Choosing the right inventory valuation method is crucial for businesses as it directly impacts financial statements, tax liabilities, and overall financial health. Inventory valuation determines the cost of goods sold (COGS) and ending inventory value, influencing profitability and key financial metrics. This blog will explore the primary inventory valuation methods (FIFO, LIFO, and WAC), their advantages and disadvantages, and how to choose the best one for your business. We will be discussing:

- Understanding Inventory Valuation

- First In, First Out

- Last In, First Out

- Weighted Average Cost

- Choosing the Right Inventory Valuation Method for Your Business

- Best Practices for Inventory Valuation

Understanding Inventory Valuation

Inventory valuation is the process of assigning a monetary value to a company’s inventory at the end of an accounting period. This valuation affects the balance sheet and income statement, influencing business decisions and financial reporting. The three most commonly used inventory valuation methods are:

Each method has distinct characteristics and is suited to different types of businesses and industries.

First-In, First-Out (FIFO)

FIFO assumes that the oldest inventory items are sold first. This means that the cost of goods sold (COGS) is based on the cost of the earliest purchased inventory, while the remaining inventory is valued at the cost of the most recent purchases.

Advantages of FIFO

- Reflects Current Market Conditions: Since FIFO values the ending inventory based on the latest purchase costs, it closely mirrors current market conditions.

- Higher Net Income: When prices are rising, FIFO results in lower COGS and higher net income because older, cheaper inventory costs are used.

- Easy to Use: FIFO is simple to understand and apply, making it a favorite for many businesses.

Disadvantages of FIFO

- Higher Taxes: The higher net income from lower COGS can lead to higher tax liabilities.

- Possible Overvaluation: During inflation, FIFO might overstate inventory value, not accurately reflecting the true replacement cost.

Who Should Use FIFO

FIFO is perfect for businesses selling perishable goods or items with a short shelf life, like food and beverage companies, because it follows the natural inventory flow.

Last-In, First-Out (LIFO)

LIFO stands for Last-In, First-Out. It means you sell the most recently purchased items first. So, your Cost of Goods Sold (COGS) is based on the cost of your newest inventory, while the remaining stock is valued at the cost of the oldest purchases.

Advantages of LIFO

- Tax Benefits: When prices rise, LIFO results in higher COGS and lower net income, which can lower your tax bill.

- Matching Current Costs to Revenues: LIFO aligns the latest costs with current revenues, providing a clearer picture of profit margins.

Disadvantages of LIFO

- Non-Reflective Inventory Value: The ending inventory is valued at older costs, which might not match current market prices, leading to potential undervaluation.

- Complexity and Compliance: LIFO can be tricky to manage and isn’t allowed under International Financial Reporting Standards (IFRS), which limits its use for international businesses.

Who Should Use LIFO?

LIFO works well for businesses with non-perishable inventory that want to reduce tax liabilities. It’s often used in industries like oil and gas, metals, and mining.

Weighted Average Cost

The weighted average cost method calculates the cost of inventory by averaging the cost of all units available for sale during a period. To determine the Cost of Goods Sold (COGS) and ending inventory, you multiply the average cost per unit by the number of units sold or still in stock.

Advantages of Weighted Average Cost

- Smooth’s Price Changes: This method evens out price changes, giving a stable value for inventory.

- Easy to Use: It’s simple to calculate and apply, making it a good choice for many businesses.

Disadvantages of Weighted Average Cost

- Less Accurate Cost Matching: It doesn’t match specific costs to revenues, which can distort profit margins when prices change a lot.

- Tax Implications: Depending on price trends, this method may not offer the same tax advantages as LIFO.

Who Should Use Weighted Average Cost?

This method is ideal for businesses with similar inventory items, such as manufacturers and retailers dealing with bulk goods.

Choosing the Right Inventory Valuation Method for Your Business

Selecting the appropriate inventory valuation method depends on several factors, including:

1. Industry and Inventory Type

- Perishable Goods: FIFO is typically the best choice for businesses dealing with perishable goods or items with limited shelf life.

- Non-Perishable Goods: LIFO can be advantageous for non-perishable goods, particularly in industries with significant price fluctuation.

2. Financial Reporting Requirements

- IFRS Compliance: If your business operates internationally and must comply with IFRS, LIFO is not an option. FIFO or weighted average cost would be more appropriate.

