Keeping accurate financial records is not just a good practice; it’s a necessity. A well-organized retail chart of accounts is your roadmap to understanding your business’s financial health. From tracking sales and purchases to managing inventory and expenses, every aspect of your retail accounting hinges on this vital financial tool.

In this guide, we explain the Retail Chart of Accounts, delve into its crucial components, and show you why Vencru is the accounting solution for retail businesses.

- What is a retail chart of accounts?

- Why is a chart of accounts important for retail businesses?

- What is Included in a Retail Chart of Accounts?

- Retail Chart of Account Template

- How Vencru can help you automate your retail chart of accounts

What is a retail chart of accounts?

A retail chart of accounts is a systematic and organized list of all the financial accounts that a retail business uses to record its financial transactions. These accounts are categorized into different types, such as assets, liabilities, equity, revenue, and expenses, to help the business track and manage its finances effectively.

Why is a Chart of Accounts important for retail businesses?

Chart of accounts is the foundation of financial management for retail businesses. It enhances financial transparency, enables accurate reporting, supports tax compliance, and aids in making informed decisions. Whether for small clothing stores or large retail chains, a robust chart of accounts is essential for financial success in the retail industry.

- Accurate Financial Reporting: A well-organized chart of accounts for a retail business ensures that financial transactions are categorized correctly. This accuracy is vital for generating accurate financial reports that provide a clear picture of the business’s health and performance.

- Tax Compliance: Retail businesses must comply with tax regulations. An adequately structured chart of accounts for retail stores helps track taxable income, expenses, and deductions. This ensures that the business pays the correct taxes and avoids potential legal issues.

- Budgeting and Forecasting: Retailers often create budgets and financial forecasts to plan for future growth and expenses. The chart of accounts plays a central role in this process by making it easier to set realistic financial goals.

- Inventory Management: A well-designed chart of accounts includes specific inventory accounts, allowing the company to track the value and quantity of its inventory accurately. This is crucial for preventing stockouts, overstocking, and correctly calculating the cost of goods sold (COGS).

- Expense Control: Expense accounts in the chart of accounts help retail businesses monitor and control their costs. With clear expense categories, companies can identify areas where expenses can be reduced, helping improve profitability.

- Audit Trail: The chart of accounts for a retail business creates a clear audit trail for all financial transactions. This is valuable for internal audits, external audits, or investigations. It ensures transparency and accountability in financial management.

Related: Retail bookkeeping: How to do bookkeeping for a retail store

What is Included in a Retail Chart of Accounts?

A Retail Chart of Accounts is the backbone of your financial record-keeping system. It encompasses every financial aspect of your retail business, efficiently categorizing accounts into five primary types: assets, liabilities, equity, revenue, and expenses. Let’s break down each of these and explore them in the context of retail accounting.

Assets:

These accounts track everything your retail business owns.

- Current Assets: Cash, bank accounts, inventory (the heart of retail), accounts receivable (what your customers owe you), and prepaid expenses.

- Non-Current Assets: Long-term investments, property, plant, equipment, and assets depreciation (e.g., when your equipment loses value over time).

Liabilities:

These accounts represent what your business owes to others.

- Current Liabilities: Accounts payable (what you owe to suppliers), short-term loans, and other accrued expenses.

- Non-Current Liabilities: Long-term loans or mortgages for your store.

Equity:

These accounts reveal your business’s net worth

- Owner’s Equity: The owner’s stake in the business.

- Retained Earnings: Accumulated profits or losses over time.

Revenue:

Revenue accounts capture income generated from sales.

- Sales: Sales revenue from all channels, whether your physical store or online sales.

- Sales Returns and Allowances: The portion of sales that customers return or get a discount on.

- Discounts: The cash reductions offered to customers to help close a sale.

Expenses

These accounts record all the costs associated with running your retail business.

- Cost of Goods Sold (COGS): The cost of acquiring or producing your products.

- Operating Expenses: Rent, utilities, wages, marketing, and all other expenses associated with running your retail business.

- Depreciation Expenses: Allocating the cost of assets over their useful life.

For example, imagine you own a clothing boutique. Your Retail Chart of Accounts will include accounts for cash, inventory (the latest arrivals and classics), accounts payable to your suppliers (those stylish trends don’t come for free), rent for your chic storefront, and wages for your friendly staff.

