Introduction

Invoices play a pivotal role in documenting the exchange of goods and services. Two types of invoices that often create confusion are proforma invoices and commercial invoices. While both serve as vital financial documents, they serve different purposes and come into play at different transaction stages. This comprehensive guide will review proforma vs commercial invoice use cases. We will also discuss how to create each of them and introduce you to Vencru, a powerful tool for managing your invoicing needs.

Proforma Invoice vs Commercial Invoice

Proforma invoices and commercial invoices serve distinct purposes. They are used at different stages of a business transaction. The primary differences between them include:

What is a Proforma Invoice?

A proforma invoice, often called a preliminary invoice or quotation, serves as a pre-contractual document the seller provides to the buyer. It outlines the details of a potential transaction, including the description of goods or services, quantities, prices, terms, and other essential information.

Example: Imagine you’re a manufacturer about to export a batch of your products to an overseas buyer. Before the actual deal is sealed, you provide the buyer with a proforma invoice detailing the product specifications, quantities, prices, and estimated shipping costs.

What is a Commercial Invoice?

A commercial invoice, on the other hand, is a legally binding document that serves as evidence of the sale between the buyer and seller. It contains comprehensive information about the transaction, such as the agreed-upon terms, actual goods or services provided, their quantities, prices, payment terms, and shipment details.

Example: the seller issues a commercial invoice to the buyer after shipping or delivering the goods. This document is essential for customs clearance and tax purposes, as it reflects the actual value of the transaction.

How to Create a Proforma Invoice

Creating a proforma invoice is relatively straightforward. You can create a proforma invoice using an estimate generator or estimate software. You can also use Microsoft Word. Include the following details:

- Your business’s name, contact information, and logo.

- The customer’s details.

- A unique invoice number and date.

- A clear description of the goods or services.

- An itemized list with quantities and prices.

- Payment terms and due date.

- Any applicable taxes, shipping costs, or discounts.

- Total amount due.

How to Create a Commercial Invoice

Creating a commercial invoice follows a process similar to a proforma invoice. The key difference lies in the inclusion of real transaction details. Here’s what to include:

- Your business’s name, contact information, and logo.

- The customer’s details.

- A unique invoice number and date.

- Comprehensive description of the delivered goods or services.

- An itemized list with quantities and actual prices.

- Agreed-upon payment terms and due date.

- Any applicable taxes, shipping costs, or discounts.

- Total amount due.

Related: Proforma Invoice vs Sales Order

Vencru: The Proforma and Commercial Invoice Software

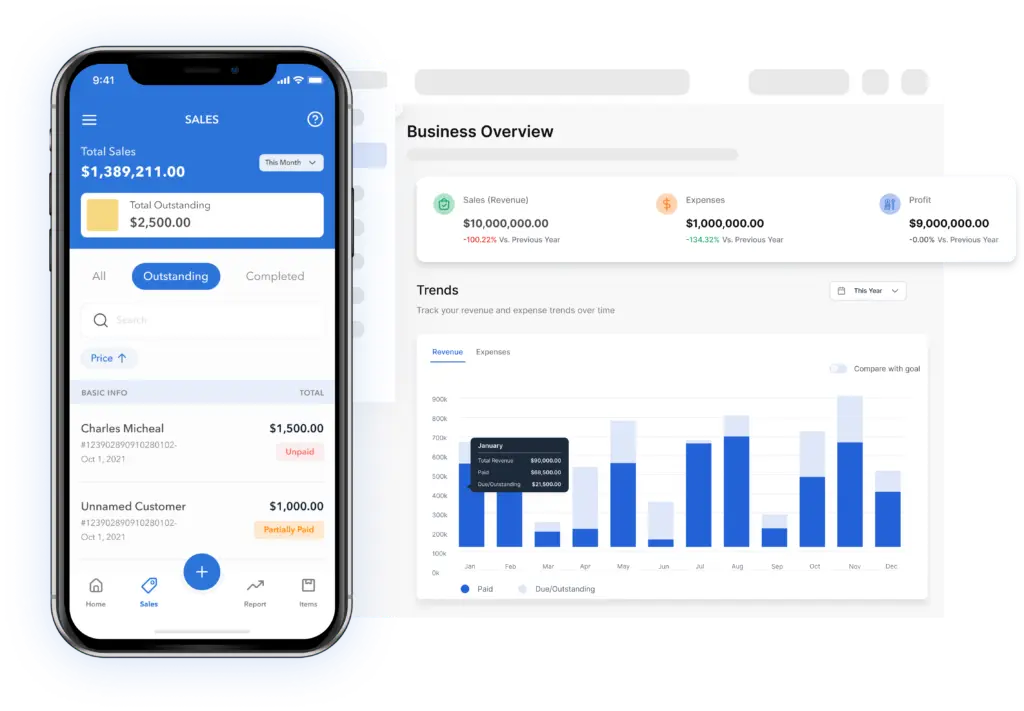

Managing your invoicing process, whether proforma or commercial, can be streamlined with the help of Vencru, an all-in-one business management software. Vencru’s features include:

- Estimating: Generate precise estimates for your products or services, ensuring clarity and transparency in your dealings.

- Invoicing: Create professional, customized invoices effortlessly. With Vencru, you can convert estimates into invoices seamlessly.

- Accounting: Keep your financial records in order with Vencru’s robust accounting tools. Track income, expenses, and more.

Conclusion

In summary, proforma invoices and commercial invoices serve distinct purposes in the world of business and trade. Proforma invoices are preliminary documents that outline potential transactions, while commercial invoices are legally binding records of completed transactions. Creating both invoices can be made efficient with the right tools, such as Vencru, which offers comprehensive features to streamline your estimating, invoicing, and accounting needs. Understanding these invoice types and utilizing the right software can enhance your business’s financial processes, ensuring smooth transactions in the competitive world of commerce.