Efficient invoicing is crucial for maintaining a healthy cash flow in any business. As a small business owner, you might be juggling various tools to get the job done. Two popular options are invoicing software and spreadsheets. Each has its advantages and challenges, and choosing the right one can significantly impact your workflow and financial management.

This post will help you understand which tool is right for your business needs and how to make an informed choice. In this post, we will discuss:

- What is an invoice?

- Understanding Invoicing Needs

- What is Invoicing with Spreadsheets: Pros and Cons

- What is Invoicing Software: Pros and Cons

- Key Factors to Consider When Making a Choice

What is an invoice?

An invoice serves as a crucial financial document issued by a seller to a buyer, detailing the transaction’s specifics. It outlines the products or services provided, quantities, agreed prices, and the total amount due. Additionally, it includes payment terms like the due date and accepted payment methods.

Invoices are vital for businesses as they facilitate accurate record-keeping, aid in tracking sales, and help manage accounts receivable. They also establish a formal record of the transaction, providing both parties with a clear understanding of their obligations. Overall, invoices play a pivotal role in ensuring smooth financial operations and maintaining healthy cash flow for businesses.

Understanding Invoicing Needs

Firstly, it’s important to recognize that invoicing isn’t just about getting paid; it’s about doing so accurately, on time, and professionally. Small businesses need reliable invoicing methods to ensure smooth operations and maintain good relationships with clients. Therefore, key needs include accuracy, timeliness, professionalism, and effective record-keeping.

What is Invoicing with Spreadsheets?

A spreadsheet for invoicing is a template or custom-created spreadsheet used to generate and manage invoices. It helps businesses keep track of sales transactions, client information, payments due, and other relevant financial data. Typically created using software like Microsoft Excel, Google Sheets, or Apple Numbers, these spreadsheets can streamline the invoicing process and provide a clear overview of a company’s financial dealings.

Spreadsheets are a common choice for many small business owners when it comes to invoicing. They offer a familiar, customizable, and often cost-effective solution. However, they also come with several drawbacks that can impact efficiency and accuracy as your business grows.

Pros:

- Low cost: Spreadsheets are often free or included with other software packages you might already be using, making them a budget-friendly option.

- Customizability: You can tailor spreadsheets to your specific invoicing needs, creating templates and formulas that work best for your business.

- Familiarity: Many business owners are already familiar with basic spreadsheet functions, reducing the learning curve and enabling quick setup.

Cons:

- Time-consuming: Manual entry and updates can eat up valuable time, which could be spent on other essential business activities. Generating and tracking invoices requires constant attention and can be a tedious process.

- Higher risk of errors: Simple mistakes, such as a misplaced decimal or incorrect data entry, can lead to significant issues like incorrect billing or financial discrepancies. These errors can be costly and damage your professional reputation.

- Lack of automation: Every task requires manual input, from creating invoices to sending reminders for overdue payments. This lack of automation can slow down your workflow and increase the likelihood of errors.

- Limited scalability: As your business grows, managing an increasing number of invoices on spreadsheets becomes cumbersome. The more clients and invoices you have, the harder it is to keep everything organized and efficient. Spreadsheets can quickly become messy and hard to handle, causing inefficiencies and possible data loss.

While spreadsheets are a viable solution for small businesses starting, their limitations become apparent as your business scales. The time and effort required to maintain accurate and efficient invoicing can be better spent on other growth activities. As your business expands, considering more robust invoicing solutions that offer automation, error reduction, and scalability can save time and reduce stress.

What is Invoicing Software?

Invoicing software is a digital tool designed to streamline the process of creating, sending, and managing invoices. It automates various aspects of invoicing, such as generating invoices, tracking payments, and sending reminders to clients.

Invoicing software like Vencru offers features beyond basic invoicing, such as expense tracking, reporting, and integration with accounting software. These tools are valuable for freelancers, small businesses, and large enterprises. They help save time, reduce errors, improve cash flow management, and provide other benefits over traditional spreadsheet methods.

Pros:

- Automation: Invoicing software can automatically generate and send invoices, significantly saving time. Recurring invoices, payment reminders, and late fees can be managed without manual intervention.

- Error reduction: Built-in checks and balances help minimize the risk of mistakes. Automated calculations ensure accuracy, reducing the likelihood of human error that can occur with manual data entry.

- Professional templates: Create polished, branded invoices effortlessly using professional templates. This not only saves time but also enhances your business’s professional image and consistency.

