Inventory management is the heartbeat of every retail and wholesale business. To make informed decisions and stay financially sound, business owners need an accurate understanding of the value of their inventory. This is where an inventory valuation report comes into play. In this article, we’ll explore the intricacies of an inventory valuation report, why it’s indispensable for retailers and wholesalers, what elements it should encompass, and how Vencru can streamline this critical process.

Table of Contents

- What is an inventory valuation report?

- Why is the valuation of inventories important in financial reporting?

- What Is Included in an Inventory Valuation Report (template below)?

- Why Vencru Is Great for Automating Inventory Valuation Reports

What Is an Inventory Valuation Report?

An inventory valuation report is a financial document that assesses the total value of a company’s inventory. It provides a snapshot of how much the inventory is worth at a specific point in time. This report is invaluable for business owners as it aids in financial decision-making, tax reporting, and understanding the business’s overall health.

Why is the valuation of inventories important in financial reporting?

Proper inventory valuation is a financial requirement and a fundamental aspect of effective business management. There are four important reasons:

Accurate Profit Calculation:

Valuing your inventory correctly directly impacts your profit calculation. The Cost of Goods Sold (COGS), a key profit component, depends on how you value your inventory. Accurate profit figures are essential for assessing business performance and making informed decisions. For example, imagine you run a bakery, and your inventory includes flour, sugar, and eggs. If you undervalue these ingredients, your COGS will be artificially low, leading to an inflated profit figure. This could mislead you into thinking your bakery is more profitable than it is.

Tax Reporting:

Most tax authorities require businesses to report their income accurately. Valuing your inventory correctly ensures that you report your taxable income in compliance with tax regulations. Incorrect inventory valuation can lead to underreporting or overreporting income, resulting in penalties or audits. For example, suppose you own a small retail store and mistakenly undervalue your inventory during tax reporting. This could lead to underreporting your income, triggering an audit, fines, or additional taxes owed.

Loan Applications:

When seeking loans or credit lines from financial institutions, accurately representing your business’s assets is crucial. Lenders rely on financial statements to assess your creditworthiness. An inventory valuation that doesn’t reflect the true value of your assets can affect your ability to secure financing. For example, suppose you plan to expand your business and need a loan to fund the expansion. In that case, an underestimated inventory value may result in the bank offering a lower loan amount than you need.

Operational Decisions:

Knowing the correct value of your inventory is essential for making informed operational decisions. For example, it helps you determine when to reorder stock, identify slow-moving items, and optimize pricing strategies. For example, If you own a clothing store, accurately valuing your inventory helps you determine which items are selling well and which are not. This information lets you make data-driven decisions about restocking, clearance sales or introducing new product lines.

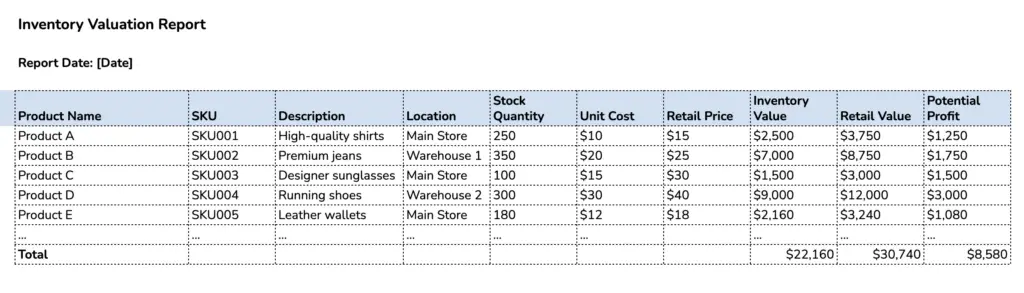

What Is Included in an Inventory Valuation Report (template below)?

Typically, a comprehensive inventory valuation report should encompass the following:

- Item Details: Product names, descriptions, and unique identifiers.

- Unit Costs: The cost of each item.

- Quantity: The number of each item in stock.

- Total Value: The value of each item multiplied by its quantity.

- Categories: Grouping items by categories, facilitating analysis.

- Valuation Method: The method used to determine the inventory’s value (FIFO, LIFO, Weighted Average, etc.).

- Date: The specific date the valuation is conducted.

- Comparison: A comparison to previous valuation reports to identify trends.

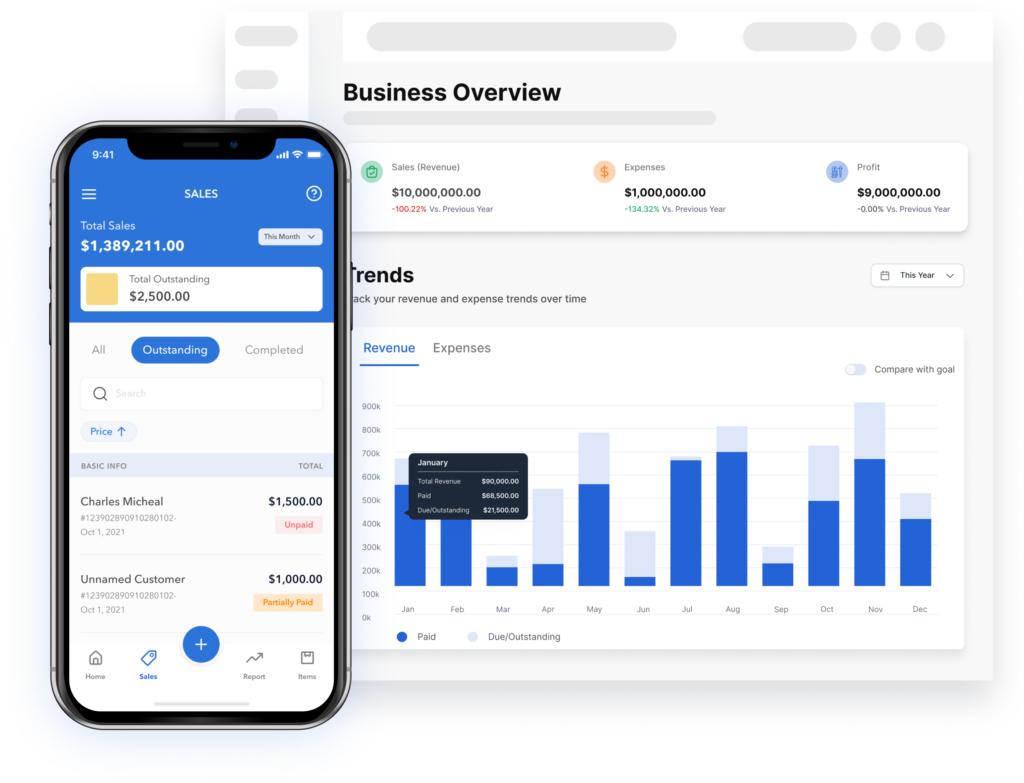

Why Vencru Is Great for Automating Inventory Valuation Reports

Vencru is an inventory and accounting software. Vencru assists retailers and wholesalers in automating inventory valuation reporting through real-time tracking, precise Cost of Goods Sold (COGS) calculations, support for average costing valuation method, comprehensive reporting, data accuracy, and a user-friendly interface. This automation saves time, reduces errors, and ensures that businesses have up-to-date inventory data for informed decision-making.

Conclusion

In the dynamic retail and wholesale world, precise inventory valuation is a non-negotiable aspect of financial management. Thus, an inventory valuation report offers business owners invaluable insights into their assets. This helps them make informed decisions, maintain tax compliance, and ensure the company’s overall financial health. With Vencru’s robust features and automation capabilities, generating an accurate inventory valuation report becomes streamlined and efficient, allowing business owners to focus on confidently growing their enterprises. Say goodbye to manual calculations and embrace the future of inventory valuation with Vencru.