To help you get started, we’ve provided a sample Retail Chart of Accounts template, which you can find at the end of this guide.

Related: Chart of Accounts: Definition, examples, and industry-specific versions

Retail Chart of Account Template (see example)

Now, let’s dive deeper into each section of a chart of accounts for a retail business

Assets – Current Assets

| Account Number | Account Name | Description |

|---|---|---|

| 101 | Cash | Physical currency on hand |

| 102 | Checking Account | Funds available in your checking account |

| 103 | Savings Account | Funds saved in an interest-bearing savings account |

| 104 | Petty Cash | A small amount of cash kept on hand for minor expenses |

| 105 | Accounts Receivable | Outstanding payments from customers |

| 106 | Inventory (Retail) | Physical stock of products available for sale in your retail store |

| 107 | Inventory (Online) | Physical stock of products available for sale through your online store. |

| 108 | Prepaid Expenses | Payments made in advance for services or goods not yet received. |

Assets – Non-Current Assets

| Account Number | Account Name | Description |

|---|---|---|

| 201 | Long-Term Investments | Investments held for more than one year, such as stocks or bonds. |

| 202 | Property | Owned land or buildings used for your retail business |

| 203 | Plant & Equipment | Machinery, fixtures, and equipment used in your store |

| 204 | Vehicles | Any vehicles used for business purposes |

| 205 | Accumulated Depreciation | A contra-asset account that represents the accumulated depreciation of your assets. |

Liabilities – Current Liabilities

| Account Number | Account Name | Description |

|---|---|---|

| 301 | Accounts Payable (Suppliers) | Amounts owed to suppliers for goods or services received. |

| 302 | Short-Term Loans | Loans payable within one year. |

| 303 | Accrued Expenses | Expenses incurred but not yet paid, e.g., utilities or rent. |

Liabilities – Non-Current Liabilities

| Account Number | Account Name | Description |

|---|---|---|

| 401 | Long-Term Loans | Loans with a repayment period exceeding one year |

| 402 | Mortgage Payable | Outstanding mortgage on your store property |

Equity

| Account Number | Account Name | Description |

|---|---|---|

| 501 | Owner’s Equity | The owner’s initial investment in the business |

| 502 | Retained Earnings | Accumulated profits or losses retained in the business. |

Revenue

| Account Number | Account Name | Description |

|---|---|---|

| 601 | In-Store Sales | Revenue generated from sales made within your physical retail store. |

| 602 | Online Sales | Revenue generated from sales made through your online retail platform. |

| 603 | Wholesale Sales | Revenue from bulk sales to other businesses or resellers |

| 604 | Sales Returns and Allowances | The value of returned products or customer discounts. |

Expenses – Cost of Goods Sold (COGS)

| Account Number | Account Name | Description |

|---|---|---|

| 701 | Cost of Goods Sold (COGS) – Retail | Costs directly associated with acquiring or producing products sold in your physical store. |

| 702 | Cost of Goods Sold (COGS) – Online | Costs directly associated with acquiring or producing products sold through your online store. |

| 703 | Freight and Shipping | Costs related to transporting goods to your retail location. |

Expenses – Operating Expenses

| Account Number | Account Name | Description |

|---|---|---|

| 801 | Rent | Lease payments for your retail space. |

| 802 | Utilities | Expenses for electricity, water, and gas. |

| 803 | Wages and Salaries | Employee compensation, including salaries and wages. |

| 804 | Marketing and Advertising | Costs related to promotional activities. |

| 805 | Insurance | Payments for business insurance policies |

| 806 | Repairs and Maintenance | Expenses for upkeep and repair of your retail space and equipment. |

| 807 | Depreciation Expenses | Allocation of asset costs over their useful life |

| 808 | Office Supplies | Costs associated with office materials. |

| 809 | Miscellaneous Expenses | Other operating expenses not covered above. |

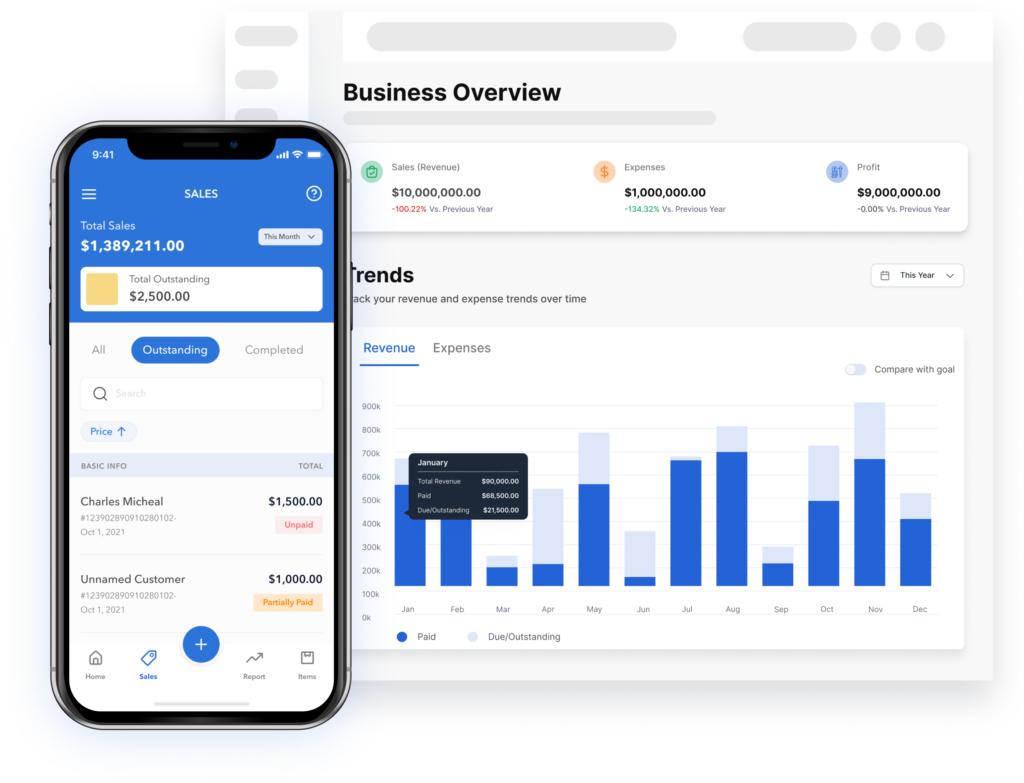

Use a Retail-Specific Accounting Software like Vencru

While spreadsheets can work for basic accounting, dedicated retail accounting software like Vencru offers distinct advantages.

Why Vencru Is the Right Inventory and Accounting Software for Retail:

- Inventory Management: Vencru streamlines inventory control across all sales channels, helping you avoid overstocking or stockouts.

- Invoicing: Create professional invoices, accept online payments, and manage accounts receivable seamlessly.

- Sales Insights: Monitor sales performance across all channels, identify top-selling products, and track your progress toward your sales goals.

- Accurate Reporting: Automatically generate financial statements. Access real-time insights on retail performance. Make tax season a breeze.

- Cost of Goods Calculation: Vencru accurately calculates the cost of goods sold (COGS), which is essential for evaluating profitability.

Benefits of Using Vencru

- Single Platform: Vencru eliminates the need for multiple software tools by combining inventory management and accounting in one platform.

- Avoid Duplicate Entries: Say goodbye to redundant data entry. Vencru ensures that your financial data is consistent across all aspects of your business.

- Data Security: Trust in Vencru’s robust security measures to safeguard your sensitive financial information.

- Customer Service: Access top-notch customer support to resolve any issues promptly.

In conclusion, a well-structured chart of accounts for a retail business is indispensable for effectively managing your retail business’s finances. With the right tools like Vencru, you can streamline your accounting processes, gain valuable insights, and ensure the financial health of your retail venture. Get started today and experience the difference Vencru can make in your retail accounting journey.

Ready to explore Vencru? Get started here or book a demo

Related Content:

- Sample Chart of Accounts for Small Business

- Guide to Restaurant Chart of Accounts (with sample PDF)

- Chart of Accounts for Rental Property: A Comprehensive Guide

- Chart Of Accounts For A Construction Company: Detailed Guide

- Chart of Accounts for Nonprofit: A Comprehensive Guide

- Chart Of Accounts For E-commerce Businesses: Detailed Guide

Disclaimer: This article is for informational purposes only and does not constitute financial or legal advice. Please consult with a qualified professional for personalized guidance.