctuating prices.

- Replacement Cost Method: This inventory valuation method updates inventory values based on the current cost to replace items. It’s great for businesses with inventory that can quickly become outdated or impacted by fast-changing technology.

- Net Realizable Value (NRV) Method: This method values inventory at the estimated selling price minus costs for completing and selling the product.

- Lower of Cost or Market (LCM): This method values inventory at the lower of its original cost or current market value.

- Weighted Average Cost: This method calculates inventory value based on the average cost of items available for sale during the period, which helps smooth out price fluctuations.

- First-In, First-Out (FIFO): This method sells the oldest inventory items first, which influences the inventory value based on this cost flow. It impacts inventory value by using the cost flow of the oldest items first. This can influence net income and carrying costs.

- Last-In, First-Out (LIFO): This method assumes the newest inventory items are sold first, impacting tax liabilities and cash flow.

How Inventory Revaluation Affects Your Business

Inventory revaluation can have a significant impact on various aspects of your business, including:

- Financial Statements: The value of your inventory directly affects your balance sheet and income statement. An increase in inventory value can boost your asset base, while a decrease can reduce it. Accurate inventory valuation is essential for presenting a true picture of your company’s financial position to stakeholders.

- Tax Implications: Changes in inventory value can affect your taxable income. An increase in inventory value may lead to higher taxable income, while a decrease can result in lower taxable income. It’s crucial to consider the tax implications of inventory revaluation and plan accordingly.

- Cost of Goods Sold (COGS): Inventory revaluation affects the calculation of COGS, which in turn impacts your gross profit margin. An upward revaluation of inventory can reduce COGS, leading to higher gross profits, while a downward revaluation can increase COGS, reducing gross profits.

- Decision Making: Accurate inventory valuation is essential for making informed business decisions. It helps assess product potential profit, determine pricing strategies, and plan inventory purchases. Revaluation provides a realistic view of inventory costs, enabling better decision-making.

- Cash Flow Management: Inventory revaluation can affect your cash flow. An increase in inventory value may require additional working capital to finance the inventory, while a decrease can free up capital. Understanding the impact on cash flow is crucial for effective financial planning and management.

Implementing Inventory Revaluation

To implement inventory revaluation effectively, businesses should:

- Choose the Right Method: Select the inventory valuation method that best suits your business needs and industry practices. Consider factors such as market fluctuations, replacement costs, and selling prices.

- Regular Review: Conduct regular reviews of inventory values to ensure they reflect current market conditions. Periodic revaluation helps in maintaining accurate financial records and making timely adjustments.

- Use Reliable Data: Base revaluation on accurate and reliable data, such as market prices, replacement costs, and selling prices. Use reputable sources and industry benchmarks to support your valuation decisions.

- Consult Professionals: Seek advice from accounting professionals or financial advisors to ensure compliance with accounting standards and tax regulations. They can provide valuable insights and help in navigating complex revaluation scenarios.

Scenarios Where Revaluing Inventory is Critical

Inventory revaluation is an essential accounting process that ensures a company’s inventory value reflects current market conditions. Here are six scenarios where revaluing inventory becomes particularly important:

1. Market Fluctuations

Industries like commodities, electronics, and fashion often face significant market price fluctuations. For instance, in the electronics industry, rapid technological changes can quickly make products obsolete. Similarly, in fashion, seasonal trends can drastically impact inventory value. Revaluing inventory in these cases ensures financial statements reflect true market value.

2. Economic Downturns

During economic downturns, consumer demand typically drops, leading to an oversupply of inventory and falling prices. Businesses need to revalue their inventory to reflect these lower market prices. This inventory adjustment helps avoid overstating assets and provides a more accurate view of the company’s financial health during tough times.

3. Technological Advancements

Companies dealing with technology products face rapid obsolescence. For example, a new smartphone model can quickly reduce the value of older models. Revaluing these items ensures that financial records are accurate and helps businesses decide on discounts or clearances to manage older stock effectively.

4. Seasonal Changes

Retail businesses selling seasonal products, such as holiday decorations or summer clothing, need to revalue inventory at the end of each season. Unsold items from one season usually have a lower value in the off-season. Revaluing helps manage stock efficiently, plan for upcoming seasons, and avoid overvalued inventory.

5. Damage or Obsolescence

Inventory that gets damaged or becomes obsolete needs revaluation to reflect its reduced value. For instance, a warehouse fire might damage stock, or a new product release might make older versions obsolete. Revaluing these items is crucial for inventory accounting; maintaining accurate financial statements and ensuring the balance sheet reflects the true value of assets.

