The world of healthcare finance can feel complex, with mountains of paperwork and seemingly endless financial codes. But fear not! Having a well-defined Healthcare chart of accounts is your key to navigating this financial landscape smoothly, for your medical practice, hospital and pharmacy.

Think of a chart of accounts as a detailed map of your financial activity. It categorizes all your income and expenses into specific accounts, providing a clear picture of your financial health. This is crucial for medical accounting, pharmacy accounting, and even hospital accounting.

Here’s a breakdown of why a chart of accounts is essential and how to set one up for your hospital, medical practice and pharmacy

- What is Chart of Accounts

- Benefits of a Chart of Accounts

- Setting Up Your Healthcare Chart of Accounts

- Essential Accounts for Healthcare Industry

- Medical Practice and Pharmacy Journal Entries

- Streamline Your Healthcare Finances with Vencru

What is Chart of Accounts?

A chart of accounts is a fundamental tool used in accounting to categorize all the financial transactions of a business. Imagine it as a detailed roadmap that meticulously organizes your income and expenses into specific accounts. This organization provides a clear picture of your financial health and is essential for businesses of all sizes, including hospital, medical practices and pharmacies.

Related Read: Chart of Accounts: Definition, examples, and industry-specific versions

Benefits of a Chart of Accounts

- Enhanced Financial Reporting: A well-organized chart of accounts for healthcare allows you to generate accurate and insightful financial reports, such as income statements, balance sheets, and cash flow statements. These reports empower you to track your financial performance, identify areas for improvement, and make informed business decisions.

- Streamlined Accounting Processes: Categorizing transactions into specific accounts simplifies the bookkeeping process and minimizes errors. It also facilitates tax preparation and ensures compliance with financial regulations.

- Improved Efficiency: A clear and consistent chart of accounts saves time and resources by eliminating confusion when recording transactions.

- Comparative Analysis: Easily compare financial data across different periods or locations with a standardized chart of accounts. This allows you to track trends and measure growth over time.

Setting Up Your Healthcare Chart of Accounts

Here are some key considerations when creating a chart of accounts for hospital and pharmacy:

- Industry Standards: Familiarize yourself with industry-standard account names and numbering systems used in medical and pharmacy accounting as well as updates to industry regulations and compliance standards. This ensures consistency and facilitates communication with external entities like insurance companies.

- Level of Detail: Strike a balance between having enough detail for accurate reporting and keeping it manageable. Too many accounts can be cumbersome, while too few can hinder insightful analysis.

- Tailor Accounts to Specific Needs: Customize your chart of accounts for hospital, pharmacy and medical practice to reflect the unique financial structure of your medical practice or pharmacy. Consider including accounts for revenue streams, such as patient consultations, prescription sales, and ancillary services, as well as expense categories like payroll, supplies, and utilities.

- Utilize Sub-Accounts for Detailed Reporting: Take advantage of sub-accounts to further categorize transactions within your healthcare chart of accounts. For example, you can create sub-accounts for different types of expenses within the payroll category, such as salaries, benefits, and overtime pay, allowing for more detailed financial reporting and analysis.

- Leverage Accounting Software for Efficiency: Invest in specialized pharmacy accounting or medical practice management software to streamline your financial management processes. These tools offer features tailored to the unique needs of healthcare providers, such as integrated billing, electronic health record (EHR) integration, and reporting capabilities.

Related Read: Accounting software for healthcare

Essential Accounts for Healthcare Industry

The chart of accounts for healthcare industry typically consists of five primary categories:

Asset Accounts

| Account Number | Account Name | Description |

|---|---|---|

| 601 | Cash on Hand | Physical cash available at the medical practice |

| 602 | Accounts Receivable | Amounts owed by patients or insurance companies |

| 603 | Medical Equipment | Value of medical devices and equipment |

| 604 | Inventory (Pharmaceutical Drugs) | Value of medications and pharmaceutical inventory |

| 605 | Pharmacy Equipment | Value of equipment used in the pharmacy |

Liability Accounts

| Account Number | Account Name | Description |

|---|---|---|

| 701 | Accounts Payable | Unpaid bills and invoices for goods and services |

| 702 | Loans Payable | Outstanding loans and debts |

| 703 | Accrued Expenses | Unpaid expenses that have been incurred but not yet paid |

Equity Accounts

| Account Number | Account Name | Description |

|---|---|---|

| 801 | Owner’s Equity | Owner’s investment in the medical practice or hospital |

| 802 | Retained Earnings | Accumulated profits or losses from operations |

Revenue Accounts

| Account Number | Account Name | Description |

|---|---|---|

| 401 | Patient Service Fees | Fees collected from patient consultations |

| 402 | Insurance Reimbursements | Payments received from insurance companies |

| 403 | Lab/Diagnostic Fees | Charges for laboratory tests and diagnostic services |

| 404 | Prescription Sales | Revenue from selling prescription medications |

| 405 | OTC Medication Sales | Revenue from selling over-the-counter medications |

| 406 | Pharmacy Services Fees | Charges for additional pharmacy services |

Expense Accounts

| Account Number | Account Name | Description |

|---|---|---|

| 501 | Salaries and Wages | Payments to medical staff and employees |

| 502 | Rent and Utilities | Rental expenses and utility bills for the facility |

| 503 | Medical Supplies | Costs associated with purchasing medical supplies |

| 504 | Equipment | Expenses related to the purchase and maintenance of medical equipment |

| 505 | Marketing Costs | Expenditure on advertising and promotional activities |

Medical Practice and Pharmacy Journal Entries

Let’s explore how to record journal entries with three common scenarios:

Scenario 1: Medical Practice Bills a Patient (Revenue & Asset Accounts)

Transaction: Dr. Jones bills a patient $100 for a consultation.

Journal Entry:

- Debit Accounts Receivable ($100)

- Credit Revenue – Patient Service Fees ($100)

Explanation: Since the patient hasn’t paid yet, the money is recorded as an asset in “Accounts Receivable.” The corresponding credit goes to “Revenue – Patient Service Fees” to reflect the income earned.

Scenario 2: Medical Practice Pays Rent (Expense & Asset Accounts)

Transaction: Dr. Lee’s practice pays $2,000 for monthly rent.

Journal Entry:

- Debit Rent and Utilities ($2,000)

- Credit Cash on Hand ($2,000)

Explanation: The rent expense is debited to “Rent and Utilities,” indicating a decrease in resources. The corresponding credit goes to “Cash on Hand” to reflect the outflow of cash used for the payment.

Scenario 3: Pharmacy Purchases Medical Supplies (Expense & Liability Accounts)

Transaction: Dr. Smith’s practice purchases $1,500 worth of medical supplies.

Journal Entry:

- Debit Medical Supplies ($1,500)

- Credit Accounts Payable ($1,500)

Explanation: The medical supplies, which are an asset, are debited to “Medical Supplies.” Since the practice hasn’t paid the supplier yet, the corresponding credit goes to “Accounts Payable” to reflect the outstanding obligation.

By understanding these essential accounts and how they interact through journal entries, you can build a robust chart of accounts that empowers you to make informed financial decisions and navigate the complexities of healthcare finance for your medical practice or pharmacy.

Related Read: Debits and Credits in Accounting: Guide with Journal Entry Examples

Streamline Your Healthcare Finances with Vencru

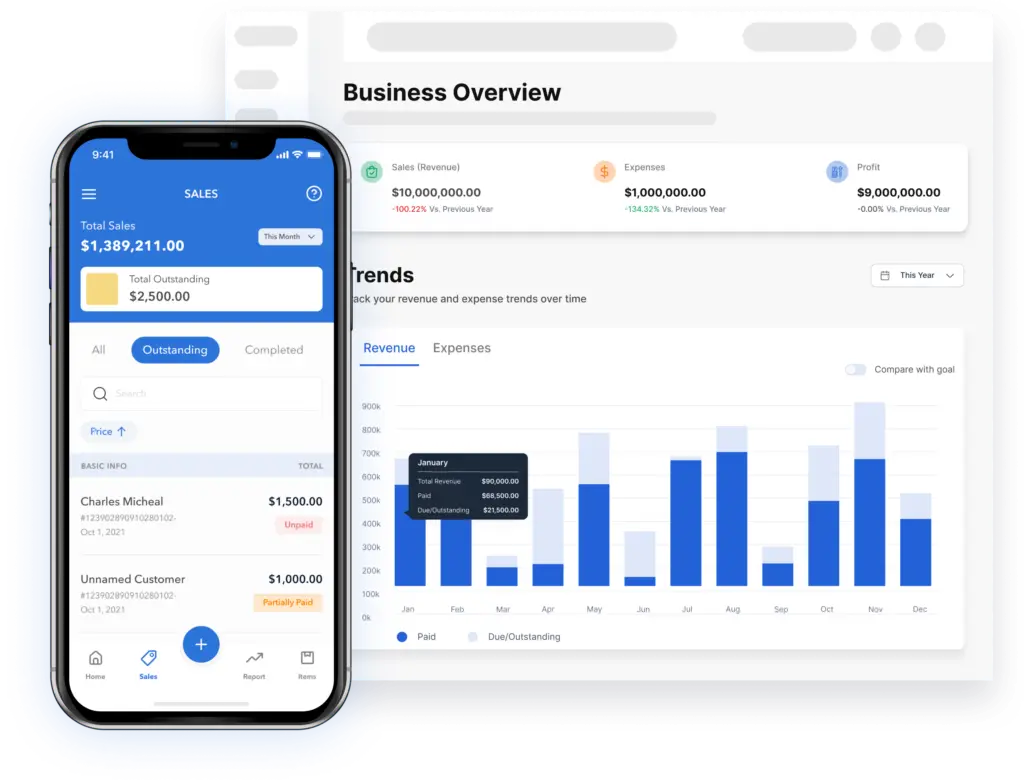

Managing the financial well-being of your medical practice or pharmacy can feel overwhelming amidst patient care and daily operations. Here’s where Vencru steps in – your all-in-one accounting solution designed specifically for the complexities of healthcare finance.

Vencru goes beyond a simple chart of accounts. Imagine a system that automates tedious tasks, minimizes errors, and empowers you with real-time financial insights – all within a user-friendly platform.

Here’s how Vencru empowers your medical practice or pharmacy:

- Effortless Chart of Accounts Management: Vencru provides pre-configured charts of accounts specifically tailored to hospital, medical practices and pharmacies. This ensures you’re using the correct accounts and capturing all your financial activity accurately.

- Automated Workflows: Eliminate manual data entry and streamline processes with features like pharmacy and medical practice invoicing and expense categorization. Free up valuable time for what matters most – your patients.

- Real-Time Financial Visibility: Gain instant insights into your financial performance with user-friendly dashboards and reports. Track key metrics like revenue, expenses, profitability, and accounts receivable – all at a glance.

- Inventory Management (for Pharmacies): Keep a close eye on your inventory levels and optimize stock to avoid stockouts or overstocking. Vencru’s inventory management tools help you make informed purchasing decisions and maintain a healthy bottom line.

- Enhanced Security and Compliance: Vencru prioritizes the security of your sensitive healthcare data. Our platform adheres to industry-standard security protocols.

- Scalability and Affordability: Vencru scales with your practice or pharmacy, accommodating your growth and evolving needs. Our subscription-based pricing ensures affordability and eliminates the upfront costs of traditional accounting software.

Ready to explore Vencru? Get started here or book a demo

Related Content:

- Guide to Retail Chart of Accounts (with sample PDF)

- Chart Of Accounts For A Construction Company: Detailed Guide

- Chart of Accounts for Nonprofit: A Comprehensive Guide

- Chart Of Accounts For E-commerce Businesses: Detailed Guide

Disclaimer: This article is for informational purposes only and does not constitute financial or legal advice. Organizations should consult qualified professionals for guidance on their specific financial management needs.