If you run a small business, chances are you’ve had some experience with invoicing procedures. Most likely, you’ve been using a simple spreadsheet to track expenses and generate bills.

“How much time does it take to invoice clients? What should I include in my invoices? Should I send them via email or snail mail”?

The average small business spends over $1,500 per year on postage alone. Suggesting that every day, thousands of dollars are spent on invoicing procedures. If they don’t get paid promptly, they risk losing customers and missing opportunities.

You may even use a template when you print out a bill. Invoice templates can save you time and effort, but they also come with challenges.

However, there are many benefits to using an online tool like Vencru instead of a traditional paper-based system.

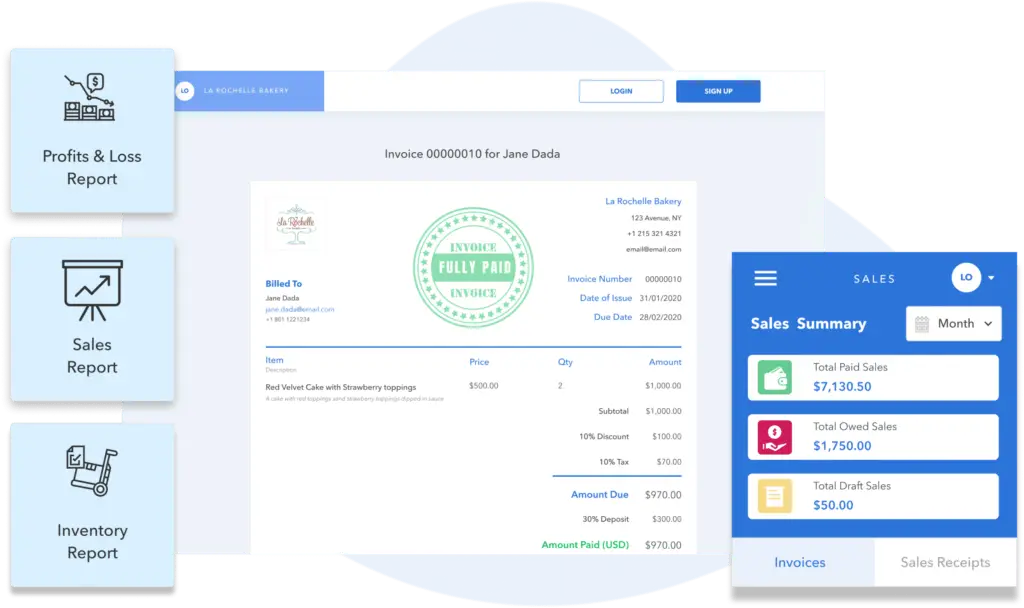

Vencru is the easiest invoicing and accounting software to get your sales and business reports. You can automate various processes using this brilliant tool.

6 Invoicing Practices For Small Businesses

Invoicing procedures are a necessary part of running your own business, whether you’re self-employed or have employees. It’s one of those things where if you do it right, you will be rewarded for doing good work.

But if you don’t pay attention to details, you could end up wasting money on postage, printing costs, late fees, bad debt…the list goes on.

Here are some of the best practices to make invoicing for small businesses more efficient:

- Make Sure Your Invoices Are Easy For Clients To Understand

- Verify It’s Clear And Reflects Your Company’s Branding

- Write down the correct date and reference number

- Ensure that the invoice includes the right terms of payment, the amount for payment, and the due date

- Clarify every item on the invoice

- Automate your routine invoicing tasks

Make Sure Your Invoices Are Easy For Clients To Understand

Make sure everything is easy for them to see so that when they glance at the form, they don’t need any help navigating through the payment process.

Keep jargon out of your writing. Clients must understand everything you say. Make them feel comfortable by keeping things simple.

Always ask for a credit card number or other forms of payment before sending the invoice. This will ensure you get paid promptly.

If there’s doubt about the validity of the payment, don’t send it until you have received confirmation from both parties.

Make Sure It’s Clear And Reflects Your Company’s Branding

A business invoice isn’t just any old piece of paper; it represents your brand. Therefore, your brand identity and value system must align with each word and format of the content.

Use every opportunity to remind your customers why they chose your product/service.

The Invoice Is An Opportunity To:

- Create a positive first impression

- Set the stage for follow-up communications

- Demonstrate your value in action

Invoices are a critical part of running a business, so it only makes sense that they should also reflect those same values. They can serve as an opportunity for you to make a positive first impression on customers and prospects alike.

This doesn’t mean you need to go all out and spend thousands of dollars on custom letterhead or envelopes. Instead, use basic templates and fonts to demonstrate your brand’s values throughout the entire experience.

Also, invoices allow you to set the stage for follow-up communications.

Write Down The Correct Date And Reference Number

When there’s so much back and forth between multiple invoices, it’s difficult to keep track of account records.

Organize your invoices by date and use references (numbers) to identify them when communicating with your client and within your organization.

Inventory management software helps you track your inventory so that you don’t double bill clients or customers.

Make sure you have the proper tools to create these invoices. A basic word processor can be used, but there’s nothing sad than creating something beautiful only to find out later that you didn’t save it in draft mode.

It may sound silly, but using the correct software can help ensure that you have everything you need.

Ensure That The Invoice Includes The Right Terms Of Payment, The Amount For Payment, And The Due Date

One way to keep things clear for the user is to clearly state any rules regarding the use (e.g., “terms of service,” “due dates,” etc.), payment options, refunds, cancellations, etc.

It helps ensure that everyone has the same understanding of the project. Ensure everything looks similar from one page to another.

Make sure not to confuse yourself when dealing with multiple invoices and multiple businesses. Write each one down clearly so there won’t be any confusion.

The last part of the invoice needs to focus on any discounts or special offers you may have. You can also include a line about shipping costs if you offer it as an option.

The customer should know their final cost before they make a purchase. Endeavor to include everything necessary to calculate the total price.

Clarify Every Item On The Invoice

The clarity for your clients is an important part of any business relationship. It gives them a chance to understand why they’re paying so much for something.

And if you show them where their money goes, then you’ve given them some insight into whether they need what you offer.

Don’t overwhelm them with too many things at once. Keep it simple! Be brief and straight.

If any additional questions need clarification, clients will certainly contact you.

Your invoice should be clear as possible, but also concise. It shouldn’t have too many words or numbers that can easily confuse the reader.

This helps them understand exactly what they are paying and why. It’ll help reinforce the trustworthiness of your business.

It can also give a bit of extra information to new clients who may not know much about you yet.

Automate Your Routine Invoicing Tasks

Accounting software simplifies the invoice creation processes by automating certain important steps.

Businesses could greatly benefit from these professional services. Invoice management can be an expensive task for companies.

Automate manual tasks using an integrated accounting system so they don’t take up too much of your time and eliminate any chance for errors.

Besides, if your business is growing, it will be more efficient to use a cloud-based tool that makes it easy for you to access data from anywhere at any time.

Invoicing software for small businesses like Vencru can help you automate your invoicing procedures and make bookkeeping for your company more efficient.

Using Vencru can help you ensure that all your invoicing policies and procedures are streamlined.

Final Takeaway

Invoices are important parts of a business. They provide information about the financial status of a company, which helps you make informed decisions on hiring new employees or spending money on marketing campaigns.