The availability of some of the best accounting software for small businesses has made the process significantly more straightforward and efficient. With these accounting and bookkeeping tools, you don’t need an expert accountant to look after your company’s finances.

Financial bookkeeping can take a lot of time and effort. Even when you have hired an expert to get the job done, there is still a margin of human error.

Why Is Accounting Software Essential For Small Businesses

There are uncountable reasons why accounting software is fundamental for your organization. Accounting software for independent ventures and small businesses can assist with facilitating the responsibility, and you don’t need to recruit more unneeded workers.

We should see more reasons why accounting software for small businesses can be advantageous.

- Automatization

- Proficiency

- Financially savvy

- Precision

- Reinforcement and backup

Automatization

Involving accounting software for your business can make it more proficient for you to create reports dependent on information gathered continuously

You can computerize the method involved with making payments, checks, spending plans, and substantially more.

You can likewise add extra administrations and elements that can assist you with dealing with all accounts and make reports naturally.

Proficiency

Without the aid of accounting software, you’ll need to do even the most minor undertakings physically. These monotonous assignments take a great deal of time and can upset the work process.

The top accounting software can assist you with making the interaction more proficient and speed it up. You can look into all the previous exchanges and get reports with a single click.

Financially Savvy

Accounting software is more financially savvy than employing an accountant. As a private venture, employing a different individual for a particular work like accounting can be excessively expensive.

With the assistance of accounting software, you can mechanize the accounting and money cycles, and you don’t need to enlist somebody with master accounting experience.

Precision

It is not debatable that PCs (Personal Computers) are more precise than people. With bookkeepers and accountants, there are higher opportunities for mistakes in reports.

Accounting software will commit fewer errors. You can adjust every one of your records with the framework and guarantee it is secure.

Regardless of whether you commit an error, the software will guarantee you know that there was a mix-up, and you can address it quickly and neatly.

Reinforcement And Backup

When you use accounting software, it is simpler to back up every one of your records and documents. The very best accounting software furnishes you with a cloud-based capacity framework and backs up everything in the framework.

It can protect every one of your reports as there is no danger of robbery or harm from fire or water. You can get the information and documents from any place on the planet assuming it is on a cloud database.

Accounting Software: Features To Look Out For

When looking for the best accounting software for small businesses, you need to keep a vast array of features and elements in mind.

These aspects of accounting software can make the process easier for you and help you securely maintain all financial records.

Important features to look out for include:

- Online Invoicing: An accounting tool that can provide invoicing software for small businesses helps the transactions become more efficient.

- Online Support: Online support can help you identify the root of any problem you are facing with the software and solve it on the go.

- Automated Reminders: An accounting software should remind you of upcoming payments and keep you updated.

- Dashboard: Your accounting software dashboard should provide you with all the key metrics and an overview of all your accounts.

- Training And Instructions: When you get accounting software, you will need training manuals to help you adjust and get used to the tool and its features.

