Inventory accounting is crucial for any product-based business, emphasizing the systematic tracking and valuation of stock. Understanding what inventory accounting is allows businesses to accurately determine their inventory’s value, which is vital for financial insights, operational efficiency, and tax compliance. Effective inventory accounting impacts profit margins, pricing strategies, inventory costs, and overall business management by ensuring optimized inventory levels and precise financial records. This blog will explore the fundamentals of inventory accounting, delve into various methods, and provide insights into effective inventory practices.

What is Inventory Accounting?

Inventory accounting is the process of tracking, valuing, and managing a company’s stock, which includes raw materials, work-in-progress (WIP), and finished goods. This accounting practice assigns a financial value to inventory and records it in the company’s financial statements. The accuracy of inventory accounting plays a critical role in a business’s overall financial health, as it directly impacts the cost of goods sold (COGS), profit margins, tax liabilities, and key financial ratios.

Inventory accounting influences decisions such as how much stock to reorder, when to reorder, and how much to sell a product for. Mismanagement of inventory accounting can lead to poor cash flow management, inaccurate financial reporting, and inefficient operations.

Why Is Inventory Accounting Important?

Inventory is often one of the largest assets on a company’s balance sheet, particularly for businesses involved in manufacturing, retail, or distribution. Effective inventory accounting methods provides businesses with several key benefits:

- Financial Transparency: By accurately valuing inventory, businesses can generate financial statements that reflect the true cost of operations and profitability.

- Cost Management: Inventory accounting helps businesses track costs associated with purchasing, holding, and selling inventory, enabling better cost control.

- Tax Compliance: Inventory is an asset, and its valuation impacts taxable income. Proper accounting ensures businesses comply with tax regulations.

- Operational Efficiency: By knowing the exact value and quantity of inventory, businesses can make informed operational decisions such as reordering stock, pricing strategies, and production planning.

Inventory Valuation Methods: Which One is Right for You?

When it comes to inventory accounting and valuation, there are a few widely accepted methods that impact financial statements and tax liabilities. Here’s an overview of the most common methods:

1. FIFO (First In, First Out)

This method assumes the oldest stock is sold first, meaning inventory is valued at the cost of the latest items. FIFO reflects the actual flow of goods in most industries and provides a more accurate view of profit margins, especially when prices rise over time.

2. LIFO (Last In, First Out)

LIFO values inventory by assuming the most recent stock is sold first. This method is less commonly used and often more favorable during inflationary periods as it increases the cost of goods sold (COGS), thereby lowering taxable income. However, it may not be accepted in all regions, such as IFRS-compliant countries.

3. WAC (Weighted Average Cost)

WAC assigns an average cost to all units of inventory, making it a simple yet effective way to calculate COGS. This method works well when inventory items are similar in cost or when tracking individual item costs is difficult, aiding in inventory management.

Related Read: Inventory Valuation Methods: Which One Should You Choose?

Managing Inventory Costs: Breaking Down Expenses

Inventory costs extend beyond the price of purchasing stock; they encompass a variety of expenses involved in storing, ordering, and managing products. Understanding these costs allows businesses to make informed decisions about inventory levels and avoid unnecessary financial burdens. Below, we break down the key types of inventory costs:

1. Holding Costs

Holding costs refer to the expenses incurred when storing unsold inventory. These include:

- Warehousing Expenses: Costs related to maintaining storage facilities, such as rent, utilities, and security.

- Insurance: Premiums that are paid to insure inventory against risks like theft, damage, or disasters.

- Depreciation: The loss in value of inventory over time, especially if items become obsolete or perishable.

- Opportunity Costs: The cost of capital tied up in unsold inventory that could be used elsewhere in the business.

2. Ordering Costs

These are the expenses involved in replenishing inventory. These include:

- Shipping and Handling: Costs associated with transporting goods from suppliers to your warehouse.

- Supplier Fees: Charges incurred for processing orders, including restocking and minimum order requirements.

- Administrative Costs: The time and resources spent managing purchase orders, negotiations with suppliers, and coordinating deliveries.

3. Stockout Costs

Stockout costs arise when a business runs out of inventory and cannot fulfill customer orders. The consequences of stockouts include:

- Lost Sales: Missed revenue opportunities due to an inability to meet demand.

- Damaged Reputation: Frequent stockouts can harm customer trust and satisfaction, leading to long-term losses.

- Expedited Shipping Costs: To mitigate stockouts, businesses may resort to rush orders, which come with higher shipping fees.

4. Carrying Costs

Carrying costs overlap with holding costs but focus specifically on expenses related to unsold inventory. These include:

- Obsolescence: The risk of products becoming outdated or no longer in demand, leading to potential markdowns or losses.