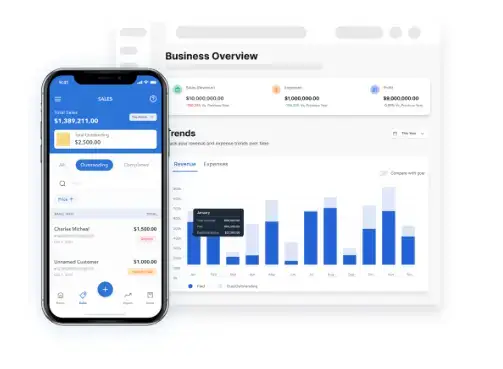

- Tracking and reporting: Easily monitor outstanding invoices and generate comprehensive financial reports. Real-time tracking of payments, overdue accounts, and overall cash flow can provide valuable insights into your business’s financial health.

- Integration: Seamlessly connect with other business tools like accounting software, CRM systems, and payment gateways. This integration streamlines your workflow and ensures all your financial data is synchronized and up to date.

- Payment Processing: Many invoicing software solutions include built-in payment processing options, allowing clients to pay directly through the invoice. This feature can speed up payment times and improve cash flow.

- Scalability: Invoicing software can grow with your business. Whether you have a handful of clients or thousands, the software can handle increasing volumes without sacrificing efficiency or accuracy.

- Mobile Accessibility: Many invoicing solutions like Vencru offer mobile apps, allowing you to manage invoices, send reminders, and track payments on the go. This flexibility ensures you stay on top of your invoicing tasks, even when away from your desk.

Cons:

- Cost: Subscription fees for invoicing software can add up over time. Depending on the features and level of service, these costs can be a consideration, especially for very small businesses or startups.

- Learning curve: It may take time to become proficient with new software. Initial setup, customization, and learning how to use all the features effectively can require a significant investment of time.

- Internet dependency: Cloud-based solutions require internet access. If your internet connection is unreliable, this dependency can pose a challenge, particularly for time-sensitive invoicing tasks.

Invoicing software provides numerous advantages over traditional spreadsheet methods, particularly in terms of automation, error reduction, and professional presentation. While there are costs and a learning curve associated with adopting new software, the benefits often outweigh these drawbacks, especially as your business grows. By leveraging the advanced features of invoicing software, you can save time, reduce errors, and maintain a more organized and efficient invoicing process.

Related Read: How Vencru compares to others

Key Factors to Consider When Making a Choice

When deciding between spreadsheets and invoicing software, it’s crucial to evaluate the specific needs and circumstances of your business. Here are key factors to consider:

- Business Size and Complexity: Larger businesses or those with complex operations require more robust invoicing systems to handle various clients, multiple products or services, and extensive financial tracking. If your business involves a lot of transactions, varied pricing models, or requires detailed financial reports, invoicing software can provide the necessary tools to manage this complexity efficiently.

- Invoice Volume: High volumes of invoices can quickly become unmanageable with spreadsheets, leading to inefficiencies and errors. Evaluate the number of invoices you process monthly. If your volume is high, invoicing software will save time and reduce the risk of mistakes, helping maintain a smooth invoicing process.

- Budget: The cost of software can be a significant consideration for small businesses or startups. However, it’s essential to balance this cost against the potential time savings and efficiency gains. Compare the subscription fees of invoicing software with the amount of time saved from automation and error reduction. Calculate the potential return on investment (ROI) to determine if the software is worth the expense.

- Integration Needs: Seamless integration with other business systems (e.g., accounting software, and CRM systems) can streamline operations and ensure all your data is synchronized. Identify the business tools you already use and check if the invoicing software integrates with them. Integration can enhance efficiency by reducing duplicate data entry and providing a unified view of your business finances.

- Team’s Technical Skills: The ease of use of the invoicing tool is critical to ensure your team can adopt and use it effectively without extensive training or frustration. Assess your team’s comfort level with technology. Choose a tool that matches their technical skills to ensure smooth implementation and utilization. User-friendly software can improve productivity and reduce the time spent on training.

Making the Decision

To sum up, both invoicing software and spreadsheets have their advantages and disadvantages. Here’s a quick checklist to help you decide:

- Do you handle a high volume of invoices monthly?

- Do you need advanced features like automation and reporting?

- Are you looking for a scalable solution as your business grows?

- Can you afford the subscription costs for invoicing software?

- Is your team comfortable using new software?

If you answered “yes” to most of these questions, invoicing software might be the better choice. If not, spreadsheets could suffice for now. Therefore, consider trying both options to see which fits your workflow best.

Streamline Your Invoicing With Vencru

Choosing the right invoicing tool is essential for efficient business operations. While spreadsheets might be adequate for some, invoicing software offers advanced features that can save time and reduce errors, especially as your business grows.

Vencru offers a comprehensive invoicing solution integrating inventory management and robust accounting features in one simple platform. Whether you’re just starting or a more established business, Vencru’s got you covered with affordably priced plans that align with your business needs. Experience simple invoicing, inventory management, purchase order management, client and vendor management, expense tracking, budgeting tools, robust double-entry accounting reports and business insights, employee management and so much more on Vencru- Get started here or book a demo.

Related Read: