In business, invoices and receipts are two vital documents that serve distinct purposes. These differences hinge on a fundamental factor: whether or not payment has been received. In this blog, we’ll discuss the difference between an invoice and a receipt, delve into their functions, and explore how you can create them efficiently using Vencru.

The Difference Between Invoice and Receipt

Before diving into the details of invoice and receipt, it’s crucial to understand their fundamental distinctions.

- Invoice: An invoice is a request for payment issued by a seller to a buyer. It outlines the products or services provided, their quantity, prices, and any applicable taxes or discounts. It is issued before the payment is made, and includes the payment instructions. An invoice is a formal transaction record and establishes the buyer’s obligation to pay.

- Receipt: On the other hand, a receipt is a document the seller issues to the buyer after receiving payment. It confirms that payment has been made and provides a transaction summary, including the date, payment method, and items purchased. A receipt acknowledges that the buyer has fulfilled their financial obligation.

Invoice Explained: What Is an Invoice?

An invoice is a commercial document a seller sends to a buyer to request payment for goods or services rendered.

For example, imagine you run a small retail store. When a customer wants to purchase multiple items, you create an invoice. This invoice includes the names of the products they selected, the quantities, the prices, and the total cost. It is given to the customer, indicating the amount they need to pay before they can leave with the products.

The invoice serves as a formal record of the transaction, including details such as the following:

- Invoice Number: A unique identifier for tracking purposes.

- Date: The date when the invoice is issued.

- Seller Information: The seller’s name, address, and contact details.

- Buyer Information: The name and address of the buyer.

- Description of Products/Services: A detailed list of items or services, including quantities, unit prices, and total amounts.

- Payment Terms: Information on when and how payment should be made.

- Tax Information: If applicable, details such as sales tax or VAT.

- Discounts: Any applicable discounts or promotions.

- Total Amount Due: The sum of all charges, including taxes and discounts.

Invoices are crucial in accounting, serving as the seller’s revenue and accounts receivable record. They also provide the buyer with documentation of their financial obligation.

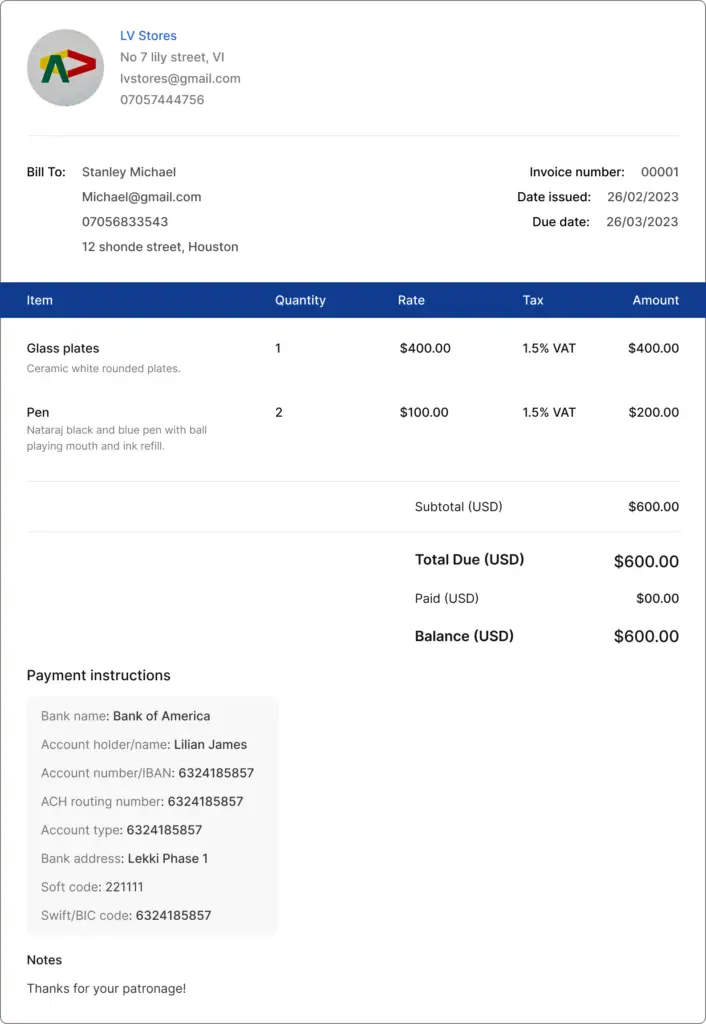

An example of an invoice from Vencru

Here’s a sample sales invoice generated through Vencru’s invoicing software. As you can see, it features an invoice number and the outstanding amount, with no payment amount included since it’s awaiting payment. Additionally, you’ll find bank details and payment terms to offer customers clear guidance on the payment process.

