The transportation and logistics industry is a powerhouse, keeping the world’s goods moving efficiently. But behind the scenes, managing the financial health of your transportation business can feel like navigating a winding road without a map. Here’s where a well-defined chart of accounts for transportation and logistics (car rental, trucking, etc.) comes in – your roadmap to financial clarity and informed decision-making.

In this guide, we’ll explore the following:

- Understanding the Chart of Accounts

- Benefits of a Tailored COA for Transportation Businesses

- Building Your Transportation-Focused COA

- Sample Chart of Accounts for Transportation and Logistics

- Transportation and Logistics Transactions with Journal Entries

- Streamline Your Transportation Business with Vencru

Understanding the Chart of Accounts

Before diving into specifics, let’s grasp the essence of the Chart of Accounts. Think of it as your business’s financial GPS, guiding you through the intricate terrain of income, expenses, assets, liabilities, and equity. Each account within the chart serves as a signpost, categorizing all your income (revenue) and expenses into specific accounts, providing a crystal-clear picture of your financial well-being.

Related Read: Chart of Accounts: Definition, example, and industry-specific versions

Benefits of a Tailored COA for Transportation Businesses

- Effortless Reporting: Generate insightful financial reports like income statements and balance sheets with ease. These reports become your allies, enabling you to track key metrics, identify improvement areas, and confidently make strategic business decisions.

- Streamlined Accounting Processes: Categorizing transactions into designated accounts simplifies bookkeeping and minimizes errors. This translates into smoother tax preparation and ensures adherence to financial regulations specific to the transportation industry.

- Enhanced Efficiency: Imagine a clear and consistent chart of accounts for car rental and trucking business – it saves you valuable time and resources by eliminating confusion when recording transactions related to vehicles, fuel, maintenance, and other transportation-specific costs.

- Industry-Specific Insights: By tailoring your chart of accounts to your specific niche (car rental, trucking, etc.), you can capture critical financial details unique to your operations. This level of granularity empowers you to benchmark your performance against industry standards and identify areas for cost optimization.

Building Your Transportation-Focused COA

Now that you understand the power of a COA, let’s roll up your sleeves and build one specifically for your transportation business! Here’s a step-by-step guide:

- Research Industry Standards: Familiarize yourself with the standard account names and numbering systems commonly used in your niche (car rental, trucking, etc.). This ensures consistency and facilitates communication with external entities like banks, accountants, and industry regulators.

- Tailor it to Your Needs: Consider factors like the type of vehicles you operate (cars, trucks, etc.), your service offerings (rentals, freight transportation, etc.), and your business structure (sole proprietorship, partnership) when customizing your COA.

- Essential Account Categories: Most COAs typically include five main categories: Assets, Liabilities, Equity, Revenue, and Expenses.

Sample Chart of Accounts for Transportation and Logistics

A well-defined chart of accounts (COA) is essential for any transportation and logistics business (car rental, trucking, etc.). It categorizes all your financial transactions, clearly showing your financial health. Here’s a sample chart of accounts with specific accounts tailored for the transportation industry, particularly focusing on car rental and trucking businesses:

Assets

| Account Code | Account Name | Description |

|---|---|---|

| 1000 | Cash | Funds available to cover business expenses held in a checking or petty cash account. |

| 1100 | Vehicles (Car Rental) | The value of cars owned by the car rental business. |

| 1101 | Trucks (Trucking) | The value of trucks owned by the trucking business. |

| 1102 | Trailers (Trucking) | The value of trailers owned by the trucking business. |

| 1200 | Equipment | Tangible assets (e.g., maintenance tools, office equipment) used in the business operations, less accumulated depreciation. |

| 1300 | Land | The physical land area owned by the business (e.g., terminal facilities for trucking companies). |

| 1400 | Buildings | Structures (e.g., office buildings, warehouses) owned by the business, less accumulated depreciation. |

| 1500 | Furniture & Fixtures (Car Rental) | Movable assets used in the car rental business (e.g., desks, chairs), less accumulated depreciation. |