6 Best Accounting Software For Small Businesses

- Vencru

- Quickbooks

- Freshbooks

- Xero

- Wave

- Sage

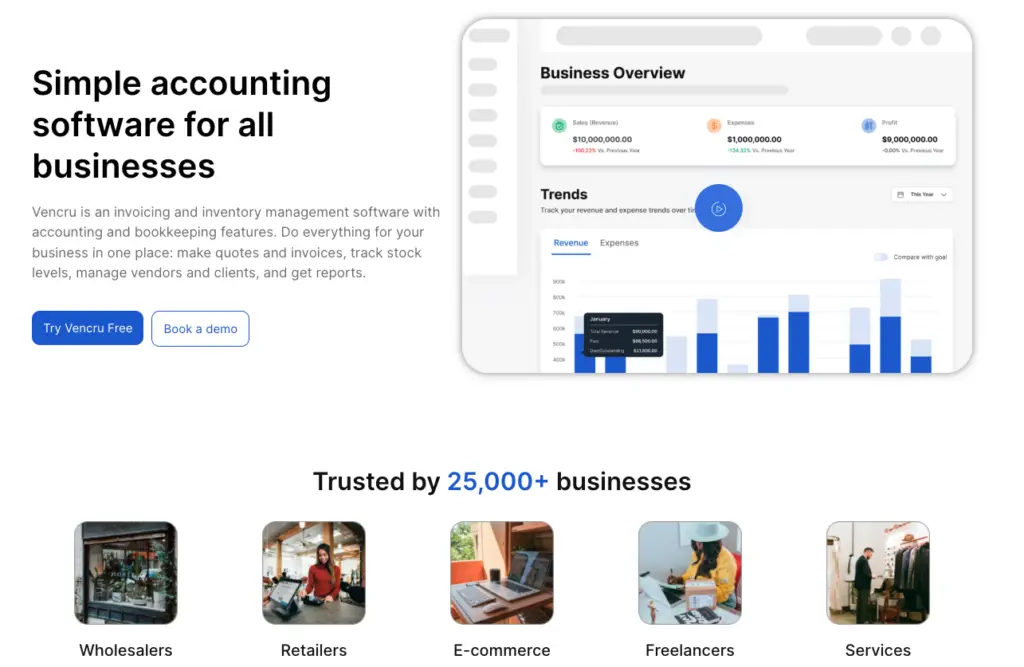

Vencru

Vencru is the simplest accounting and invoicing software. With Vencru, you can keep track of all your inventory and sales and the transactions taking place. You can develop in-depth cash flow and accounting reports for your business. Vencru invoicing includes the option to accept payments directly from the invoice. Summary of the features its easy-to-use features:

- Accounting reports

- Invoicing

- Inventory control and management

- Expense tracking

- Client management

- Mobile app

With the use of the Vencru app, you can manage multiple businesses from the comfort of your home, office, gym, or even a recreation center.

Pricing

Vencru offers a free plan and paid plans. Paid plans starts at $6 per month.

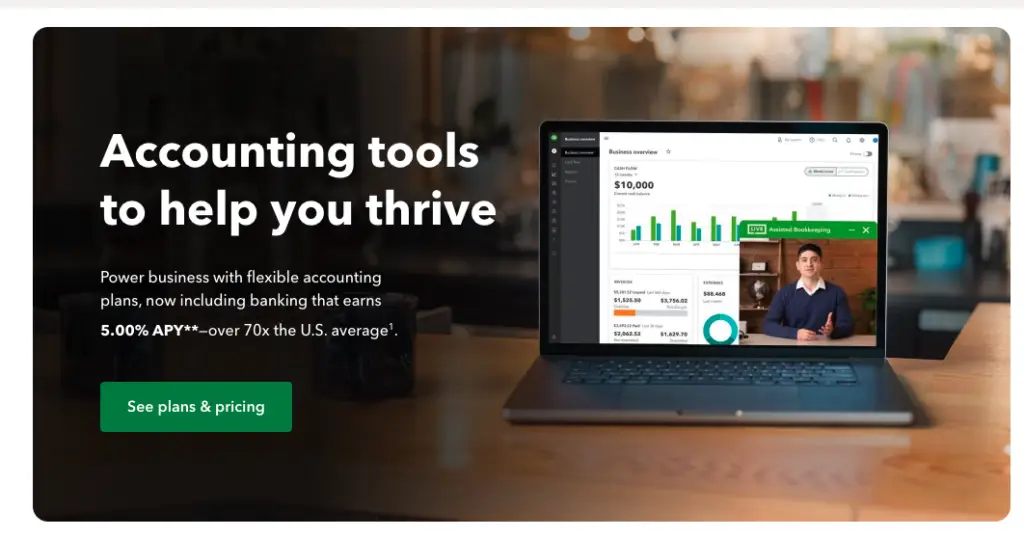

Quickbooks

Quickbooks is considered one of the best accounting software for small businesses. It is widely used by professionals in various industries for all their accounting needs. With the help of Quickbooks, you can keep track of all your accounts through any device. You can choose from various plans and take advantage of features like inventory management, budgeting, time-tracking, and much more.

Pricing starts at $15 per month

Freshbooks

Freshbooks provides small businesses with all accounting solutions to make their processes more efficient. For service-based businesses that require invoicing, Freshbooks is one of the best accounting software.