Related: What is an Invoice?; Invoice template explained: What is an invoice or receipt?

Receipt Explained: What Is a Receipt?

A receipt is a document the seller issues to the buyer after receiving payment. You generate a receipt once your customer pays for the items listed on the invoice or pays upfront. This document acknowledges the payment and serves as proof of purchase. It’s like the final piece of the transaction puzzle.

Receipt typically includes the following information:

- Receipt Number: A unique identifier for reference.

- Date: The date when payment was received.

- Seller Information: The seller’s name, address, and contact details.

- Buyer Information: The buyer’s name (which can be the same as the invoice recipient).

- Description of Payment: A transaction summary, including the items paid for and their corresponding amounts.

- Payment Method: Details about how the payment was made, such as cash, credit card, or check.

- Total Amount Paid: The sum of the payment received.

Receipts are essential for both sellers and buyers. They provide evidence of payment, reconcile financial records, and are often required for accounting and tax purposes. Buyers may also use receipts to track expenses or as proof of warranty or return eligibility.

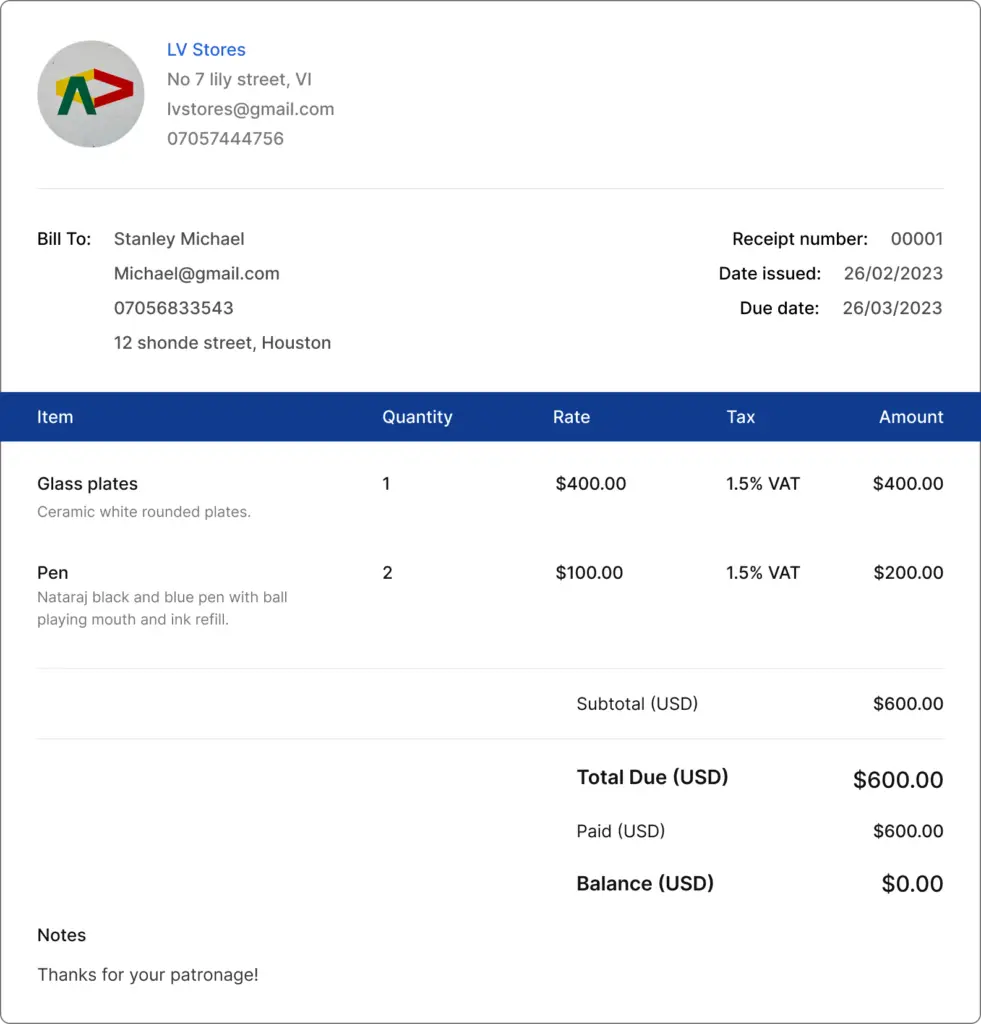

Example of a receipt from Vencru

Here’s an illustration of a sales receipt generated through Vencru’s invoicing software. Take a look, and you’ll observe essential details such as a unique receipt number, the outstanding amount, and the payment made.

Why are invoices and receipts necessary?

Invoices and receipts play pivotal roles in business transactions and financial management. Receipts provide proof of payment and enable record-keeping. Invoices initiate the payment process, serve as legal documents, and contribute to professionalism and financial control. Both documents are integral to the smooth functioning of businesses and financial accountability.