- Storage Risks: Losses from damaged or spoiled inventory due to improper storage conditions.

5. Setup Costs

Setup costs occur when switching production from one item to another in manufacturing environments. These costs include labor, equipment adjustments, and time spent preparing new production runs. Businesses that frequently shift between products may face higher setup costs.

6. Acquisition Costs

These are the direct costs incurred to obtain inventory, including the purchase price, shipping, and taxes. While acquisition costs may seem straightforward, understanding the full scope of these expenses is essential for determining the true cost of inventory.

7. Spoilage Costs

Spoilage costs apply to businesses that handle perishable goods, such as food, beverages, or pharmaceuticals. It occurs when inventory becomes unusable due to expiration or contamination, leading to financial loss.

Why Managing Inventory Costs Matters

Effectively managing inventory costs is critical to maintaining profitability and operational efficiency. By understanding and controlling these costs, businesses can:

- Optimize Cash Flow: Minimize unnecessary spending on holding, ordering, and carrying inventory.

- Increase Profit Margins: Reduce the financial impact of stockouts, spoilage, and obsolescence.

- Enhance Customer Satisfaction: Avoid stockouts and ensure timely deliveries, leading to stronger customer relationships.

Through a clear understanding of the various types of inventory costs, businesses can implement the best inventory accounting practices to minimize these expenses and maximize profitability.

Inventory Accounting Methods: Cash Basis vs. Accrual Basis

Businesses typically use either cash-basis or accrual-basis accounting methods to manage inventory. Understanding these methods is essential because they determine how you record inventory transactions and how your financial statements represent your business operations.

1. Cash Basis Accounting for Inventory

With the cash basis method, you record inventory purchases and sales only when cash changes hands. You recognize transactions when you make or receive payments, not when you buy or sell inventory. As a result, you expense inventory immediately when purchased, and it doesn’t appear as an asset on your balance sheet. Small businesses or sole proprietors often prefer this inventory accounting method, especially if they manage limited inventory.

2. Accrual Basis Accounting for Inventory

Accrual basis accounting, which follows GAAP standards, records transactions when they occur, regardless of payment timing. You record inventory as an asset when purchased and expense it only when sold. This inventory accounting method provides a more accurate view of your financial performance by matching the revenue from sales with the corresponding costs. Larger businesses use the accrual method because it gives a clearer picture of profitability and complies with standard accounting regulations. Adhering to inventory accounting best practices, such as regular audits and leveraging technology, further enhances accuracy and efficiency in managing inventory and financial reporting.

Comparison: Cash Basis vs. Accrual Basis

| Aspect | Cash Basis | Accrual Basis |

|---|---|---|

| Recognition of Inventory | Expensed immediately when cash is paid | Recorded as an asset and expensed upon sale (COGS) |

| Financial Accuracy | Less accurate, does not track inventory assets | Provides accurate financial statements by matching COGS with sales |

| Balance Sheet Impact | No inventory is recorded as an asset | Inventory appears as an asset until sold |

| Compliance | GAAP and IFRS-compliant | GAAP and IFRS compliant |

| Business Suitability | Suitable for small businesses with simple inventory | Ideal for larger businesses with more complex inventory and long cash cycles. |

Stock Types and Their Impact on Accounting

Understanding the different types of stock in inventory accounting is crucial for accurate financial reporting and valuation. Each stock type represents a different stage in the production or sales process, and its classification affects how it appears on financial statements. Properly managing and accounting for these inventory types helps businesses assess their financial health, control costs, and make informed decisions. Let’s explore the key stock types:

1. Raw Materials

Raw materials are the essential components or ingredients used to produce goods. They remain part of the inventory until consumed in the production process. Examples include metals, fabrics, chemicals, or any direct inputs required for manufacturing finished products.

You list raw materials as current assets on the balance sheet until you use them. Once consumed, you transfer their cost to work-in-progress or expense it directly as part of the Cost of Goods Sold (COGS).

2. Work-in-Progress (WIP)

Work-in-progress inventory includes items that are in the production process but not yet completed. WIP accounts for the costs of raw materials, direct labor, and overhead invested in partially finished products. Managing WIP helps businesses understand production efficiency and costs. You list WIP as a separate line item under inventory on the balance sheet, reflecting the ongoing cost of unfinished goods. To value WIP, you add the costs of raw materials, labor, and overhead.

3. Finished Goods

Finished goods are products that have completed the production process and are ready for sale. These items have incurred all necessary costs, including raw materials, labor, and overhead. For retailers or manufacturers, finished goods are the inventory that generates revenue when sold. You record them as inventory assets on the balance sheet. Once sold, you transfer their value to COGS, reducing the inventory account and impacting the business’s profit margin.