Liabilities

| Account Code | Account Name | Description |

|---|---|---|

| 2000 | Accounts Payable | Money owed to suppliers (e.g., fuel vendors, repair shops) for goods or services purchased on credit. |

| 2100 | Loans Payable (Car Rental) | The outstanding balance of loans taken to finance vehicle purchases for the car rental business. |

| 2101 | Truck Loans (Trucking) | The outstanding balance of loans taken to finance the purchase of trucks for the trucking business. |

Equity

| Account Code | Account Name | Description |

|---|---|---|

| 3000 | Owner’s Equity | The initial investment made by the owner(s) of the business, plus any accumulated profits or losses. |

| 3100 | Retained Earnings | The accumulated profits of the business are reinvested in the business rather than paid out as dividends. |

Revenue

| Account Code | Account Name | Description |

|---|---|---|

| 4000 | Car Rentals (Car Rental) | Revenue earned from renting cars to customers. |

| 4001 | Freight Transportation Fees (Trucking) | Revenue earned from transporting goods for customers. |

| 4002 | Detention Charges (Trucking) | Revenue earned from additional fees levied for exceeding allowed unloading time at delivery destinations. |

| 4003 | Fuel Surcharges (Trucking) | Revenue earned from additional charges based on fluctuating fuel costs. |

| 4004 | Insurance Waivers (Car Rental) | Revenue earned from selling optional insurance waivers to car rental customers. |

| 4005 | Late Fees | Revenue earned from late charges for vehicle returns (car rentals) or late deliveries (trucking). |

Expenses

| Account Code | Account Name | Description |

|---|---|---|

| 5000 | Vehicle Maintenance & Repairs | Costs associated with maintaining and repairing vehicles (cars or trucks). |

| 5100 | Fuel Costs | The cost of fuel for operating vehicles. |

| 5200 | Insurance Premiums | Costs of various business insurance policies (e.g., liability, property, worker’s compensation). |

| 5300 | Employee Salaries & Benefits | The total cost of employee compensation, including salaries, bonuses, and payroll taxes. |

| 5400 | Marketing & Advertising | Costs associated with marketing and advertising the business. |

| 5500 | Permits & Licenses (Trucking) | Costs associated with obtaining and maintaining permits and licenses required for operating trucks. |

Transportation and Logistics Transactions with Journal Entries

Now that you have a solid understanding of the chart of accounts for transportation and logistics businesses (car rental, trucking, etc.), let’s see how these accounts come alive with real-world scenarios and their corresponding journal entries:

Scenario 1: Renting a Car and Paying Cash (Car Rental Business)

Transaction: A customer rents a car for $200 and pays in cash.

Journal Entry:

| Account Code | Account Name | Debit | Credit | Description |

|---|---|---|---|---|

| 1000 | Cash | $200 | Increase in cash received from car rental. | |

| 4000 | Car Rentals | $200 | Revenue earned from renting a car. |

Scenario 2: Making a Fuel Payment with a Credit Card (Trucking Business)

Transaction: The trucking company pays $500 for fuel using a credit card.

Journal Entry:

| Account Code | Account Name | Debit | Credit | Description |

|---|---|---|---|---|

| 510o | Fuel Costs | $500 | Expense incurred for fuel. | |

| 2000 | Accounts Payable | $500 | Increase in debt owed to the fuel supplier. |

Scenario 3: Paying Monthly Salaries to Drivers (Transportation & Logistics)

Transaction: The company pays its drivers a total of $3,000 in monthly salaries.

Journal Entry:

| Account Code | Account Name | Debit | Credit | Description |

|---|---|---|---|---|

| 5300 | Employee Salaries & Benefits | $3,000 | Expense incurred for employee salaries. | |

| 1000 | Cash (if paid in cash) | $3,000 | Decrease in cash used to pay salaries. | |

| 2000 | Accounts Payable (if paid with a check) | $3,000 | Increase in debt owed for employee salaries. |

These scenarios demonstrate how transactions flow through the chart of accounts using debits and credits to record financial activity. By consistently maintaining these entries, you’ll gain valuable insights into your transportation and logistics business’s financial health, allowing you to make informed decisions for long-term success.