- Tax Considerations: Evaluate the tax implications of each method. LIFO can reduce tax liabilities during rising prices, while FIFO may result in higher tax liabilities due to higher reported net income.

3. Price Trends

- Rising Prices: LIFO can be beneficial during rising prices as it results in higher COGS and lower taxable income.

- Stable or Declining Prices: FIFO or weighted average cost methods may be more suitable if prices are stable or declining.

4. Business Objectives

- Profitability: Consider the impact on reported profitability. FIFO tends to result in higher net income during inflation, which can attract investors.

- Inventory Valuation: If accurate inventory valuation is critical for your business, FIFO provides a value that closely reflects current market conditions.

5. Operational Complexity

- Ease of Implementation: Assess the ease of implementation and ongoing management. FIFO and weighted average cost methods are generally simpler to apply and manage compared to LIFO.

Best Practices for Inventory Valuation

Implementing best practices can help ensure accurate and effective inventory valuation:

1. Regularly Review and Update

Regularly review and update your inventory valuation method to ensure it aligns with current business conditions, market trends, and regulatory requirements.

2. Use Inventory Management Software

Leverage inventory management software to automate calculations, track inventory movements, and generate accurate reports. This can help reduce errors and improve efficiency.

3. Conduct Physical Inventories

Perform regular physical inventories to verify the accuracy of recorded inventory levels and identify discrepancies. This helps ensure that your inventory valuation reflects the actual inventory on hand.

4. Collaborate with Financial Experts

Work with accountants and financial experts to assess the impact of different valuation methods on your financial statements and tax liabilities. Their expertise can help you make informed decisions.

5. Monitor Market Trends

Stay informed about market trends and price fluctuations. Understanding these trends can help you choose the most appropriate inventory valuation method and make necessary adjustments.

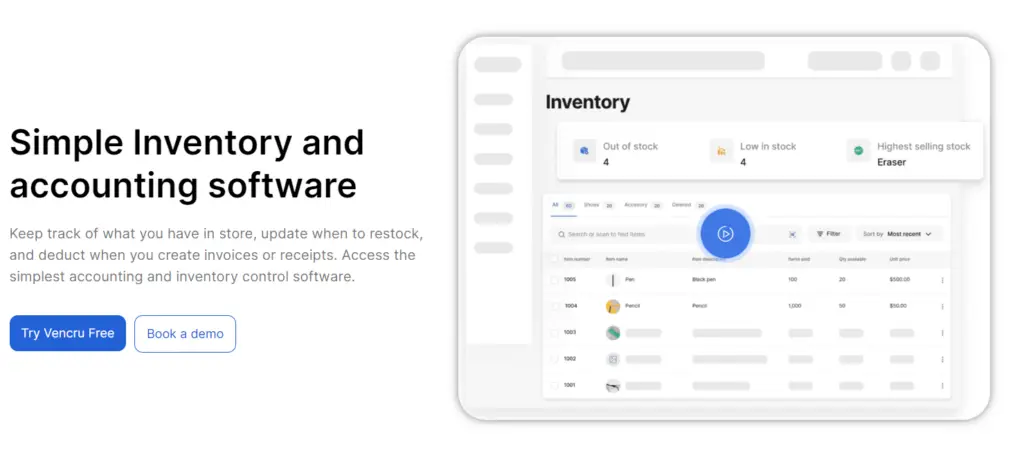

Simplify Inventory Valuation with Vencru

Choosing the right inventory valuation method is crucial, and Vencru makes it easier. Here’s how:

- Automated Calculations: Vencru handles inventory valuation calculations for you, reducing errors and saving time.

- Real-Time Data: Keep your inventory levels and costs updated in real-time for accurate valuations.

- Comprehensive Reporting: Generate reports to understand the financial impact of each valuation method.

- User-Friendly Interface: Vencru’s intuitive design simplifies managing inventory and valuations.

Conclusion

Choosing the right inventory valuation method is a critical decision that can significantly impact your business’s financial health and efficiency. By understanding the advantages and disadvantages of FIFO, LIFO, and weighted average cost methods, you can select the best approach for your specific industry, inventory type, and business objectives. Implementing best practices and leveraging technology can further enhance the accuracy and effectiveness of your inventory valuation process, ultimately contributing to better financial management and improved business performance.

Related Content