4. Maintenance, Repair, and Operating (MRO) Goods

MRO goods are items used to maintain or repair equipment, machinery, and other business assets. These materials are not part of the final product but are essential for smooth operations. Examples include lubricants, cleaning supplies, and spare parts for machinery. MRO inventory is classified as a current asset but does not directly impact COGS unless used for repairing production-related machinery.

5. Consignment Inventory

Consignment inventory refers to stock owned by a supplier but held by a retailer or distributor until sold. The retailer does not pay for the goods upfront; instead, they pay the supplier after a sale. This arrangement lets businesses carry inventory with less financial risk. Since the retailer does not own consignment inventory, it does not list it as an asset on their balance sheet. However, you must track it carefully to ensure proper accounting when the goods are sold.

6. Transit Inventory

Transit inventory includes goods that have been purchased but are still in transit between the supplier and the buyer. These items have not yet been received and, therefore, have not been added to the inventory. You can include transit inventory in the buyer’s financial statements, depending on the terms of the sale. Once received, you add it to the inventory account.

How to Account for Stock Discrepancies

Stock discrepancies occur when recorded inventory levels don’t match the actual physical count. These discrepancies often result from theft, damage, human error, or miscounting during stock audits. Accurately accounting for stock discrepancies is essential for maintaining correct financial records and effective inventory management. Following inventory accounting best practices can help ensure accuracy and efficiency in managing inventory.

Steps for Accounting for Stock Discrepancies

- Identify the Cause: Investigate the discrepancy by reviewing purchase orders, sales records, and physical inventory counts. Determine if the issue stems from shrinkage, miscounts, damaged goods, or another factor.

- Adjust Inventory Records: After identifying the cause, update your inventory records to match the physical count. This keeps your balance sheet accurate, reflecting actual stock levels.

- Record Adjustments in Financial Statements: Depending on whether the discrepancy is a loss (due to shrinkage or damage) or a gain (if the stock was undercounted), record the adjustment appropriately. This impacts both the inventory asset account and the Cost of Goods Sold (COGS).

- For Shrinkage or Loss: When inventory is lost, record the missing stock as an expense under COGS.

Formula:Inventory Shrinkage Loss = Book Inventory - Physical Inventory - For Gains: If the physical count exceeds the recorded inventory, adjust the stock levels upward and record the gain in financial statements.

Formula:Inventory Gain = Physical Inventory - Book Inventory

- For Shrinkage or Loss: When inventory is lost, record the missing stock as an expense under COGS.

- Monitor and Prevent Future Discrepancies: Regularly conduct inventory audits, utilize inventory management software like Vencru for real-time stock tracking, and train staff on accurate stock handling to minimize future discrepancies.

Best Practices for Inventory Accounting

Effective inventory accounting goes beyond just tracking stock levels; it requires implementing strategies that improve accuracy, efficiency, and financial transparency. Here are essential best practices for managing inventory accounting:

- Regular Audits: Consistently conduct physical inventory audits to verify that the recorded inventory levels match the actual stock on hand. This is one of the best inventory accounting practices to detect discrepancies, theft, or damage, ensuring accurate financial reporting.

- Leverage Technology: Implementing inventory management software such as Vencru enables real-time monitoring of stock levels, sales, and purchases. This reduces manual errors, improves data accuracy, and ensures that your inventory records are always up to date.

- Cycle Counting: Instead of doing a full inventory count at year-end, businesses can adopt cycle counting. This method involves counting smaller subsets of inventory throughout the year, improving accuracy while reducing disruption.

- Proper Classification: Accurately classifying inventory into raw materials, work-in-progress (WIP), and finished goods ensures proper valuation and financial reporting.

- Demand Forecasting: Use historical data and predictive analytics to forecast inventory needs. This practice helps avoid overstocking or stockouts, improving cash flow and operational efficiency.

- Maintain Accurate Inventory Valuation: Select and consistently use the right inventory valuation method (FIFO, LIFO, or WAC). Your chosen method should align with your business model, regulatory requirements, and financial goals.

- Monitor Inventory Turnover: Keep an eye on inventory turnover rates to identify slow-moving items or overstock situations. Low turnover could indicate inefficiencies in purchasing or production processes, while high turnover suggests effective inventory management.

Related Read: Inventory Management Best Practices: Guide

Inventory Accounting Glossary: Terms and Formulas

Cost of Goods Sold (COGS)

This represents the total cost of producing or purchasing the goods that were sold during a specific period.