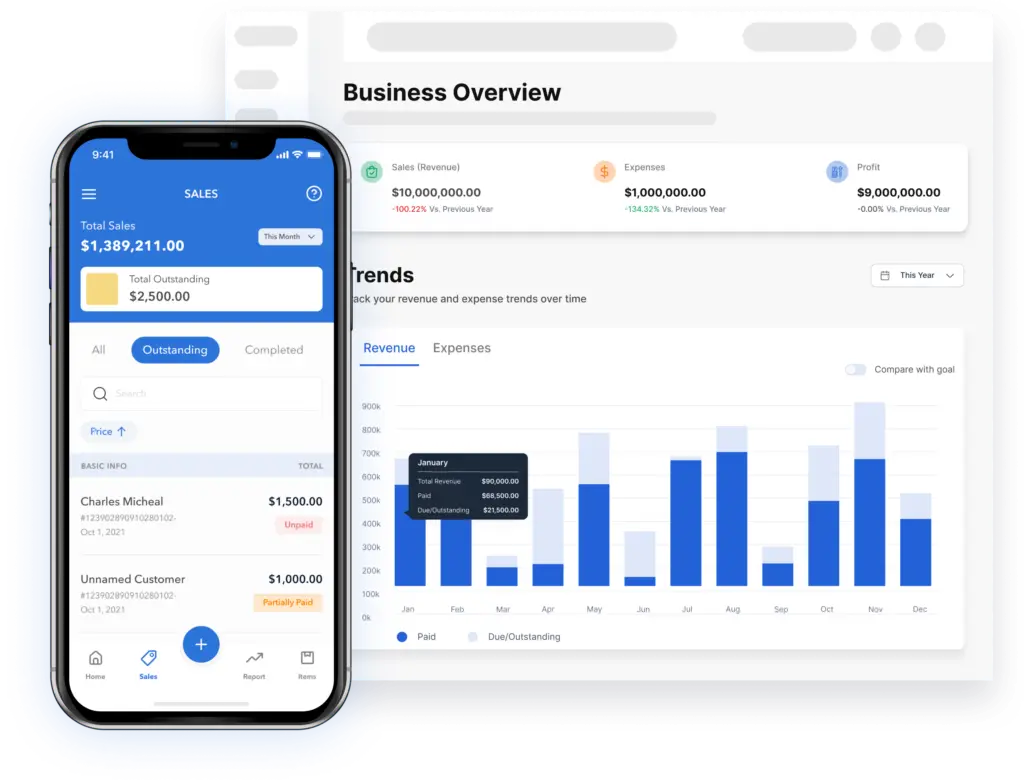

Streamline Your Transportation Business with Vencru

The transportation and logistics industry thrives on efficiency. You keep the world’s goods moving, but managing your finances can feel like navigating a traffic jam without a GPS. Vencru is your secret weapon to clear the roadblocks and propel your business toward financial success.

Here’s why Vencru is the perfect co-pilot for your transportation and logistics journey:

- Effortless Chart of Accounts Management: Vencru provides a pre-built chart of accounts. No more struggling to categorize transactions.

- Seamless Expense Tracking: Vencru lets you capture and categorize expenses on the go with our mobile app. Say goodbye to manual data entry and hello to accuracy and efficiency!

- Real-Time Financial Insights: Gain instant visibility into your financial performance. Vencru’s insightful reports become your window into the world of key metrics. Track fuel costs, vehicle maintenance expenses, and overall profitability with ease.

- Effortless Collaboration: Vencru fosters seamless collaboration with your team, accountant, or financial advisor. Share reports, track key metrics, and access financial data anytime, anywhere, on any device.

- Scalability for Growth: As your business scales, Vencru scales with you. Our flexible plans adapt to your evolving needs, ensuring you have the tools and features you need to stay ahead of the curve.

Ready to explore Vencru? Get started here or book a demo

Related Content