6. Business Acquisitions and Mergers

During mergers and acquisitions, companies must revalue inventory to provide an accurate business worth assessment. This process makes sure the inventory’s value is accurate, helping with fair deals and easy integration after the acquisition. Accurate inventory valuation is key to successful business deals.

Leveraging Vencru’s Inventory Management Solution

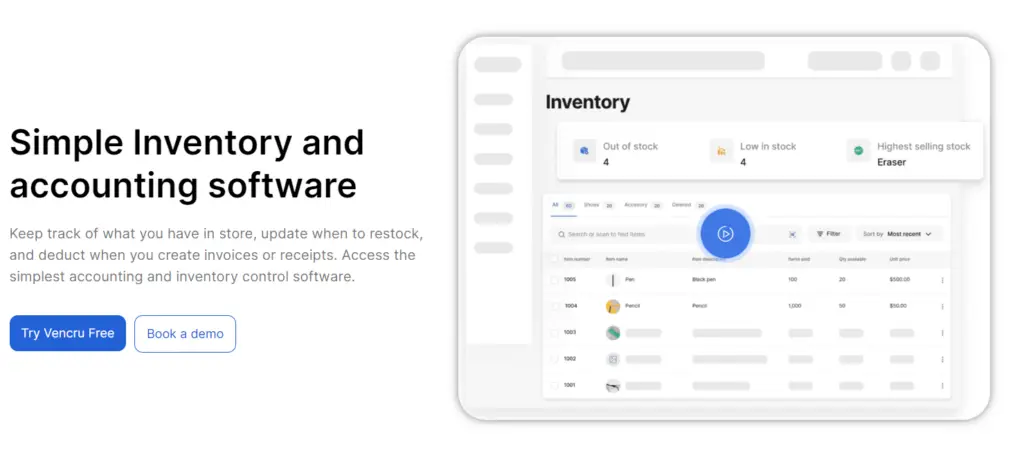

Vencru’s inventory management and accounting software can significantly simplify the process of inventory revaluation and enhance its accuracy. Here’s how:

- Automated Calculations: Vencru automates the revaluation process, reducing the risk of human error and saving valuable time. With real-time updates, businesses can always have an accurate view of their inventory value.

- Real-Time Data: Vencru provides real-time data on inventory levels, market prices, and replacement costs. This ensures that businesses have the most up-to-date information for accurate revaluation.

- Comprehensive Reporting: With Vencru, businesses can generate detailed reports that highlight changes in inventory value and their impact on financial statements. These reports are crucial for internal decision-making and external reporting.

- User-Friendly Interface: Vencru’s intuitive interface makes it easy for businesses to manage their inventory and perform revaluations. Even users with limited accounting knowledge can navigate the system effectively.

Related Read: How Vencru compares to others

Tips for Successful Inventory Revaluation

Here are a few tips to ensure successful inventory revaluation:

- Stay Updated on Market Trends: Keeping an eye on market trends and price fluctuations can help you make timely revaluation decisions. This is particularly important for businesses dealing with commodities or fast-moving consumer goods.

- Set Up a Revaluation Policy: Make a clear policy for revaluing inventory. Include how often you will do it, the inventory valuation methods you’ll use, and who is responsible for the process. This helps manage net income and loss on inventory, especially during supply chain disruptions.

- Regular Audits: Conduct regular inventory audits to verify the accuracy of your records and revaluations. Audits can identify discrepancies and ensure that your inventory management practices align with industry standards.

- Technology Integration: Utilize advanced technologies such as AI and machine learning to forecast market trends and automate revaluation processes. This can enhance accuracy and reduce manual effort.

- Continuous Training: Invest in ongoing training for your staff to keep them updated on best practices in inventory management and revaluation. Knowledgeable employees are better equipped to handle complex revaluation scenarios.

Conclusion

Inventory revaluation is a vital process for businesses to ensure accurate financial reporting and effective decision-making. By understanding its impact and implementing it correctly, businesses can maintain a realistic view of their inventory costs, improve financial planning, and enhance overall business performance. Vencru’s inventory management solution provides the tools and automation necessary to streamline the revaluation process, ensuring that businesses can easily and confidently navigate the challenges of market fluctuations.

Ready to transform your Inventory management? Explore Vencru here or book a demo.

Related Content