Formula: COGS = Beginning Inventory + Purchases - Ending Inventory

Gross Profit

Gross profit is the revenue earned from sales minus the cost of goods sold, indicating how efficiently a business produces its goods.

Formula: Gross Profit = Revenue - COGS

Inventory Turnover Ratio

This ratio measures how many times a company sells and replaces its inventory over a given period.

Formula: Inventory Turnover Ratio = COGS / Average Inventory

Note: Average Inventory = (Beginning Inventory + Ending Inventory) / 2

Days Sales of Inventory (DSI)

DSI calculates the average number of days it takes to sell a company’s inventory during a specific period.

Formula: DSI = 365 / Inventory Turnover Ratio

Weighted Average Cost (WAC)

WAC is a method used in inventory accounting to value inventory by calculating an average cost for all units available for sale.

Formula: WAC = Total Cost of Inventory / Total Units Available for Sale

Straight-Line Depreciation

This method of depreciation spreads the cost of an asset evenly over its useful life.

Formula: Depreciation Expense = (Cost of Asset - Residual Value) / Useful Life

Average Cost Per Unit

The average cost per unit helps determine the cost to produce or purchase one unit of inventory.

Formula: Average Cost Per Unit = Total Cost of Goods Available for Sale / Total Units Available for Sale

Economic Order Quantity (EOQ)

EOQ is the ideal order quantity that minimizes the total holding and ordering costs.

Formula: EOQ = √((2 * Demand * Ordering Cost) / Holding Cost)

Reorder Point

This indicates when new inventory should be ordered based on usage and lead time.

Formula: Reorder Point = Average Daily Usage * Lead Time

Periodic Inventory System

This system updates inventory records at specific intervals (e.g., weekly, or monthly). A physical inventory count is performed at the end of each period.

Perpetual Inventory System

The perpetual inventory system continuously tracks inventory levels with each purchase, sale, and return. Inventory and COGS are updated in real-time, giving businesses accurate stock information:

Inventory Level = Previous Inventory + Purchases - Sales

Automate Your Inventory Accounting with Vencru

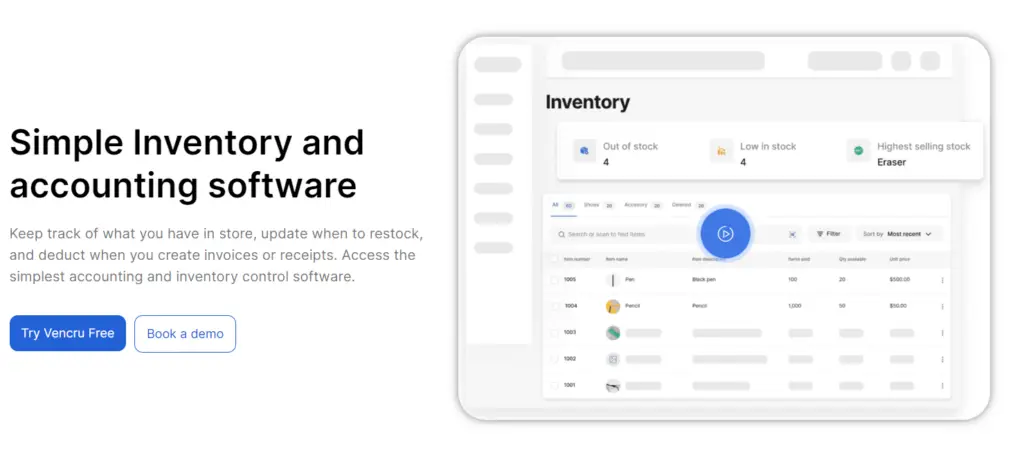

Vencru simplifies inventory accounting with powerful automation tools and methods that streamline your processes. Here’s how Vencru can transform your inventory management:

- Real-Time Inventory Updates: Monitor stock levels instantly to prevent overstocking and stockouts, ensuring you always have the right amount of inventory

- Customizable Reporting: Effortlessly generate detailed financial and inventory reports tailored to your needs, providing valuable insights into your business’s performance.

- Integrated System: Seamlessly syncs inventory data with sales, expenses, and invoicing, creating a cohesive view of your business operations and enhancing overall efficiency.

By integrating Vencru’s comprehensive platform, you can enhance financial accuracy and streamline your inventory accounting, allowing you to focus on driving business growth.

Conclusion

Inventory accounting plays a vital role in the success of any product-based business. Mastering inventory accounting methods, effectively managing inventory costs, and implementing best practices are key to enhancing profitability and operational efficiency. As you apply these principles, you’ll gain valuable insights that drive informed decision-making and support long-term growth. By focusing on accurate inventory tracking and strategic management, you can ensure that your business remains competitive and well-positioned for future success.