Not only does it generate invoices, but it can also help with the basic accounting needs of your business. Freshbooks can help you with collecting client retainers, receiving payments, sending proposals, and much more.

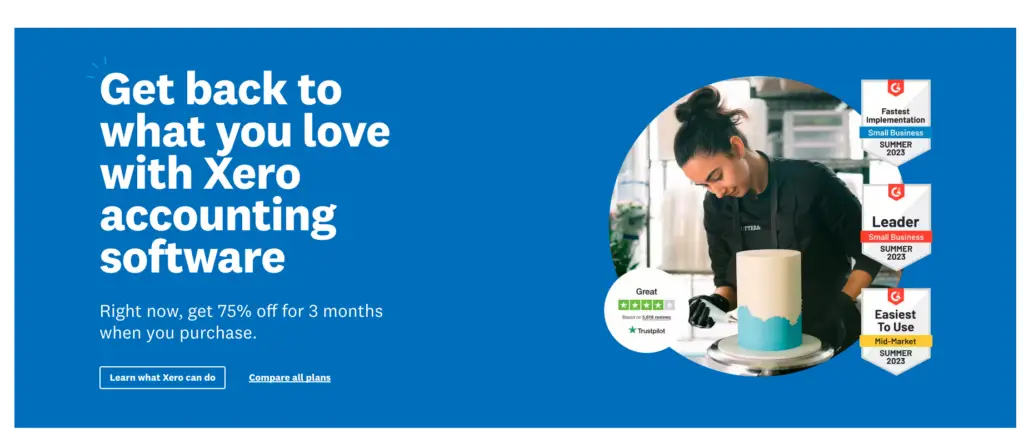

Xero

If you are a business that operates on a small scale and wants the most simple accounting solutions, Xero is one of the best options. You can integrate it with third-party payroll applications to make your process more efficient.

Xero has an easy-to-use interface, which makes it the best tool for people who are not the most tech-savvy or have prior experience with accounting software. You can use Xero to collect online payments, manage inventory, and a lot more.

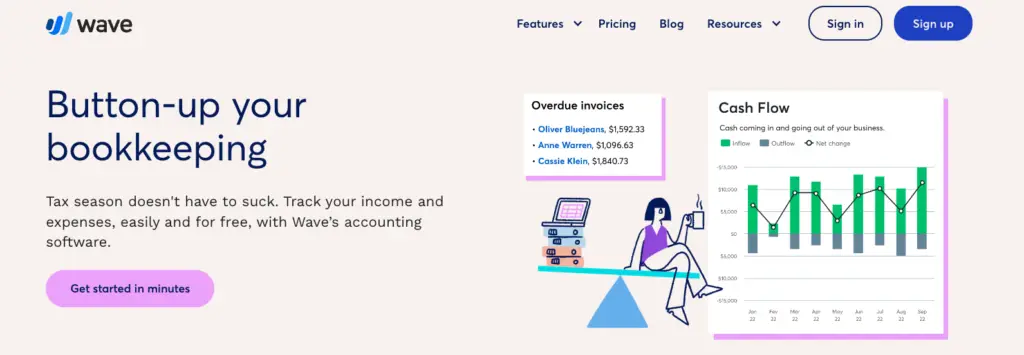

Wave Apps

For small businesses that are service-based and don’t need tools for inventory management or running payroll, Wave is the smartest option. It is simple accounting software that can help with the invoicing process of your small business.

Wave is free accounting software, which makes it the most used by freelancers. It covers all the basic accounting needs, and you can get reports regarding your finances at the end of the year for your tax returns.

Sage

Sage helps you streamline your business’s accounting and invoicing needs in one place. It syncs with all your bank accounts and automates the monetary operations for your business. With the help of Sage, you can keep track of every transaction being made from your account.

Sage provides users with a cloud-based accounting system, and it is extremely helpful for businesses in any industry. Sage handles your tax and compliance for you, automating all your financial activities.

Final Takeaway

Accounting software is essential for small businesses in this day and age. You need a tool that can help you manage all your finances, and automate payments for your accounts.

Using the best accounting software for your business takes away the need to hire an expert professional only to look after your finances.

Make sure you stay tuned to our blog to get more amazing resources to help you navigate the market as a small business. Good luck!