See below for several reasons:

Receipts:

- Proof of Payment: Receipts are concrete evidence of a payment. They give customers confidence that they have completed their financial transactions.

- Record Keeping: Businesses use receipts to record all transactions comprehensively. This is crucial for accounting, taxation, and financial reporting purposes.

- Refunds and Returns: Receipts are vital when customers need to return a product or request a refund. They validate the original purchase and help businesses process these requests efficiently.

- Warranty and Guarantees: Receipts often serve as proof of purchase for products with warranties or guarantees. Customers may need these receipts to claim services or replacements.

- Expense Tracking: Individuals and businesses use receipts to track their expenses accurately. This is particularly important for budgeting, expense reimbursement, and tax deductions.

Invoices:

- Request for Payment: Invoices are formal requests for payment from a seller to a buyer. They outline the products or services, costs, and payment terms. Invoices are essential for initiating the payment process.

- Legal Document: Invoices are legally binding documents that establish an obligation for the buyer to pay the specified amount by a certain date. They can be used as evidence in case of payment disputes or legal issues.

- Record of Sales: For businesses, invoices serve as a sales record. They help track revenue, manage accounts receivable, and evaluate business performance.

- Tax Compliance: Invoices are often required for tax compliance. They provide the necessary documentation for businesses to accurately calculate and report their taxable income.

- Professionalism: Well-structured invoices with clear information convey professionalism to clients. They create a positive impression and build trust between businesses and customers.

- Payment Tracking: Invoices include payment due dates, enabling businesses to track outstanding payments and follow up with customers who have not paid on time.

How to Create an Invoice

You can create an invoice using a generator, an invoicing app, or an invoice template. To create an invoice manually, follow these steps:

- Gather Information: Collect all necessary details, including your contact information, the buyer’s information, a description of products/services, prices, and payment terms.

- Choose a Format: You can create an invoice using Microsoft Word, Excel, or dedicated invoicing software.

- Design the Invoice: Include all the information mentioned earlier and choose a professional and clear layout.

- Add an Invoice Number: Assign a unique identifier to each invoice for tracking purposes.

- Calculate Totals: Ensure that the totals, including any taxes or discounts, are calculated correctly.

- Save and Send: Save the invoice as a PDF and send it to the buyer via email or mail a printed copy.

Creating an Invoice with Vencru invoicing software:

- Vencru simplifies the invoicing process significantly. Here’s how you can create an invoice using Vencru:

- Log In or Sign Up: If you’re not using Vencru, sign up for an account. If you have an account, log in.

- Navigate to Invoicing: Click the “Sales” section, then the “Create Invoice” button in Vencru.

- Fill in Details: Enter the necessary information, including your and the buyer’s details, the description of products/services, prices, taxes, and discounts.

- Generate Invoice: Vencru will automatically generate a professional-looking invoice based on your provided information.

How to Create a Receipt

You can create a receipt using an online receipt maker, an invoicing app, or a sales receipt template. Creating a receipt manually is a straightforward process:

- Gather Information: Collect details about the payment, including the date, amount paid, and payment method.

- Design the Receipt: Create a clear and concise format using software like Word or Excel.

- Include Payment Details: Add the payment date, amount, payment method, and a brief description of what the payment is for.

- Receipt Number: Assign a unique receipt number for tracking purposes.

- Save and Send: Save the receipt as a PDF and send it to the buyer.:

Vencru: The Sales Receipt Generator

Vencru takes the hassle out of creating sales receipts. With Vencru, you can effortlessly generate professional receipts with just a few clicks. Our user-friendly platform ensures that your receipts are accurate, well-organized, and compliant with accounting standards.

To create an in Vencru:

- Log In or Sign Up: Access your Vencru account or sign up if you’re a new user.

- Navigate to Receipts: Click the “Sales” section, then the “Create Receipt” button in Vencru.

- Fill in Payment Details: Enter the payment date, amount, payment method, and description.

- Generate Receipt: Vencru will generate a professional receipt based on your provided information.

- Review and Send: Review the receipt for accuracy and click “Send” to email it directly to the buyer.

Vencru ensures that your receipts are well-organized and include all the necessary information for proper record-keeping.

Conclusion

Invoice and receipt play distinct but equally essential roles in business transactions. Invoices request payment, while receipts confirm payment. Knowing how to create and manage these documents is essential for maintaining accurate financial records and ensuring a smooth sales process.

Vencru simplifies creating invoices and receipts so you can focus on your main business tasks while keeping your financial records organized. Vencru helps small business owners and freelancers with easy-to-use invoicing and receipt management features. It saves time and reduces errors. Start using Vencru today to experience the benefits of efficient sales documentation.